Defense Sector Investment: BigBear.ai (BBAI) Stock Upgrade And Outlook

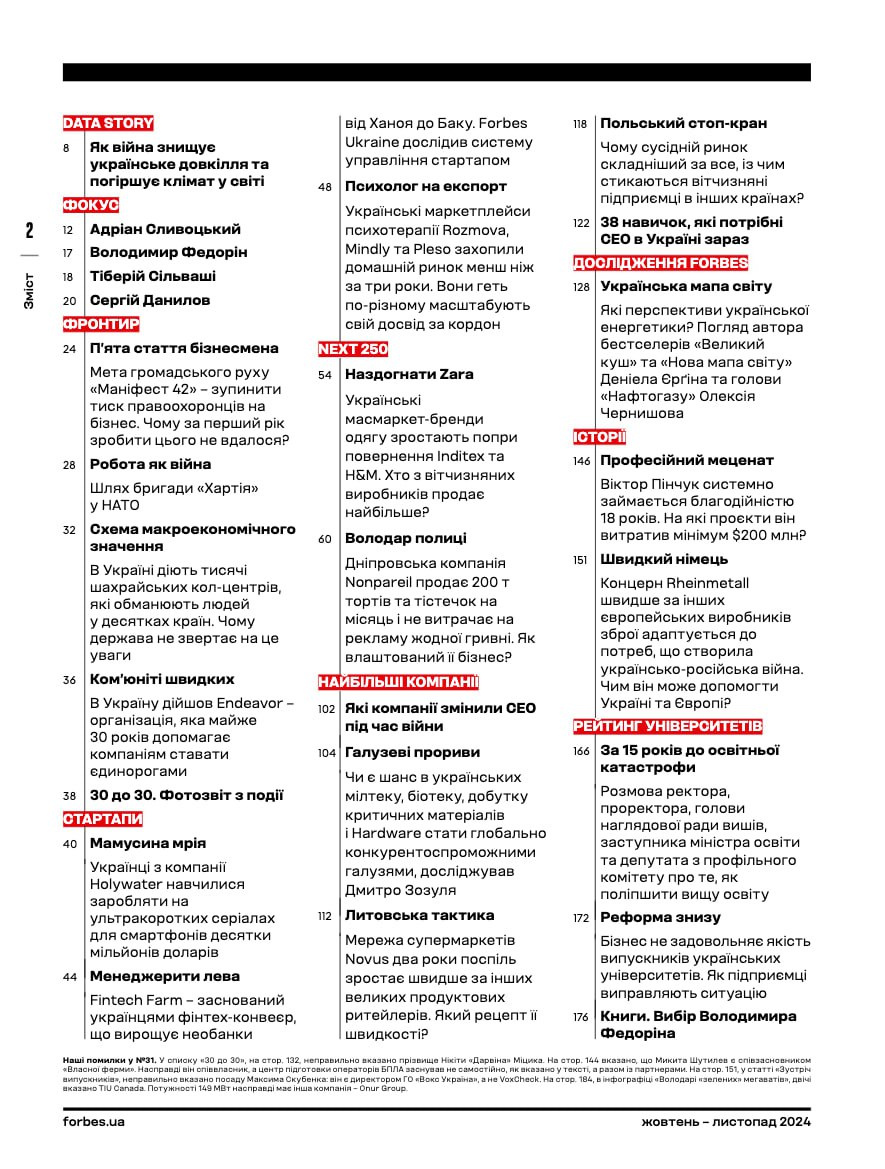

Table of Contents

BigBear.ai (BBAI) Stock Upgrade Analysis

Reasons Behind the Upgrade

Several factors contributed to the recent upgrade of BBAI stock. Analysts cited the following key reasons:

- Strong Contract Wins: BigBear.ai has secured several significant contracts with major defense agencies, demonstrating strong demand for its AI-powered solutions. One notable example is a multi-million dollar contract for advanced data analytics, showcasing the company's ability to win large-scale projects.

- Innovative AI Solutions: BBAI's portfolio of innovative AI solutions addresses critical needs within the defense sector, including intelligence analysis, cybersecurity, and logistics optimization. Their unique approach to data fusion and predictive modeling sets them apart from competitors.

- Improved Financial Outlook: The company has demonstrated significant improvement in its financial metrics, including revenue growth and a positive outlook on earnings per share (EPS). This improved financial performance directly contributed to the analyst upgrade. The increase in BBAI stock price reflects this positive trajectory.

These factors, combined with the growing market for defense AI, have led to a significant upgrade in BBAI's valuation by multiple financial analysts. The improved BBAI stock price is a direct reflection of this positive sentiment.

Impact of the Upgrade on Investor Sentiment

The analyst upgrade immediately impacted investor sentiment, leading to a surge in BBAI stock price and trading volume. Investor confidence has visibly increased, as evidenced by the heightened trading activity and positive market reaction. The increased BBAI stock performance is a direct result of the improved investor confidence and the positive outlook for the company's future.

BigBear.ai's Position in the Defense Sector

Competitive Advantage

BigBear.ai possesses several key competitive advantages within the defense sector:

- Proprietary AI Technologies: BBAI boasts proprietary AI and machine learning algorithms that provide superior accuracy and efficiency compared to competitors. This technological edge translates to better solutions for its defense clients.

- Strategic Partnerships: The company has established strong partnerships with major defense contractors and technology providers, allowing it to expand its reach and access new market opportunities. These collaborations enhance BBAI's competitive standing within the defense AI landscape.

- Deep Domain Expertise: BBAI possesses a deep understanding of the specific needs and challenges faced by defense organizations, enabling it to tailor its solutions effectively. This expertise allows BBAI to create highly relevant and valuable products for its defense clients.

These factors collectively solidify BigBear.ai's position as a significant player in the defense AI landscape.

Growth Potential and Market Opportunities

The defense AI market is poised for significant growth in the coming years. BigBear.ai is well-positioned to capitalize on this growth through several key market opportunities:

- Expanding into New Defense Applications: BBAI can leverage its existing technologies to expand into new applications, such as autonomous systems and advanced threat detection. This diversification provides further avenues for BBAI growth potential.

- Geographical Expansion: The company can expand its reach into new geographical markets, particularly those with strong defense budgets and a growing need for AI-powered solutions. This geographical expansion will further unlock significant market opportunities for BBAI.

- Leveraging Partnerships for Growth: Further strategic partnerships will allow BBAI to scale its operations and reach a wider client base within the defense sector, thus maximizing the company’s growth potential.

Risks and Challenges Facing BigBear.ai

Potential Downside Risks

Despite its positive outlook, BigBear.ai faces several potential risks and challenges:

- Intense Competition: The defense AI market is becoming increasingly competitive, with both established players and new entrants vying for market share. This competitive landscape presents a key risk factor for BBAI.

- Regulatory Hurdles: The defense industry is highly regulated, and navigating regulatory requirements can be complex and time-consuming. Regulatory changes or delays could impact BBAI's project timelines and revenue streams.

- Geopolitical Risks: Global political instability and economic uncertainties can impact defense spending and create unforeseen challenges for BBAI's business operations. Geopolitical risks are an inherent aspect of operating within the defense sector.

Mitigation Strategies

BigBear.ai is employing several strategies to mitigate these risks:

- Investing in R&D: Continued investment in research and development helps maintain a competitive advantage and ensures that BBAI's technology remains at the forefront of the defense AI landscape.

- Strengthening Partnerships: Strengthening existing and forging new partnerships enables BBAI to better navigate regulatory hurdles and expand its market access.

- Diversifying Revenue Streams: Diversifying its client base and exploring new application areas helps mitigate the impact of potential setbacks in specific projects or market segments.

Conclusion: Defense Sector Investment: BigBear.ai (BBAI) Stock Outlook and Call to Action

The recent stock upgrade of BigBear.ai (BBAI) reflects its strong performance, innovative technology, and significant opportunities within the burgeoning defense AI market. While risks exist, BBAI's strategic mitigation plans and strong position in the sector suggest a positive outlook for Defense Sector Investment in BBAI. However, it is crucial to conduct thorough due diligence before making any investment decisions related to BBAI stock. Learn more about BigBear.ai (BBAI) and the exciting world of defense sector investment and make informed decisions based on your own research.

Featured Posts

-

Kahnawake Casino Dispute 220 Million In Damages Sought

May 21, 2025

Kahnawake Casino Dispute 220 Million In Damages Sought

May 21, 2025 -

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 21, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 21, 2025 -

Kritichno Vazhlivi Telekanali Ukrayini Rishennya Minkulturi Schodo 1 1 Inter Stb Ta Inshikh

May 21, 2025

Kritichno Vazhlivi Telekanali Ukrayini Rishennya Minkulturi Schodo 1 1 Inter Stb Ta Inshikh

May 21, 2025 -

Trans Australia Run Record A New Challenger Emerges

May 21, 2025

Trans Australia Run Record A New Challenger Emerges

May 21, 2025 -

Saisonende Bundesliga Abstieg Fuer Bochum Und Holstein Kiel Leipzig Enttaeuscht

May 21, 2025

Saisonende Bundesliga Abstieg Fuer Bochum Und Holstein Kiel Leipzig Enttaeuscht

May 21, 2025

Latest Posts

-

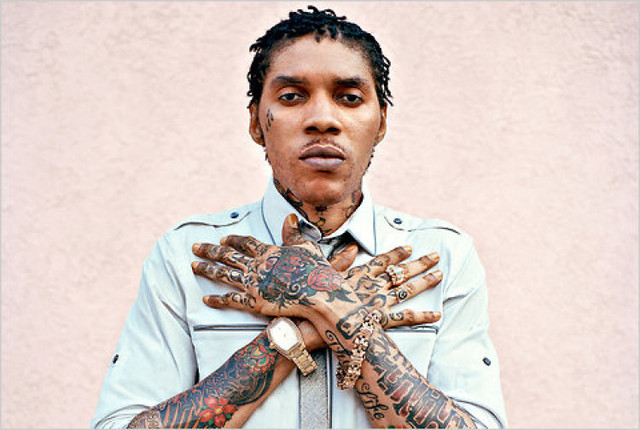

The Unforgettable Vybz Kartel Brooklyn Concerts Sell Out

May 22, 2025

The Unforgettable Vybz Kartel Brooklyn Concerts Sell Out

May 22, 2025 -

Vybz Kartels New York Shows Sold Out Success In Brooklyn

May 22, 2025

Vybz Kartels New York Shows Sold Out Success In Brooklyn

May 22, 2025 -

Brooklyn Roars For Vybz Kartel Sold Out Shows A Testament To His Enduring Popularity

May 22, 2025

Brooklyn Roars For Vybz Kartel Sold Out Shows A Testament To His Enduring Popularity

May 22, 2025 -

Vybz Kartel Electrifies Brooklyn Sold Out Concerts Captivate Fans

May 22, 2025

Vybz Kartel Electrifies Brooklyn Sold Out Concerts Captivate Fans

May 22, 2025 -

The Role Of Kartel In Shaping Rum Culture Analysis From Stabroek News

May 22, 2025

The Role Of Kartel In Shaping Rum Culture Analysis From Stabroek News

May 22, 2025