Cryptocurrency's Resilience Amidst Trade Wars: A Winning Prospect

Table of Contents

Decentralization as a Protective Shield Against Geopolitical Risks

Cryptocurrencies, unlike traditional fiat currencies, are not controlled by any single government or central bank. This decentralized architecture makes them significantly less susceptible to government regulations and trade restrictions imposed during trade wars. The inherent resilience stems from its distributed ledger technology (DLT).

- No single point of failure: The network’s decentralized nature means there's no central server or authority that can be targeted or shut down.

- Reduced reliance on centralized financial institutions: Transactions bypass traditional banking systems, mitigating risks associated with sanctions or capital controls.

- Transactions are processed peer-to-peer: This ensures that transactions are independent of geographical location and political boundaries.

- Examples: During periods of international tension, certain cryptocurrencies have continued to operate freely, unaffected by specific country's sanctions, demonstrating their resilience in a volatile geopolitical environment.

This decentralization offers investors a valuable diversification opportunity, reducing their exposure to the risks associated with centralized financial systems and geopolitical instability. Diversifying into crypto assets can act as a buffer against the impacts of trade wars on traditional investment portfolios.

Borderless Transactions: Bypassing Trade Barriers

Cryptocurrencies facilitate international transactions without the complexities and restrictions of traditional banking systems. This is a significant advantage during periods of trade uncertainty.

- Reduced transaction fees compared to traditional cross-border payments: Crypto transactions often involve significantly lower fees, especially for large sums of money.

- Faster transaction speeds: Crypto transactions are typically processed much faster than traditional bank transfers, making them ideal for time-sensitive international payments.

- Access to global markets regardless of trade disputes: Businesses can continue to operate internationally without being hindered by trade barriers or sanctions.

- Examples: Numerous businesses are already leveraging crypto for cross-border payments, showcasing the technology’s ability to bypass traditional financial constraints and overcome trade barriers.

This borderless nature is particularly beneficial for businesses operating internationally, enabling them to maintain smooth operations and mitigate the disruptions caused by trade wars. The ability to conduct seamless transactions regardless of trade restrictions provides a competitive edge during times of economic uncertainty.

Volatility: A Double-Edged Sword

The volatility of cryptocurrencies is often cited as a major drawback. However, during periods of economic uncertainty, this volatility can be reframed as a potential advantage.

- Cryptocurrency prices can fluctuate independently of traditional market trends: This decoupling from traditional assets can offer a hedge against market downturns caused by trade wars.

- Potential for rapid growth during market downturns: While risky, periods of instability can sometimes lead to significant price increases in certain cryptocurrencies.

- Risk management strategies for mitigating volatility: Diversification across various cryptocurrencies and dollar-cost averaging can help manage risk.

- Historical examples: There are historical examples where cryptocurrencies have outperformed traditional assets during periods of significant market volatility and geopolitical uncertainty.

It is crucial to emphasize, however, that careful consideration and robust risk management are paramount. Informed investment decisions are essential to navigate the volatile cryptocurrency market.

Understanding the Risks Involved in Cryptocurrency Investment

Investing in cryptocurrencies carries inherent risks. It's essential to acknowledge these before making any investment decisions.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and this uncertainty poses a risk.

- Security risks: Cryptocurrency exchanges and wallets are potential targets for hacking and scams, leading to potential losses.

Due diligence is crucial. Only invest what you can afford to lose, and thoroughly research any cryptocurrency before investing.

Cryptocurrency: A Winning Prospect in Uncertain Times

In conclusion, cryptocurrency's resilience amidst trade wars stems from its decentralized nature, borderless transactions, and—when managed effectively—its inherent volatility. These factors contribute to its potential as a hedge against geopolitical risk and economic uncertainty caused by trade disputes. Cryptocurrencies offer a unique opportunity for diversification and mitigating the risks associated with traditional assets.

Explore the world of cryptocurrency and discover how it might provide a winning prospect for your portfolio during times of trade uncertainty. Further your understanding by researching reputable exchanges and educational resources on cryptocurrency investment.

Featured Posts

-

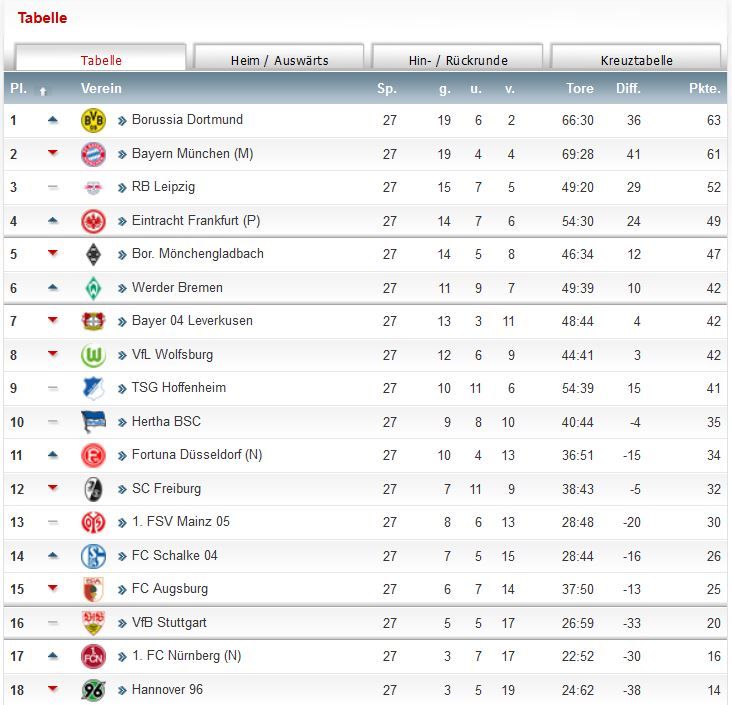

Bundesliga Spieltag 27 Koeln Neuer Tabellenfuehrer

May 09, 2025

Bundesliga Spieltag 27 Koeln Neuer Tabellenfuehrer

May 09, 2025 -

Rio Ferdinands Champions League Prediction Who Wins

May 09, 2025

Rio Ferdinands Champions League Prediction Who Wins

May 09, 2025 -

Your Guide To The Nl Federal Election Candidates

May 09, 2025

Your Guide To The Nl Federal Election Candidates

May 09, 2025 -

Is Colapinto The Next Red Bull Driver Lawsons Position Under Scrutiny

May 09, 2025

Is Colapinto The Next Red Bull Driver Lawsons Position Under Scrutiny

May 09, 2025 -

Trumps Dc Prosecutor Pick Jeanine Pirro

May 09, 2025

Trumps Dc Prosecutor Pick Jeanine Pirro

May 09, 2025