DAX's Rise: Assessing The Risk Of A Wall Street Market Reversal

Table of Contents

The DAX (Deutscher Aktienindex), Germany's leading stock market index, and the broader Wall Street market are intrinsically linked. Global economic events, geopolitical shifts, and investor sentiment often ripple across these markets, creating a complex interplay of influences. Understanding this interconnectedness is paramount for navigating the current market climate and mitigating potential losses.

Analyzing the DAX's Recent Performance and Drivers

Economic Factors Fueling the DAX's Growth

Several economic factors have contributed to the DAX's recent growth. Strong performance indicators point to a healthy German economy, influencing the overall DAX performance.

- Robust German Economic Data: Recent data reveals strong growth in key sectors like manufacturing and exports, fueling investor confidence. Germany's unemployment rate remains low, further bolstering economic optimism.

- Eurozone Recovery: The broader Eurozone's economic recovery is also supporting the DAX. Improved economic conditions in other major European economies contribute to increased trade and investment within the region.

- Strong Corporate Earnings: Many DAX-listed companies have reported robust corporate earnings, reflecting strong demand and efficient operations. These positive earnings reports enhance investor confidence and drive up stock prices.

- Global Demand: Increased global demand for German goods, particularly in key export markets, has fueled economic growth and positively impacted the DAX.

These factors, reflected in various DAX performance indicators, paint a picture of a thriving German economy, providing a strong foundation for the DAX's growth. However, this positive outlook needs to be analyzed in the context of potential risks.

Geopolitical Influences and Their Impact on the DAX

Geopolitical events significantly influence investor sentiment and market volatility. The DAX's trajectory is not immune to these external pressures.

- The War in Ukraine: The ongoing conflict in Ukraine creates significant geopolitical risk, impacting global supply chains and energy prices. This uncertainty can negatively affect investor confidence and trigger market corrections.

- US-China Relations: The complex and evolving relationship between the US and China continues to create uncertainty in the global economy. Escalating tensions could negatively impact global trade and investor sentiment, potentially affecting the DAX.

These geopolitical factors introduce uncertainty and volatility into the market, highlighting the importance of carefully considering these risks when assessing the DAX's potential for future growth and the associated risk of a DAX market reversal. The impact of these events on investor confidence and market behavior is a crucial aspect to consider.

Identifying Potential Risks and Warning Signs of a Market Reversal

Overvaluation and Bubble Concerns in the DAX

Despite the positive economic indicators, concerns remain about potential overvaluation in certain sectors within the DAX.

- Market Overvaluation: Some analysts suggest that certain sectors within the DAX may be overvalued, based on metrics like Price-to-Earnings (P/E) ratios. This elevated valuation increases the risk of a significant correction.

- Stock Market Bubble: The possibility of speculative bubbles forming in specific sectors cannot be discounted. Rapid price increases fueled by speculation rather than fundamental value increase the likelihood of a sharp market downturn.

- DAX Valuation Metrics: A thorough analysis of DAX valuation metrics is essential to identify potential overvaluation and gauge the correction risk. Comparing current valuations to historical averages and industry benchmarks can provide valuable insights.

These concerns highlight the need for cautious optimism and a careful evaluation of the underlying valuations within the DAX.

Inflationary Pressures and Central Bank Policies

Inflationary pressures and central bank policies significantly impact market dynamics.

- Inflationary Pressures: Persistent inflationary pressures force central banks to implement tighter monetary policy, potentially slowing economic growth and impacting market performance.

- Interest Rate Hikes: Interest rate hikes by the Federal Reserve and the European Central Bank aim to curb inflation but can also slow economic growth and negatively impact the DAX's performance. The DAX's sensitivity to interest rates makes it vulnerable to these policy changes.

- Monetary Policy: Central banks' monetary policies play a crucial role in shaping market sentiment and influencing the direction of the DAX. Understanding these policies is vital for assessing the potential for a market correction.

Technical Indicators Suggesting a Potential DAX Reversal

Technical analysis provides valuable insights into potential market trends.

- Technical Analysis: Examining technical indicators such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can offer signals of an upcoming correction or reversal in the DAX.

- Moving Averages: The behavior of moving averages can indicate potential trend reversals. A downward trend in moving averages can signal a weakening market.

- RSI and MACD: RSI and MACD are momentum indicators that can help identify overbought or oversold conditions in the market, potentially signaling a reversal. DAX technical indicators should be carefully monitored for signs of a potential shift.

By using charts and graphs to visualize these indicators, investors can better understand potential shifts in the market and prepare accordingly.

Conclusion: The Future of the DAX and Wall Street Interdependence

The DAX's recent performance has been impressive, driven by robust economic data and strong corporate earnings. However, potential risks, including overvaluation concerns, inflationary pressures, and geopolitical uncertainties, warrant careful consideration. The interconnectedness of the DAX and Wall Street underscores the importance of a comprehensive risk assessment. Key takeaways include the necessity of considering both economic and geopolitical factors when assessing market risks. Diversification and prudent investment strategies are crucial for mitigating potential losses.

Stay ahead of the curve by continually monitoring the DAX's performance and assessing the risk of a Wall Street market reversal. Understanding the potential for a DAX-driven Wall Street market reversal is crucial for informed investment decisions.

Featured Posts

-

Brb Acquires Banco Master Public Meets Private In Brazils Banking Sector

May 25, 2025

Brb Acquires Banco Master Public Meets Private In Brazils Banking Sector

May 25, 2025 -

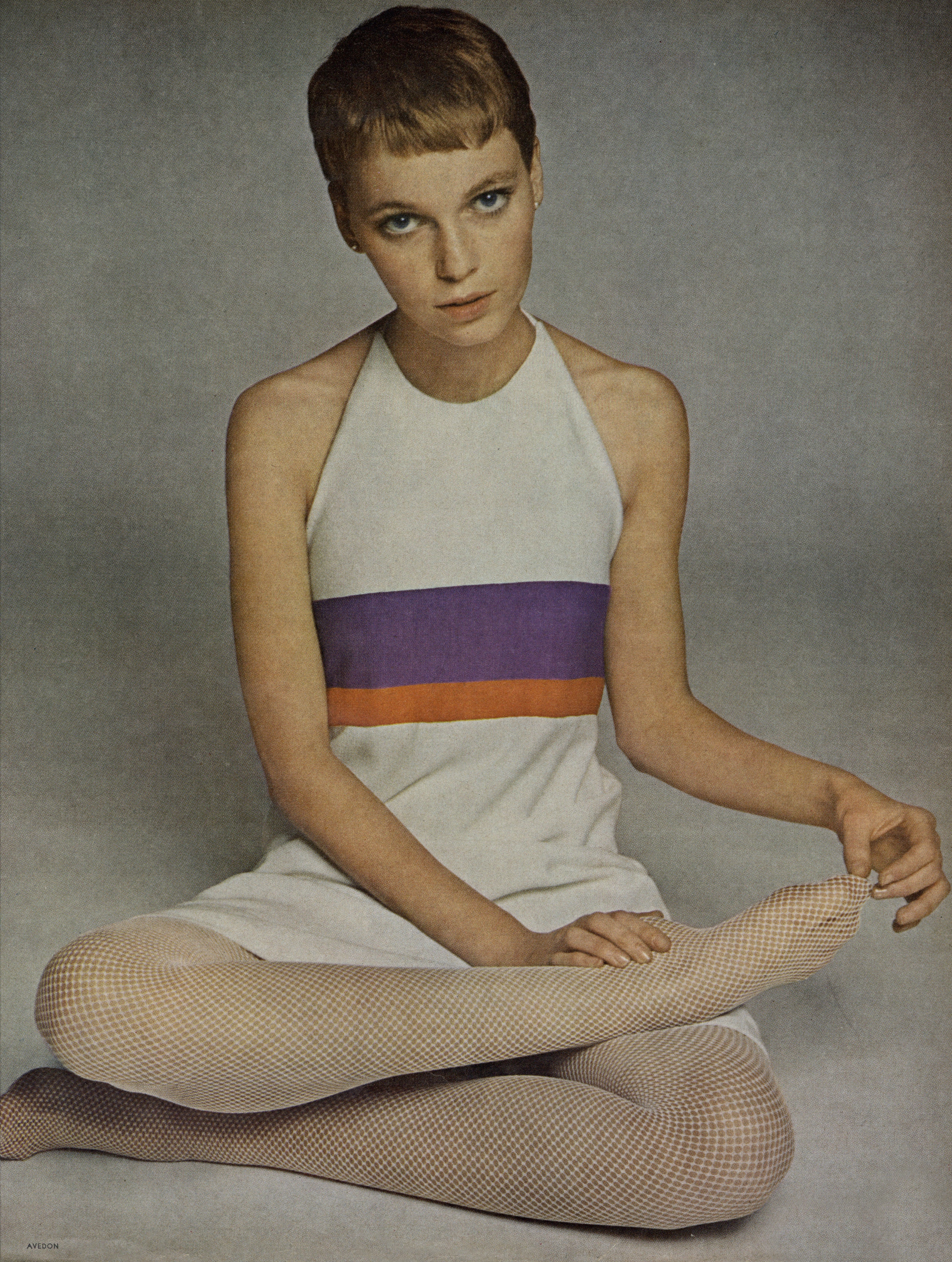

Michael Caines Mia Farrow Sex Scene Story An Unexpected Guest

May 25, 2025

Michael Caines Mia Farrow Sex Scene Story An Unexpected Guest

May 25, 2025 -

Investing In The Amundi Djia Ucits Etf Monitoring The Net Asset Value

May 25, 2025

Investing In The Amundi Djia Ucits Etf Monitoring The Net Asset Value

May 25, 2025 -

The Issue Of Thames Water Executive Bonuses A Public Perspective

May 25, 2025

The Issue Of Thames Water Executive Bonuses A Public Perspective

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Life

May 25, 2025

Escape To The Country Top Locations For A Tranquil Life

May 25, 2025

Latest Posts

-

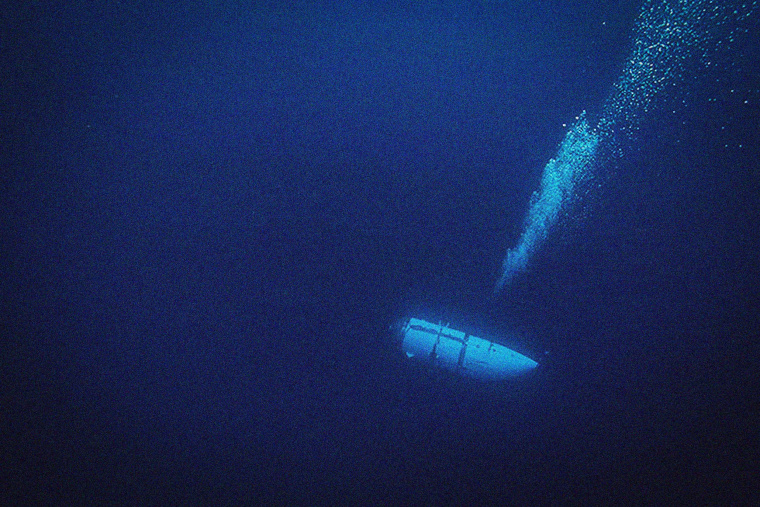

The Sound Of Disaster Analyzing The Titan Sub Implosion Footage

May 25, 2025

The Sound Of Disaster Analyzing The Titan Sub Implosion Footage

May 25, 2025 -

Footage Of Titan Subs Implosion The Distinctive Bang Explained

May 25, 2025

Footage Of Titan Subs Implosion The Distinctive Bang Explained

May 25, 2025 -

Houseboat No Its A Container Ship On A Front Lawn Cnn

May 25, 2025

Houseboat No Its A Container Ship On A Front Lawn Cnn

May 25, 2025 -

Examining Trumps Aggressive Stance On European Trade Deals

May 25, 2025

Examining Trumps Aggressive Stance On European Trade Deals

May 25, 2025 -

Titan Sub Implosion Footage Reveals The Devastating Sound

May 25, 2025

Titan Sub Implosion Footage Reveals The Devastating Sound

May 25, 2025