Detailed Breakdown: House GOP's Trump Tax Cut Plan

Table of Contents

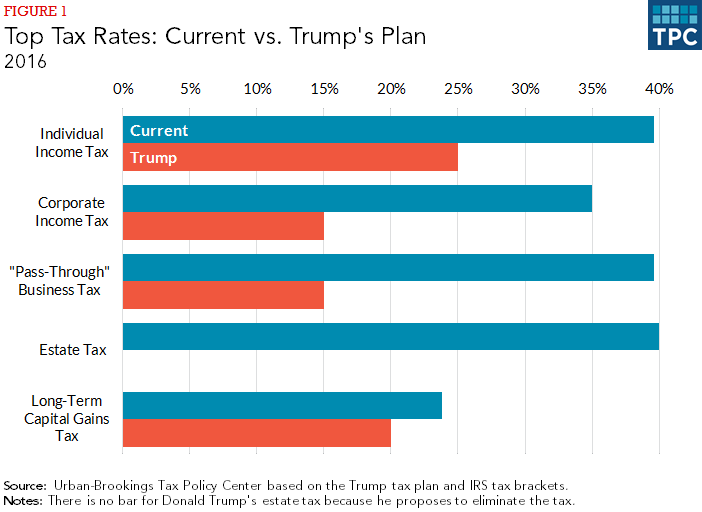

Core Tax Rate Reductions

The heart of the House GOP's Trump Tax Cuts plan lies in its proposed reductions to both individual and corporate income tax rates. These changes aim to stimulate economic growth, but their impact remains a subject of considerable discussion.

Individual Income Tax Rates

The plan proposes significant changes to individual income tax brackets. While the exact figures are still subject to revision, the general direction is towards lower rates across the board.

- Proposed Rate Changes: The plan may lower the top individual income tax rate from the current 37% to a level potentially closer to the 35% rate seen during the Trump administration's 2017 tax cuts. Lower brackets would also experience reductions, though the extent of those reductions is yet to be fully detailed.

- Estimated Tax Savings: The projected tax savings vary considerably depending on income level. Higher-income earners are expected to realize more significant savings in absolute terms, while lower-income individuals might experience smaller percentage reductions. Precise figures are difficult to predict without finalized legislation.

- Comparison with Trump's 2017 Tax Cuts: While inspired by the 2017 tax cuts, this new proposal may differ in its specific rate structures and the distribution of tax benefits across income groups. A direct comparison requires the release of the final legislative text.

Corporate Tax Rate Changes

The proposed reduction in the corporate tax rate is another central element of the plan. Proponents argue that lowering the rate will boost investment, job creation, and overall economic activity.

- Proposed Corporate Tax Rate: The plan aims to lower the corporate tax rate, potentially returning it to a level similar to the 20% rate enacted under the 2017 Tax Cuts and Jobs Act.

- Impact on Small Businesses vs. Large Corporations: While all corporations would benefit from a lower rate, the impact could vary depending on size and structure. Smaller businesses might find it easier to reinvest profits due to increased cash flow, while larger corporations may prioritize shareholder returns.

- Comparison with the Current Corporate Tax Rate: Currently, the corporate tax rate stands at 21%. The proposed reduction represents a significant change, potentially impacting business strategies and investment decisions.

Key Deduction and Credit Modifications

Beyond tax rate reductions, the House GOP's Trump Tax Cut Plan proposes several changes to deductions and credits, potentially altering the tax burden for many individuals and families.

Standard Deduction Changes

The standard deduction, the amount taxpayers can deduct without itemizing, might be altered under this plan.

- Proposed Changes to the Standard Deduction Amount: Details regarding any changes to the standard deduction are yet to be released. However, adjustments could significantly impact the number of taxpayers choosing to itemize versus using the standard deduction.

- Impact on Taxpayers Who Itemize vs. Those Who Take the Standard Deduction: Changes to the standard deduction could shift the balance between itemizing and taking the standard deduction, potentially affecting the tax liability of different taxpayers.

- Analysis of the Impact on Different Family Sizes: The impact of any change will likely vary based on factors such as family size and income, with larger families potentially seeing more significant benefits or drawbacks.

Child Tax Credit Adjustments

The Child Tax Credit (CTC), a crucial support for families with children, may also undergo revisions.

- Proposed Changes to the Child Tax Credit Amount: The plan may modify the existing CTC, possibly increasing the credit amount or adjusting eligibility requirements.

- Changes to Eligibility Criteria: Alterations to eligibility criteria could expand or limit the number of families who qualify for the credit.

- Potential Impact on Families with Different Numbers of Children: The impact on families will vary significantly depending on the number of qualifying children.

Other Notable Deduction Changes

The plan may include changes to other significant deductions, such as mortgage interest deductions or state and local tax (SALT) deductions.

- Specific Changes to Each Deduction: The specifics of these changes are currently unknown.

- Potential Impact of Each Change on Different Taxpayer Groups: These changes could disproportionately affect specific groups of taxpayers based on their financial situations and geographic location.

- Overall Effect on Tax Burden for Various Taxpayers: The combined impact of these modifications on the overall tax burden is difficult to predict without detailed legislative text.

Economic and Political Implications

The House GOP's Trump Tax Cut Plan has far-reaching economic and political consequences that extend beyond its immediate impact on tax rates.

Projected Economic Growth

Supporters argue that the tax cuts will stimulate economic growth.

- Projected GDP Growth Rates Under the Plan: Economic forecasts surrounding the plan's impact on GDP growth are widely varied and depend heavily on the specific details of the proposed changes.

- Projected Job Creation: The plan's proponents anticipate increased job creation due to stimulated business investment. However, this prediction relies on several assumptions about business behavior and overall economic conditions.

- Potential Inflationary Pressures: Significant tax cuts could lead to increased demand and potentially inflationary pressures, depending on the overall health of the economy.

Political Ramifications

The tax plan is certain to have major political ramifications.

- Public Opinion Polls Regarding the Tax Plan: Public opinion on the plan is divided, with some supporting the tax cuts as a stimulus for economic growth and others concerned about their impact on income inequality.

- Potential Impact on the Upcoming Elections: The plan is likely to become a major issue in upcoming elections, influencing voter turnout and political alignments.

- Likely Legislative Hurdles and Opposition: The plan will likely face significant opposition from Democrats and potentially even some Republicans, leading to prolonged legislative battles.

Conclusion

The House GOP's Trump-inspired tax cut plan presents a multifaceted and potentially transformative set of changes to the US tax code. This analysis highlights key features, but a complete understanding requires further research. This plan's success hinges on its ability to deliver on its promises of economic growth while addressing concerns about income inequality. For a comprehensive understanding of how this plan might impact your personal finances, consult a qualified tax professional. Further research into the House GOP's Trump Tax Cut Plan is strongly recommended to fully appreciate its implications.

Featured Posts

-

Photo 5141426 Cassie And Alex Fines Red Carpet Moment At The Mob Land Premiere

May 13, 2025

Photo 5141426 Cassie And Alex Fines Red Carpet Moment At The Mob Land Premiere

May 13, 2025 -

Natural Fiber Composites Market 2029 A Detailed Global Forecast

May 13, 2025

Natural Fiber Composites Market 2029 A Detailed Global Forecast

May 13, 2025 -

Doom The Dark Ages Early Access Release Dates And Times Across Regions

May 13, 2025

Doom The Dark Ages Early Access Release Dates And Times Across Regions

May 13, 2025 -

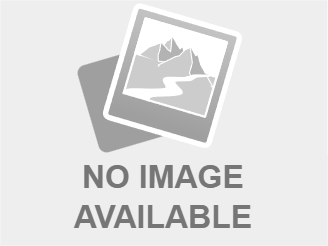

Stock Market Valuations Bof As Reassurance For Investors

May 13, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 13, 2025 -

Addressing The Ethical Concerns Of Halal Slaughter For Vegans

May 13, 2025

Addressing The Ethical Concerns Of Halal Slaughter For Vegans

May 13, 2025