Declining Home Sales Signal Market Crisis, According To Realtors

Table of Contents

Factors Contributing to Declining Home Sales

Several interconnected factors are fueling the current decrease in home sales, creating a perfect storm for market instability. Realtors are pointing to these key issues as primary drivers of the slowdown.

Rising Interest Rates

Increased interest rates are significantly impacting home affordability. Higher rates translate directly into larger monthly mortgage payments, reducing the purchasing power of potential homebuyers.

- Impact on Monthly Payments: A 1% increase in interest rates can dramatically increase monthly mortgage payments, often exceeding the budget of many prospective buyers.

- Effect on Buyer Purchasing Power: With higher interest rates, buyers can afford to purchase a less expensive home, reducing demand in higher price brackets.

- Year-Over-Year Rate Comparison: Compared to last year, interest rates have risen by X%, making mortgages considerably more expensive for many. (Insert actual percentage increase here based on current data). This significant jump has drastically altered the affordability landscape.

High Inflation and Economic Uncertainty

Soaring inflation and a general sense of economic uncertainty are further dampening buyer enthusiasm. Consumers are hesitant to commit to large financial obligations like mortgages when facing rising prices and job insecurity.

- Impact on Disposable Income: Inflation eats away at disposable income, leaving less money available for a down payment and monthly mortgage payments.

- Fear of Job Losses: Economic uncertainty fuels anxiety about job security, making potential homebuyers reluctant to take on a substantial financial commitment.

- Hesitation to Commit to Large Purchases: In times of economic uncertainty, consumers tend to postpone large purchases like houses, preferring to conserve their resources. Current consumer confidence indices (insert data here) reflect this hesitation.

Limited Inventory

The persistent shortage of homes for sale is another critical factor contributing to declining home sales. Low inventory creates intense competition amongst buyers, often leading to bidding wars and inflated prices, further hindering affordability.

- Reasons for Low Inventory: Several factors contribute to low inventory, including historically low construction rates in previous years and sellers hesitant to list their properties due to concerns about finding suitable replacements.

- Impact on Bidding Wars: Limited supply fuels intense competition, pushing prices upward and making it challenging for many buyers to secure a home.

- Effect on Affordability: The combination of low inventory and high demand creates an unaffordable market for many potential homeowners. The current months of inventory (insert data here) highlight the severity of this supply shortage.

Increased Housing Costs

The cost of building a new home or even renovating an existing one has skyrocketed. This increase in both construction and renovation costs impacts both new and existing home prices, making them less accessible to many buyers.

- Increased Material Costs: The price of lumber, concrete, and other essential building materials has surged dramatically, significantly increasing construction costs. (Insert specific examples and data here, e.g., lumber price increase percentage.)

- Impact on Construction Timelines: Supply chain disruptions and labor shortages are lengthening construction timelines, further impacting costs and availability.

- Effect on Overall Home Prices: Higher construction costs inevitably lead to increased prices for both new and existing homes, making them less affordable for many buyers.

Impact of Declining Home Sales on the Market

The consequences of declining home sales extend beyond simply fewer transactions. The effects ripple throughout the entire real estate market and the broader economy.

Price Adjustments

Reduced demand is likely to lead to price adjustments in the housing market. While some markets might remain resilient, others could experience price corrections.

- Potential for Price Drops in Specific Markets: Markets with oversupply or weaker demand are most susceptible to price drops.

- Impact on Homeowners' Equity: Falling prices can negatively impact homeowners' equity, particularly those who purchased their homes recently at higher prices.

- Predictions for Future Price Trends: Experts predict (insert expert predictions and analysis here) for price trends in the coming months and years.

Market Slowdown

The overall real estate market is experiencing a significant slowdown. This translates to fewer transactions, reduced competition among buyers, and a more cautious approach from both buyers and sellers.

- Impact on Real Estate Agents: Reduced transaction volume directly impacts the income of real estate agents and brokers.

- Implications for Related Industries: The slowdown has knock-on effects on related industries like mortgage lenders, home improvement companies, and furniture retailers.

- Potential for a Longer-Term Correction: Some analysts believe the current slowdown could evolve into a longer-term market correction.

Impact on the Economy

A declining housing market has significant implications for the broader economy, potentially impacting consumer spending, job creation, and overall economic growth.

- Ripple Effect on Related Industries: The housing market's slowdown ripples through the economy, affecting various industries linked to construction, finance, and consumer spending.

- Impact on GDP: A weakened housing market can negatively impact the Gross Domestic Product (GDP) due to decreased construction activity and related economic activity.

- Potential for Government Intervention: Depending on the severity of the downturn, the government may consider intervention measures to stabilize the market.

Conclusion

The significant decrease in declining home sales is a result of a confluence of factors, including rising interest rates, high inflation, limited inventory, and increased housing costs. Realtors' concerns about a potential market crisis are justified given the severity of these interconnected issues. The consequences of this slowdown extend beyond the real estate market, impacting the broader economy and affecting consumers' financial well-being. Understanding the factors driving these declining home sales is crucial. Stay informed and consult with a qualified realtor to navigate this challenging market. Don't let the current state of declining home sales catch you off guard; plan ahead.

Featured Posts

-

Amorim To Block Man Uniteds Bid For Star Player

May 30, 2025

Amorim To Block Man Uniteds Bid For Star Player

May 30, 2025 -

The End Of An Era Evan Longorias Retirement From The Tampa Bay Rays

May 30, 2025

The End Of An Era Evan Longorias Retirement From The Tampa Bay Rays

May 30, 2025 -

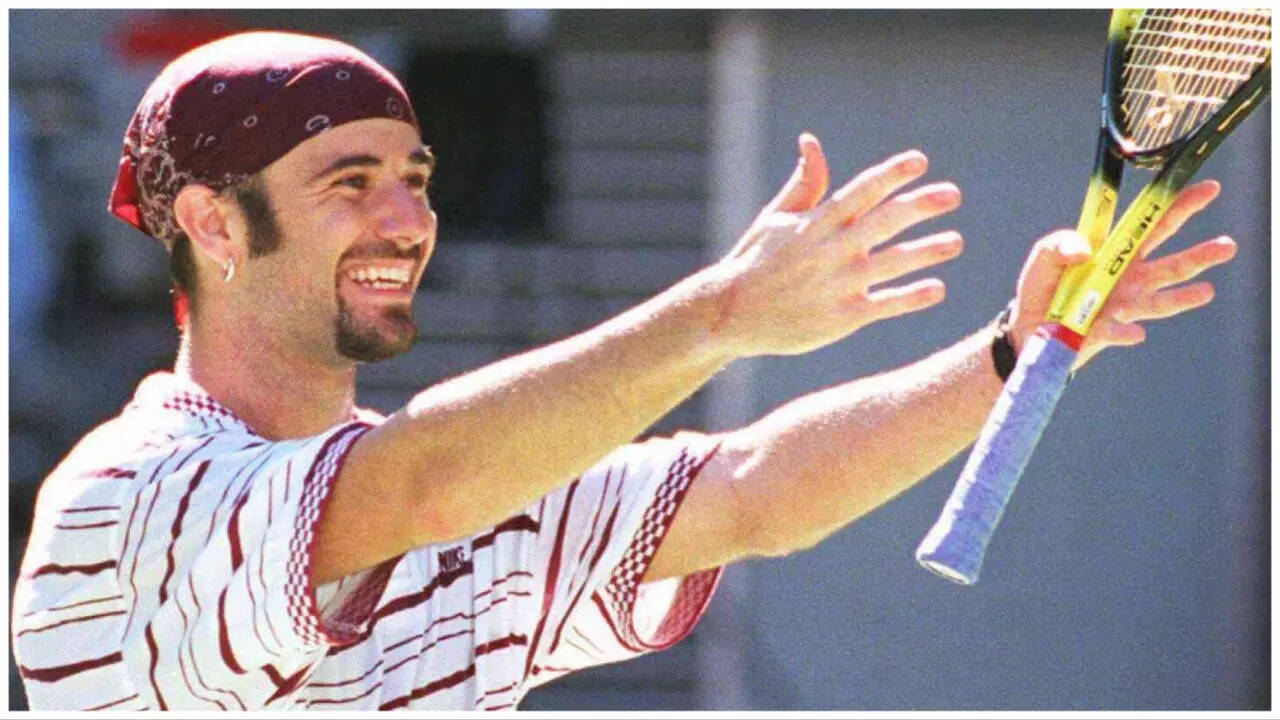

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025 -

Andre Agassi Joins The Pickleball Pro Tour Debut Match Review

May 30, 2025

Andre Agassi Joins The Pickleball Pro Tour Debut Match Review

May 30, 2025 -

French Open 2024 Ruud And Tsitsipas Early Departures Swiateks Continued Success

May 30, 2025

French Open 2024 Ruud And Tsitsipas Early Departures Swiateks Continued Success

May 30, 2025

Latest Posts

-

Summer Arts And Entertainment A Locals Guide To The Best Events

May 31, 2025

Summer Arts And Entertainment A Locals Guide To The Best Events

May 31, 2025 -

Girons Victory Ends Berrettinis Madrid Campaign

May 31, 2025

Girons Victory Ends Berrettinis Madrid Campaign

May 31, 2025 -

The Comprehensive Summer Arts And Entertainment Guide For Location If Applicable

May 31, 2025

The Comprehensive Summer Arts And Entertainment Guide For Location If Applicable

May 31, 2025 -

Madrid Masters 1000 Berrettinis Exit Confirmed

May 31, 2025

Madrid Masters 1000 Berrettinis Exit Confirmed

May 31, 2025 -

Elon Musk Resigns From Trump Administration Reasons And Implications

May 31, 2025

Elon Musk Resigns From Trump Administration Reasons And Implications

May 31, 2025