Digital Banking Disruptor Chime Announces US IPO Plans

Table of Contents

Chime's Rise to Prominence: A Fintech Success Story

Chime's journey is a testament to the power of fintech innovation. Founded with a mission to offer a more accessible and transparent banking experience, Chime quickly differentiated itself from traditional banks by eliminating overdraft fees and offering early direct deposit. This resonated strongly with its target demographic – millennials and Gen Z – who embraced its user-friendly mobile banking app and fee-free services. This unique approach to digital banking fueled Chime's explosive growth, solidifying its position as a major player in the neobank sector.

- Year founded and initial funding rounds: Chime was founded in 2013 and secured significant funding rounds, fueling its rapid expansion and product development.

- Key features differentiating Chime from traditional banks: No overdraft fees, early direct deposit, fee-free debit card, budgeting tools, and a seamless mobile-first experience are key differentiators.

- Significant user growth statistics: Chime boasts millions of active users, showcasing its significant market penetration in the digital banking space.

- Expansion into new financial products and services: Chime has expanded its offerings beyond basic banking, including credit builder products and investment services, further solidifying its position as a comprehensive financial platform.

The Chime IPO: Details and Implications

The Chime IPO is expected to be one of the most significant fintech events of the year. While the exact timing and size are yet to be fully disclosed, the potential valuation is substantial, reflecting Chime's impressive growth trajectory and market position. The IPO's success will have significant implications for the broader financial markets, potentially attracting further investment in the burgeoning fintech sector. Leading investment banks are likely to be involved in underwriting the offering, further demonstrating investor confidence in Chime’s future.

- Expected IPO date (if available): [Insert expected date if available, otherwise state "To be announced."]

- Projected share price range: [Insert projected range if available, otherwise state "To be determined."]

- Number of shares to be offered: [Insert number of shares if available, otherwise state "To be announced."]

- Use of IPO proceeds: Funds are likely to be used for further expansion of services, potential acquisitions, and bolstering Chime’s technological infrastructure.

Competitor Analysis and Market Positioning

Chime operates in a competitive landscape, with established players like Robinhood, Square, and other digital banking platforms vying for market share. However, Chime’s unique selling propositions (USPs), such as its focus on fee transparency and its user-friendly mobile app, provide a significant competitive advantage. Its strong brand recognition and substantial user base contribute to its market dominance. While challenges exist, including increasing competition and regulatory hurdles, Chime's growth potential remains substantial.

- Key competitors and their market positions: Robinhood, Square, and other established neobanks present significant competition.

- Chime's unique selling propositions (USPs): Fee-free banking, early direct deposit, and a user-friendly mobile app are key differentiators.

- Potential challenges and threats to Chime's future growth: Increased competition, evolving regulatory landscape, and potential economic downturns pose challenges.

Investor Sentiment and Future Outlook for the Chime IPO

Investor sentiment surrounding the Chime IPO is largely positive, driven by the company's strong growth trajectory and its disruptive model in the digital banking sector. However, potential risks and uncertainties, such as macroeconomic conditions and increased competition, need to be considered. Analyst ratings and price targets vary, reflecting the inherent uncertainty associated with any IPO. Nonetheless, the long-term growth prospects for Chime and the broader digital banking industry remain promising.

- Analyst ratings and price targets: [Insert analyst ratings and price targets if available.]

- Potential risks related to competition, regulation, or market conditions: Increased competition from established players and new entrants, evolving regulations, and economic downturns pose risks.

- Long-term projections for Chime's revenue and profitability: Analysts predict significant revenue growth and increasing profitability for Chime in the coming years.

Conclusion: The Future of Chime and the Digital Banking Landscape After the IPO

The Chime IPO marks a pivotal moment for both the company and the digital banking industry. Its success will solidify Chime's position as a leading player in the fintech sector and potentially catalyze further investment in the space. The Chime IPO's impact on digital banking and broader financial markets will be significant, shaping the future of finance. Chime's innovative approach and continued growth potential position it for continued success in the post-IPO era. The future of digital banking looks bright, and Chime is poised to play a central role.

Stay tuned for updates on the Chime IPO and its impact on the digital banking landscape. Follow [your website/social media] for more insights into the Chime IPO and other exciting developments in the fintech world.

Featured Posts

-

Lion Electric Investor Group Presents Revised Takeover Bid

May 14, 2025

Lion Electric Investor Group Presents Revised Takeover Bid

May 14, 2025 -

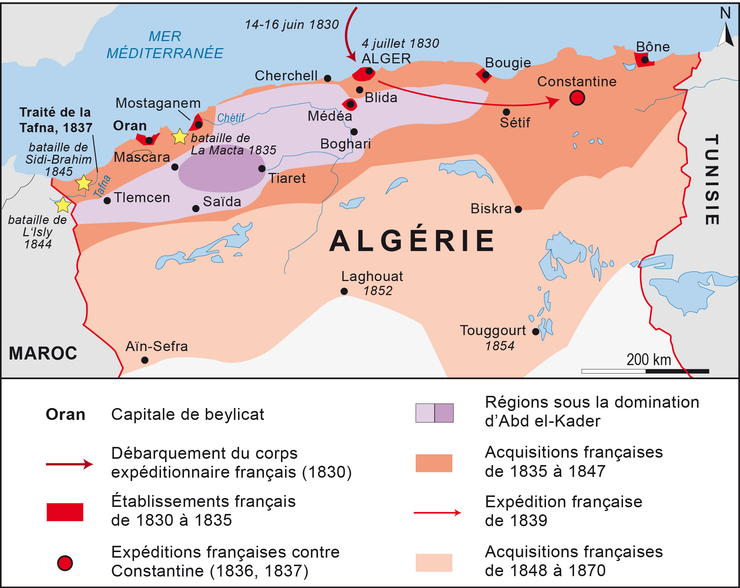

Cote D Or L Impact Des Tensions France Algerie Sur La Region

May 14, 2025

Cote D Or L Impact Des Tensions France Algerie Sur La Region

May 14, 2025 -

Teds Animated Return A New Series With Wahlberg And Seyfried

May 14, 2025

Teds Animated Return A New Series With Wahlberg And Seyfried

May 14, 2025 -

Fury Rejects Pauls 3 Million Fight Offer Love Island Star Fuels Boxing Feud

May 14, 2025

Fury Rejects Pauls 3 Million Fight Offer Love Island Star Fuels Boxing Feud

May 14, 2025 -

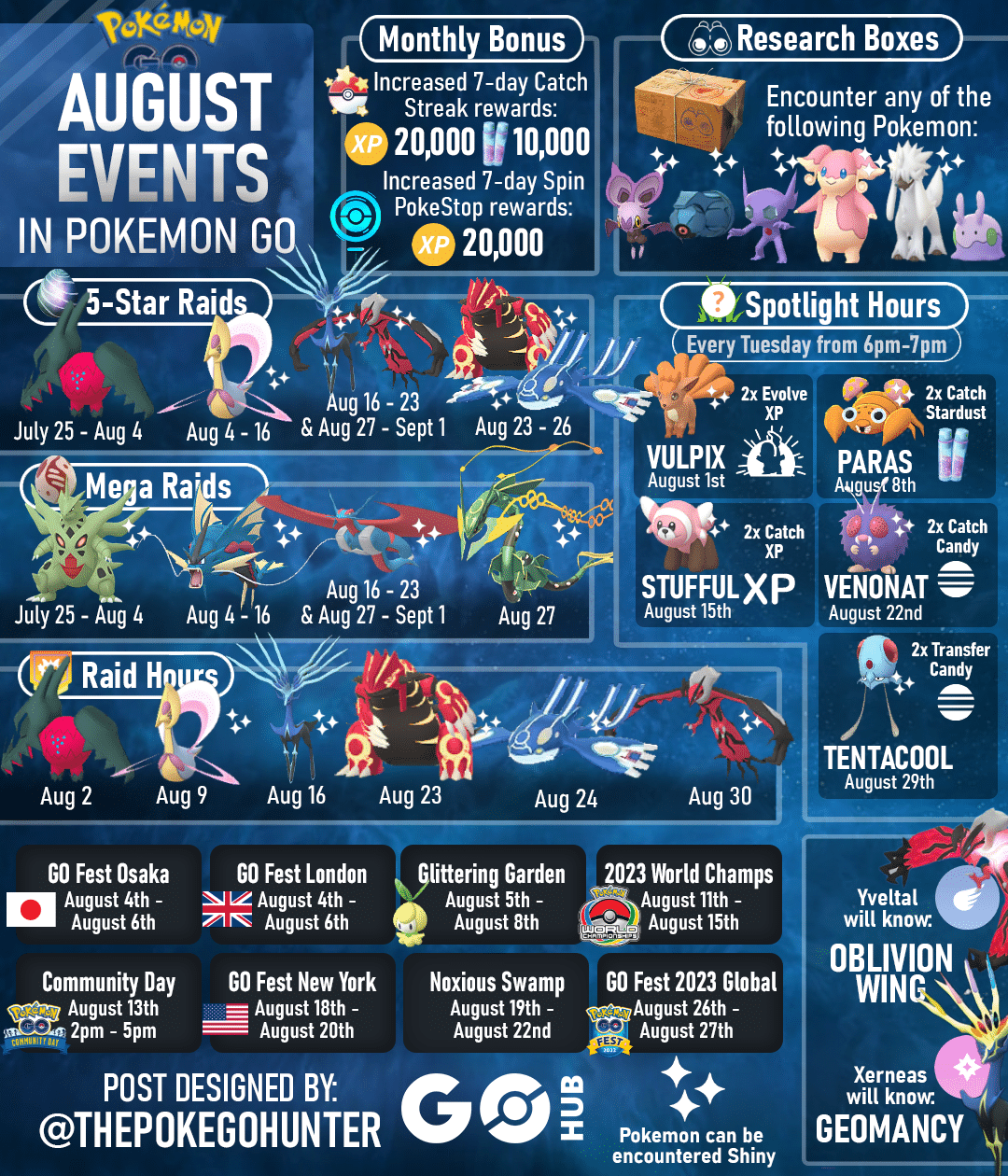

Predicted Pokemon Go Events For May 2025 Raids Spotlight Hours And Community Days

May 14, 2025

Predicted Pokemon Go Events For May 2025 Raids Spotlight Hours And Community Days

May 14, 2025