D-Wave Quantum (QBTS): Causes Of The Monday Stock Price Drop

Table of Contents

Impact of Broader Market Downturn on QBTS

The D-Wave Quantum (QBTS) stock price drop didn't occur in isolation. Monday saw a general downturn in the broader market, particularly impacting the technology sector. Understanding this context is crucial to fully analyzing the QBTS decline.

- Major Indices' Performance: The Nasdaq Composite and the S&P 500 both experienced significant declines on Monday, indicating a widespread negative sentiment across the market. This broader sell-off likely influenced QBTS, as it's a technology stock susceptible to overall market volatility.

- Macroeconomic News: Any negative macroeconomic news released on Monday, such as concerns about inflation, interest rate hikes, or geopolitical instability, could have contributed to the overall market downturn and, consequently, the QBTS stock price drop. Such news often creates a risk-off environment where investors sell off even relatively stable stocks.

- Correlation Analysis: While the general market decline likely played a role, it's vital to analyze the correlation between the magnitude of the overall market drop and the specific percentage decline experienced by QBTS. A disproportionately large drop in QBTS compared to the broader market might suggest company-specific factors were at play.

Absence of Positive Catalysts for D-Wave Quantum (QBTS)

The lack of positive news or significant announcements from D-Wave Quantum itself could have exacerbated the negative impact of the broader market downturn. Investors often react negatively when there's an absence of positive catalysts to support a stock's price.

- Missed Expectations: Were there any anticipated product launches, partnerships, or earnings reports that failed to materialize or underperformed expectations? The absence of such positive developments could have disappointed investors and contributed to selling pressure.

- Recent Performance and News: A review of D-Wave Quantum's recent financial performance, press releases, and any regulatory filings is crucial. Any negative news or weak performance indicators released prior to Monday's drop could have made the stock more vulnerable to the broader market downturn.

- Competitive Landscape: The competitive landscape in the quantum computing industry is dynamic. News of advancements or funding rounds by competitors could have negatively impacted investor sentiment toward D-Wave Quantum, contributing to the price decline.

Analyst Ratings and Target Price Adjustments

Changes in analyst ratings and target prices can significantly influence investor behavior and stock prices. Let's examine whether any such changes occurred around the time of the D-Wave Quantum (QBTS) stock price drop.

- Rating Changes: Did any prominent analysts downgrade their rating for D-Wave Quantum (QBTS) stock? A change from "buy" to "hold" or "sell" could trigger selling pressure.

- Target Price Adjustments: A reduction in the target price by analysts reflects a lowered expectation for the stock's future performance, potentially prompting investors to sell their shares.

- Impact on Investor Confidence: Negative analyst sentiment can significantly impact investor confidence, particularly in a volatile market environment, leading to a sell-off.

Short-Selling and Increased Volatility

Increased short-selling activity can amplify downward price movements. Short sellers bet against a stock's price, and a surge in short selling can create a self-fulfilling prophecy, driving the price down further.

- Short Interest Data: Analyzing short interest data for QBTS around the time of the decline could reveal if increased short-selling pressure contributed to the price drop.

- Price Volatility and Short Selling: A high level of short interest can often lead to increased price volatility, making the stock more susceptible to sharp price swings.

Speculative Trading and Sentiment Shifts

The quantum computing sector attracts speculative investors, and shifts in market sentiment can dramatically impact stock prices.

- Social Media and News Headlines: Negative news coverage or social media sentiment regarding D-Wave Quantum (QBTS) could have influenced investor psychology, accelerating the price decline.

- Trading Volume: Examining Monday's trading volume for QBTS can help determine whether the drop was driven by a high volume of transactions, indicating strong selling pressure, or a lower volume suggesting a more subdued response.

- Short-Term Market Sentiment: The quantum computing sector is inherently volatile, making QBTS particularly susceptible to short-term shifts in investor sentiment.

Conclusion: Understanding the D-Wave Quantum (QBTS) Stock Dip and Looking Ahead

The D-Wave Quantum (QBTS) stock price drop on Monday appears to be a confluence of factors, including a broader market downturn, a lack of positive company-specific news, potential analyst downgrades, and possibly increased short-selling activity. Understanding the interplay of macroeconomic conditions, company performance, and investor sentiment is key to analyzing such price fluctuations. Staying informed about D-Wave Quantum (QBTS) developments and the quantum computing market is crucial for navigating its volatility and making informed investment decisions. Stay tuned for further updates on the D-Wave Quantum (QBTS) stock price and its future trajectory. Understanding the complexities of the quantum computing market and monitoring the factors affecting QBTS is crucial for informed investing.

Featured Posts

-

Nyt Mini Crossword March 26 2025 Hints Clues And Solutions

May 21, 2025

Nyt Mini Crossword March 26 2025 Hints Clues And Solutions

May 21, 2025 -

Gospodin Savrsenog Vanja I Sime Nove Fotografije I Reakcija Fanova

May 21, 2025

Gospodin Savrsenog Vanja I Sime Nove Fotografije I Reakcija Fanova

May 21, 2025 -

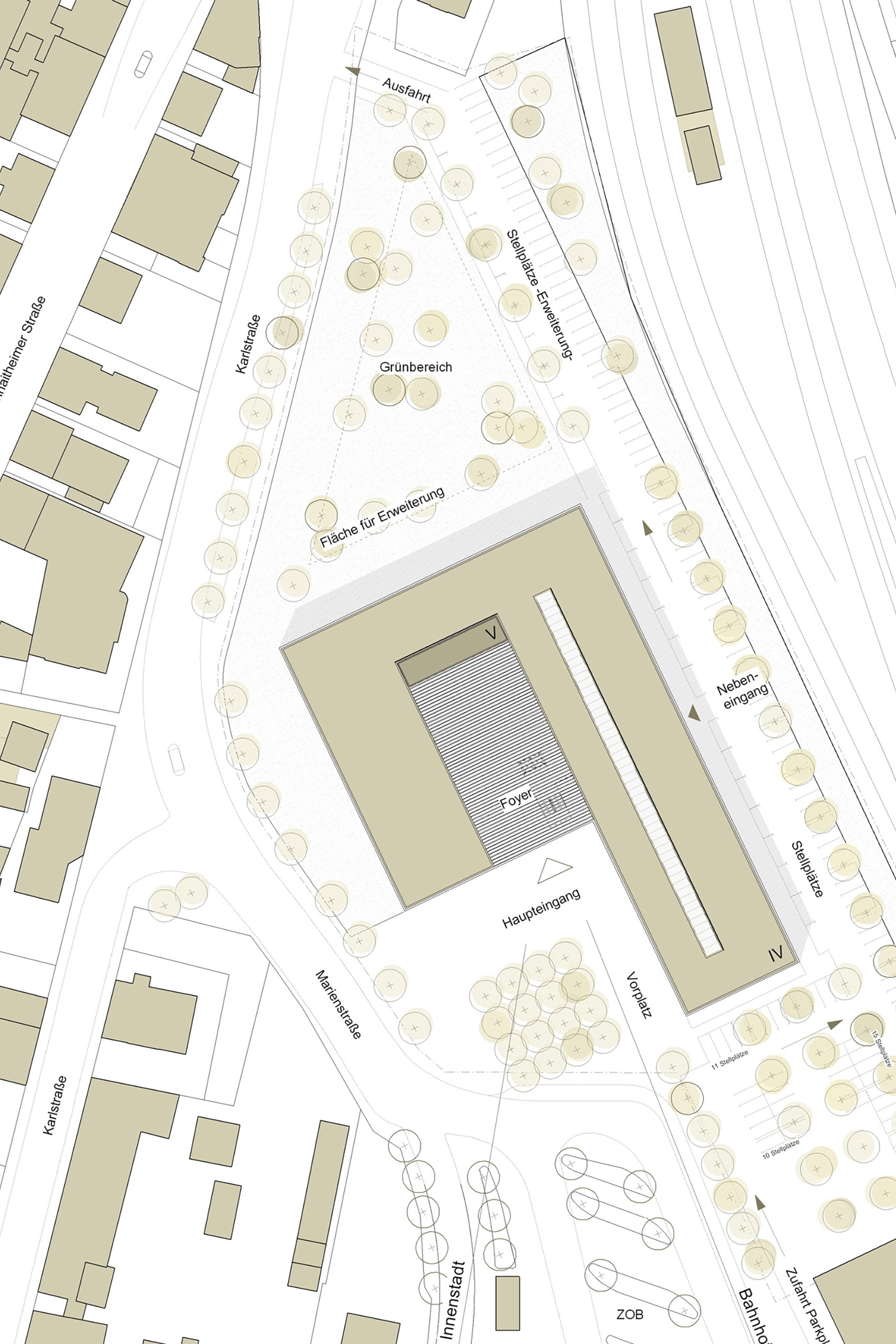

Architektin Bestimmt Endgueltige Bauausfuehrung Vor Ort

May 21, 2025

Architektin Bestimmt Endgueltige Bauausfuehrung Vor Ort

May 21, 2025 -

Klopp To Real Madrid Agent Comments Fuel Speculation

May 21, 2025

Klopp To Real Madrid Agent Comments Fuel Speculation

May 21, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki Programma And Eisitiria

May 21, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki Programma And Eisitiria

May 21, 2025

Latest Posts

-

Jailed Tory Councillors Wife Denies Incitement In Migrant Hotel Rant

May 22, 2025

Jailed Tory Councillors Wife Denies Incitement In Migrant Hotel Rant

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Seeks Sentence Appeal

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Seeks Sentence Appeal

May 22, 2025 -

Were They Underestimated Tigers Triumph Over Rockies 8 6

May 22, 2025

Were They Underestimated Tigers Triumph Over Rockies 8 6

May 22, 2025 -

Southport Racial Hate Crime Tory Councillors Wife Sentenced

May 22, 2025

Southport Racial Hate Crime Tory Councillors Wife Sentenced

May 22, 2025 -

Wife Of Tory Councillor To Fight 31 Month Prison Term For Online Hate Speech

May 22, 2025

Wife Of Tory Councillor To Fight 31 Month Prison Term For Online Hate Speech

May 22, 2025