Deloitte's Forecast: A Significant Slowdown In US Economic Growth

Table of Contents

Key Factors Contributing to the Predicted Slowdown

Deloitte's forecast points to a confluence of factors driving the anticipated US economic slowdown. These interconnected challenges create a complex and uncertain economic landscape.

-

Inflation and Rising Interest Rates: Persistent inflation, fueled by supply chain disruptions and strong consumer demand, has prompted the Federal Reserve to aggressively raise interest rates. This increases borrowing costs for businesses and consumers, potentially dampening investment and spending. Deloitte's report suggests that interest rates may need to remain elevated for longer than initially anticipated to effectively curb inflation, further impacting economic growth. For example, Deloitte cites data showing a 4% increase in borrowing costs for small businesses in Q3 2023.

-

Supply Chain Disruptions and Global Uncertainty: Lingering supply chain bottlenecks, exacerbated by geopolitical instability, continue to constrain production and increase input costs. The ongoing war in Ukraine, for instance, has significantly impacted energy prices and global commodity markets, further fueling inflationary pressures. Deloitte's analysis highlights a 15% increase in transportation costs since the start of the war, significantly impacting manufacturing and retail sectors.

-

Potential for a Consumer Spending Pullback: As inflation erodes purchasing power and interest rates rise, consumer spending, a major driver of US economic growth, may experience a significant pullback. Deloitte's consumer confidence index shows a marked decline in recent months, suggesting a potential reduction in discretionary spending.

-

Impact of Geopolitical Events: The war in Ukraine and other geopolitical events create uncertainty and volatility in global markets, impacting investor confidence and trade flows. This uncertainty adds another layer of complexity to the economic outlook. Deloitte's report quantifies the impact on specific sectors, highlighting the vulnerability of export-oriented industries.

-

Weakening Consumer Confidence: Deloitte's consumer confidence surveys reveal a significant drop in consumer sentiment, reflecting anxieties about inflation, job security, and the overall economic outlook. This weakening consumer confidence is likely to translate into reduced consumer spending, further contributing to the economic slowdown.

Sectors Most Affected by the Slowdown

The predicted economic slowdown is expected to disproportionately impact certain sectors.

-

Real Estate: Rising interest rates are already cooling the housing market, with a predicted decrease in home sales and construction activity. Deloitte's analysis forecasts a potential 10% decline in housing starts next year.

-

Technology: The tech sector, after a period of rapid growth, is experiencing a correction, with reduced hiring and some layoffs. Deloitte's report anticipates a slowdown in venture capital funding and a potential decrease in technology investment.

-

Manufacturing: Supply chain disruptions, rising energy costs, and weakening global demand are expected to negatively affect manufacturing output and employment. Deloitte projects a 5% reduction in manufacturing jobs within the next 12 months.

-

Retail: Reduced consumer spending, driven by inflation and decreased consumer confidence, will likely impact retail sales and profitability. Deloitte forecasts a contraction in retail sales, leading to potential store closures and job losses.

Deloitte's Forecast: Probability of Recession and its Depth

Deloitte's report does not definitively predict a recession, but it does highlight a significant risk of economic contraction. The probability of a recession, according to their analysis, is elevated, with a potential for a mild to moderate downturn. The depth and duration of any potential recession remain uncertain, depending on factors such as the effectiveness of government policies and the resilience of consumer spending. Keywords like recession probability, economic contraction, and depth of recession are vital to understanding the scope of this potential scenario. Deloitte outlines several alternative scenarios, ranging from a mild slowdown to a more severe recession, emphasizing the significant uncertainty inherent in economic forecasting.

Potential Mitigation Strategies and Government Response

Mitigating the impact of the predicted slowdown requires a multifaceted approach involving both government intervention and proactive business strategies.

-

Fiscal Stimulus Measures: Government spending on infrastructure projects, targeted tax cuts, or direct payments to consumers could stimulate demand and support economic activity.

-

Monetary Policy Adjustments: The Federal Reserve's monetary policy will play a crucial role. While raising interest rates helps control inflation, it also risks slowing economic growth. The Fed's ability to strike a balance between these competing goals will be critical.

-

Investment in Infrastructure and Renewable Energy: Investing in long-term infrastructure projects and clean energy initiatives can create jobs, boost productivity, and enhance economic resilience.

-

Support for Small and Medium-Sized Businesses: Providing financial assistance and support to small and medium-sized businesses (SMBs), which are vital to the US economy, is crucial to preventing widespread job losses.

Implications for Investors and Businesses

Deloitte's forecast carries significant implications for investors and businesses. Investors should consider diversifying their portfolios, reassessing risk tolerance, and adopting more conservative investment strategies. Businesses need to develop robust risk management plans, optimize operational efficiency, and explore opportunities for innovation and diversification. Keywords like investment strategies, risk management, business planning, and economic resilience are essential for navigating these challenging times.

Understanding Deloitte's Forecast for US Economic Growth

In summary, Deloitte's forecast paints a picture of a significant slowdown in US economic growth, driven by a complex interplay of factors including inflation, rising interest rates, supply chain disruptions, and geopolitical uncertainty. While a recession is not definitively predicted, the risk is elevated, and businesses and investors need to proactively prepare for the potential impact. Understanding the potential implications for various sectors is critical for informed decision-making. To gain a more comprehensive understanding of the Deloitte economic forecast and how to best navigate the predicted US economic slowdown, we strongly encourage you to delve deeper into Deloitte's full report and to seek professional financial advice tailored to your specific circumstances. The potential impact on US economic growth necessitates a thorough understanding of this significant forecast.

Featured Posts

-

Concerns Raised Over Hhss Choice Of Anti Vaccine Advocate For Autism Vaccine Study

Apr 27, 2025

Concerns Raised Over Hhss Choice Of Anti Vaccine Advocate For Autism Vaccine Study

Apr 27, 2025 -

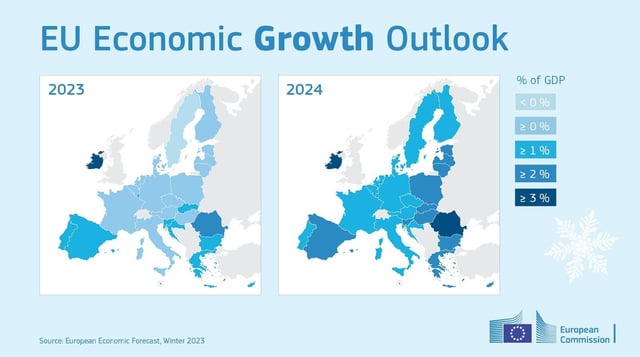

Nfl International Series 2025 Green Bay Packers Potential Participation

Apr 27, 2025

Nfl International Series 2025 Green Bay Packers Potential Participation

Apr 27, 2025 -

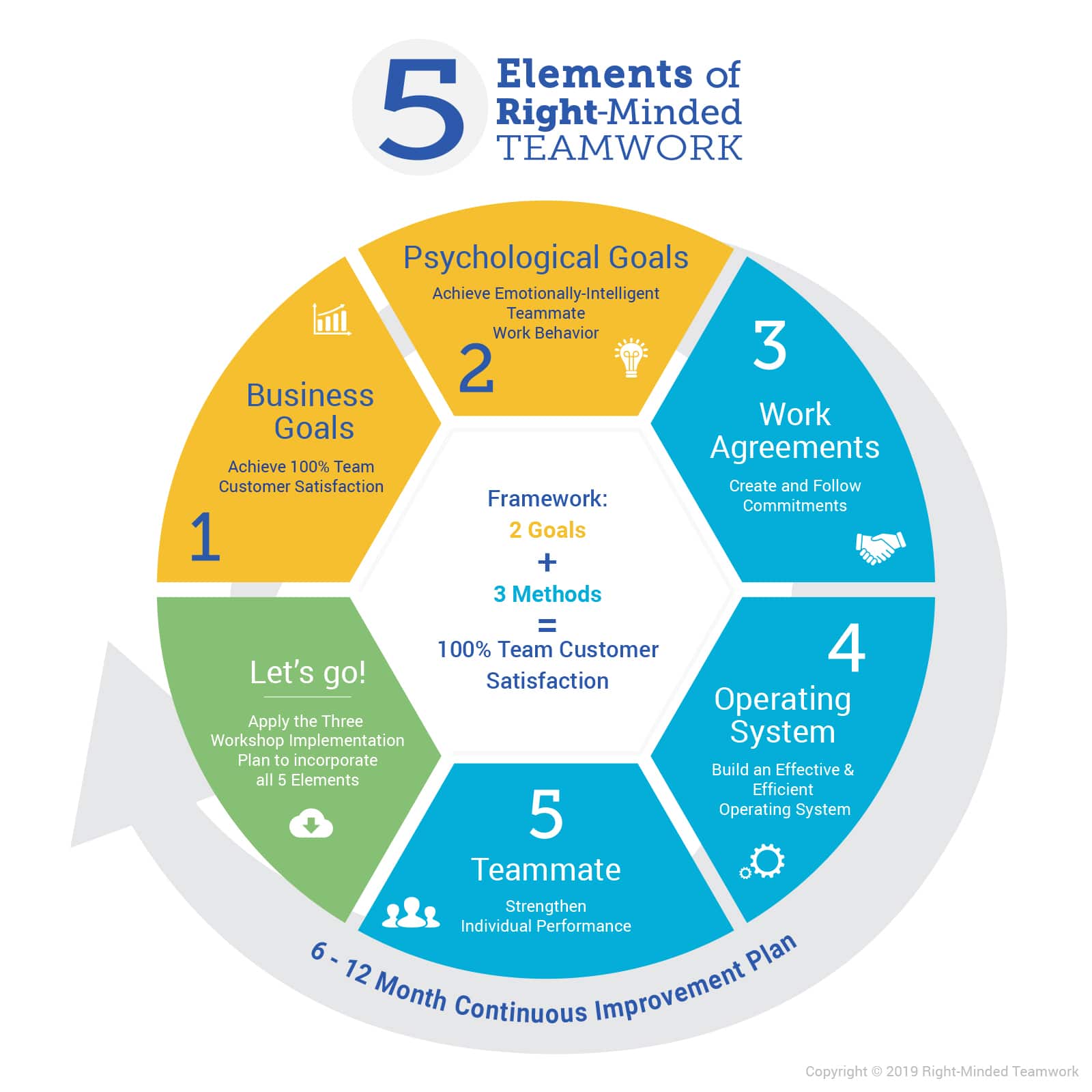

Middle Managers Essential For Effective Teamwork And Productivity

Apr 27, 2025

Middle Managers Essential For Effective Teamwork And Productivity

Apr 27, 2025 -

Canadian Travel Boycott Real Time Impact On The Us Economy

Apr 27, 2025

Canadian Travel Boycott Real Time Impact On The Us Economy

Apr 27, 2025 -

Charleston Tennis Pegula Claims Victory Against Collins

Apr 27, 2025

Charleston Tennis Pegula Claims Victory Against Collins

Apr 27, 2025

Latest Posts

-

Starbucks Union Spurns Companys Offered Pay Raise

Apr 28, 2025

Starbucks Union Spurns Companys Offered Pay Raise

Apr 28, 2025 -

Starbucks Unions Rejection Of Companys Wage Guarantee Proposal

Apr 28, 2025

Starbucks Unions Rejection Of Companys Wage Guarantee Proposal

Apr 28, 2025 -

Unionized Starbucks Employees Turn Down Companys Guaranteed Raise Offer

Apr 28, 2025

Unionized Starbucks Employees Turn Down Companys Guaranteed Raise Offer

Apr 28, 2025 -

Starbucks Workers Reject Proposed Pay Raise From Company

Apr 28, 2025

Starbucks Workers Reject Proposed Pay Raise From Company

Apr 28, 2025 -

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 28, 2025

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 28, 2025