Direct Lender Tribal Loans: Guaranteed Approval For Bad Credit

Table of Contents

What are Direct Lender Tribal Loans?

Direct lender tribal loans are short-term loans offered by lending institutions that have a relationship with Native American tribes. These loans are often marketed to individuals with bad credit who may have difficulty securing financing from traditional banks or credit unions. It's crucial to understand that these loans differ from payday loans and other short-term loan options, though they share some similarities. Tribal loan providers often operate online, offering convenience and accessibility.

- Relationship with Tribes: The relationship between tribal lenders and Native American tribes is a key aspect. These lenders often operate on tribal land, which can impact the regulatory environment they operate under. The exact nature of this relationship and its legal implications can be complex and vary depending on the specific lender and tribe involved.

- Regulatory Environment: The regulatory landscape for tribal lenders is often less stringent than for traditional lenders. This can lead to both advantages and disadvantages for borrowers. Regulations vary significantly and are subject to change.

- Direct Lender vs. Broker: Opting for a direct lender eliminates the middleman (a broker), potentially leading to faster processing and potentially clearer terms. Brokers, on the other hand, might offer a wider range of options, but this convenience often comes with added fees.

- Interest Rates and Fees: Interest rates and fees for direct lender tribal loans are often higher than those offered by traditional lenders. It's essential to carefully compare these costs to make an informed decision.

Understanding "Guaranteed Approval" Claims

Many advertisements for tribal loans boast "guaranteed approval." This is a misleading claim. While some lenders might have more lenient approval processes than traditional banks, no legitimate lender can guarantee approval. Your approval depends entirely on your individual financial circumstances.

- Factors Influencing Approval: Several factors determine your eligibility, including your credit score, income, existing debt (debt-to-income ratio), and employment history. A strong application will significantly improve your chances.

- Realistic Expectations: Be realistic about the loan amount you can afford to repay and the associated interest rates. Don't overborrow. Understand that even with a higher chance of approval, higher interest rates often compensate for the risk the lender takes.

- Pre-Approval Limitations: While some lenders offer pre-approval, this isn't a guarantee of final approval. Pre-approval simply suggests you meet some initial criteria; a formal application and credit check are still required.

- Responsible Borrowing: Remember that borrowing responsibly is crucial. Before applying for any loan, carefully evaluate your financial situation and ensure you can comfortably afford the repayments.

Benefits and Drawbacks of Direct Lender Tribal Loans

Direct lender tribal loans offer both potential benefits and significant drawbacks. A balanced perspective is essential before making a decision.

- Benefits:

- Easier Approval with Bad Credit: Compared to traditional loans, these loans may be easier to obtain if you have a poor credit history.

- Convenience of Online Applications: The online application process is often simpler and more convenient than traditional methods.

- Faster Funding: In some cases, funding can be faster than with traditional loans.

- Drawbacks:

- Potentially High Interest Rates: Interest rates tend to be significantly higher than those offered by traditional lenders.

- Potential for Debt Traps: If not managed responsibly, these loans can easily lead to a cycle of debt.

- Less Stringent Regulations: The less stringent regulatory environment may not offer the same consumer protections as with traditional lending.

Finding Reputable Direct Lender Tribal Loans

It's crucial to research lenders thoroughly to avoid scams and predatory lending practices. Many illegitimate operations prey on individuals with poor credit.

- Identifying Legitimate Lenders: Check for proper licensing, read online reviews from other borrowers (look for patterns and consistency), verify contact information, and confirm the lender's physical address.

- Loan Scams and Red Flags: Be wary of lenders who guarantee approval, demand upfront fees, or pressure you into making quick decisions. Look for transparent and clear terms and conditions.

- Resources for Reliable Information: Use reputable financial websites and consumer protection agencies to research lenders and gather information.

- Transparency in Fees and Interest Rates: Always ensure that all fees and interest rates are clearly disclosed upfront before you agree to anything.

Conclusion

Direct lender tribal loans can be an option for individuals with bad credit seeking financial assistance. However, the often-misleading "guaranteed approval" claims should be treated with skepticism. Approval depends on your financial situation, and these loans often carry high interest rates and potential risks. Before applying for direct lender tribal loans, carefully weigh the benefits and drawbacks, research lenders thoroughly, compare options, and borrow responsibly. Remember to explore all alternative financial solutions and consider budgeting strategies before committing to any high-interest loan. Understanding the terms and conditions is crucial for avoiding financial hardship.

Featured Posts

-

Roland Garros 2024 Nadals Farewell And Sabalenkas Championship

May 28, 2025

Roland Garros 2024 Nadals Farewell And Sabalenkas Championship

May 28, 2025 -

Climate Whiplash A New Report Highlights The Dangers Facing Cities Worldwide

May 28, 2025

Climate Whiplash A New Report Highlights The Dangers Facing Cities Worldwide

May 28, 2025 -

Hujan Di Jawa Timur Kondisi Cuaca Terbaru Dan Prakiraan 24 Maret

May 28, 2025

Hujan Di Jawa Timur Kondisi Cuaca Terbaru Dan Prakiraan 24 Maret

May 28, 2025 -

Boosting Chinas Economy The Crucial Role Of Consumer Confidence

May 28, 2025

Boosting Chinas Economy The Crucial Role Of Consumer Confidence

May 28, 2025 -

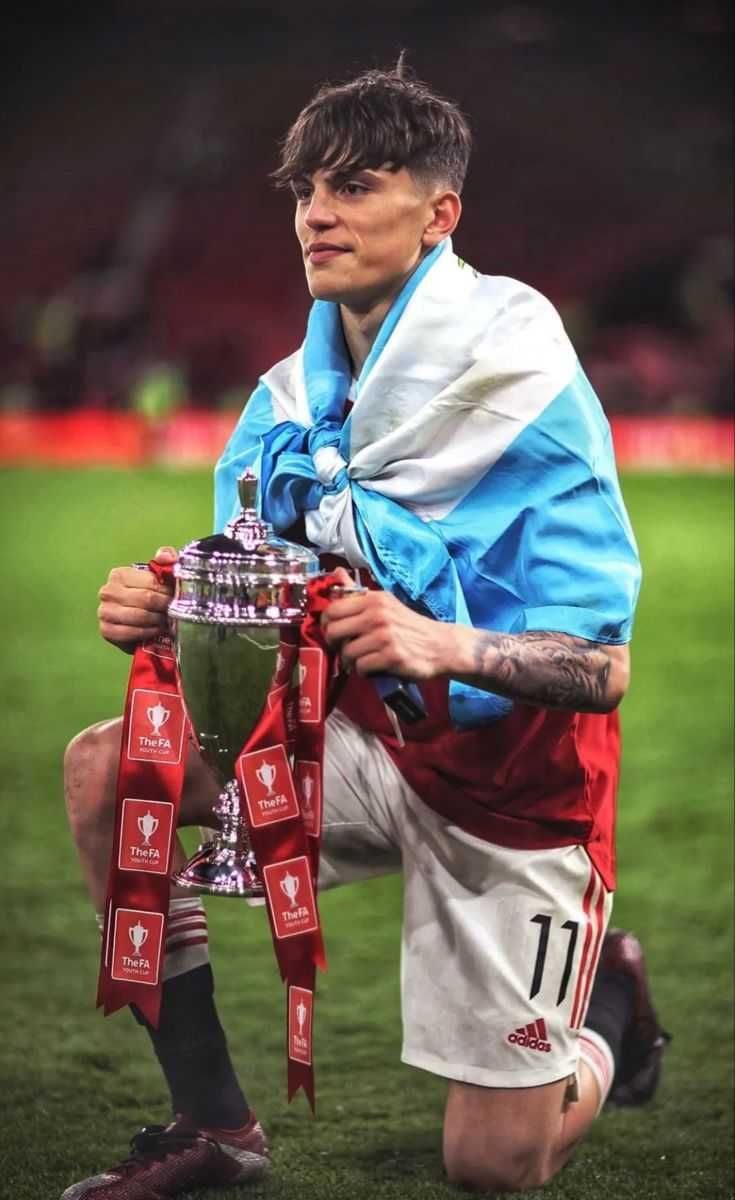

Garnachos Man Utd Dip Lyon Player Points Finger At Amorim

May 28, 2025

Garnachos Man Utd Dip Lyon Player Points Finger At Amorim

May 28, 2025