Double-Digit Rally For Uber In April: A Deep Dive Analysis

Table of Contents

Stronger-Than-Expected Q1 Earnings Report & Positive Future Guidance

Uber's Q1 2024 earnings report significantly exceeded analysts' expectations, laying the groundwork for the impressive double-digit rally. Key metrics painted a picture of robust growth and improved profitability, bolstering investor confidence.

- Revenue Growth: Uber reported a [Insert Specific Revenue Figure] in Q1 2024, representing a [Insert Percentage]% increase compared to Q1 2023. This significant jump surpassed analysts' projections by [Insert Percentage]%.

- Segmental Growth: Growth was witnessed across all key segments. Ride-sharing experienced a [Insert Percentage]% increase in revenue, driven by increased ridership. Uber Eats delivery also saw impressive growth, with revenue surging by [Insert Percentage]%. Freight services contributed [Insert Percentage]% to overall revenue growth.

- Improved Operational Efficiency: Uber showcased improvements in operational efficiency, leading to [mention specific improvements, e.g., reduced costs per ride, increased driver retention]. This positive trend further fueled the double-digit rally.

- Positive Future Guidance: The company's optimistic future guidance, projecting continued growth in key metrics for the remainder of the year, reinforced investor confidence and contributed significantly to the April stock surge.

Increased Ridership and Demand Post-Pandemic

The recovery of the ride-sharing market played a pivotal role in Uber's double-digit rally. Post-pandemic, increased demand for transportation services directly translated into higher ridership and revenue for the company.

- Increased Ridership: Data shows a significant increase in daily/monthly ridership compared to the previous year, with numbers reaching [Insert Specific Data/Percentage Increase]. This rebound exceeded initial projections and indicates a strong recovery in travel and commuting patterns.

- Factors Contributing to Increased Demand: The easing of pandemic restrictions, a return to offices for many employees, and a surge in leisure travel all contributed significantly to the increased demand for ride-sharing services.

- Geographical Variations: While demand recovery was widespread, certain regions experienced particularly strong growth, contributing disproportionately to Uber's overall performance. [Mention specific regions and their impact if data is available].

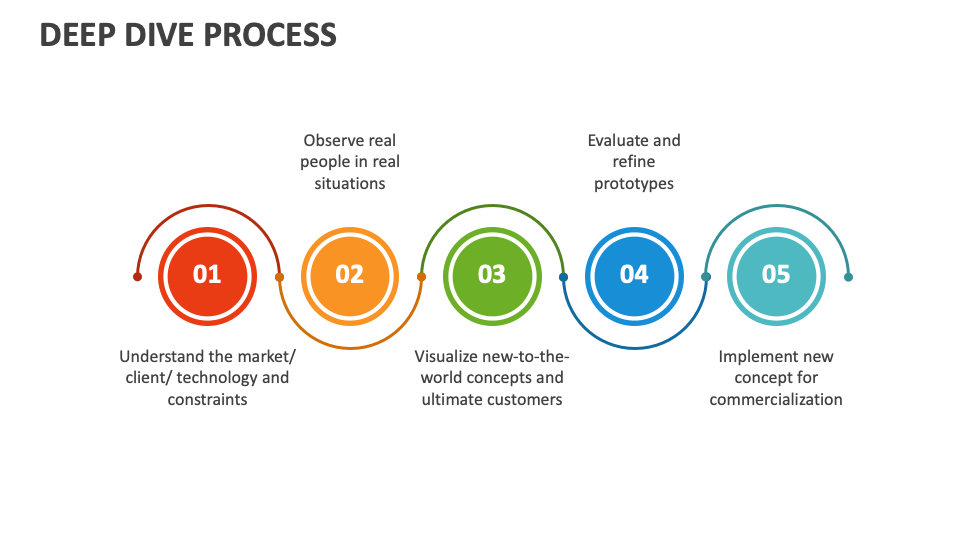

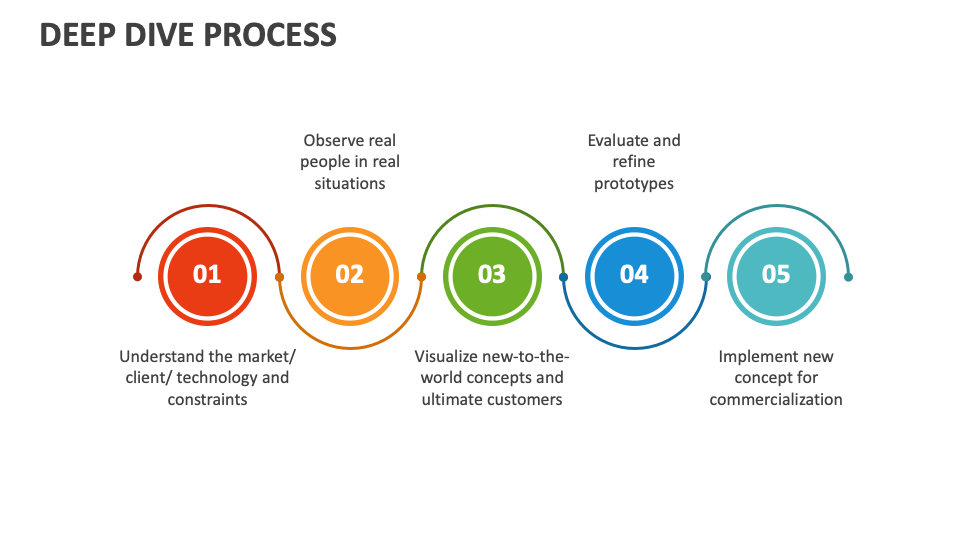

Successful Implementation of New Strategies and Technological Advancements

Uber's proactive approach to innovation and its successful implementation of new strategies also contributed to the April double-digit rally. Technological advancements and strategic initiatives enhanced efficiency and boosted customer satisfaction.

- New Features and Services: The launch of [mention specific new features, e.g., new subscription plans, enhanced safety features, improved in-app experience] improved the customer experience, leading to increased usage and positive reviews.

- Technological Advancements: Investments in technology, including [mention specific technologies, e.g., AI-powered route optimization, improved driver matching algorithms], enhanced operational efficiency, reduced costs, and improved driver and rider satisfaction.

- Successful Marketing Campaigns: Targeted marketing campaigns and strategic partnerships significantly boosted brand visibility and customer acquisition, driving further growth and contributing to the overall double-digit rally.

Favorable Market Conditions and Investor Sentiment

Broader macroeconomic factors and prevailing investor sentiment played a significant role in amplifying Uber's double-digit rally. A positive outlook in the tech sector and favorable news contributed to investor confidence.

- Positive Tech Sector Sentiment: A generally positive outlook for the tech sector, with increased investor appetite for growth stocks, created a favorable environment for Uber's stock price appreciation.

- Positive News and Events: [Mention any specific positive news or events, e.g., successful partnerships, regulatory approvals, positive industry reports] further enhanced investor confidence and fuelled the stock price increase.

- Analyst Ratings and Upgrades: Positive analyst ratings and upgrades contributed to the increased investor interest, accelerating the double-digit rally.

Understanding Uber's Double-Digit April Rally and Future Outlook

Uber's impressive double-digit rally in April resulted from a confluence of factors: strong Q1 earnings, increased post-pandemic ridership, successful new strategies, and favorable market conditions. While this sustained double-digit growth is encouraging, the sustainability of this momentum depends on continued strong performance across all segments and the ability to navigate potential challenges such as increasing competition and economic uncertainty. Maintaining this level of double-digit performance will require ongoing innovation and adaptation.

To stay informed about Uber's performance and future developments, subscribe to our newsletter, follow the company's news, and continue to analyze the factors driving their success—continuing to monitor the effects of this significant double-digit rally and subsequent performance. Understanding the dynamics behind this remarkable achievement is crucial for investors and industry observers alike.

Featured Posts

-

Wnba Salary Dispute Angel Reeses Perspective On A Potential Strike

May 17, 2025

Wnba Salary Dispute Angel Reeses Perspective On A Potential Strike

May 17, 2025 -

Tenis Efsanesi Djokovic 37 Yasinda Hala Zirvede

May 17, 2025

Tenis Efsanesi Djokovic 37 Yasinda Hala Zirvede

May 17, 2025 -

What Is Creatine A Guide To Its Benefits And Risks

May 17, 2025

What Is Creatine A Guide To Its Benefits And Risks

May 17, 2025 -

Network18 Media And Investments Stock Price Live Nse Bse Data Technical Analysis April 21 2025

May 17, 2025

Network18 Media And Investments Stock Price Live Nse Bse Data Technical Analysis April 21 2025

May 17, 2025 -

Giants Vs Mariners Assessing Injuries Before The April 4 6 Series

May 17, 2025

Giants Vs Mariners Assessing Injuries Before The April 4 6 Series

May 17, 2025

Latest Posts

-

Knicks Jalen Brunson Injury Latest Update And Return Timeline

May 17, 2025

Knicks Jalen Brunson Injury Latest Update And Return Timeline

May 17, 2025 -

The Knicks Jalen Brunson Problem A Slow Road To Recovery

May 17, 2025

The Knicks Jalen Brunson Problem A Slow Road To Recovery

May 17, 2025 -

Will The Knicks Offense Recover Quickly With Brunsons Return

May 17, 2025

Will The Knicks Offense Recover Quickly With Brunsons Return

May 17, 2025 -

New York Knicks Prove Their Depth Without Jalen Brunson

May 17, 2025

New York Knicks Prove Their Depth Without Jalen Brunson

May 17, 2025 -

Jalen Brunson Out How The Knicks Are Handling The Depth Challenge

May 17, 2025

Jalen Brunson Out How The Knicks Are Handling The Depth Challenge

May 17, 2025