D-Wave Quantum Inc. (QBTS) Stock Drop On Thursday: Reasons And Analysis

Table of Contents

Negative Earnings Report & Missed Revenue Projections

The most immediate and significant factor contributing to the QBTS stock drop was the company's disappointing Q[Insert Quarter – e.g., 2] earnings report. This report revealed a substantial shortfall in revenue compared to both analyst predictions and the company's own previous guidance.

Detailed analysis of the Q[Quarter] earnings report:

-

Specific numbers regarding revenue shortfall: The report indicated a revenue shortfall of [Insert Percentage]% compared to the projected [Insert Projected Revenue] and [Insert Percentage]% lower than the revenue generated in the previous quarter. This represents a significant deviation from expectations.

-

Comparison to analyst predictions and previous quarters: Analysts had, on average, predicted revenue of [Insert Analyst Prediction], significantly higher than the reported figures. This miss also marked a considerable downturn from the previous quarter's performance.

-

Explanation of the discrepancy between expectations and actual results: The company attributed the shortfall to [Insert Company's Explanation - e.g., delays in major contract signings, increased competition, slower-than-expected adoption rates]. However, the market clearly reacted negatively to this explanation.

-

Mention any downward revisions in future projections: Further exacerbating investor concerns, D-Wave Quantum Inc. revised its future revenue projections downwards, indicating a potentially prolonged period of underperformance. This fueled further selling pressure, contributing to the QBTS stock price decline. The quantum computing investment landscape suddenly looked less promising for some.

Keywords: QBTS earnings, revenue shortfall, missed projections, financial performance, quantum computing investment.

Impact of Competitive Landscape and Market Sentiment

The competitive landscape in the quantum computing sector is rapidly evolving, and this has had a clear impact on QBTS stock performance. Increased competition and technological advancements are placing pressure on D-Wave Quantum Inc.

Discussion of emerging competitors and technological advancements:

-

Mention key players in the quantum computing market: Companies like IBM, Google, and IonQ are making significant strides in the field, often with different approaches to quantum computing. This intensified competition directly affects D-Wave's market share and investor confidence.

-

Analysis of recent developments in competing technologies: Recent breakthroughs in areas like superconducting qubits and trapped ion technology have raised the bar for the entire industry, putting pressure on D-Wave to innovate and maintain its competitive edge.

-

Impact of overall market sentiment towards quantum computing stocks: The overall market sentiment towards quantum computing stocks has been somewhat cautious lately, influenced by factors such as the relatively early stage of the technology's development and the uncertainties surrounding its commercial viability. This broader negative sentiment further amplified the impact of D-Wave's disappointing results.

-

Discuss any negative news cycles or industry-wide trends: Negative news cycles surrounding other players in the quantum computing space could also contribute to a general downturn affecting QBTS.

Keywords: quantum computing competition, market sentiment, industry trends, technological advancements, QBTS competitors.

Macroeconomic Factors and Broader Market Downturn

The QBTS stock drop did not occur in isolation. Broader macroeconomic factors also contributed to the decline.

Analysis of the influence of general economic conditions:

-

Correlation between the QBTS drop and broader market trends: The overall market experienced a downturn on Thursday, and QBTS stock followed this broader trend, suggesting a correlation between general market sentiment and investor behavior in relation to D-Wave.

-

Discussion of interest rate hikes or other economic indicators: Rising interest rates and other economic indicators reflecting a cautious outlook can make investors more risk-averse, leading them to sell more volatile stocks like those in the emerging quantum computing sector.

-

The role of investor risk aversion in the stock's decline: Investor risk aversion plays a significant role in the market's reaction to negative news. In uncertain economic times, investors tend to move towards safer investments, contributing to the selling pressure observed in the QBTS stock price.

Keywords: macroeconomic factors, market downturn, interest rates, investor sentiment, risk aversion.

Technical Analysis of QBTS Stock Chart

Analyzing the QBTS stock chart using technical indicators provides further insight into the stock's price action.

Interpretation of the stock's price action using technical indicators:

-

Mention key support and resistance levels: The stock price broke through key support levels, indicating a weakening of bullish sentiment and confirming the bearish trend.

-

Analyze trading volume during the drop: High trading volume during the drop suggests significant selling pressure and a lack of buyers willing to step in and support the price.

-

Discuss candlestick patterns or other relevant technical indicators: Candlestick patterns like long bearish candles or bearish engulfing patterns further confirmed the negative momentum.

Keywords: technical analysis, stock chart, support and resistance, trading volume, candlestick patterns.

Conclusion: Assessing the Future of D-Wave Quantum Inc. (QBTS) Stock

The D-Wave Quantum Inc. (QBTS) stock drop is attributable to a confluence of factors. Disappointing earnings, a competitive landscape, broader macroeconomic uncertainty, and negative technical indicators all contributed to the decline. While D-Wave Quantum Inc. operates in a promising sector, the short-term outlook remains uncertain.

The drop serves as a reminder of the inherent risks in investing in emerging technologies. While the long-term potential of quantum computing remains significant, investors should exercise caution and perform thorough due diligence before investing in QBTS or other quantum computing stocks. Stay informed about future developments and conduct thorough research before making any investment decisions related to QBTS or similar quantum computing stocks.

Featured Posts

-

Broadcast Networks Abc Cbs And Nbc Face Scrutiny Over New Mexico Gop Arson Attack Censorship

May 21, 2025

Broadcast Networks Abc Cbs And Nbc Face Scrutiny Over New Mexico Gop Arson Attack Censorship

May 21, 2025 -

Vybz Kartel Self Esteem Issues And Skin Lightening

May 21, 2025

Vybz Kartel Self Esteem Issues And Skin Lightening

May 21, 2025 -

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025 -

Cassis Blackcurrant Cocktails Recipes And Serving Suggestions

May 21, 2025

Cassis Blackcurrant Cocktails Recipes And Serving Suggestions

May 21, 2025 -

Peppa Pigs Mummys Pregnancy The Gender Reveal

May 21, 2025

Peppa Pigs Mummys Pregnancy The Gender Reveal

May 21, 2025

Latest Posts

-

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025 -

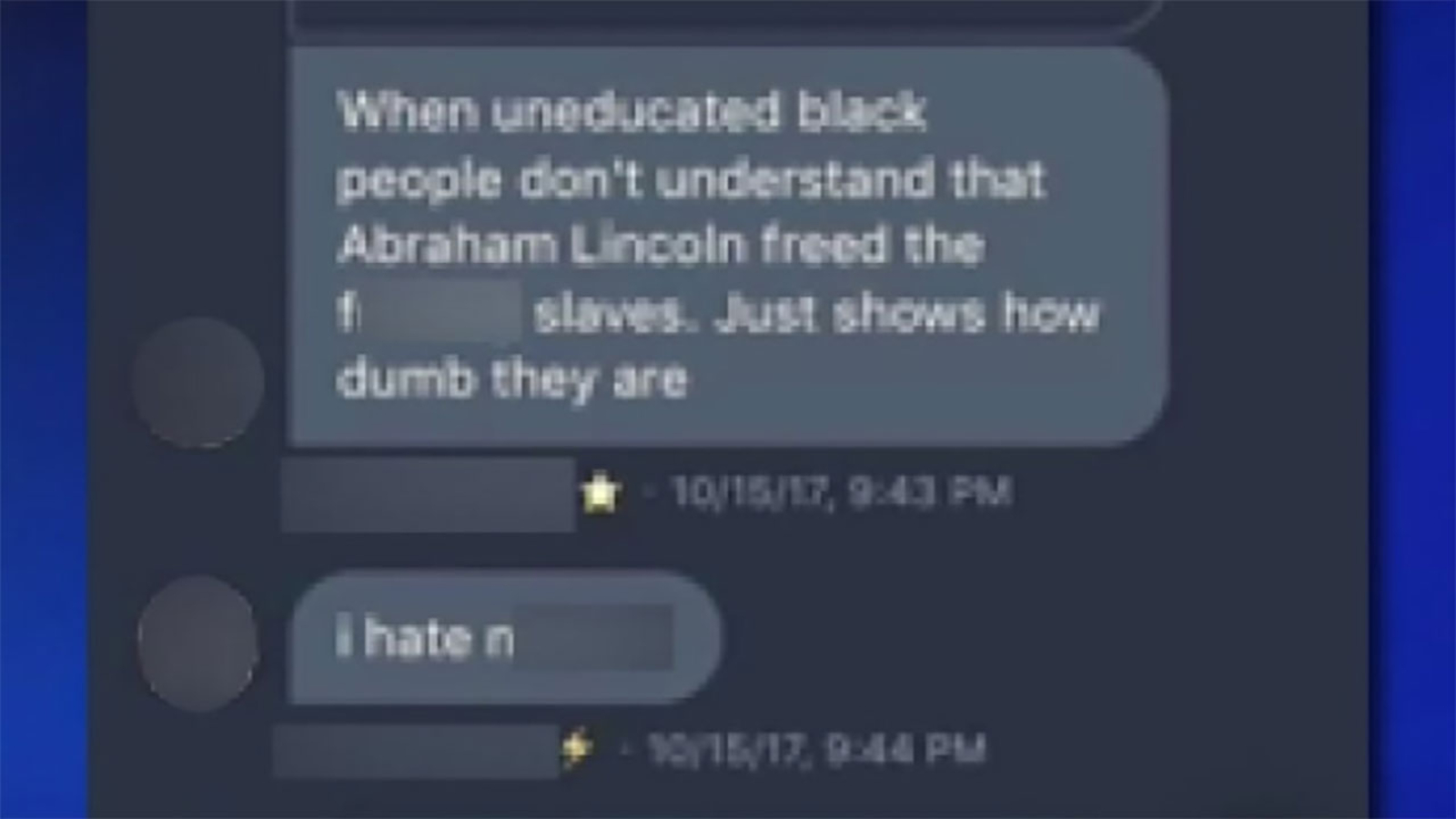

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025 -

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025 -

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025