Diversion Of Resources? State Treasurers Question Tesla's Board On Musk

Table of Contents

State Treasurers' Concerns Regarding Resource Allocation

Growing unease among state treasurers regarding Tesla's financial stability is fueled by concerns about the potential impact of Elon Musk's diverse business interests. These concerns aren't solely about Musk's entrepreneurial spirit; they center on the potential drain of resources from Tesla's core operations to support his other ventures. This raises questions about the long-term sustainability of Tesla's growth and profitability.

-

Specific examples of Musk's other companies and their potential drain on Tesla resources: Musk's involvement in SpaceX, the ambitious space exploration company, and his recent acquisition and transformation of Twitter (now X) are frequently cited as examples. The substantial financial investments and managerial attention required by these companies could divert crucial resources and talent away from Tesla.

-

Financial implications for Tesla shareholders: State treasurers, representing significant state pension funds and other investments, are major Tesla shareholders. They are understandably concerned that the diversion of resources could negatively impact Tesla's profitability, ultimately affecting the returns on their investments. The potential for diluted shareholder value due to resource allocation towards less profitable ventures is a key worry.

-

The role of state treasurers as significant investors: State treasurers manage billions of dollars in public funds, making them significant investors in the stock market, including Tesla. Their concerns, therefore, carry considerable weight and influence the overall market perception of Tesla. Their scrutiny of Tesla's Board underscores the seriousness of the resource allocation issue.

Scrutiny of Tesla's Board's Oversight Responsibilities

The effectiveness of Tesla's Board in overseeing Musk's actions and ensuring responsible resource allocation within Tesla is under intense scrutiny. The board's role is paramount in protecting shareholder interests and ensuring the company's long-term viability.

-

Discussion of the board's composition and its independence: Questions are raised about the independence of Tesla's Board given Musk's significant influence and ownership stake in the company. Critics argue that a truly independent board would more assertively challenge Musk’s decisions and prioritize Tesla's core business.

-

Examination of the board's track record in overseeing Musk's actions: The board's past performance in managing Musk's sometimes unconventional business practices is being rigorously examined. Previous instances where Musk's actions have caused market volatility or raised concerns about compliance are being re-evaluated in the current context.

-

Mention any previous instances of controversy or criticism directed at the board: Reports and analyses of previous controversies surrounding Tesla, including those related to production targets, safety concerns, or regulatory investigations, are being used to assess the board's effectiveness and responsiveness to potential risks. The lack of proactive measures to address potential conflicts of interest related to Musk’s multiple ventures is a recurring theme of criticism.

The Impact on Tesla's Stock Performance

The concerns surrounding resource allocation are undeniably linked to Tesla's stock market performance. Analyzing this correlation is crucial to understanding the full extent of the impact.

-

Analyze recent stock fluctuations and link them to news related to Musk's other ventures: Significant drops in Tesla's stock price often coincide with news about financial challenges or controversies involving Musk's other companies. This highlights the market's sensitivity to the perception of resource diversion.

-

Examine analyst opinions and predictions on Tesla's future performance in light of these concerns: Financial analysts are increasingly factoring these concerns into their predictions for Tesla's future performance, reflecting a growing market skepticism about the long-term financial stability of the company.

Calls for Increased Transparency and Accountability

Growing calls for increased transparency and accountability from Tesla's Board are echoing throughout the financial community. State treasurers and other significant investors are demanding greater clarity on resource allocation and a more robust oversight mechanism.

-

Mention the calls for more detailed financial disclosures from Tesla: There are increasing calls for Tesla to provide more detailed financial disclosures that explicitly separate the financial performance and resource allocation of Tesla from Musk's other ventures. This would provide greater transparency and allow for more informed investor decision-making.

-

Highlight the potential for regulatory intervention or shareholder lawsuits: The lack of transparency and potential conflicts of interest could lead to regulatory intervention from bodies like the SEC, along with potential shareholder lawsuits seeking to protect their investments.

-

Explore the potential consequences of inaction on the part of Tesla's board: Continued inaction from Tesla's Board could severely damage the company's reputation, erode investor confidence, and ultimately jeopardize its long-term success.

Conclusion

The concerns raised by state treasurers about Tesla's Board's oversight of Elon Musk and the potential diversion of resources from Tesla's core business are significant. The impact on Tesla's stock performance and the calls for increased transparency and accountability highlight the crucial role of effective corporate governance. The scrutiny of Tesla's Board raises critical questions about corporate governance and the responsibilities of boards of directors in overseeing the actions of powerful CEOs. Further investigation is crucial to ensure the long-term health and stability of Tesla. Stay informed about developments surrounding Tesla's Board and the ongoing debate about resource allocation. Understanding the complexities of Tesla's Board is key to making informed investment decisions.

Featured Posts

-

Diamondbacks Ninth Inning Comeback 5 Run Rally Beats Brewers

Apr 23, 2025

Diamondbacks Ninth Inning Comeback 5 Run Rally Beats Brewers

Apr 23, 2025 -

Son Dakika Izmir Okullari 24 Subat Pazartesi Icin Tatil Edildi Mi

Apr 23, 2025

Son Dakika Izmir Okullari 24 Subat Pazartesi Icin Tatil Edildi Mi

Apr 23, 2025 -

Analyse Des Marches Bfm Bourse 17 Fevrier 15h Et 16h

Apr 23, 2025

Analyse Des Marches Bfm Bourse 17 Fevrier 15h Et 16h

Apr 23, 2025 -

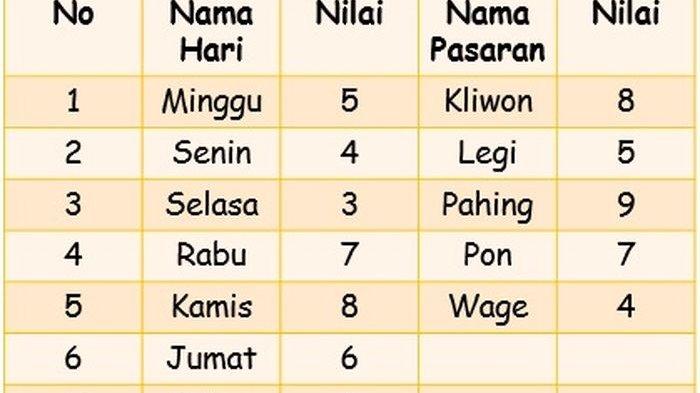

Kecocokan Jodoh Weton Jumat Wage Dan Senin Legi Ramalan Primbon Jawa

Apr 23, 2025

Kecocokan Jodoh Weton Jumat Wage Dan Senin Legi Ramalan Primbon Jawa

Apr 23, 2025 -

Mlb Record Set Reds String Of 1 0 Losses Reaches New Heights

Apr 23, 2025

Mlb Record Set Reds String Of 1 0 Losses Reaches New Heights

Apr 23, 2025