De Minimis Tariffs On Chinese Goods: Key Considerations For G-7 Countries

Table of Contents

H2: Defining De Minimis Tariffs and Their Impact on Chinese Imports

De minimis tariffs refer to the low thresholds below which imported goods are exempt from customs duties. These thresholds vary across countries but generally apply to low-value shipments, often those purchased online. For example, a common threshold might be $800 or less. The impact of these tariffs on Chinese imports is significant, particularly given China's dominance in the global manufacturing and e-commerce sectors.

- Impact on e-commerce and cross-border retail: De minimis tariffs significantly affect the booming cross-border e-commerce market. Lowering the threshold can lead to a surge in online purchases from Chinese retailers, potentially benefiting consumers with lower prices but also posing challenges for domestic businesses.

- Effects on consumer purchasing power and choice: Lower tariffs generally translate to lower prices for consumers, increasing purchasing power and providing access to a wider variety of goods. However, excessively low thresholds can lead to a flood of cheap imports, potentially undercutting domestic producers.

- Shift in import patterns from China: Changes in de minimis tariffs can dramatically shift import patterns. A reduction might lead to a substantial increase in low-value goods imported from China, while an increase could shift demand towards domestically produced goods or imports from other countries.

According to a recent report by [insert credible source and link here], the volume of Chinese goods affected by de minimis tariff changes in [mention specific G-7 country or region] was [insert statistic]. This highlights the significant scale of the issue and the potential for considerable economic impact.

H2: Economic Implications for G-7 Countries

The macroeconomic consequences of varying de minimis tariff levels are multifaceted and depend heavily on the specific threshold and the responsiveness of domestic industries.

- Potential job creation/loss due to tariff changes: Lowering tariffs could lead to job losses in certain domestic industries unable to compete with cheaper imports from China. Conversely, it could create jobs in sectors related to e-commerce and logistics handling the increased import volume.

- Inflationary pressures and consumer price impacts: Changes in tariffs directly influence consumer prices. Lower tariffs generally reduce prices, while higher tariffs increase them, potentially contributing to inflation. The magnitude of this impact depends on the elasticity of demand and supply.

- Effects on supply chains and global trade: De minimis tariffs can disrupt global supply chains, particularly if they lead to retaliatory measures or trade disputes. This can result in increased costs, delays, and uncertainty for businesses.

The potential for trade imbalances is a significant concern. A substantial increase in low-value imports from China, driven by low de minimis tariffs, could exacerbate existing trade deficits for some G-7 nations.

H2: Geopolitical Considerations and Trade Relations with China

De minimis tariff policies have significant geopolitical ramifications, impacting relations between G-7 countries and China.

- Potential for retaliatory tariffs from China: Unilateral adjustments to de minimis tariffs by G-7 countries could provoke retaliatory measures from China, escalating trade tensions and harming global trade.

- The role of international trade organizations (WTO): The WTO framework plays a vital role in regulating tariffs and resolving trade disputes. G-7 countries must navigate their de minimis tariff policies within the bounds of WTO rules and agreements.

- Impact on bilateral trade negotiations and agreements: De minimis tariff decisions can significantly influence bilateral trade negotiations and agreements between G-7 countries and China, potentially impacting future collaborative efforts.

Effective strategies for mitigating trade disputes include proactive communication, transparent policymaking, and a commitment to multilateral cooperation. Arbitration and mediation through the WTO can provide valuable dispute resolution mechanisms.

H2: Optimizing De Minimis Tariff Policies for G-7 Nations

Harmonizing de minimis tariffs across G-7 countries could streamline trade, reduce complexities, and promote fair competition.

- Collaborative approaches to tariff setting: G-7 nations could collaboratively establish a common framework for de minimis tariffs, ensuring a level playing field and reducing the potential for trade disputes.

- Balancing consumer benefits with domestic industry protection: Optimal de minimis tariff policies require carefully balancing the benefits of lower consumer prices with the need to protect domestic industries from unfair competition.

- The role of data-driven policymaking and impact assessments: Before implementing changes, thorough data-driven analysis and impact assessments are crucial to understanding the potential consequences of different tariff levels.

Consistent, transparent, and predictable de minimis tariff policies are essential for creating a stable and predictable business environment, both for domestic producers and for international trade partners.

3. Conclusion

Effectively managing de minimis tariffs on Chinese goods is crucial for G-7 nations. This requires a nuanced understanding of the economic, geopolitical, and social implications of these policies. Strategies for international collaboration and data-driven policymaking are vital to ensure fair competition and economic stability. Ignoring the complexities of these tariffs risks creating trade imbalances, damaging Sino-G7 relations, and potentially harming domestic industries.

Call to Action: G-7 countries need a collaborative and evidence-based approach to de minimis tariffs on Chinese goods. Understanding the complexities of these tariffs, including their impact on e-commerce and consumer choice, is paramount to building resilient and competitive economies. Further research and ongoing dialogue on these critical issues are essential to finding the optimal balance between fostering international trade and protecting domestic interests. A coordinated, transparent, and data-driven approach is vital for navigating the challenges presented by de minimis tariffs and ensuring a fair and equitable trading environment for all.

Featured Posts

-

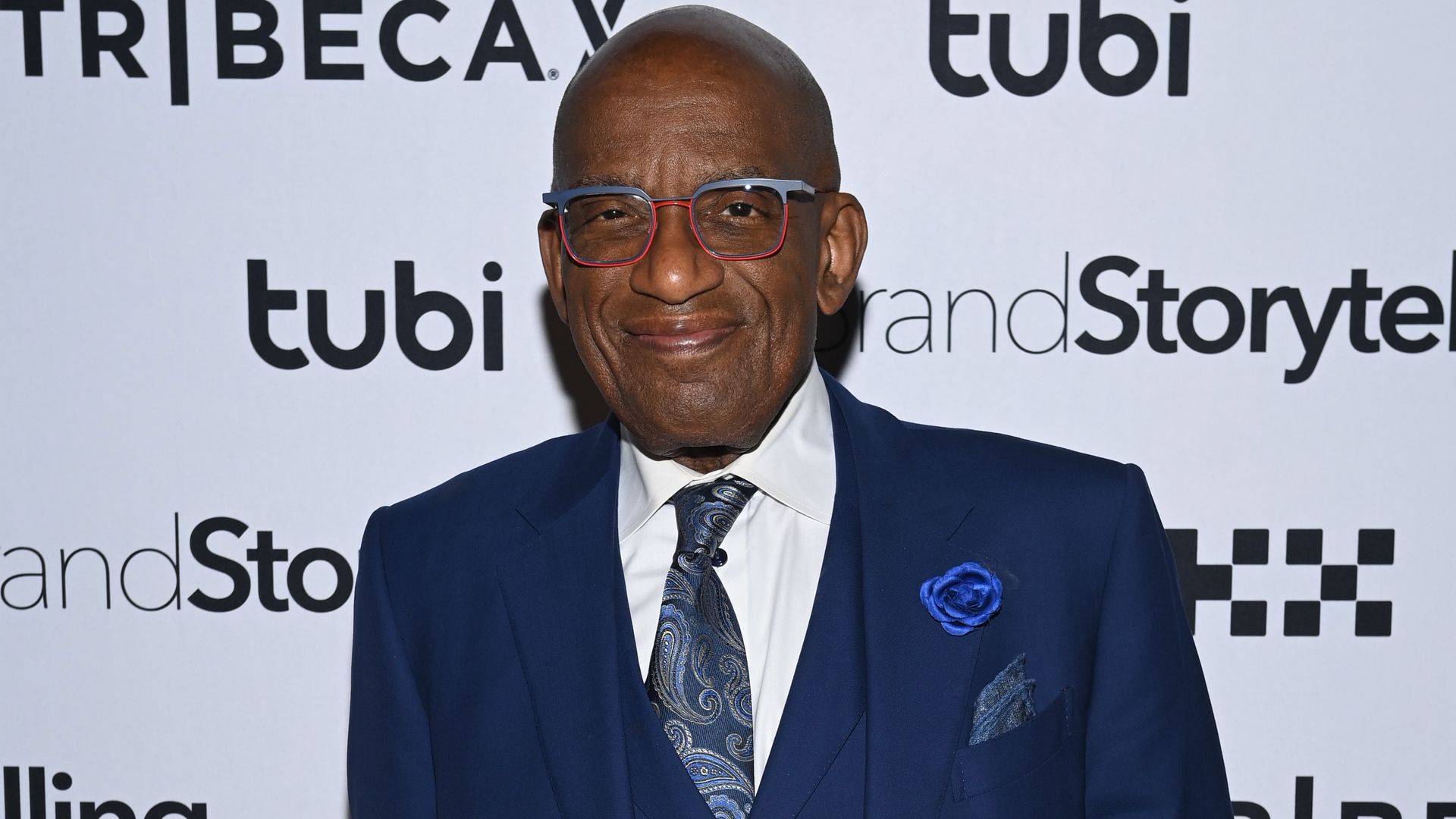

Al Roker Under Fire Co Hosts Reaction To Off Record Comments

May 23, 2025

Al Roker Under Fire Co Hosts Reaction To Off Record Comments

May 23, 2025 -

Muzarabani Targets 100 Test Wickets A Special Milestone For Zimbabwe

May 23, 2025

Muzarabani Targets 100 Test Wickets A Special Milestone For Zimbabwe

May 23, 2025 -

Erik Ten Hag Next Juventus Manager Man United News And Transfer Speculation

May 23, 2025

Erik Ten Hag Next Juventus Manager Man United News And Transfer Speculation

May 23, 2025 -

More Than Bmw And Porsche Examining The China Problem Facing Automakers

May 23, 2025

More Than Bmw And Porsche Examining The China Problem Facing Automakers

May 23, 2025 -

Managing The Increasing Wolf Population In The North State

May 23, 2025

Managing The Increasing Wolf Population In The North State

May 23, 2025

Latest Posts

-

How Joe Jonas Handled A Couple Fighting Over Him

May 23, 2025

How Joe Jonas Handled A Couple Fighting Over Him

May 23, 2025 -

The Hilarious Reason A Couple Argued Over Joe Jonas

May 23, 2025

The Hilarious Reason A Couple Argued Over Joe Jonas

May 23, 2025 -

How Joe Jonas Handled A Couples Argument About Him

May 23, 2025

How Joe Jonas Handled A Couples Argument About Him

May 23, 2025 -

Couple Fights Over Joe Jonas His Response Is Golden

May 23, 2025

Couple Fights Over Joe Jonas His Response Is Golden

May 23, 2025 -

Joe Jonas The Unexpected Mediator In A Couples Fight

May 23, 2025

Joe Jonas The Unexpected Mediator In A Couples Fight

May 23, 2025