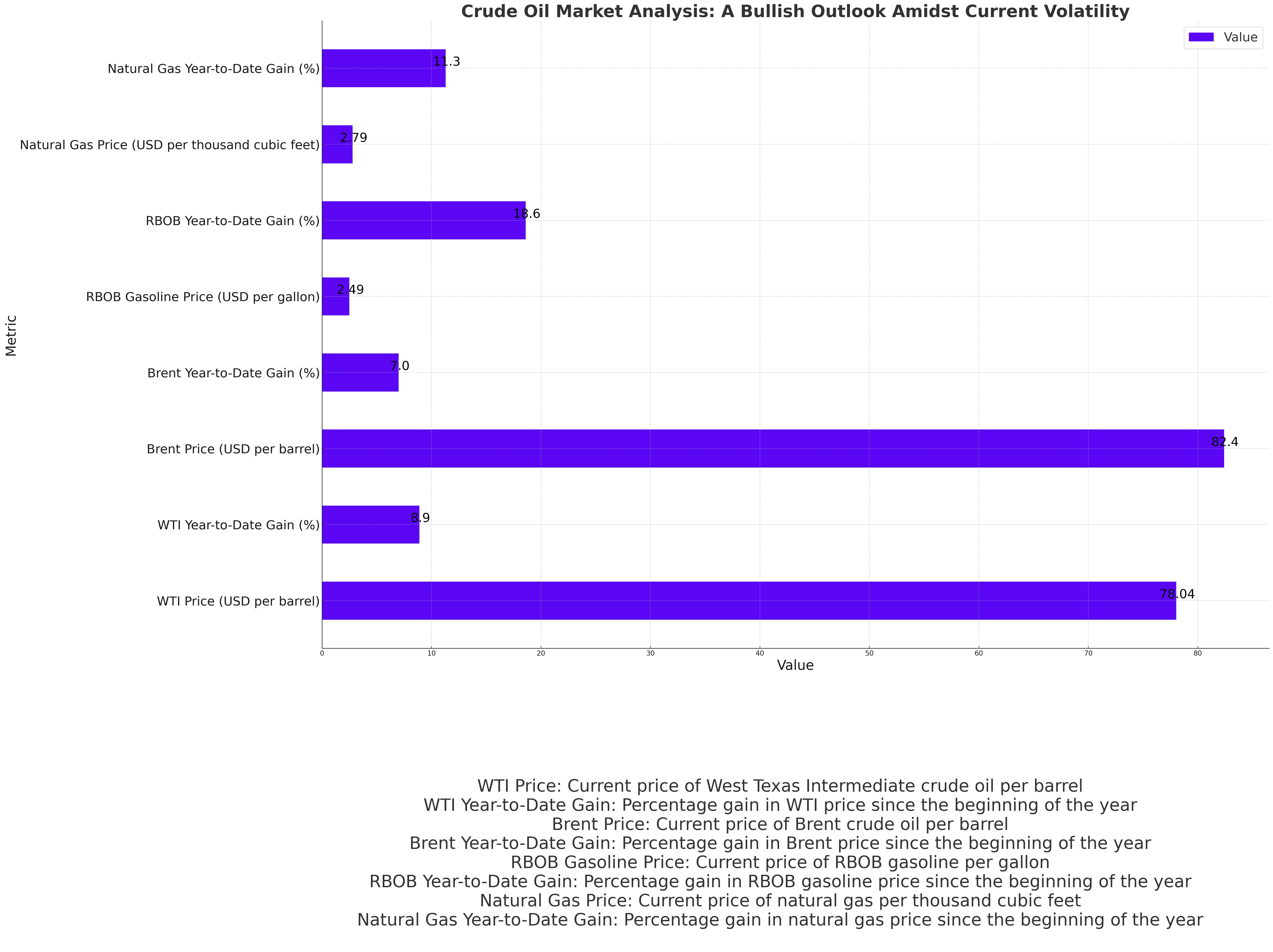

Crude Oil Market Analysis: Key Developments On May 16

Table of Contents

Geopolitical Influences on Crude Oil Prices

Geopolitical events significantly influence crude oil prices, often creating uncertainty and impacting supply chains. The oil market is highly sensitive to news and developments that can affect the availability and price of crude oil.

Impact of the Ukraine Conflict

The ongoing war in Ukraine continues to exert pressure on the crude oil market. The conflict has disrupted established supply chains, leading to significant price fluctuations.

- Pipeline Disruptions: The war has directly impacted major oil pipelines, reducing the flow of Russian crude oil to global markets. This reduction in supply has contributed to higher prices.

- Sanctions on Russian Oil Exports: International sanctions imposed on Russia have further restricted its oil exports, exacerbating supply shortages and driving up prices. Estimates suggest a significant reduction in daily barrel exports since the start of the conflict.

- Market Sentiment: The uncertainty surrounding the conflict and its potential to escalate contributes to a risk premium in oil prices, as investors seek safety and higher returns. This geopolitical risk premium adds to the already volatile market conditions. Keywords: Ukraine conflict, Russia oil sanctions, oil supply disruption, geopolitical risk premium.

Middle East Tensions

The Middle East remains a critical region for global oil production and any instability can significantly impact the crude oil market.

- Regional Instability: Political tensions and conflicts in various Middle Eastern countries can disrupt oil production and exports, leading to price increases. Even the threat of disruption can trigger price rises due to market speculation.

- OPEC Production: Decisions made by OPEC (Organization of the Petroleum Exporting Countries) and its allies (OPEC+) directly influence global oil supply and, consequently, prices. Any potential production cuts or disagreements within OPEC+ can trigger immediate market reactions. Keywords: Middle East oil, OPEC production, geopolitical instability, oil price volatility.

OPEC+ Production Decisions and Their Market Impact

OPEC+ decisions play a pivotal role in shaping the crude oil market. Their production quotas directly influence global supply and demand dynamics.

OPEC+ Meeting Outcomes

While no major OPEC+ meeting was held on May 16th, the lingering effects of previous meetings and the ongoing discussions on production quotas continue to influence market sentiment. Any announcements regarding future production adjustments would dramatically impact oil prices.

- Production Levels: The agreed-upon production quotas from prior OPEC+ meetings serve as a benchmark for global supply. Any deviation from these targets, whether through underproduction or overproduction by member states, can significantly impact prices.

- Rationale Behind Decisions: OPEC+ decisions are often based on analyses of global oil demand, economic forecasts, and geopolitical factors. Understanding the rationale behind these decisions helps to predict future market trends. Keywords: OPEC+ meeting, oil production quotas, oil supply and demand, OPEC strategy.

Compliance with Production Targets

Monitoring the compliance of OPEC+ member states with their agreed-upon production targets is crucial for understanding market dynamics.

- Discrepancies: Differences between agreed production levels and actual output by member states can lead to either supply surpluses or shortages. These discrepancies directly impact prices.

- Market Consequences: Non-compliance can lead to price volatility, as market participants react to the unexpected changes in supply. This can create both opportunities and risks for investors and traders. Keywords: OPEC compliance, oil production, market share, cartel behaviour.

Global Oil Demand and Economic Indicators

Global oil demand is heavily influenced by economic growth and other macroeconomic indicators.

Demand Outlook

Global oil demand is projected to continue its upward trend, driven by economic recovery in many parts of the world.

- Global Oil Consumption: Data from various sources point to a steady increase in global oil consumption, reflecting growth in industrial activity and transportation.

- Factors Impacting Future Demand: Factors such as the pace of economic growth, the adoption of alternative energy sources, and seasonal variations will significantly influence future oil demand. Keywords: Global oil demand, economic growth, energy consumption, seasonal demand.

Impact of Economic Data

Macroeconomic indicators released around May 16th, such as inflation rates and GDP growth figures, can significantly influence crude oil prices.

- Inflation and GDP Growth: High inflation rates and strong GDP growth can typically boost oil demand, leading to higher prices. Conversely, weak economic data can reduce demand and lead to lower prices.

- Market Sentiment: Economic data can also significantly impact market sentiment, influencing investor behaviour and price movements. Positive economic data can bolster confidence, while negative data can create uncertainty and lead to price declines. Keywords: Economic indicators, inflation, GDP growth, market sentiment, oil price correlation.

Conclusion

The crude oil market on May 16th was shaped by a complex interaction of geopolitical factors, OPEC+ decisions, and global economic indicators. The ongoing Ukraine conflict, potential Middle East tensions, and the level of compliance with OPEC+ production targets all contributed to the volatility observed in oil prices. Understanding these dynamics is critical for navigating the intricacies of the crude oil market. Stay ahead of the curve in the dynamic crude oil market. Follow our regular crude oil market analysis for updates and insights on oil price forecast and energy market trends. [Link to relevant content/resources]

Featured Posts

-

The Impact Of False Angel Reese Quotes On Public Perception

May 17, 2025

The Impact Of False Angel Reese Quotes On Public Perception

May 17, 2025 -

Knicks Brunson Addresses Thibodeaus Uncertain Future

May 17, 2025

Knicks Brunson Addresses Thibodeaus Uncertain Future

May 17, 2025 -

Jalen Brunson Injury The Latest Update For New York Knicks

May 17, 2025

Jalen Brunson Injury The Latest Update For New York Knicks

May 17, 2025 -

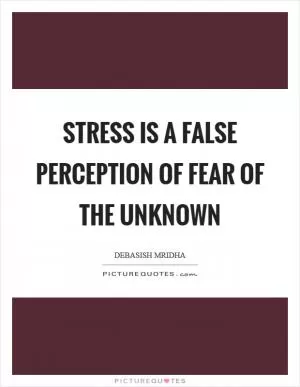

Investing In Middle Management A Strategy For Improved Company Performance And Employee Engagement

May 17, 2025

Investing In Middle Management A Strategy For Improved Company Performance And Employee Engagement

May 17, 2025 -

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025

Latest Posts

-

Nba Addresses Missed Call Impacting Pistons In Game 4

May 17, 2025

Nba Addresses Missed Call Impacting Pistons In Game 4

May 17, 2025 -

Aews Josh Alexander Exclusive Interview On Don Callis And His Wrestling Path

May 17, 2025

Aews Josh Alexander Exclusive Interview On Don Callis And His Wrestling Path

May 17, 2025 -

Nba Referees Under Fire After Pistons Game 4 Loss

May 17, 2025

Nba Referees Under Fire After Pistons Game 4 Loss

May 17, 2025 -

Nba Game 4 Controversy Pistons No Call Costs Them

May 17, 2025

Nba Game 4 Controversy Pistons No Call Costs Them

May 17, 2025 -

1 Double Q Interview Josh Alexander On Joining Aew And His Relationship With Don Callis

May 17, 2025

1 Double Q Interview Josh Alexander On Joining Aew And His Relationship With Don Callis

May 17, 2025