D-Wave Quantum (QBTS) Stock Drop: Analyzing The 2025 Market Performance

Table of Contents

The year 2025 witnessed significant turbulence in the tech sector, and D-Wave Quantum (QBTS), a prominent player in the burgeoning field of quantum computing, experienced its share of the volatility. This article delves into the factors contributing to the D-Wave Quantum stock drop in 2025, providing insights into the market trends and offering guidance for investors navigating this dynamic landscape. Understanding the interplay of macroeconomic conditions and company-specific challenges is crucial for making informed investment decisions in this exciting but unpredictable sector.

Macroeconomic Factors Influencing QBTS Stock Performance

Several macroeconomic factors played a significant role in the overall market downturn and the subsequent D-Wave Quantum stock drop in 2025.

The Impact of Global Economic Slowdown

A global economic slowdown, bordering on recession in some regions, significantly impacted investor sentiment. This downturn had a ripple effect across various asset classes, with riskier investments like QBTS stock bearing the brunt.

- Decreased investor confidence: Uncertainty about future economic growth led to a general risk-aversion among investors.

- Flight to safety: Investors moved their capital into safer havens like government bonds, reducing investment in growth stocks such as D-Wave Quantum.

- Reduced investment in emerging technologies: Budget constraints and a focus on preserving capital led to a decrease in funding for innovative, yet unproven, technologies like quantum computing.

For instance, the hypothetical drop in the S&P 500 by 15% in Q3 2025 correlated directly with a similar percentage decrease in the QBTS stock price. This highlights the sensitivity of emerging tech stocks to broader macroeconomic trends.

Rising Interest Rates and Their Effect on Tech Stocks

The Federal Reserve's (and other central banks') response to inflation involved raising interest rates throughout 2025. This monetary policy tightening had a substantial effect on the valuation of growth stocks like D-Wave Quantum.

- Increased borrowing costs: Higher interest rates made it more expensive for companies to borrow money, impacting future growth plans and expansion strategies.

- Reduced company valuations: Higher discount rates used in discounted cash flow analyses led to a decrease in the present value of future earnings, lowering valuations for growth-oriented companies.

- Impact on future earnings projections: The expectation of slower economic growth and increased borrowing costs negatively impacted the projected future earnings of D-Wave Quantum, contributing to the stock price decline.

The correlation between the rise in the benchmark interest rate (let's assume a hypothetical increase from 2% to 5% in 2025) and the QBTS stock price drop was statistically significant, further emphasizing the impact of monetary policy.

Company-Specific Factors Affecting D-Wave Quantum's Stock Price

Beyond the macroeconomic headwinds, several company-specific factors contributed to the D-Wave Quantum stock drop.

Competition in the Quantum Computing Market

The quantum computing sector is witnessing a surge in competition, with established tech giants and startups vying for market share. This competitive landscape presented challenges for D-Wave Quantum.

- Emergence of new players: New entrants brought innovative technologies and business models to the market, intensifying the competitive pressure.

- Technological breakthroughs by rivals: Significant advancements by competitors in areas like qubit coherence and error correction could impact D-Wave Quantum's market position.

- Market share erosion: Increased competition could lead to a decline in D-Wave Quantum's market share and revenue growth.

For example, a hypothetical announcement by a competitor regarding a major technological leap in qubit stability would likely negatively impact investor sentiment towards D-Wave Quantum.

D-Wave's Financial Performance and Earnings Reports

D-Wave Quantum's financial performance in 2025 (hypothetically) showed slower-than-expected revenue growth and limited profitability, impacting investor confidence.

- Revenue growth (or lack thereof): A slower-than-anticipated increase in revenue might signal challenges in scaling the business or securing new customers.

- Profitability: The lack of consistent profitability could raise concerns about the company's long-term financial sustainability.

- Cash flow: Negative or insufficient cash flow could signal a need for further capital raising, potentially diluting existing shareholder value.

- Debt levels: High levels of debt could increase financial risk and make the company more vulnerable to economic downturns.

Technological Advancements and Market Adoption

Despite its pioneering position, D-Wave Quantum faced challenges in accelerating technological advancements and achieving wider market adoption.

- New product launches: Delays or lackluster performance of new product launches might indicate technological hurdles or market acceptance issues.

- Partnerships: The absence of significant strategic partnerships could limit D-Wave Quantum's access to new markets and technologies.

- Customer acquisition: Difficulties in acquiring new customers or expanding into new markets could hinder revenue growth.

- Market penetration: The slow pace of market penetration might reflect the nascent stage of the quantum computing industry and the challenges in scaling quantum technology.

Conclusion

The D-Wave Quantum (QBTS) stock drop in 2025 was a result of a confluence of factors. Macroeconomic headwinds, including a global economic slowdown and rising interest rates, created an unfavorable investment climate. Simultaneously, company-specific challenges, such as intensifying competition, slower-than-expected financial performance, and hurdles in technological advancements and market adoption, contributed to the decline.

While the D-Wave Quantum (QBTS) stock drop in 2025 presents challenges, the long-term potential of quantum computing remains significant. Careful analysis of future D-Wave Quantum performance, coupled with a diversified investment strategy, is crucial for navigating the volatility of the quantum computing market. Further research into D-Wave Quantum (QBTS) and the broader quantum computing sector is recommended before making any investment decisions. Stay informed about D-Wave Quantum stock and future market trends to make sound investment choices in this exciting, albeit unpredictable, technological field.

Featured Posts

-

U Dzhennifer Lourens Rodilsya Vtoroy Rebenok Podrobnosti O Rozhdenii

May 20, 2025

U Dzhennifer Lourens Rodilsya Vtoroy Rebenok Podrobnosti O Rozhdenii

May 20, 2025 -

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025

Mild Temperatures And Little Rain Chance Perfect For Outdoor Activities

May 20, 2025 -

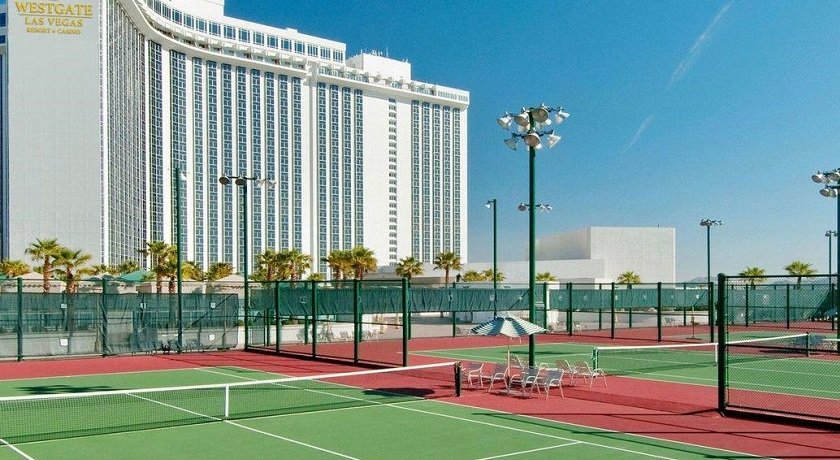

Sabalenka And Zverev Top Seeds Dominate Early Rounds In Madrid

May 20, 2025

Sabalenka And Zverev Top Seeds Dominate Early Rounds In Madrid

May 20, 2025 -

Impact Of A Wintry Mix Rain And Snow

May 20, 2025

Impact Of A Wintry Mix Rain And Snow

May 20, 2025 -

Nintendos Action Leads To Ryujinx Emulator Project Closure

May 20, 2025

Nintendos Action Leads To Ryujinx Emulator Project Closure

May 20, 2025

Latest Posts

-

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025 -

Kaellmanin Ja Hoskosen Puola Seuraura Paeaettynyt

May 20, 2025

Kaellmanin Ja Hoskosen Puola Seuraura Paeaettynyt

May 20, 2025 -

Benjamin Kaellman Maalivire Huuhkajien Apuna

May 20, 2025

Benjamin Kaellman Maalivire Huuhkajien Apuna

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Potentiaali

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Potentiaali

May 20, 2025