Dismissing High Stock Valuations: Insights From BofA

Table of Contents

BofA's Rationale for Dismissing High Valuations

BofA's bullish stance on current stock valuations rests on several key pillars. They believe that several fundamental factors support the current market levels, despite what might appear to be stretched valuations on the surface.

Strong Corporate Earnings & Profitability

BofA's assessment highlights robust corporate earnings growth as a primary justification for current stock prices. They point to several factors driving this strong performance:

- Robust profit margins despite inflationary pressures. Many companies have successfully navigated inflationary headwinds, maintaining healthy profit margins through efficient cost management and pricing strategies.

- Strong revenue growth exceeding expectations. Numerous sectors have shown impressive revenue growth, exceeding analyst forecasts and demonstrating resilience in the face of economic uncertainty. This sustained growth fuels higher valuations.

- Efficient cost management strategies employed by companies. Companies have become increasingly adept at managing costs, improving operational efficiency, and streamlining processes to protect profit margins in a challenging economic environment. Examples include increased automation and supply chain optimization. This efficiency translates to higher profitability and supports higher stock prices. BofA's report specifically mentions strong performance in the technology and consumer staples sectors as key drivers.

Low Interest Rates and Monetary Policy

Low interest rates play a significant role in influencing stock valuations and investor behavior. BofA's analysis emphasizes the impact of the current monetary policy environment:

- Impact of low borrowing costs on corporate investment and expansion. Cheap borrowing allows companies to invest more readily in expansion, research and development, and acquisitions, leading to future growth and higher earnings.

- Attractiveness of equities compared to low-yielding bonds. When interest rates are low, the return on bonds becomes less attractive, driving investors towards higher-yielding assets like equities. This increased demand pushes stock prices upward.

- BofA's prediction on the future trajectory of interest rates. While acknowledging potential rate hikes, BofA's analysis suggests that interest rates are likely to remain relatively low in the foreseeable future, continuing to support equity valuations. This prediction, however, is inherently uncertain and depends on several economic factors.

Long-Term Growth Potential & Innovation

BofA's long-term outlook is optimistic, focusing on the potential for sustained economic growth fueled by technological innovation:

- Focus on specific sectors with high growth potential (e.g., technology, renewable energy). BofA identifies key sectors poised for significant expansion, driven by technological advancements and increasing demand. These sectors command higher valuations due to their growth potential.

- Discussion of innovative business models driving future earnings growth. The emergence of new business models and disruptive technologies is expected to drive future earnings growth and justify current valuations. Companies leveraging AI, cloud computing, and other advanced technologies are particularly well-positioned.

- BofA's projections for long-term economic expansion. BofA's analysis incorporates projections for long-term economic expansion, providing a framework for justifying current, seemingly high, stock valuations. This longer-term perspective helps to contextualize short-term volatility.

Counterarguments and Risks to BofA's Perspective

While BofA presents a compelling case, it's crucial to acknowledge potential counterarguments and risks:

Inflationary Pressures and Rising Interest Rates

Inflationary pressures and rising interest rates pose significant risks to BofA's optimistic outlook:

- Analysis of current inflation rates and potential future trajectories. Sustained high inflation could erode corporate profit margins and cool investor enthusiasm, potentially triggering a market correction. BofA acknowledges this risk but suggests that current levels are manageable.

- Impact of rising interest rates on corporate borrowing costs. Higher interest rates increase borrowing costs for companies, potentially hindering investment and expansion plans, leading to slower earnings growth.

- Potential for a market correction due to rising interest rates. A sharp increase in interest rates could trigger a market correction, as investors shift their focus to less risky assets. This is a significant risk that investors should carefully consider.

Geopolitical Risks and Uncertainty

Geopolitical instability and global uncertainty can significantly impact stock market valuations:

- Specific geopolitical events and their influence on market confidence. Uncertainties surrounding geopolitical events can lead to market volatility and impact investor sentiment negatively, putting downward pressure on valuations.

- BofA's assessment of the likelihood of significant geopolitical disruptions. BofA's analysis acknowledges these risks but suggests that the probability of major disruptions is moderate. However, unpredictable events can significantly affect the market.

- Potential impact of geopolitical risks on corporate earnings. Geopolitical events can disrupt supply chains, impact demand, and affect corporate earnings, potentially leading to lower stock prices.

Conclusion

This article analyzed BofA's perspective on dismissing concerns surrounding high stock valuations, focusing on factors like strong corporate earnings, low interest rates, and long-term growth potential. While acknowledging potential risks like inflation and geopolitical uncertainties, BofA's assessment suggests that current valuations are at least partially justified. However, investors should carefully weigh these factors against the potential risks before making investment decisions.

Call to Action: Understanding BofA's insights on dismissing high stock valuations is crucial for informed investment decisions. Stay informed about market analysis and consider consulting with a financial advisor before making any investment decisions related to high-valuation stocks. Learn more about BofA's market analysis [link to BofA report or relevant resource].

Featured Posts

-

E Bay And Section 230 Legal Implications Of Selling Banned Chemicals

May 07, 2025

E Bay And Section 230 Legal Implications Of Selling Banned Chemicals

May 07, 2025 -

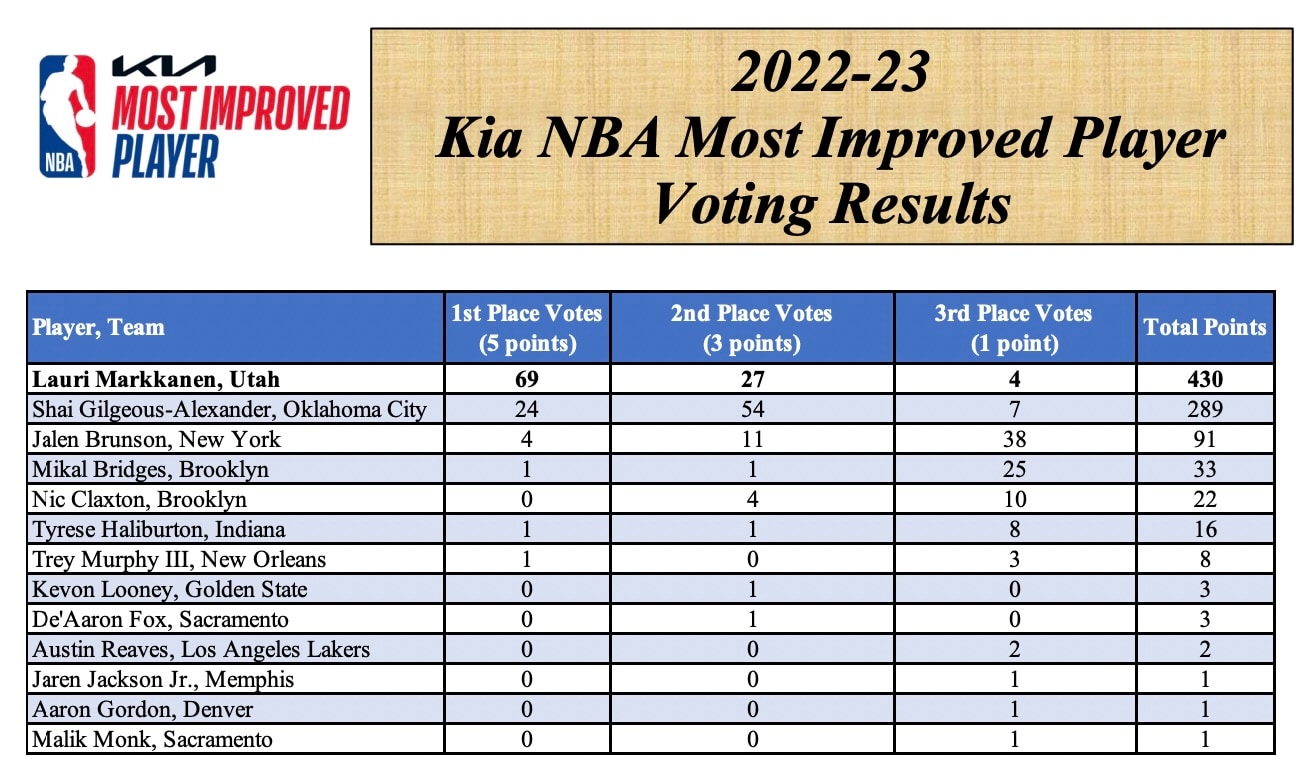

Nba Most Improved Player Award Winner Quiz Test Your Basketball Knowledge

May 07, 2025

Nba Most Improved Player Award Winner Quiz Test Your Basketball Knowledge

May 07, 2025 -

Evaluating The Julius Randle Trade Possibility For The Minnesota Timberwolves

May 07, 2025

Evaluating The Julius Randle Trade Possibility For The Minnesota Timberwolves

May 07, 2025 -

Warriors Aim To Outpace Old School Rockets

May 07, 2025

Warriors Aim To Outpace Old School Rockets

May 07, 2025 -

The Last Of Us Isabela Merced Discusses A Powerful Change

May 07, 2025

The Last Of Us Isabela Merced Discusses A Powerful Change

May 07, 2025

Latest Posts

-

Cavs Ticket Donation Program Simplifies Charitable Giving

May 07, 2025

Cavs Ticket Donation Program Simplifies Charitable Giving

May 07, 2025 -

The White Lotus Season 3 Identifying The Voice Actor For Kenny

May 07, 2025

The White Lotus Season 3 Identifying The Voice Actor For Kenny

May 07, 2025 -

The White Lotus Season 3 Unmasking The Voice Of Kenny

May 07, 2025

The White Lotus Season 3 Unmasking The Voice Of Kenny

May 07, 2025 -

White Lotus Latest Episode Features Surprise Oscar Winner

May 07, 2025

White Lotus Latest Episode Features Surprise Oscar Winner

May 07, 2025 -

Oscar Winner Makes White Lotus Appearance A Deeper Look

May 07, 2025

Oscar Winner Makes White Lotus Appearance A Deeper Look

May 07, 2025