David Gentile, GPB Capital Founder, Receives 7-Year Prison Sentence For Fraud

Table of Contents

The GPB Capital Fraud Scheme: A Detailed Overview

GPB Capital Holdings, once a prominent private equity firm, marketed itself as an investment vehicle focusing primarily on automotive dealerships and healthcare businesses. However, investigations revealed a complex web of deceit, built on a foundation of falsified financial statements and misleading marketing materials. The fraudulent activities were perpetrated through a series of deceptive practices designed to lure unsuspecting investors.

- Misrepresentation of assets and financial performance: GPB Capital consistently overstated the value of its assets and presented inflated financial performance figures to potential investors, masking significant operational challenges and losses.

- Inflated valuations of investments: The valuations of GPB Capital's portfolio companies were artificially inflated, creating a false impression of profitability and growth. This was achieved through undisclosed related-party transactions and manipulation of accounting practices.

- Misuse of investor funds: Investor funds were allegedly diverted for purposes other than those stated in the offering documents, including personal enrichment of key executives and covering operating losses.

- Lack of transparency and inadequate disclosures: GPB Capital failed to provide investors with complete and accurate information regarding its financial condition and investment strategy, creating an environment ripe for fraud.

- Specific examples of defrauded investors: Numerous accounts detail how investors were misled into believing their investments were secure and profitable, only to discover significant losses once the fraud was uncovered. Many investors relied on the reputation of GPB Capital and its principals, leading to significant financial hardship.

David Gentile's Role in the Fraud and the Sentencing

David Gentile, as the founder and CEO of GPB Capital, played a central role in the fraud. Evidence presented during the trial showed his direct involvement in the creation and execution of the deceptive scheme. He actively participated in the misrepresentation of financial information, the inflation of asset values, and the misuse of investor funds.

The legal proceedings against Gentile culminated in a seven-year prison sentence. The judge cited the significant scale of the fraud, the deliberate nature of the deception, and the profound impact on numerous investors as key factors in determining the sentence. While other individuals within GPB Capital were also implicated, Gentile's role as the mastermind positioned him as the central figure in the prosecution's case.

- Length of the prison sentence: Seven years.

- Restitution ordered: A significant amount of restitution was ordered to be paid to defrauded investors, though the full recovery of losses remains uncertain.

- Other penalties imposed: In addition to prison time, Gentile likely faced substantial fines and other financial penalties.

Impact on Investors and the Regulatory Response

The GPB Capital fraud had a devastating impact on a large number of investors. Thousands of individuals suffered significant financial losses, some losing their life savings. The SEC (Securities and Exchange Commission) launched a comprehensive investigation, leading to the charges filed against Gentile and others.

- Number of investors affected: Thousands of investors across the country were impacted.

- Estimated financial losses: Hundreds of millions of dollars in losses were incurred by investors.

- Actions taken by regulatory bodies: The SEC played a vital role in uncovering the fraud and prosecuting those responsible. Other regulatory bodies may have also been involved in the investigation and subsequent enforcement actions.

- Potential reforms to prevent future investment fraud: The GPB Capital case highlights the need for stricter regulations, enhanced investor protection measures, and improved oversight of private equity firms.

Lessons Learned from the GPB Capital Case and Preventing Future Fraud

The GPB Capital case serves as a cautionary tale for investors, emphasizing the critical importance of due diligence and risk awareness. Investors should be wary of overly optimistic promises, unrealistic returns, and a lack of transparency from investment firms. Regulatory oversight and investor protection are essential components of a healthy and functioning financial market.

- Thorough due diligence before investing: Always conduct comprehensive research and verify claims made by investment firms.

- Understanding investment risks: Recognize that all investments carry inherent risks and understand the potential for loss.

- Diversifying investments: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risk.

- Seeking advice from qualified financial advisors: Consult with a registered investment advisor before making any significant investment decisions.

Conclusion: Understanding the David Gentile and GPB Capital Case

The David Gentile and GPB Capital case is a stark reminder of the devastating consequences of investment fraud. The 7-year prison sentence handed down to Gentile underscores the severity of his actions and the need for strong legal consequences to deter similar schemes. The significant financial losses suffered by investors highlight the importance of investor education, robust regulatory oversight, and enhanced investor protection measures. The case underscores the urgent need for increased transparency and accountability within the investment industry.

The David Gentile case serves as a stark warning about the dangers of investment fraud. Protect yourself by learning more about due diligence and seeking professional financial advice. Share this article to help others avoid becoming victims of similar schemes. Understanding the intricacies of the GPB Capital fraud and the subsequent legal ramifications is crucial for safeguarding your financial future and preventing future instances of investment fraud.

Featured Posts

-

The Henry Cavill Nova Rumor A Deep Dive Into The Speculation

May 11, 2025

The Henry Cavill Nova Rumor A Deep Dive Into The Speculation

May 11, 2025 -

Dansk Melodi Grand Prix 2025 Stem Pa Din Favorit Nu

May 11, 2025

Dansk Melodi Grand Prix 2025 Stem Pa Din Favorit Nu

May 11, 2025 -

Lily Collins Sizzling New Calvin Klein Campaign Photo 5133602

May 11, 2025

Lily Collins Sizzling New Calvin Klein Campaign Photo 5133602

May 11, 2025 -

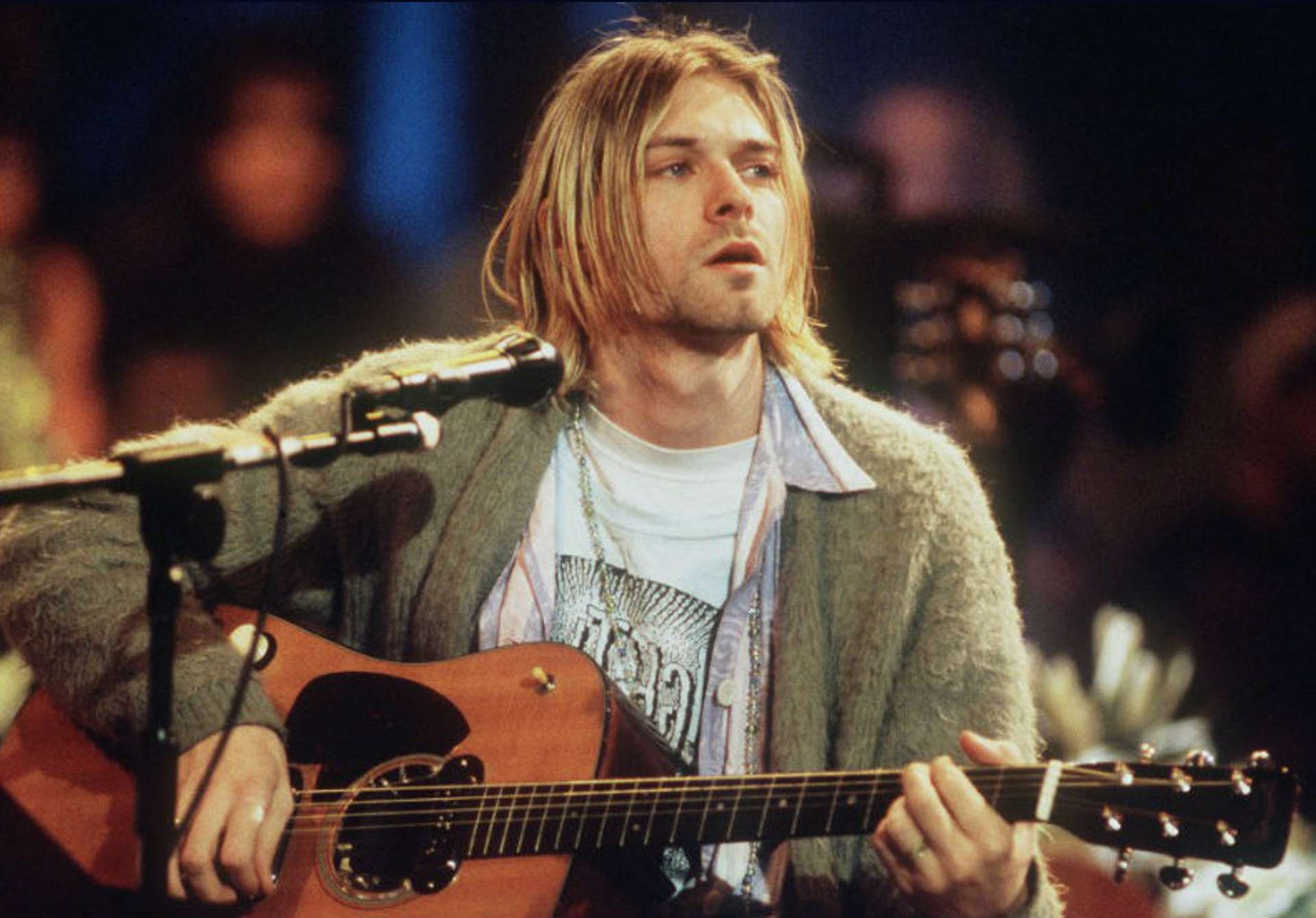

100 Mtv Unplugged Performances Where To Watch Online

May 11, 2025

100 Mtv Unplugged Performances Where To Watch Online

May 11, 2025 -

Mtv Cribs Unveiling The Opulence Of Celebrity Real Estate

May 11, 2025

Mtv Cribs Unveiling The Opulence Of Celebrity Real Estate

May 11, 2025