D-Wave Quantum Inc. (QBTS): Investigating The Sharp Stock Price Decrease In 2025

Table of Contents

Macroeconomic Factors Influencing QBTS Stock Performance in 2025

The sharp downturn in QBTS stock in 2025 wasn't isolated; it mirrored a broader trend affecting the technology sector. Understanding the macroeconomic climate is crucial to grasping the extent of the impact on D-Wave.

Overall Market Volatility

2025 presented a challenging economic landscape. Several factors contributed to widespread market volatility, impacting even high-growth sectors like quantum computing.

- Global Recessionary Pressures: A global economic slowdown led to decreased investor confidence and a flight to safety, with investors moving away from riskier assets, including speculative tech stocks like QBTS.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks to combat inflation increased borrowing costs for companies, hindering expansion and impacting profitability projections for many, including D-Wave.

- Inflation Concerns: Persistent inflation eroded consumer spending and business investment, further dampening the overall economic outlook and impacting investor sentiment towards growth stocks.

- Investor Risk Aversion: The combination of recessionary fears, inflation, and geopolitical uncertainty fueled a general risk-averse sentiment among investors, leading to a sell-off in many high-growth, yet unproven, technology sectors, including quantum computing. This risk aversion disproportionately impacted QBTS, given its position as a relatively young company in a still-developing market.

Company-Specific Factors Contributing to the QBTS Stock Drop

While macroeconomic headwinds played a significant role, several company-specific factors contributed to the QBTS stock price decline.

Missed Earnings Expectations

D-Wave's financial performance in 2025 fell short of analysts' expectations. While precise figures require further investigation (and are beyond the scope of this general analysis), hypothetical scenarios could include:

- Revenue shortfalls: Actual revenue was significantly below projected figures, indicating challenges in sales and market penetration.

- Increased losses: Operating losses may have widened compared to previous years, raising concerns about D-Wave's long-term financial viability.

- Slowed growth: Year-over-year growth rates may have slowed considerably, signaling a potential plateau in market adoption.

A detailed analysis of D-Wave's financial statements from 2025 would be necessary to provide specific data and a conclusive evaluation.

Competition in the Quantum Computing Landscape

The quantum computing landscape is rapidly evolving, with several competitors emerging and posing a threat to D-Wave's market position.

- Emergence of new players: Several startups and established tech giants are investing heavily in quantum computing R&D, potentially offering superior technologies or business models.

- Technological advancements: Competitors may have achieved significant breakthroughs in areas like qubit stability, scalability, or error correction, making their quantum computers more attractive to potential customers.

- Market share erosion: Increased competition could lead to a reduction in D-Wave's market share, affecting revenue growth and investor confidence.

Understanding the competitive landscape and the relative strengths and weaknesses of different quantum computing technologies is critical to evaluating QBTS's future potential.

Technological Challenges and Delays

D-Wave may have encountered unforeseen technical challenges or delays in its product development or deployment.

- Qubit stability issues: Challenges in maintaining the stability and coherence of qubits, which are the fundamental building blocks of quantum computers, could have hampered performance and delayed product launches.

- Scalability limitations: Scaling up the number of qubits in a quantum computer is a major hurdle. Delays in achieving higher qubit counts could negatively impact D-Wave's competitiveness.

- Integration challenges: Integrating quantum computers with existing classical computing infrastructure can be complex, and delays in this area could impede market adoption.

These technological hurdles could have eroded investor confidence and contributed to the QBTS stock price decline.

Changes in Management or Strategy

Any shifts in leadership, corporate strategy, or investor relations could impact investor sentiment.

- Leadership changes: Significant changes in senior management can create uncertainty and affect investor confidence.

- Strategic shifts: A change in D-Wave's market focus or business strategy might have been poorly received by investors.

- Negative investor relations: Controversies or negative press coverage concerning D-Wave’s management or business practices could lead to a sell-off.

Conclusion: Understanding and Navigating the QBTS Stock Price Decline – Future Outlook

The D-Wave Quantum Inc. (QBTS) stock price decline in 2025 resulted from a confluence of macroeconomic factors and company-specific challenges. The global economic slowdown, increased competition, potential technological hurdles, and possible internal factors all played a role. It highlights the importance of considering both the broader economic context and the specific performance and challenges of a company when evaluating its stock.

The future of QBTS stock remains uncertain. While the quantum computing sector holds immense long-term potential, investors should proceed with caution. Thorough due diligence, including a comprehensive analysis of D-Wave's financial performance, technological advancements, and competitive positioning, is essential before making any investment decisions. Stay informed about industry developments and carefully assess the risks and rewards associated with investing in D-Wave Quantum (QBTS) and the dynamic quantum computing market.

Featured Posts

-

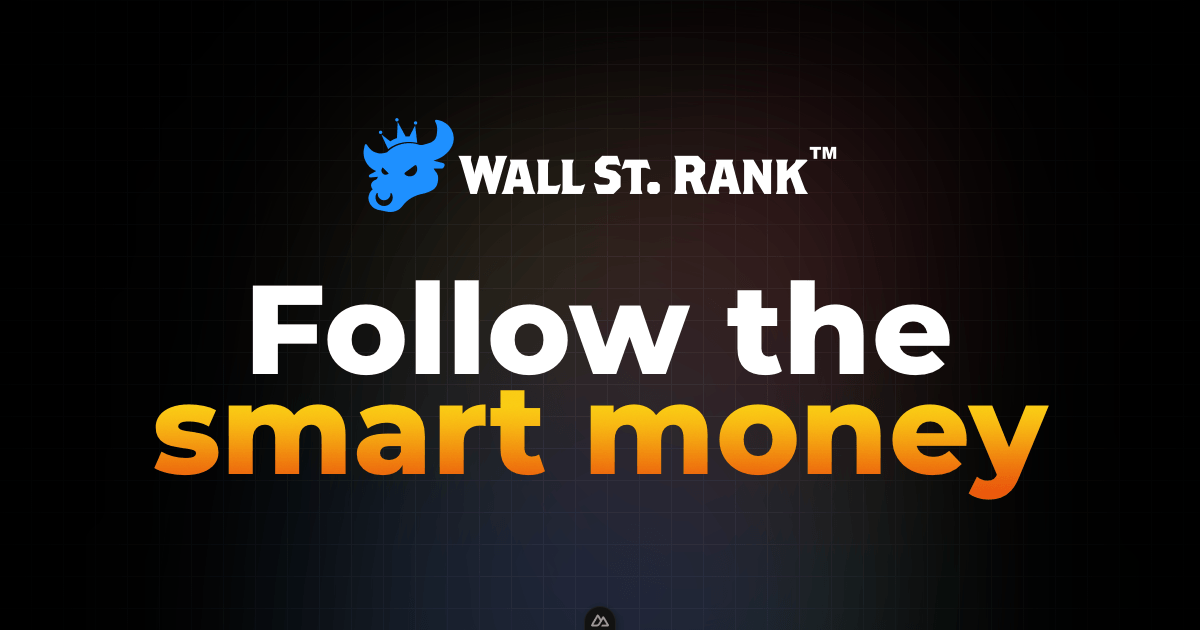

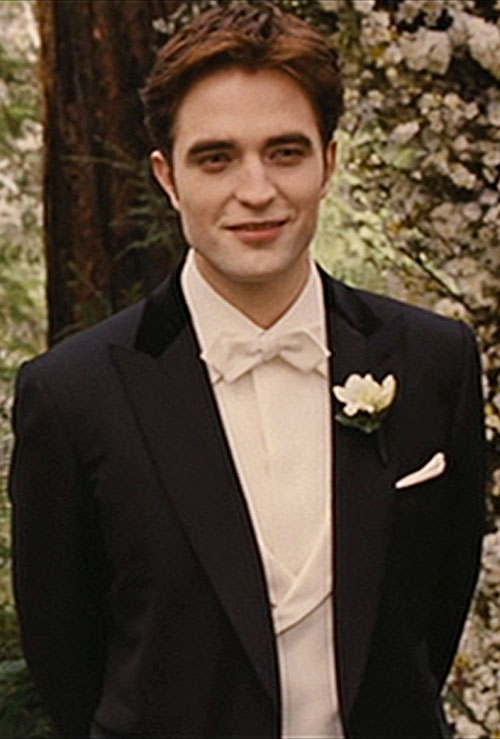

Beyond Edward Cullen Robert Pattinsons Relationships Explored

May 20, 2025

Beyond Edward Cullen Robert Pattinsons Relationships Explored

May 20, 2025 -

Ferraris Chinese Gp Start Hamilton And Leclercs Contact

May 20, 2025

Ferraris Chinese Gp Start Hamilton And Leclercs Contact

May 20, 2025 -

Potential Layoffs At Good Morning America Impact On Cast And Crew

May 20, 2025

Potential Layoffs At Good Morning America Impact On Cast And Crew

May 20, 2025 -

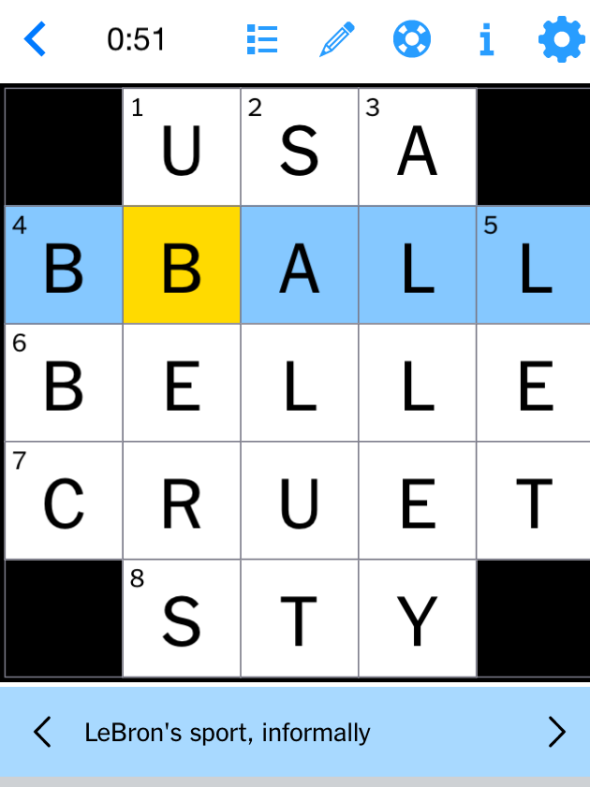

Solve The Nyt Mini Crossword March 13 Answers And Tips

May 20, 2025

Solve The Nyt Mini Crossword March 13 Answers And Tips

May 20, 2025 -

Robert Pattinson Shares Acting Process With Suki Waterhouse

May 20, 2025

Robert Pattinson Shares Acting Process With Suki Waterhouse

May 20, 2025

Latest Posts

-

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025 -

Kaellmanin Ja Hoskosen Puola Seuraura Paeaettynyt

May 20, 2025

Kaellmanin Ja Hoskosen Puola Seuraura Paeaettynyt

May 20, 2025 -

Benjamin Kaellman Maalivire Huuhkajien Apuna

May 20, 2025

Benjamin Kaellman Maalivire Huuhkajien Apuna

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Potentiaali

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Potentiaali

May 20, 2025