Decline In Frankfurt: DAX Closes Slightly Below 24,000

Table of Contents

Factors Contributing to the DAX Decline

Several interconnected economic and geopolitical factors have contributed to the recent DAX decline. The current market volatility is a complex issue, influenced by both internal and external pressures on the German economy and the wider European Union.

-

Inflation and Interest Rate Hikes: Persistent inflation across the Eurozone has forced the European Central Bank (ECB) to implement aggressive interest rate hikes. These hikes, while aimed at curbing inflation, increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting investor confidence. Keywords: ECB interest rates, inflation, recession, geopolitical risk, investor sentiment, market psychology.

-

Global Economic Slowdown and Recessionary Fears: The global economy is facing significant headwinds, with fears of a looming recession in many major economies. This uncertainty is impacting investor sentiment, leading to a flight to safety and a sell-off in riskier assets, including those represented in the DAX.

-

Geopolitical Instability: The ongoing war in Ukraine continues to exert significant pressure on the global economy, causing energy price spikes and supply chain disruptions. This geopolitical instability contributes to market uncertainty and negatively affects investor confidence. The energy crisis in Europe, exacerbated by the war, is a significant factor in this decline.

-

Specific Company Performance: The performance of individual companies within the DAX also plays a crucial role. Negative earnings reports or disappointing forecasts from major German corporations can trigger sell-offs and contribute to the overall decline.

-

Investor Sentiment and Market Psychology: Market psychology is a powerful force. Negative news, coupled with existing anxieties about inflation and recession, can create a self-fulfilling prophecy, leading to further sell-offs and increased market volatility.

Analysis of the DAX Performance Below 24,000

The DAX closing below 24,000 is a significant event, marking a notable decline from recent highs. Whether this represents a temporary dip or the start of a more sustained downturn remains to be seen. [Insert Chart/Graph of DAX performance here]. A comparison with previous market downturns reveals similarities in terms of triggering factors but also differences in the specific economic context. This current situation necessitates close monitoring of key economic indicators to better understand the underlying trends. Keywords: DAX performance, market analysis, stock market trends, technical analysis, chart analysis. Technical analysis of the DAX chart suggests [Insert technical analysis interpretation, e.g., potential support levels, resistance levels, trendline analysis]. This analysis will help investors understand the potential direction of the market.

Impact on German and European Economies

The decline in the DAX has significant implications for both the German and European economies. The interconnectedness of European markets means that a downturn in Germany, Europe's largest economy, will likely have wider repercussions.

-

German Businesses and Employment: A weakening DAX can translate to reduced investment, slower growth, and potential job losses in various sectors of the German economy, especially export-oriented industries.

-

Investor Confidence: The decline erodes investor confidence, both domestically and internationally, potentially leading to reduced investment and further economic slowdown.

-

Consumer Spending: Reduced investor confidence and potential job losses can also dampen consumer spending, creating a negative feedback loop that exacerbates the economic downturn.

-

European Union Economic Outlook: Given Germany's central role in the European Union, the DAX decline casts a shadow over the broader economic outlook for the EU, potentially impacting growth and stability across the bloc. Keywords: German economy, European economy, economic impact, investor confidence, consumer spending.

Conclusion: Navigating the Frankfurt DAX Decline – Outlook and Recommendations

The DAX closing below 24,000 reflects a complex interplay of inflation, geopolitical uncertainty, and global economic anxieties. The significance of this decline cannot be underestimated, as it potentially signals a broader economic slowdown in Germany and the EU. The outlook remains cautious, with several potential scenarios depending on the evolution of the global economy and geopolitical situation. While a swift recovery is possible, preparedness for a more prolonged period of market volatility is prudent. Keywords: DAX outlook, market forecast, investment strategy, financial advice.

It is crucial to stay informed about DAX performance and market trends. However, we strongly recommend seeking professional financial advice before making any investment decisions. Monitor the DAX index closely for further updates and changes to better navigate this period of market uncertainty. Understanding the nuances of the DAX and its connection to the broader global economy is key to making informed decisions.

Featured Posts

-

The Ultimate Escape To The Country Properties Activities And More

May 25, 2025

The Ultimate Escape To The Country Properties Activities And More

May 25, 2025 -

Hromadne Prepustanie V Nemecku Dosledky Pre Ekonomiku A Zamestnancov

May 25, 2025

Hromadne Prepustanie V Nemecku Dosledky Pre Ekonomiku A Zamestnancov

May 25, 2025 -

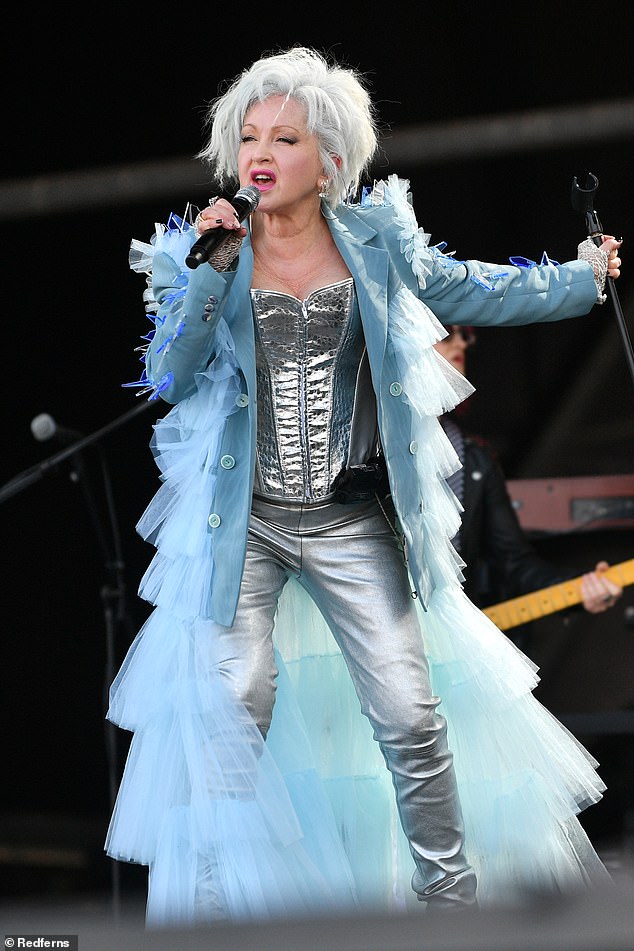

Us Bands Glastonbury Gig Unconfirmed But Likely

May 25, 2025

Us Bands Glastonbury Gig Unconfirmed But Likely

May 25, 2025 -

Mest Myagkovu Satira Ryazanova V Garazhe I Pomosch Brezhneva

May 25, 2025

Mest Myagkovu Satira Ryazanova V Garazhe I Pomosch Brezhneva

May 25, 2025 -

Kuda Propali Pobediteli Evrovideniya Poslednikh 10 Let

May 25, 2025

Kuda Propali Pobediteli Evrovideniya Poslednikh 10 Let

May 25, 2025

Latest Posts

-

Tik Tok Tourism Backlash Amsterdam Residents Sue City Over Snack Bar Overload

May 25, 2025

Tik Tok Tourism Backlash Amsterdam Residents Sue City Over Snack Bar Overload

May 25, 2025 -

Lawsuit Filed Amsterdam Residents Blame Tik Tok For Crowds At Popular Snack Spot

May 25, 2025

Lawsuit Filed Amsterdam Residents Blame Tik Tok For Crowds At Popular Snack Spot

May 25, 2025 -

L Impatto Dei Dazi Sulle Borse La Ue Promette Una Risposta Decisa

May 25, 2025

L Impatto Dei Dazi Sulle Borse La Ue Promette Una Risposta Decisa

May 25, 2025 -

Nuovi Dazi Le Borse Europee Tremano Reazione Della Ue Imminente

May 25, 2025

Nuovi Dazi Le Borse Europee Tremano Reazione Della Ue Imminente

May 25, 2025 -

Borse In Picchiata La Ue Risponde Alle Nuove Tariffe Con Forti Avvertimenti

May 25, 2025

Borse In Picchiata La Ue Risponde Alle Nuove Tariffe Con Forti Avvertimenti

May 25, 2025