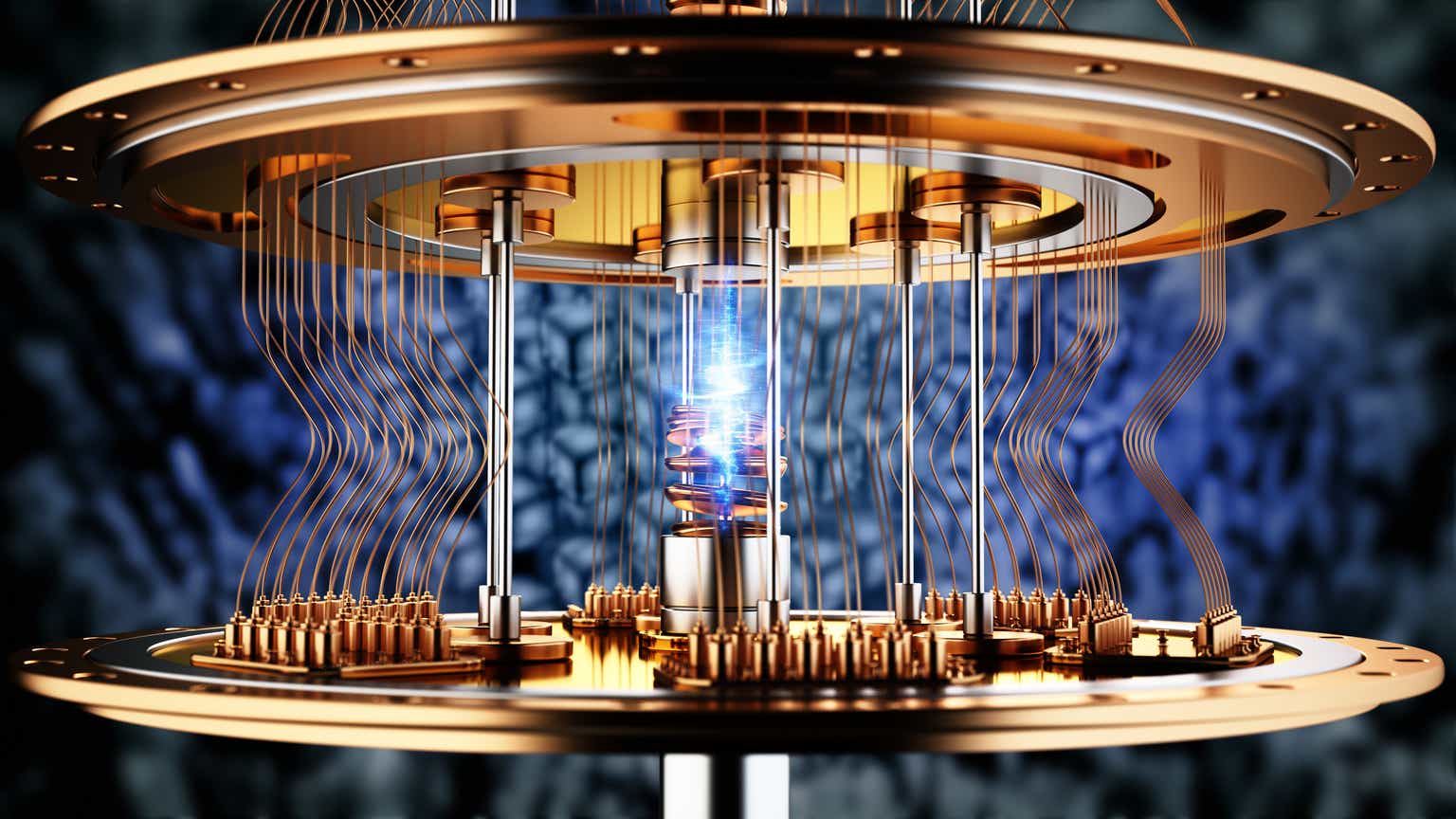

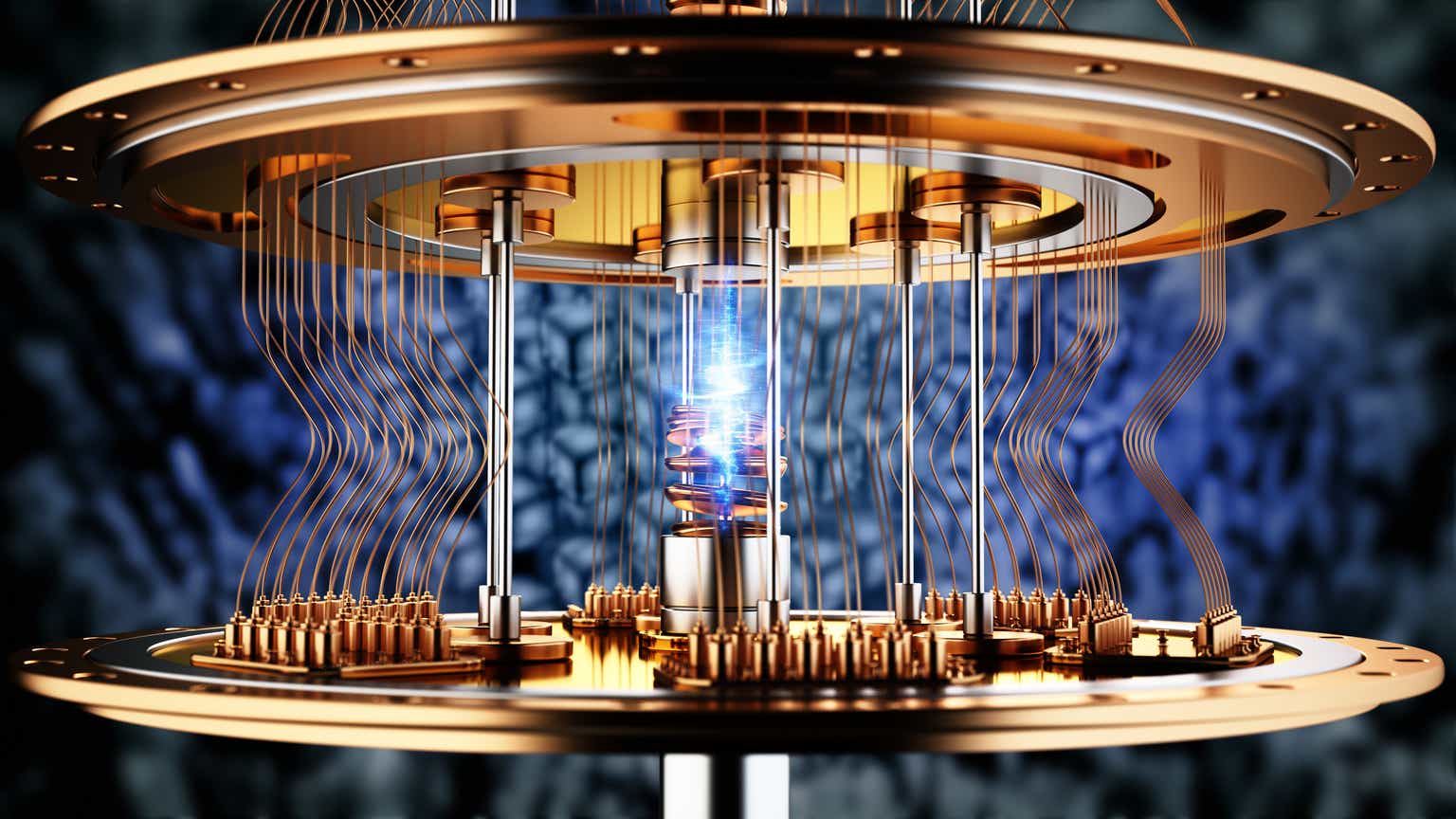

D-Wave Quantum (QBTS) Stock: Explaining Thursday's Price Drop

Table of Contents

Thursday saw a significant drop in D-Wave Quantum (QBTS) stock price, leaving many investors scrambling to understand the cause. This article delves into the potential factors contributing to this market volatility, examining recent news and broader market trends affecting this burgeoning quantum computing company. We'll analyze the key events and provide context for understanding the fluctuations in QBTS stock, helping you navigate the complexities of investing in this exciting yet volatile sector.

Analyzing the Immediate Triggers for the QBTS Stock Drop

To understand Thursday's QBTS stock plunge, we need to examine potential immediate triggers. This involves a thorough investigation into news releases, market analyses, and overall trading activity.

-

Examining Press Releases from D-Wave Quantum: Did D-Wave Quantum release any news on Thursday, such as disappointing earnings reports, revised guidance, or announcements of project delays that might have spooked investors? Negative news, even if seemingly minor, can significantly impact investor sentiment and trigger sell-offs. A close review of any official communication is crucial.

-

Assessing Analyst Downgrades or Negative Reports: Analyst ratings and reports play a substantial role in influencing stock prices. Were there any downgrades from prominent investment firms on Thursday or in the preceding days leading up to the drop? Negative commentary from influential analysts can trigger a cascade of sell orders.

-

Considering the Impact of Broader Market Trends on the Tech Sector: The overall performance of the tech sector and broader market conditions often influence individual stock performance. A general market downturn or negative sentiment towards technology stocks could have contributed to the QBTS price drop, regardless of company-specific news.

-

Looking for Unusual Trading Activity: Unexpectedly high trading volume or unusual price swings can indicate significant institutional investor activity, short-selling pressure, or algorithmic trading impacting the stock's price. Analyzing trading data can provide insights into the reasons behind the sudden drop.

The Broader Context: Quantum Computing Sector Performance

Understanding the context within the broader quantum computing sector is essential. Was the QBTS stock drop isolated, or did the entire sector experience a downturn?

-

Comparing QBTS Performance to Other Publicly Traded Quantum Computing Companies: Comparing QBTS's performance against competitors like IonQ (IONQ) or Rigetti Computing (RGTI) helps determine whether the drop was specific to D-Wave or a reflection of broader industry concerns. If competitors also experienced declines, it suggests sector-wide headwinds.

-

Analyzing Industry-Specific News or Trends Affecting Investor Confidence: Negative news related to quantum computing technology, such as setbacks in research or increased competition, can negatively affect investor confidence across the entire sector.

-

Considering the General Investor Sentiment Towards Riskier, Growth-Oriented Technology Stocks: Quantum computing is a high-growth, high-risk sector. Changes in overall investor risk appetite, especially concerning speculative growth stocks, can significantly impact companies like D-Wave Quantum.

Evaluating Long-Term Factors Affecting QBTS Stock Valuation

While immediate triggers explain short-term volatility, long-term factors influence QBTS stock valuation.

-

Discussing the Company's Financial Health and Growth Trajectory: D-Wave's financial performance, including revenue growth, profitability, and cash reserves, directly impacts investor confidence. Concerns about the company's long-term financial sustainability can lead to stock price declines.

-

Analyzing the Competitive Landscape and D-Wave's Position Within It: The quantum computing industry is highly competitive. D-Wave's ability to maintain a competitive edge through innovation and market share will significantly impact its long-term prospects.

-

Assessing Technological Advancements and Their Potential Impact on Future Valuation: Breakthroughs in quantum computing technology can dramatically shift the industry landscape, positively or negatively impacting D-Wave's valuation. Conversely, slower-than-expected advancements might lower investor expectations.

-

Identifying Any Regulatory or Geopolitical Risks Affecting the Sector: Government regulations and geopolitical factors can significantly influence the quantum computing industry. Changes in regulatory frameworks or international relations could negatively impact D-Wave's operations and stock price.

Interpreting Investor Sentiment and Market Reactions

Understanding investor sentiment and market reactions is key to interpreting the QBTS price drop.

-

Analyzing Social Media Sentiment Regarding QBTS: Social media platforms often reflect prevailing investor sentiment. Negative sentiment expressed on platforms like Twitter or Reddit could have contributed to the sell-off.

-

Examining Trading Volumes and Patterns to Identify Potential Institutional Investor Activity: High trading volume coupled with significant price drops might suggest institutional investors are reducing their holdings, potentially exacerbating the decline.

-

Considering the Impact of Short Selling on the Stock Price: Short selling, where investors bet against a stock's price, can put downward pressure on the stock. An increase in short positions could have contributed to the QBTS price drop.

-

Discussing the Influence of Algorithmic Trading: Algorithmic trading, employing computer programs to execute trades based on pre-defined rules, can amplify price swings. Algorithmic trading reacting to negative news or market trends could have contributed to the volatility.

Conclusion

This article explored various factors contributing to the significant drop in D-Wave Quantum (QBTS) stock price on Thursday. We examined immediate triggers like news releases, broader market trends affecting the quantum computing sector, and long-term considerations including the company's financial health and competitive landscape. Investor sentiment and market reactions also played crucial roles in the price fluctuation. Understanding the interplay of these factors is vital for navigating the complexities of investing in QBTS stock.

Call to Action: Understanding the volatility of QBTS stock and the quantum computing market requires continuous monitoring of news, financial reports, and market trends. Stay informed on future developments in D-Wave Quantum (QBTS) and the quantum computing sector to make informed investment decisions. Learn more about investing in quantum computing stocks and conduct thorough research before investing. Remember that investing in QBTS stock and other quantum computing companies involves significant risk.

Featured Posts

-

D Wave Quantum Qbts Stock Performance On Thursday A Comprehensive Review

May 21, 2025

D Wave Quantum Qbts Stock Performance On Thursday A Comprehensive Review

May 21, 2025 -

The Klopp Effect Transforming Hout Bay Fcs Game

May 21, 2025

The Klopp Effect Transforming Hout Bay Fcs Game

May 21, 2025 -

Spectacles Engages Au Festival Le Bouillon De Clisson

May 21, 2025

Spectacles Engages Au Festival Le Bouillon De Clisson

May 21, 2025 -

Efimereyontes Giatroi Patras 12 And 13 Aprilioy Odigos Eyresis

May 21, 2025

Efimereyontes Giatroi Patras 12 And 13 Aprilioy Odigos Eyresis

May 21, 2025 -

I Ypothesi Giakoymaki Bullying Vasanismoi Kai I Thliveri Kataliksi

May 21, 2025

I Ypothesi Giakoymaki Bullying Vasanismoi Kai I Thliveri Kataliksi

May 21, 2025

Latest Posts

-

Nova Filmska Adaptacija Sydney Sweeney U Filmu Temeljenom Na Redditu

May 22, 2025

Nova Filmska Adaptacija Sydney Sweeney U Filmu Temeljenom Na Redditu

May 22, 2025 -

The True Story Behind Sydney Sweeneys Latest Film A Viral Reddit Phenomenon

May 22, 2025

The True Story Behind Sydney Sweeneys Latest Film A Viral Reddit Phenomenon

May 22, 2025 -

Redditova Prica Postaje Film Sa Sydney Sweeney

May 22, 2025

Redditova Prica Postaje Film Sa Sydney Sweeney

May 22, 2025 -

Sydney Sweeneys New Movie Based On A Viral Reddit Story About A Missing Girl

May 22, 2025

Sydney Sweeneys New Movie Based On A Viral Reddit Story About A Missing Girl

May 22, 2025 -

Film Po Prici S Reddita Sydney Sweeney U Glavnoj Ulozi

May 22, 2025

Film Po Prici S Reddita Sydney Sweeney U Glavnoj Ulozi

May 22, 2025