David Dodge Predicts Ultra-Low Growth For Canada In 2024

Table of Contents

The Factors Contributing to Ultra-Low Growth in Dodge's Prediction

David Dodge's prediction of ultra-low growth for the Canadian economy in 2024 is rooted in a confluence of factors, both domestic and international. These challenges paint a complex picture of economic uncertainty for the coming year.

Global Economic Headwinds

The global economic landscape presents significant headwinds for Canada. High global inflation, persistent supply chain disruptions, and the looming risk of recession in major economies like the United States are all contributing to a less-than-optimistic outlook.

- Global Inflation: Persistently high inflation rates worldwide are eroding purchasing power and dampening consumer demand, impacting Canadian exports and economic growth.

- Recessionary Risks: The potential for recession in major trading partners, particularly the US, poses a serious threat to Canada's export-oriented economy. A US recession would likely lead to decreased demand for Canadian goods and services.

- Supply Chain Disruptions: Ongoing supply chain bottlenecks continue to constrain production and increase input costs, further contributing to inflationary pressures and hindering economic expansion.

These international challenges create a climate of global economic uncertainty that directly impacts Canada's economic prospects.

High Interest Rates and Their Impact

The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, are having a noticeable impact on the Canadian economy. Higher interest rates increase borrowing costs for businesses and consumers, leading to reduced investment and consumer spending.

- Reduced Consumer Spending: Higher interest rates make borrowing more expensive, leading to decreased consumer spending on big-ticket items like homes and vehicles. This dampens overall economic activity.

- Decreased Investment: Businesses are less likely to invest in expansion or new projects when borrowing costs are high, slowing down job creation and economic growth.

- Housing Market Slowdown: The housing market, a significant driver of the Canadian economy, is particularly vulnerable to higher interest rates. Increased mortgage rates are leading to a cooling of the housing market, potentially triggering a price correction.

The Bank of Canada's monetary policy, while aimed at controlling inflation, is also contributing to the ultra-low growth prediction by reducing economic activity.

Challenges in Specific Sectors

Certain sectors of the Canadian economy are facing unique challenges that further contribute to the prediction of ultra-low growth.

- Housing Market: As mentioned above, the housing market faces significant headwinds due to higher interest rates and potential overvaluation in some regions.

- Manufacturing: The manufacturing sector is struggling with rising input costs, supply chain disruptions, and weakening global demand.

- Energy Sector: While the energy sector has seen some positive momentum, uncertainty around global energy prices and policies could impact its overall contribution to economic growth.

Implications of Ultra-Low Growth for Canadians

The predicted ultra-low growth has significant implications for Canadians across various aspects of their lives.

Job Market and Employment

Ultra-low growth typically translates into slower job creation and potentially higher unemployment rates. Certain sectors, particularly those sensitive to interest rate changes and consumer spending, may experience job losses.

- Increased Unemployment: A slowdown in economic activity can lead to layoffs and reduced hiring across various sectors.

- Slower Job Creation: Businesses are less likely to create new jobs in an environment of low growth and uncertainty.

Consumer Spending and Inflation

Ultra-low growth can create a vicious cycle. Reduced consumer spending, driven by higher interest rates and uncertainty, could further dampen economic activity and potentially prolong inflationary pressures.

- Reduced Purchasing Power: High inflation, combined with stagnant wages, erodes consumer purchasing power, impacting their ability to spend.

- Weakened Consumer Confidence: Uncertainty about the economic outlook can lead to decreased consumer confidence, further reducing spending.

Government Policy and Response

The Canadian government will likely need to implement policy measures to address the predicted ultra-low growth. This may involve fiscal stimulus or adjustments to monetary policy.

- Fiscal Stimulus: Government spending on infrastructure projects or social programs could be used to stimulate economic activity.

- Monetary Policy Adjustments: The Bank of Canada may need to adjust its monetary policy based on the evolving economic situation, potentially through interest rate cuts.

Conclusion: Navigating the Uncertain Economic Landscape: Understanding David Dodge's Ultra-Low Growth Prediction for Canada in 2024

David Dodge's prediction of ultra-low growth for the Canadian economy in 2024 is a serious concern, stemming from a combination of global economic headwinds, high interest rates, and sector-specific challenges. The implications for Canadians are significant, potentially affecting employment, consumer spending, and the government's response. The uncertain economic landscape requires careful navigation. Staying informed about the latest developments concerning David Dodge's prediction and the Canadian economy is crucial for informed decision-making. Consider consulting a financial advisor for personalized guidance. Understanding the potential impacts of ultra-low growth is key to preparing for the challenges ahead.

Featured Posts

-

Tezyz Alteawn Altjary Byn Alsewdyt Wadhrbyjan Ntayj Mbahthat Wzyr Altjart

May 02, 2025

Tezyz Alteawn Altjary Byn Alsewdyt Wadhrbyjan Ntayj Mbahthat Wzyr Altjart

May 02, 2025 -

Lotto 6aus49 Ueberpruefen Sie Ihre Zahlen Vom 19 April 2025

May 02, 2025

Lotto 6aus49 Ueberpruefen Sie Ihre Zahlen Vom 19 April 2025

May 02, 2025 -

Kort Geding Kampen Vs Enexis Stroomvoorziening Duurzaam Schoolgebouw

May 02, 2025

Kort Geding Kampen Vs Enexis Stroomvoorziening Duurzaam Schoolgebouw

May 02, 2025 -

Using Ai To Transform Mundane Scatological Data Into Informative Podcasts

May 02, 2025

Using Ai To Transform Mundane Scatological Data Into Informative Podcasts

May 02, 2025 -

Balsillies Golf Venture Partners With Saudi Developer For Middle East Luxury Resorts

May 02, 2025

Balsillies Golf Venture Partners With Saudi Developer For Middle East Luxury Resorts

May 02, 2025

Latest Posts

-

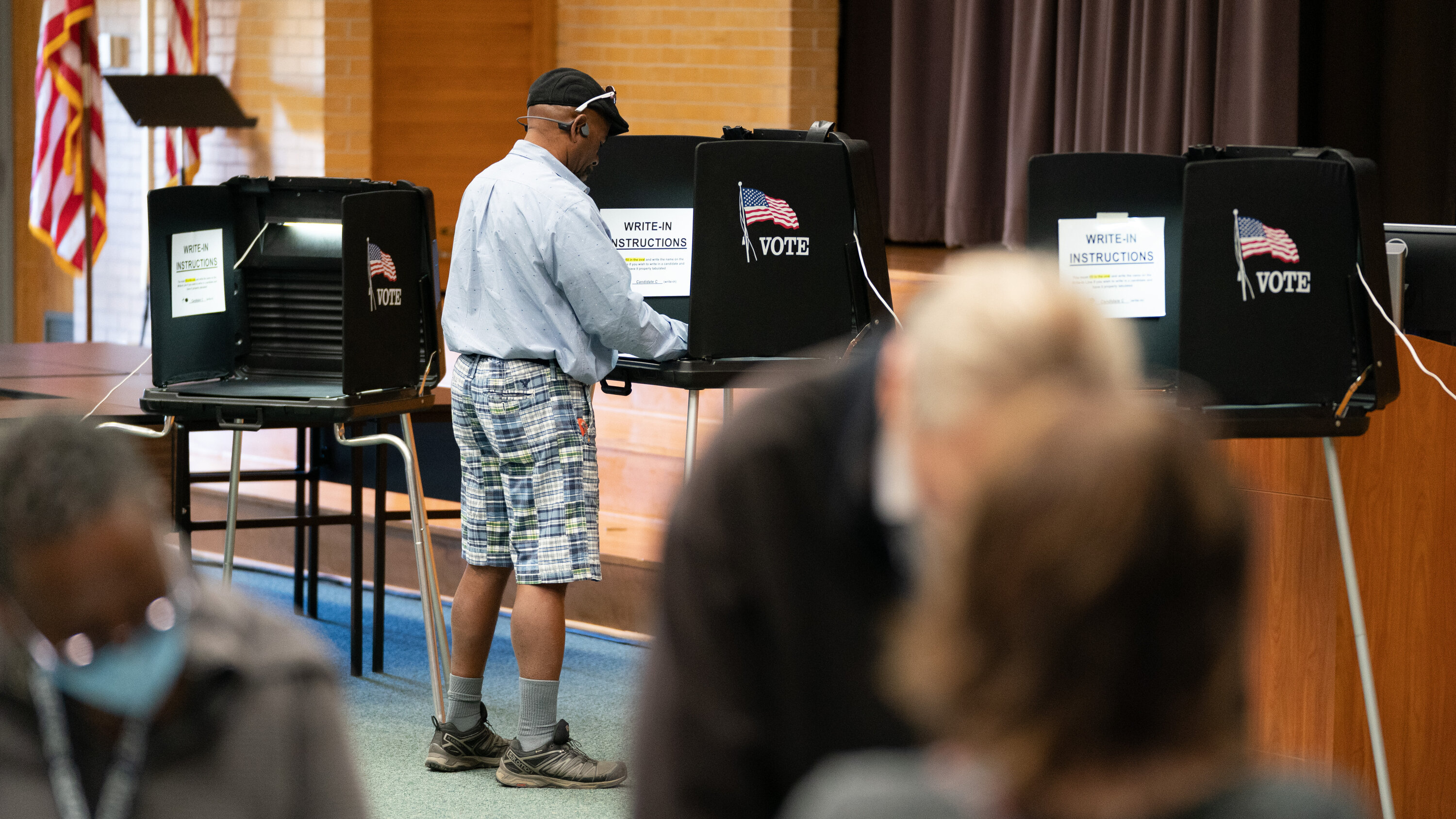

Nebraska Voter Id Campaign Wins National Clearinghouse Award

May 02, 2025

Nebraska Voter Id Campaign Wins National Clearinghouse Award

May 02, 2025 -

Analysis Gop Candidates Appeal After North Carolina Supreme Court Loss

May 02, 2025

Analysis Gop Candidates Appeal After North Carolina Supreme Court Loss

May 02, 2025 -

North Carolina Supreme Court Gop Candidate Challenges Recent Rulings

May 02, 2025

North Carolina Supreme Court Gop Candidate Challenges Recent Rulings

May 02, 2025 -

Understanding The Gop Candidates Appeal In The North Carolina Supreme Court Race

May 02, 2025

Understanding The Gop Candidates Appeal In The North Carolina Supreme Court Race

May 02, 2025 -

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 02, 2025

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 02, 2025