D-Wave Quantum (QBTS) Stock: Monday's Decline Explained

Table of Contents

Market Sentiment and Overall Tech Stock Performance

Broad Market Trends

Monday's dip in D-Wave Quantum (QBTS) stock wasn't an isolated incident. The broader market experienced a downturn, particularly impacting the technology sector. Major indices like the Nasdaq Composite showed significant declines. This overall negative sentiment heavily influenced the performance of many tech stocks, including QBTS.

- Interest Rate Hikes: Concerns about continued interest rate hikes by central banks contributed to a risk-off environment.

- Inflationary Pressures: Persistent inflation and uncertainty about its trajectory further dampened investor enthusiasm.

- Geopolitical Uncertainty: Ongoing global geopolitical tensions added to the market's overall anxiety.

The correlation between QBTS and broader tech indices suggests that Monday's decline was partly a reflection of a wider market correction, not solely a result of D-Wave Quantum-specific factors.

Investor Psychology and Risk Aversion

Quantum computing is a high-growth, high-risk sector. Investor sentiment towards such speculative assets can shift dramatically. Risk aversion increases during periods of market uncertainty, leading investors to move away from potentially volatile stocks like QBTS.

- Negative News in Related Sectors: Negative news in related technology sectors can trigger a sell-off in the entire tech space, impacting QBTS.

- Profit-Taking: After periods of significant gains, investors may engage in profit-taking, leading to increased selling pressure.

Early-stage technology stocks, by their nature, are inherently volatile. Understanding this volatility is paramount for successful investment in companies like D-Wave Quantum.

Specific News and Catalysts Affecting D-Wave Quantum (QBTS)

Absence of Positive News or Catalysts

The absence of positive news or anticipated catalysts can create a void that fuels selling pressure. If investors expected a significant product launch, partnership announcement, or positive earnings report, and none materialized, it can lead to disappointment and subsequent selling.

- Delayed Product Launches: Any delay in anticipated product launches can negatively impact investor confidence.

- Missed Earnings Expectations: If the company's recent performance didn't meet investor expectations, this can contribute to the decline.

For QBTS stock price, positive company news is a vital driver of growth; its absence can create a negative impact.

Potential Negative News or Speculation

Even unsubstantiated rumors or negative speculation can significantly affect stock prices. In the age of social media, news, both true and false, spreads rapidly, influencing investor behavior.

- Negative Analyst Reports: Negative analyst reports, even if based on limited information, can create a downward spiral.

- Unconfirmed Market Rumors: Unconfirmed rumors circulating on social media or online forums can generate negative sentiment.

Understanding the impact of social media and market rumors on QBTS is crucial for navigating the investment landscape.

Technical Analysis of QBTS Stock Chart

Chart Patterns and Support Levels

A basic examination of the QBTS stock chart on Monday might reveal technical indicators suggesting a potential decline. While detailed technical analysis requires expertise, some common patterns can be observed by even casual investors.

- Bearish Engulfing Candles: This pattern, where a large bearish candle completely engulfs a previous bullish candle, often signals a potential reversal.

- Breakdown from Support: A break below a key support level can trigger further selling pressure.

Support and resistance levels indicate price areas where buyers and sellers are likely to battle. Breaks above or below these levels can signal significant price movements.

Trading Volume and Liquidity

Analyzing trading volume provides insights into the intensity of selling pressure. High volume during a price decline suggests strong selling pressure, while low volume indicates less significant selling.

- High Volume Decline: A significant price drop accompanied by high volume suggests a strong bearish sentiment.

- Low Volume Decline: A price drop with low volume might indicate a temporary correction or a lack of conviction among sellers.

Liquidity, or the ability to easily buy or sell shares, is also a factor. Low liquidity can amplify price swings.

Conclusion: Navigating the Volatility of D-Wave Quantum (QBTS) Stock

Monday's decline in D-Wave Quantum (QBTS) stock was likely a confluence of factors: broader market weakness, investor risk aversion, the absence of positive news, and potentially negative speculation. Understanding these interconnected elements is vital for investors considering QBTS. Remember that investing in quantum computing, like any emerging technology, involves inherent volatility. Before investing in D-Wave Quantum (QBTS) stock, conduct thorough due diligence, carefully analyzing market conditions, company-specific news, and the inherent risks involved. Monitor D-Wave Quantum (QBTS) stock closely, stay informed about company developments, and analyze the future performance of QBTS to make informed investment decisions.

Featured Posts

-

545 Million Economic Zone Investment Facilitated By Maybank

May 20, 2025

545 Million Economic Zone Investment Facilitated By Maybank

May 20, 2025 -

Biarritz Vs Asbh Pro D2 L Importance Du Facteur Mental

May 20, 2025

Biarritz Vs Asbh Pro D2 L Importance Du Facteur Mental

May 20, 2025 -

Pracuju Manazeri Radsej V Kancelarii Alebo Z Home Officu

May 20, 2025

Pracuju Manazeri Radsej V Kancelarii Alebo Z Home Officu

May 20, 2025 -

Liverpool And Arsenal Vie For Premier League Star Transfer Battle Heats Up

May 20, 2025

Liverpool And Arsenal Vie For Premier League Star Transfer Battle Heats Up

May 20, 2025 -

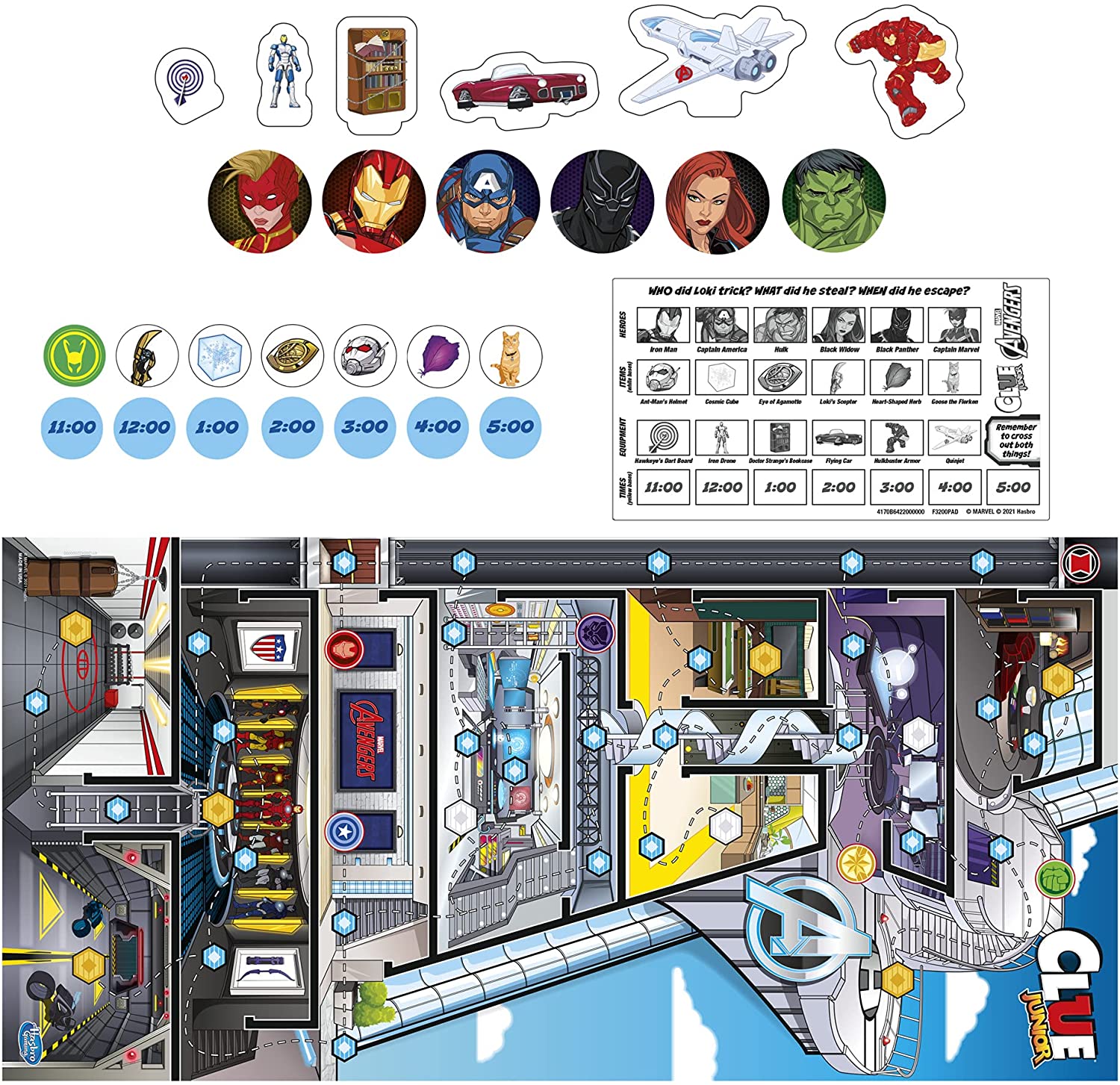

Solving The Nyt Mini Crosswords Marvel Avengers Clue May 1 2024

May 20, 2025

Solving The Nyt Mini Crosswords Marvel Avengers Clue May 1 2024

May 20, 2025

Latest Posts

-

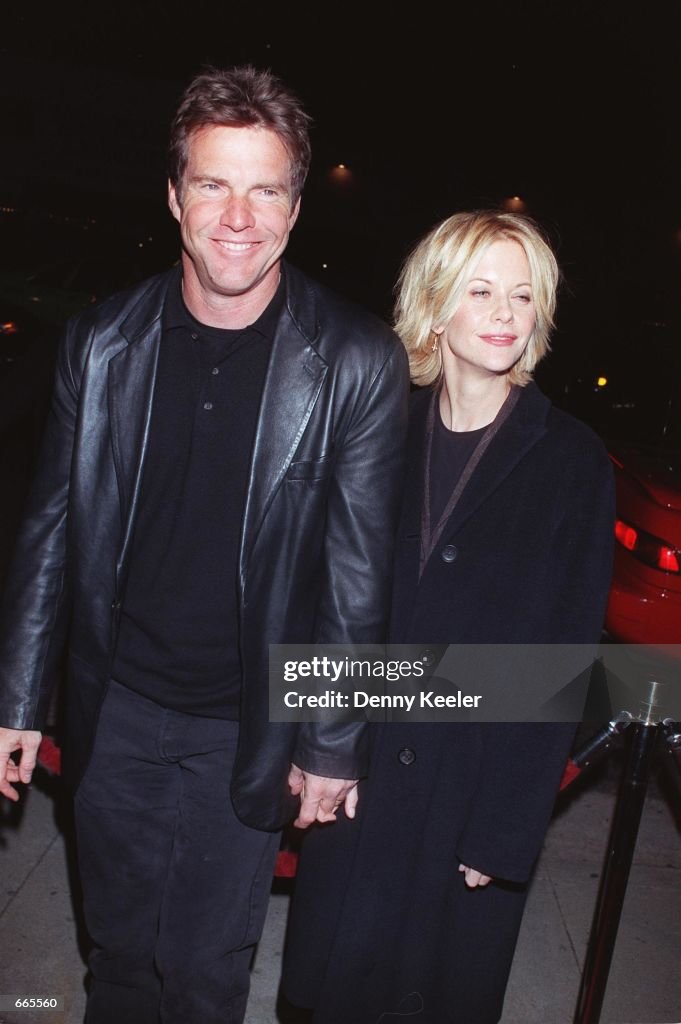

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025 -

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025 -

Sejarah Kemenangan Liverpool Di Liga Inggris Peran Krusial Para Pelatih

May 21, 2025

Sejarah Kemenangan Liverpool Di Liga Inggris Peran Krusial Para Pelatih

May 21, 2025 -

Chicago Cubs Couples Hot Dog Kiss Captures Hearts

May 21, 2025

Chicago Cubs Couples Hot Dog Kiss Captures Hearts

May 21, 2025 -

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025