D-Wave Quantum (QBTS) Stock Decline Explained: Thursday's Market Movement

Table of Contents

Thursday saw a significant downturn for D-Wave Quantum (QBTS) stock, leaving many investors scrambling to understand the cause. This unexpected market movement sent ripples through the quantum computing sector, prompting questions about the company's future and the overall stability of this emerging technology. This article delves into the potential factors contributing to this sharp drop, analyzing the day's events and offering insights into the current state of D-Wave Quantum and its stock performance. We'll explore various contributing factors and assess their potential long-term impact on QBTS and the broader quantum computing investment landscape.

Analyzing the QBTS Stock Drop: Key Factors

Several intertwined factors likely contributed to the QBTS stock decline on Thursday. Let's examine the most significant ones:

Lack of Recent Positive News/Announcements

The absence of recent positive news or announcements played a crucial role in the QBTS stock drop. The quantum computing sector is highly sensitive to positive developments. Companies in this nascent field often see their stock prices surge following major product launches, successful partnerships, or significant funding rounds. Conversely, periods without such positive news can lead to sell-offs.

- Absence of major product launches: No new advancements or significant improvements to D-Wave's quantum annealing systems were announced recently.

- Limited partnerships: A lack of new partnerships with key players in the industry could dampen investor enthusiasm.

- No major funding announcements: No news of large funding rounds or strategic investments in the company.

- Quiet period before earnings reports: Companies often experience reduced market activity during the quiet period before reporting earnings, and any negative speculation can greatly impact the share price.

- Competitor successes: Positive news from competing companies in the quantum computing space might have shifted investor attention and capital away from QBTS.

The absence of positive news can trigger a negative market sentiment, especially considering the high volatility characteristic of the quantum computing sector. Investors often react quickly to perceived opportunities and risks, leading to amplified price swings.

Overall Market Sentiment and Sector-Wide Corrections

The QBTS stock drop didn't occur in a vacuum. Broader market trends and sector-wide corrections significantly influenced its performance.

- Broader technology stock downturn: A general negative trend in the broader technology sector could have dragged down QBTS alongside other technology stocks.

- Correlation with other quantum computing stocks: The price movements of QBTS may be correlated with other quantum computing stocks, implying a sector-wide correction or shift in investor sentiment within the industry.

- Macroeconomic factors: Rising interest rates, inflation concerns, or broader economic uncertainties can increase risk aversion among investors, leading to sell-offs even in companies with strong fundamentals.

- General risk aversion: Investors might be shifting away from higher-risk investments, including those in the relatively speculative quantum computing sector, leading to a decline in QBTS stock.

These macroeconomic and sector-wide trends can significantly amplify the impact of company-specific news, leading to larger price swings. The interconnectedness of the global financial markets makes it essential to consider these broader trends when analyzing individual stock performance.

Technical Analysis and Trading Activity

Technical analysis of QBTS trading volume and patterns on Thursday could provide additional insights into the stock decline.

- High trading volume: A significantly higher than average trading volume on Thursday could indicate a large number of investors selling their shares simultaneously.

- Resistance levels breached: The stock price may have fallen below crucial support or resistance levels, triggering further sell-offs as investors react to these technical signals.

- Sell-off patterns: Technical analysts may have observed specific sell-off patterns on the charts, further reinforcing the negative momentum.

- Short selling: Increased short selling activity could contribute to a downward price pressure.

- Institutional investor activity: The actions of large institutional investors can heavily impact a stock's price, especially in smaller-cap companies like D-Wave.

Technical analysis provides a valuable perspective, but it’s crucial to remember that these indicators are not predictive in themselves, and should be considered in conjunction with other fundamental factors.

Speculation and Investor Psychology

Speculation and investor psychology play a significant role in driving short-term stock price volatility.

- Social media sentiment: Negative social media sentiment and news coverage surrounding QBTS could have amplified sell-offs.

- Fear and uncertainty: Uncertainty about the future prospects of D-Wave and the quantum computing industry may have led to increased investor anxiety and selling pressure.

- Market manipulation or misinformation: In rare cases, market manipulation or the spread of misinformation can significantly impact a stock's price.

Investor sentiment can be highly volatile and susceptible to rumor, speculation and sudden shifts in confidence. Understanding the influence of these factors is vital in navigating the risks associated with investing in this burgeoning field.

Conclusion

This article examined several possible reasons for the D-Wave Quantum (QBTS) stock decline on Thursday. The decline appears to be a confluence of factors, including the absence of positive company-specific news, broader market trends affecting technology stocks, technical trading patterns, and overall investor psychology and sentiment. While pinpointing a single definitive cause is challenging, understanding the interplay of these factors is crucial for successfully navigating the inherent volatility of investing in the quantum computing sector.

Call to Action: Stay informed about future developments affecting D-Wave Quantum (QBTS) stock and the broader quantum computing landscape. Continue researching the quantum computing industry to make informed investment decisions. Monitor news and analysis related to QBTS and its competitors to gain a comprehensive understanding of this dynamic and rapidly evolving sector. Understanding the diverse factors influencing QBTS stock price movements is vital for navigating this innovative, yet volatile, technology investment opportunity.

Featured Posts

-

Usmc Tomahawk Cruise Missile Launching Drone Truck Army Evaluation

May 20, 2025

Usmc Tomahawk Cruise Missile Launching Drone Truck Army Evaluation

May 20, 2025 -

Wwe Raw Results And Winners May 19th 2025 Match Grades

May 20, 2025

Wwe Raw Results And Winners May 19th 2025 Match Grades

May 20, 2025 -

Projet D Adressage D Abidjan 14 279 Voies Identifiees

May 20, 2025

Projet D Adressage D Abidjan 14 279 Voies Identifiees

May 20, 2025 -

Services Juridiques Complets Atkinsrealis Droit Inc

May 20, 2025

Services Juridiques Complets Atkinsrealis Droit Inc

May 20, 2025 -

Descentes De La Bcr Dans Les Marches D Abidjan Une Operation De Controle Surprise En Cote D Ivoire

May 20, 2025

Descentes De La Bcr Dans Les Marches D Abidjan Une Operation De Controle Surprise En Cote D Ivoire

May 20, 2025

Latest Posts

-

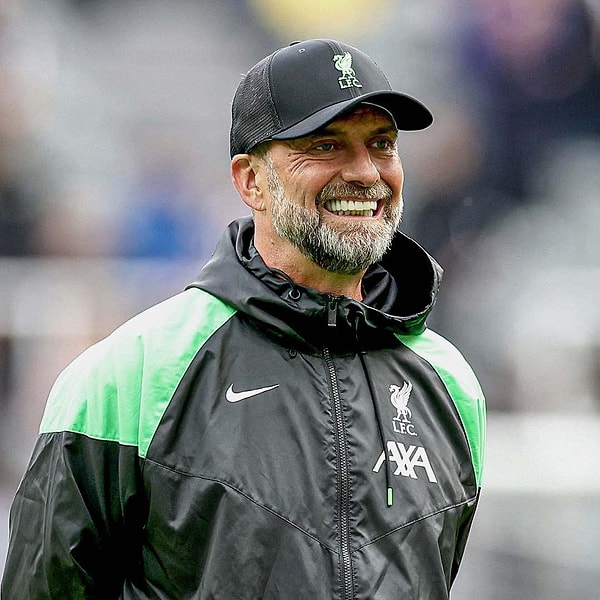

Liverpool Ve Real Madrid Klopp Ile Ancelotti Nin Basarilari

May 21, 2025

Liverpool Ve Real Madrid Klopp Ile Ancelotti Nin Basarilari

May 21, 2025 -

Bayern Muenih In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025

Bayern Muenih In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025 -

2024 25 Premier League Champions In Pictures

May 21, 2025

2024 25 Premier League Champions In Pictures

May 21, 2025 -

From Anfield To Hout Bay Klopps Coaching Influence On A South African Club

May 21, 2025

From Anfield To Hout Bay Klopps Coaching Influence On A South African Club

May 21, 2025 -

Real Madrid In Gelecegi Ancelotti Mi Klopp Mu

May 21, 2025

Real Madrid In Gelecegi Ancelotti Mi Klopp Mu

May 21, 2025