Deutsche Bank Targets Global Investors In Saudi Arabia

Table of Contents

Deutsche Bank's Strategic Rationale for Targeting Saudi Arabia

Deutsche Bank's focus on Saudi Arabia is a calculated move based on several key factors, making it a strategically important market for the bank's global growth.

Vision 2030 and Economic Diversification

Saudi Arabia's Vision 2030 is a transformative economic and social reform plan aimed at diversifying the Kingdom's economy away from its reliance on oil. This ambitious plan presents significant investment opportunities across various sectors. Vision 2030's focus on creating a vibrant and diversified economy is attracting considerable international attention. The plan aims to unlock the country's vast potential in sectors previously underdeveloped, leading to an influx of foreign direct investment (FDI).

- Attractive Investment Sectors:

- Infrastructure Development: Massive investments in transportation, energy, and telecommunications infrastructure are underway.

- Technology and Digital Transformation: Saudi Arabia is investing heavily in technology and digital infrastructure, creating opportunities for tech companies and investors.

- Tourism and Entertainment: Significant developments in tourism and entertainment are creating opportunities in hospitality, leisure, and related sectors.

- Renewable Energy: Saudi Arabia is committed to developing renewable energy sources, leading to significant investment in solar and wind power projects.

Saudi Arabia's Growing Financial Market

The Saudi financial market is experiencing significant growth and development, offering attractive prospects for international investors. The Saudi Stock Exchange (Tadawul), a key component of this growth, is becoming increasingly sophisticated and liquid, making it an appealing destination for global investors seeking diverse investment opportunities.

- Key Market Growth Indicators:

- Increasing Market Capitalization: Tadawul's market capitalization has steadily increased in recent years.

- Growing Number of Listed Companies: A diverse range of companies, across various sectors, are listed on Tadawul.

- Enhanced Regulatory Framework: Improvements to the regulatory environment are attracting more foreign investment.

- Growing Trading Volumes: Increased trading activity reflects growing investor confidence and market liquidity.

Competitive Advantages of Deutsche Bank

Deutsche Bank brings significant strengths and expertise to the Saudi Arabian market. Its extensive experience in global investment banking, coupled with its understanding of complex financial transactions, positions it to cater to the sophisticated needs of both international and local investors.

- Services for International Investors:

- Wealth Management: Providing customized wealth management solutions tailored to high-net-worth individuals.

- Investment Banking Services: Offering comprehensive advisory, underwriting, and capital markets services.

- Trade Finance: Facilitating international trade and commerce through various financial instruments.

- Corporate Banking: Providing comprehensive financial services to multinational corporations operating in Saudi Arabia.

Key Strategies Employed by Deutsche Bank

Deutsche Bank's success in attracting global investors to Saudi Arabia relies on a multifaceted approach that combines targeted marketing, tailored investment products, and a commitment to a strong local presence.

Targeted Marketing and Outreach

Deutsche Bank is actively engaging with global investors through a range of targeted marketing and outreach initiatives. This includes participating in international investment conferences and building relationships with key players in the global investment community.

- Marketing and Outreach Examples:

- Targeted Conferences and Roadshows: Hosting and participating in events specifically aimed at attracting foreign investment to Saudi Arabia.

- Strategic Partnerships: Collaborating with Saudi government agencies and organizations to promote investment opportunities.

- Digital Marketing Campaigns: Utilizing online platforms and social media to reach potential investors globally.

Investment Product and Service Offerings

Deutsche Bank is offering a range of investment products and services tailored to the specific needs of international investors in Saudi Arabia. This includes Sharia-compliant investment options to cater to the local market requirements.

- Tailored Investment Products and Services:

- Sukuk Offerings: Providing access to Islamic bonds (Sukuk), a significant asset class in the Saudi market.

- Equity Investments: Offering opportunities for investment in publicly traded Saudi companies.

- Private Equity Investments: Facilitating investments in promising private Saudi companies.

- Real Estate Investment Trusts (REITs): Offering diversified investment opportunities in the Saudi real estate market.

Strengthening Local Presence and Partnerships

Deutsche Bank is committed to establishing a strong on-the-ground presence in Saudi Arabia, building crucial relationships with local businesses and institutions. This will enable the bank to better understand and serve its clients in the market.

- Examples of Partnerships and Collaborations:

- Joint ventures with local Saudi firms.

- Strategic alliances with regional financial institutions.

- Sponsorship of local economic development initiatives.

Implications and Future Outlook

Deutsche Bank's strategy in Saudi Arabia has significant implications for the country's economic development and for the bank's own future growth.

Impact on Saudi Arabia's Economic Growth

Deutsche Bank's efforts to attract global investors to Saudi Arabia are expected to contribute positively to the nation's economic growth, supporting the goals outlined in Vision 2030. Increased FDI will stimulate various sectors, create jobs, and transfer technological expertise.

- Positive Economic Outcomes:

- Increased FDI: Attracting substantial foreign investment.

- Job Creation: Generating employment opportunities for Saudi nationals.

- Technological Transfer: Facilitating the transfer of advanced technologies and expertise.

Competition and Market Dynamics

The Saudi Arabian financial sector is competitive, with established international and local players. Deutsche Bank's strategic positioning will be crucial for differentiating itself and capturing market share.

- Key Competitors: Other major international banks operating in Saudi Arabia.

Long-Term Prospects for Deutsche Bank in Saudi Arabia

Deutsche Bank's long-term success in Saudi Arabia will depend on its ability to adapt to the evolving market dynamics, maintain strong partnerships, and consistently deliver high-quality services. The success of Vision 2030 will undoubtedly impact Deutsche Bank's growth trajectory.

- Factors Contributing to Success:

- Strong local partnerships.

- Deep understanding of the Saudi market.

- Adaptability to regulatory changes.

Conclusion

Deutsche Bank's strategic focus on attracting global investors to Saudi Arabia represents a significant opportunity for both the bank and the Kingdom's economic development. By leveraging its expertise and adapting to the unique needs of the Saudi market, Deutsche Bank is well-positioned to capitalize on the growth potential offered by Vision 2030. This initiative underscores the bank's commitment to international expansion and demonstrates its confidence in the future of the Saudi Arabian economy. To learn more about Deutsche Bank's investment opportunities in Saudi Arabia, visit their website and explore the range of services available for global investors interested in the Saudi market. Explore the potential of Deutsche Bank Saudi Arabia today!

Featured Posts

-

Harga Kawasaki Z900 Dan Z900 Se Review Spesifikasi Dan Fitur Unggulan

May 30, 2025

Harga Kawasaki Z900 Dan Z900 Se Review Spesifikasi Dan Fitur Unggulan

May 30, 2025 -

Des Moines Memorial Day Weekend Events Parades And Remembrance

May 30, 2025

Des Moines Memorial Day Weekend Events Parades And Remembrance

May 30, 2025 -

M Net Firmenlauf Augsburg Alle Infos Zum Heutigen Lauf

May 30, 2025

M Net Firmenlauf Augsburg Alle Infos Zum Heutigen Lauf

May 30, 2025 -

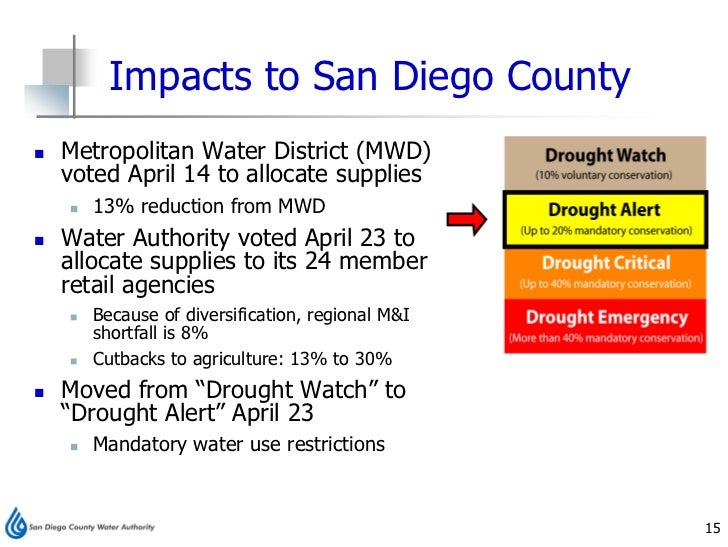

San Diego Water Authority To Sell Surplus Water To Offset Costs

May 30, 2025

San Diego Water Authority To Sell Surplus Water To Offset Costs

May 30, 2025 -

Des Moines Central Campus Agriscience Program Paused What We Know

May 30, 2025

Des Moines Central Campus Agriscience Program Paused What We Know

May 30, 2025