Dissecting The GOP Tax Plan: Fact-Checking The Deficit Claims

Table of Contents

The GOP Tax Plan's Initial Projections and Their Shortcomings

Proponents of various GOP tax plans often initially projected either minimal increases or even decreases in the national deficit. These projections, however, frequently fell short of a complete picture.

- Methodology: The methodology used to arrive at these projections often relied on dynamic scoring—models that assume tax cuts stimulate economic growth, leading to increased tax revenues that offset the initial revenue loss.

- Limitations and Biases: These models often incorporated optimistic assumptions about economic growth and underestimated the potential for increased borrowing. Furthermore, they frequently failed to account for the potential for tax cuts to disproportionately benefit high-income earners, who tend to save a larger portion of their income rather than spend it, thus limiting the stimulative effect.

- External Factors: Crucial external economic factors, such as global economic uncertainty, were often not fully considered or were given insufficient weight in the initial projections. For instance, the impact of global trade wars or unforeseen recessions were not always properly factored into the long-term estimations.

- Citations: Independent analyses from organizations like the Congressional Budget Office (CBO) and the Tax Policy Center often presented alternative, more cautious assessments of the plan's budgetary impact. These reports should be consulted for a more balanced perspective on the GOP Tax Cuts Deficit. (Citations would be inserted here in a published article).

Related Keywords: GOP Tax Cuts Deficit, Tax Plan Economic Impact, Budgetary Impact of Tax Cuts

Analyzing the Revenue Projections: Are They Realistic?

A central claim underpinning many GOP tax plans is that the resulting economic growth will offset revenue losses from lower tax rates. This relies heavily on the principles of supply-side economics.

- Economic Growth Correlation: The assumed correlation between tax cuts and significant economic growth is a critical assumption. Historical data on similar tax cuts often shows a weaker relationship than proponents suggest. While some growth may occur, it's rarely sufficient to fully compensate for lost revenue.

- Historical Data: Analyzing historical data reveals that the actual revenue impact of past tax cuts has often fallen short of initial projections. The Laffer Curve, a theoretical model supporting supply-side economics, is subject to significant debate about its applicability in real-world scenarios.

- Investment and Consumer Spending: While increased investment and consumer spending are posited to drive revenue generation, the extent to which this occurs is often difficult to predict accurately and depends on various factors, including consumer and business confidence.

- Economic Studies: Numerous economic studies, some supporting and others refuting the projected revenue increases, highlight the complexity and uncertainty surrounding the relationship between tax cuts and economic growth. (Citations would be included here for a published article).

Related Keywords: Tax Revenue Projections, Economic Growth Tax Cuts, Supply-Side Economics, Laffer Curve

The Impact of Debt and the National Debt

The impact of any GOP tax plan on the national debt and its long-term consequences deserves careful consideration.

- Deficit vs. Debt: It's crucial to understand the difference: a deficit is the annual shortfall between government spending and revenue, while the national debt is the accumulated total of past deficits.

- Projected Debt Increase: Most analyses suggest that GOP tax plans lead to a significant increase in the national debt. The magnitude of this increase often depends on the specific details of the plan and the assumptions about economic growth.

- Long-Term Implications: A significantly increased national debt can lead to higher interest rates, crowding out other government spending, and potentially impacting the nation's credit rating.

- Credit Rating Downgrades: A sustained increase in the national debt can negatively affect the U.S. credit rating, making it more expensive to borrow money in the future, thus increasing the cost of government operations.

Related Keywords: National Debt Increase, US National Debt, Government Spending, Fiscal Policy

Considering Long-Term Effects and Unintended Consequences

Beyond the immediate budgetary impact, potential unforeseen consequences warrant attention.

- Social Programs: Budget constraints resulting from increased debt can lead to cuts in vital social programs, impacting healthcare, education, and other crucial public services.

- Income Inequality: Tax cuts are often criticized for disproportionately benefiting high-income earners, potentially exacerbating income inequality. A progressive tax system aims to mitigate this effect, but the level of this mitigation is a key aspect of any debate about tax policy.

- International Trade and Investment: The international ramifications of significant changes in fiscal policy, including tax cuts, can also have unintended consequences. This could include shifts in foreign investment or changes to international trade relationships.

Conclusion

Analyzing the impact of GOP tax plans on the deficit requires a careful consideration of various factors beyond initial projections. The optimistic assumptions underlying many initial assessments frequently clash with a more nuanced understanding of complex economic interactions. The potential for increased national debt, higher interest rates, and cuts in crucial social programs all demand careful scrutiny. The relationship between tax cuts, economic growth, and overall revenue generation is far from straightforward and often subject to considerable debate. Critical analysis of claims surrounding tax plans and their economic consequences is paramount.

Call to Action: Continue to research and critically evaluate future GOP tax plans and their projected impact on the deficit. Stay informed about the GOP Tax Plan Deficit to make informed decisions as a citizen. Understand the nuances of the GOP Tax Plan's budgetary impacts and their potential long-term repercussions.

Featured Posts

-

El Regreso De Javier Baez Salud Y Exito En La Mlb

May 21, 2025

El Regreso De Javier Baez Salud Y Exito En La Mlb

May 21, 2025 -

The Goldbergs A Comprehensive Guide To The Hit Tv Show

May 21, 2025

The Goldbergs A Comprehensive Guide To The Hit Tv Show

May 21, 2025 -

Updated Trans Australia Run World Record Challenge

May 21, 2025

Updated Trans Australia Run World Record Challenge

May 21, 2025 -

La Petite Italie De L Ouest Architecture Histoire Et Patrimoine Toscan

May 21, 2025

La Petite Italie De L Ouest Architecture Histoire Et Patrimoine Toscan

May 21, 2025 -

New Olympic Swimming Site To Be Centrepiece Of Nices Aquatic Development

May 21, 2025

New Olympic Swimming Site To Be Centrepiece Of Nices Aquatic Development

May 21, 2025

Latest Posts

-

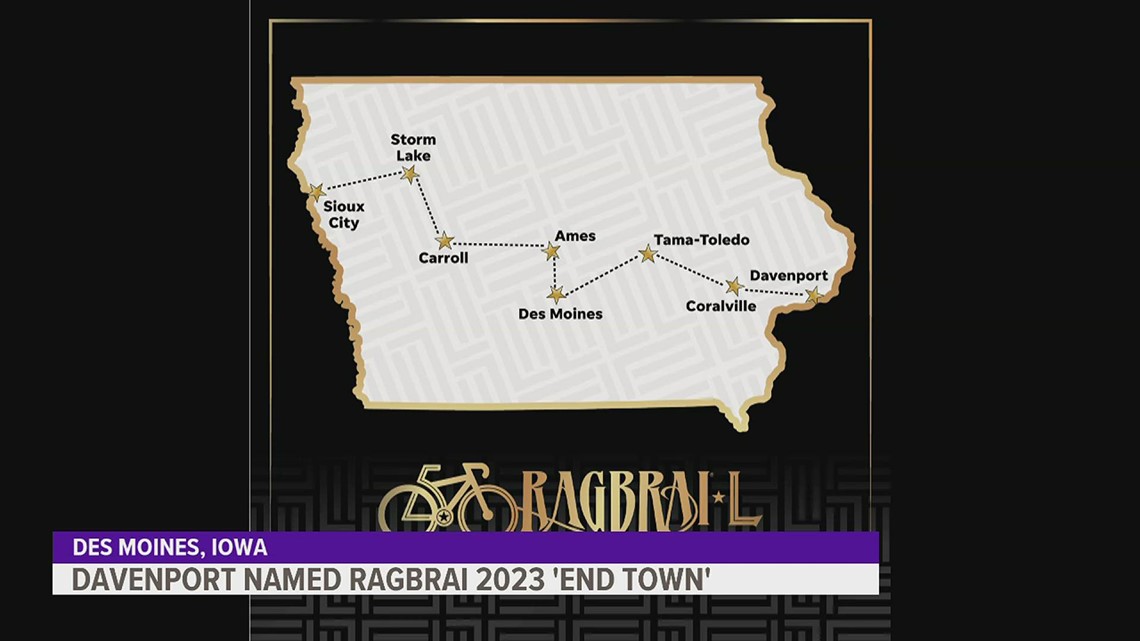

Ragbrai And Beyond Exploring Scott Savilles Cycling Life

May 21, 2025

Ragbrai And Beyond Exploring Scott Savilles Cycling Life

May 21, 2025 -

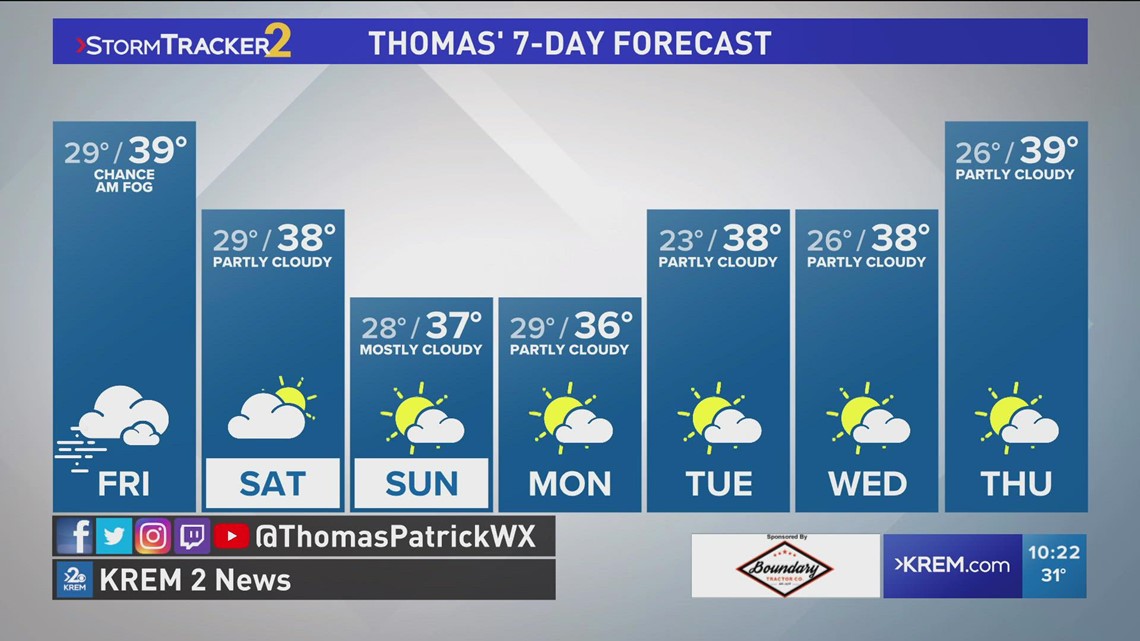

Prepare For Mild Temperatures And Dry Conditions

May 21, 2025

Prepare For Mild Temperatures And Dry Conditions

May 21, 2025 -

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 21, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 21, 2025 -

How To Predict Breezy And Mild Weather For Your Next Trip

May 21, 2025

How To Predict Breezy And Mild Weather For Your Next Trip

May 21, 2025 -

Expecting Mild Temperatures Low Rain Probability This Week

May 21, 2025

Expecting Mild Temperatures Low Rain Probability This Week

May 21, 2025