Deutsche Bank's Saudi Arabia Investment Push: Wooing Global Investors

Table of Contents

Deutsche Bank's Strategic Objectives in Saudi Arabia

Deutsche Bank's objectives in Saudi Arabia are firmly rooted in capitalizing on the nation's rapid economic growth and diversification efforts, as outlined in Saudi Vision 2030. The bank aims to establish a dominant market presence, forging strategic partnerships to achieve several key goals:

- Secure a dominant position in Saudi Arabia's burgeoning capital markets: This involves becoming a key player in underwriting IPOs, bond issuances, and other capital market transactions.

- Facilitate foreign direct investment (FDI) into the Kingdom: Deutsche Bank leverages its global network to attract foreign capital, helping to finance Saudi Arabia's ambitious development projects.

- Leverage expertise in mergers and acquisitions (M&A) to support Saudi Vision 2030 initiatives: The bank's M&A expertise is crucial for facilitating the restructuring and privatization of state-owned enterprises, a core element of Vision 2030.

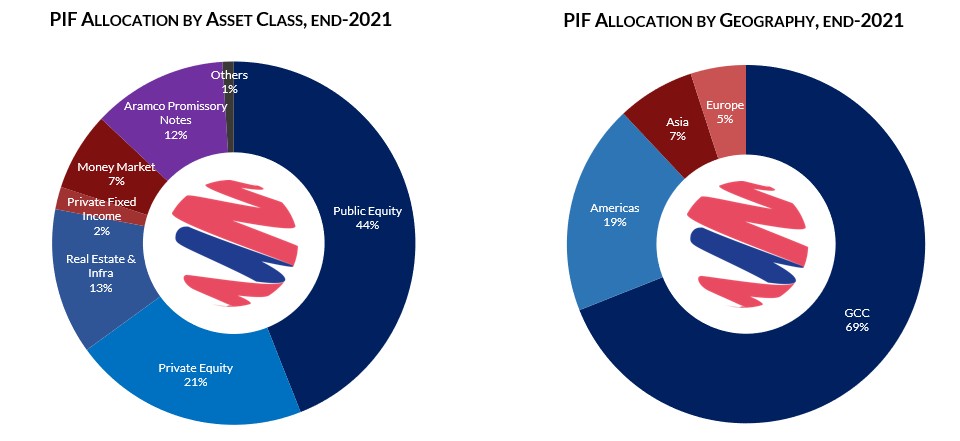

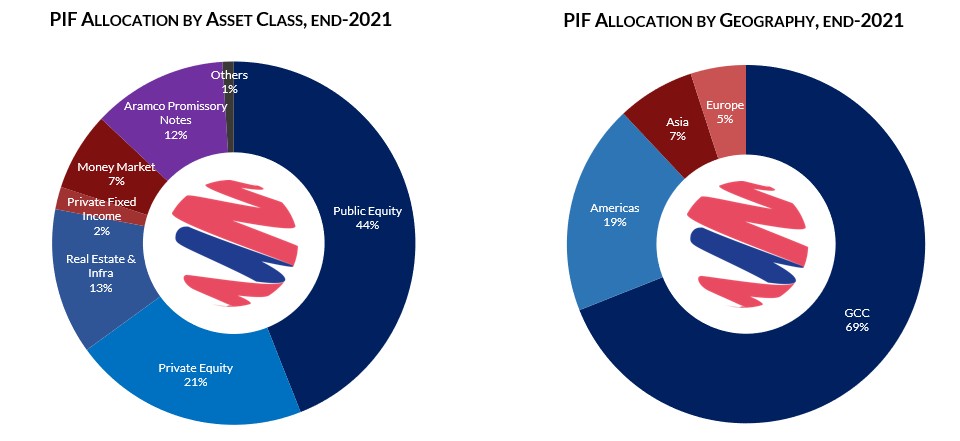

- Develop strong relationships with key Saudi Arabian businesses and government entities: Building trust and strong relationships is paramount to navigating the local business environment and securing lucrative opportunities. This includes fostering relationships with the Public Investment Fund (PIF) and other key players.

Key Investment Areas & Opportunities

Deutsche Bank is focusing its investment efforts on sectors vital to Saudi Arabia's economic diversification strategy. These key areas offer significant potential for both the bank and its investors:

- Infrastructure Development: Massive infrastructure projects are underway, creating opportunities for Deutsche Bank in financing transportation networks, utilities upgrades, and the development of new cities. This includes involvement in projects related to NEOM and other mega-projects.

- Renewable Energy Transition: Saudi Arabia is aggressively pursuing renewable energy sources. Deutsche Bank is well-positioned to finance solar, wind, and other renewable energy projects, contributing to the Kingdom's sustainability goals.

- Technology Investments: Aligned with Vision 2030's digital transformation goals, Deutsche Bank is actively seeking opportunities in the burgeoning Saudi technology sector, including FinTech and other innovative companies.

- Privatization & Public-Private Partnerships (PPPs): The privatization of state-owned assets and the increased use of PPPs are creating numerous opportunities for Deutsche Bank to advise on and participate in these significant transactions.

Attracting Global Investors: The Deutsche Bank Advantage

Deutsche Bank's global reach and extensive experience in international finance are key differentiators in attracting foreign investment to Saudi Arabia. The bank offers several advantages:

- Access to a global pool of potential investors: Deutsche Bank's international network allows it to connect Saudi investment opportunities with a diverse range of global investors.

- Sophisticated risk management and due diligence services: The bank's expertise in risk assessment and due diligence provides investors with the confidence needed to participate in Saudi Arabia's dynamic market.

- Deep sector expertise: Deutsche Bank's deep understanding of various sectors allows them to identify and assess the most promising investment opportunities.

- Facilitating cross-border transactions and partnerships: The bank's expertise streamlines the complex processes involved in cross-border investments.

Challenges and Risks

Despite the significant opportunities, Deutsche Bank faces several challenges in its Saudi Arabia investment push:

- Geopolitical risks and regional instability: The geopolitical landscape of the Middle East presents inherent risks that need to be carefully managed.

- Navigating the complexities of the Saudi Arabian regulatory framework: Understanding and complying with the regulatory environment is crucial for success.

- Intense competition: Deutsche Bank faces competition from other major international investment banks already operating in the region.

- Market volatility and potential economic downturns: Economic fluctuations can impact investment decisions and project viability.

Conclusion

Deutsche Bank's investment strategy in Saudi Arabia represents a bold and strategically sound move, aligning with the Kingdom's ambitious Vision 2030 and offering significant returns for global investors. While navigating the inherent challenges requires careful planning and execution, Deutsche Bank’s global reach, deep expertise, and focus on strategic partnerships position it well to capitalize on the immense growth potential within Saudi Arabia. Learn more about Deutsche Bank’s Saudi Arabia investment opportunities and how you can participate in this transformative economic journey. Discover the latest developments in Deutsche Bank's Saudi Arabia investment push and explore how you can benefit from this exciting growth story.

Featured Posts

-

Us Imposes Steep Tariffs On Southeast Asian Solar Imports Up To 3 521 Duties

May 30, 2025

Us Imposes Steep Tariffs On Southeast Asian Solar Imports Up To 3 521 Duties

May 30, 2025 -

Nhw Astqlal Wtny Mstdam

May 30, 2025

Nhw Astqlal Wtny Mstdam

May 30, 2025 -

San Diego Inclement Weather Program Tonights Activation

May 30, 2025

San Diego Inclement Weather Program Tonights Activation

May 30, 2025 -

Retraites Discussions Entre Le Rn Et La Gauche Sur L Age De Depart

May 30, 2025

Retraites Discussions Entre Le Rn Et La Gauche Sur L Age De Depart

May 30, 2025 -

Lng In Bc Assessing The Progress Of Five Significant Developments

May 30, 2025

Lng In Bc Assessing The Progress Of Five Significant Developments

May 30, 2025