D-Wave Quantum Inc. (QBTS): A Deep Dive Into This Week's Stock Price Volatility

Table of Contents

Recent News and Announcements Impacting QBTS Stock Price

Recent news and announcements have played a significant role in the observed QBTS stock volatility. Analyzing these events and their market reception is vital for assessing the current situation and forecasting future price movements.

New Product Releases and Market Reception

D-Wave's recent product releases and their market reception are key drivers of QBTS stock volatility. Any new advancements or shortcomings in their quantum computing technology directly impact investor sentiment.

-

Specific product release details and its potential market impact: For example, the launch of a new, more powerful quantum annealing system could generate excitement and drive up the stock price. Conversely, delays or setbacks in product development could lead to negative reactions. Specific details on improvements in qubit count, processing speed, or application suitability are crucial to understand the impact.

-

Analyst ratings and price targets post-announcement: Post-release, financial analysts provide ratings and price targets that influence investor decisions. Positive ratings and increased price targets generally lead to increased stock value, while negative assessments can depress the price. Keep an eye on reputable analyst firms for these crucial pieces of information.

-

Media coverage and public perception: Positive media coverage amplifies the positive impact of new releases, while negative coverage (e.g., highlighting technological challenges) can exacerbate volatility and negatively impact the stock price. Monitoring both mainstream and specialized tech publications is crucial.

-

Comparison to competitor announcements and their respective stock performance: Comparing D-Wave's announcements and subsequent stock performance to those of competitors like IBM, Google, or Rigetti Computing provides crucial context and benchmarks for evaluating the success or failure of the release.

Financial Results and Earnings Reports

D-Wave's financial performance significantly impacts QBTS stock volatility. Investors closely scrutinize earnings reports to gauge the company's financial health and future prospects.

-

Key figures from the latest earnings report (revenue, losses, etc.): Examining revenue growth, net losses, and operating expenses provides insights into the company's financial stability and potential for future profitability. Significant deviations from expectations can lead to substantial price fluctuations.

-

Comparison to previous quarters and year-over-year performance: Tracking performance trends over time reveals growth patterns and helps predict future performance. Consistent improvements can instill investor confidence, while declining performance generates negative sentiment.

-

Investor reaction to the financial results: Immediate investor reactions to earnings releases provide a snapshot of market sentiment and often directly correlate with immediate price changes. Analyzing this reaction – often visible in post-earnings trading volume and price movements – is crucial.

-

Analyst interpretation of the financial data and its implications for future growth: Analysts' interpretations of the earnings data shape investor perceptions and influence future trading strategies. Understanding their forecasts and reasoning is critical for long-term investment planning.

Market Sentiment and Investor Behavior

Understanding market sentiment and investor behavior is crucial to interpreting QBTS stock volatility. External factors and investor psychology play a substantial role.

Overall Market Conditions

Broader market conditions heavily influence QBTS stock price, independent of company-specific news.

-

Current state of the tech sector and its impact on quantum computing stocks: The overall health of the technology sector impacts all tech stocks, including those in the quantum computing space. A downturn in the tech sector can disproportionately affect riskier investments like QBTS.

-

Influence of broader economic factors (interest rates, inflation, recession fears): Macroeconomic factors such as interest rate hikes, inflation, and recessionary fears impact investor risk appetite. During periods of economic uncertainty, investors often shift away from riskier assets, leading to price drops.

-

Comparison of QBTS's performance against other quantum computing stocks: Benchmarking QBTS's performance against its competitors provides valuable context. If the entire quantum computing sector experiences a downturn, QBTS’s volatility might simply reflect sector-wide trends.

Speculation and Trading Activity

Speculation and trading activity contribute significantly to QBTS stock volatility.

-

Volume of QBTS stock traded recently: High trading volumes suggest increased investor interest, potentially signifying significant price movement, either positive or negative.

-

Identification of potential short-selling or other speculative trading patterns: Short-selling can amplify price declines, while other speculative trading strategies can induce rapid price swings.

-

Discussion of social media sentiment and its influence on stock prices: Social media sentiment can significantly influence investor psychology, leading to herd behavior and amplified price fluctuations.

Analysis of QBTS's Long-Term Potential

While short-term volatility is significant, assessing QBTS's long-term potential is vital for making informed investment decisions.

Technological Advancements and Market Opportunities

D-Wave's technological trajectory and the market opportunities it addresses define its long-term potential.

-

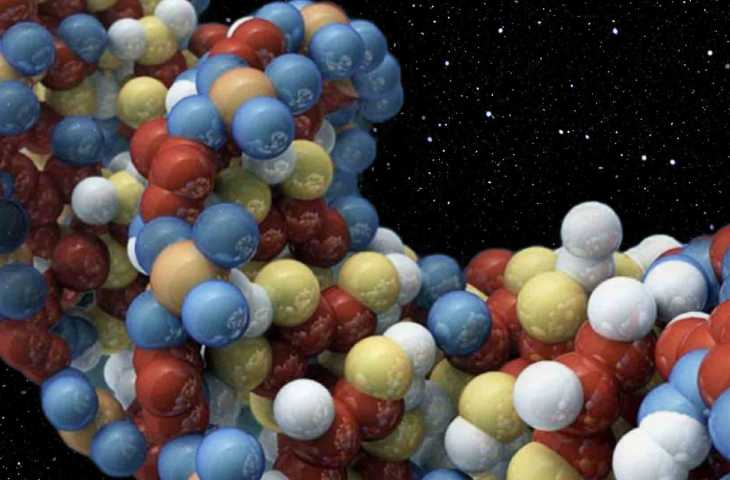

Analysis of D-Wave's technological advantages and disadvantages: Understanding D-Wave's technological strengths (e.g., annealing technology) and weaknesses (e.g., compared to gate-based quantum computers) is crucial for evaluating its competitive edge and long-term viability.

-

Discussion of the potential market size for quantum computing applications: Assessing the potential market size for quantum computing applications in various fields (finance, materials science, drug discovery) helps determine the overall market opportunity for D-Wave.

-

Evaluation of D-Wave's competitive landscape and its positioning within the industry: Understanding D-Wave's position relative to its competitors and its ability to innovate and secure market share is essential for evaluating its future prospects.

Risks and Challenges

Investing in QBTS involves inherent risks and challenges. Acknowledging these is crucial for managing expectations.

-

Technological hurdles in quantum computing development: Quantum computing is a nascent field with significant technological hurdles. Setbacks and unforeseen challenges could negatively impact D-Wave's progress and stock price.

-

Competition from other companies in the quantum computing field: The quantum computing landscape is competitive, with major players constantly innovating. D-Wave's ability to maintain its competitive edge is crucial.

-

Regulatory and financial risks: Regulatory changes and financial uncertainties (e.g., funding challenges) could significantly impact the company's operations and stock price.

Conclusion

This deep dive into the recent QBTS stock volatility highlights the interplay of several factors, including recent news, market sentiment, and D-Wave's long-term potential. Understanding these factors is key to informed investment decisions. While the future of QBTS remains uncertain, carefully monitoring news, financial performance, and market trends will be crucial for navigating the inherent volatility of this promising but risky investment. Stay informed on QBTS stock volatility, analyze the risks, and make your investment strategies accordingly. Understanding the nuances of QBTS stock price fluctuations will be crucial to successful investing in this exciting but unpredictable sector.

Featured Posts

-

Trump Administrations Ai Bill A Win But Not The End Of The Story

May 20, 2025

Trump Administrations Ai Bill A Win But Not The End Of The Story

May 20, 2025 -

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025 -

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

May 20, 2025

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

May 20, 2025 -

Unraveling The Mysteries A Look At Agatha Christies Poirot Stories

May 20, 2025

Unraveling The Mysteries A Look At Agatha Christies Poirot Stories

May 20, 2025 -

Solve The Nyt Mini Crossword March 18 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 18 Answers

May 20, 2025

Latest Posts

-

Ancelotti Nin Ayriliginin Ardindan Real Madrid In Yeni Teknik Direktoer Adaylari

May 21, 2025

Ancelotti Nin Ayriliginin Ardindan Real Madrid In Yeni Teknik Direktoer Adaylari

May 21, 2025 -

Juergen Klopp Mu Carlo Ancelotti Mi Teknik Direktoer Karsilastirmasi

May 21, 2025

Juergen Klopp Mu Carlo Ancelotti Mi Teknik Direktoer Karsilastirmasi

May 21, 2025 -

Klopp Un Geri Doenuesue Bir Devrin Baslangici Mi

May 21, 2025

Klopp Un Geri Doenuesue Bir Devrin Baslangici Mi

May 21, 2025 -

Real Madrid Ancelotti Den Sonra Kim Gelecek Juergen Klopp Guendemde

May 21, 2025

Real Madrid Ancelotti Den Sonra Kim Gelecek Juergen Klopp Guendemde

May 21, 2025 -

Hout Bay Fcs Rise The Klopp Connection

May 21, 2025

Hout Bay Fcs Rise The Klopp Connection

May 21, 2025