Dogecoin, Trump, And Musk: A Retrospective Analysis

Table of Contents

Elon Musk's Influence on Dogecoin

Tweets and Market Volatility

Elon Musk's tweets have been directly correlated with significant Dogecoin price fluctuations. His pronouncements, often cryptic or humorous, have sent shockwaves through the cryptocurrency market. This influence raises significant questions about market manipulation and the ethical implications of such powerful statements.

- Example 1: In February 2021, Musk tweeted "Dogecoin is the people's crypto," leading to a substantial price surge.

- Example 2: Conversely, a less positive tweet later that year resulted in a notable price drop.

- Example 3: His frequent use of the Dogecoin meme further amplified its online presence and attracted new investors.

The legal and ethical ramifications of Musk's influence on Dogecoin are complex. While he hasn't directly manipulated the market, his actions undoubtedly contributed to its volatility, impacting countless investors. Regulators are grappling with how to address the influence of social media personalities on cryptocurrency markets.

Musk's Business Interests and Dogecoin Adoption

Beyond social media engagement, Musk's motivations might extend to strategic investments or brand-building initiatives. While there's no public evidence of direct large-scale investment in Dogecoin, his endorsements could be seen as a form of indirect investment, benefiting from its price appreciation.

- Potential Tesla Integration: While never fully implemented, speculation around Tesla accepting Dogecoin as payment briefly sent the coin's value soaring.

- SpaceX and Dogecoin: Similarly, rumors of SpaceX using Dogecoin fueled investor enthusiasm, highlighting the power of association with established brands.

- Brand Synergy: Musk's association with Dogecoin enhanced its memetic appeal, strengthening its brand recognition and attracting a broader range of investors.

Musk's business ventures and pronouncements have arguably played a crucial role in legitimizing Dogecoin to some extent, although its underlying technology remains relatively simple.

Donald Trump's Stance on Cryptocurrencies (Including Dogecoin)

Public Statements and Their Market Effect

Donald Trump's views on cryptocurrencies, while not always explicitly focused on Dogecoin, still carry significant weight in the market. His opinions influence investor sentiment and regulatory expectations.

- Limited Direct Mentions: Unlike Musk, Trump hasn't directly endorsed or criticized Dogecoin extensively. However, his broader comments on cryptocurrencies have indirectly affected the market.

- Market Reactions: Any statement by Trump regarding cryptocurrency regulations or the overall digital asset landscape could trigger significant price swings in Dogecoin and other cryptocurrencies.

- Indirect Influence: Trump's general stance on economic policy and regulation shapes the broader environment in which cryptocurrencies operate, impacting investor confidence.

The relative silence from Trump on Dogecoin specifically creates a curious counterpoint to Musk's outspoken advocacy. This contrasting approach highlights the diverse ways prominent figures can shape the cryptocurrency market.

Political Implications and Regulatory Uncertainty

Trump's potential policies regarding cryptocurrency regulation would significantly influence the future of Dogecoin and other digital assets. A more favorable regulatory environment could lead to increased adoption, while a stricter approach could stifle growth.

- Potential for Increased Regulation: A Trump administration might prioritize stricter regulations on cryptocurrencies to combat illicit activities and protect investors.

- Impact on Dogecoin's Future: Such regulations could either hinder Dogecoin's growth or force it to adapt to a more formalized framework.

- Political Uncertainty: The political climate and potential policy shifts significantly affect investor confidence and market sentiment.

The political landscape, and the potential impact of influential political figures, creates a considerable layer of uncertainty for the cryptocurrency market.

The Meme-Coin Phenomenon and its Sustainability

Dogecoin's Technological Limitations

Dogecoin, unlike Bitcoin or Ethereum, lacks significant technological innovation. Its primary appeal lies in its memetic origins and community engagement, rather than its technological sophistication.

- Simple Technology: Dogecoin utilizes a relatively basic blockchain technology compared to other established cryptocurrencies.

- Scalability Issues: Its transaction speed and scalability are comparatively limited.

- Lack of Unique Features: It doesn't offer any unique features or functionalities that distinguish it from other cryptocurrencies.

Dogecoin's success primarily stems from hype and social media influence, raising questions about its long-term sustainability.

Speculative Investing and Market Manipulation

Investing in meme coins like Dogecoin carries substantial risk due to extreme market volatility and susceptibility to manipulation.

- Price Manipulation Attempts: The history of Dogecoin includes instances of suspected price manipulation through coordinated social media campaigns or pump-and-dump schemes.

- Regulatory Challenges: Regulators struggle to effectively address market manipulation in the decentralized world of cryptocurrencies.

- Investor Risks: Investors must be aware of the risks associated with highly volatile assets and understand the importance of responsible investment strategies.

Investing in Dogecoin or any meme coin requires a high degree of risk tolerance and careful consideration of market dynamics. Diversification and responsible investment practices are crucial.

Conclusion

This retrospective analysis of Dogecoin's trajectory, inextricably linked to the influence of Elon Musk and Donald Trump, reveals a complex interplay of social media hype, market speculation, and political considerations. While the meme-coin's success has highlighted the power of influencer marketing in the cryptocurrency space, it also underscores the inherent risks and vulnerabilities associated with highly volatile assets. Understanding the forces that shape the Dogecoin market, as well as the actions of prominent figures like Musk and Trump, is crucial for navigating the increasingly complex world of cryptocurrencies. To stay informed about the future of Dogecoin and other cryptocurrencies, continue your research and stay updated on the latest news and developments in the rapidly evolving crypto landscape. Further research into the long-term sustainability of meme-coins and the regulatory implications of social media influence on cryptocurrency markets is essential.

Featured Posts

-

Mlb Return Chase Lee Pitches Scoreless Inning May 12 2025

May 31, 2025

Mlb Return Chase Lee Pitches Scoreless Inning May 12 2025

May 31, 2025 -

Thursday Night Diamond Highlights District Champions And Playoff Qualifiers

May 31, 2025

Thursday Night Diamond Highlights District Champions And Playoff Qualifiers

May 31, 2025 -

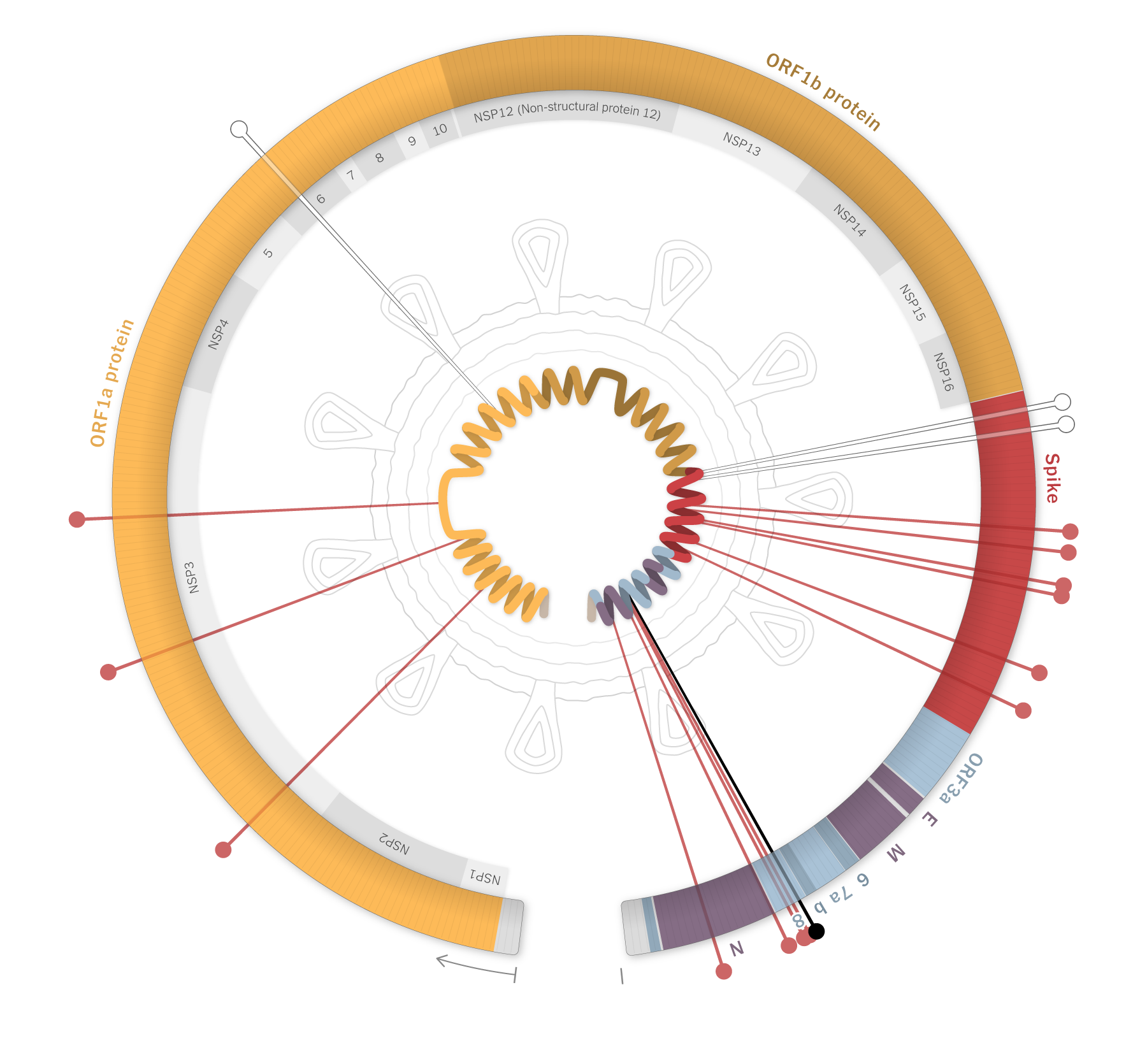

Understanding The Rising Covid 19 Variant Lp 8 1

May 31, 2025

Understanding The Rising Covid 19 Variant Lp 8 1

May 31, 2025 -

Runes Dominant Victory Indian Wells Masters Triumph Over Tsitsipas

May 31, 2025

Runes Dominant Victory Indian Wells Masters Triumph Over Tsitsipas

May 31, 2025 -

Rome Masters Jannik Sinner Va Cuoc Doi Dau Dang Chu Y Voi Carlos Alcaraz

May 31, 2025

Rome Masters Jannik Sinner Va Cuoc Doi Dau Dang Chu Y Voi Carlos Alcaraz

May 31, 2025