Credit Score Damage Control: Addressing Past-Due Student Loans

Table of Contents

Understanding the Impact of Past-Due Student Loans on Your Credit

Late payments on student loans have a severe impact on your creditworthiness, significantly affecting both your FICO score and VantageScore. These scores are crucial factors lenders use to assess your credit risk. A damaged credit score can lead to a cascade of negative consequences that extend far beyond your student loans.

- Negative impact on FICO scores: Late or missed payments remain on your credit report for seven years, significantly lowering your FICO score. This can make it harder to get approved for loans, credit cards, and even renting an apartment.

- Difficulty securing loans (auto, mortgage): Lenders see a low credit score as a high risk. Consequently, you may face higher interest rates or even loan application denials for mortgages, auto loans, and other significant financial products.

- Higher insurance premiums: Your credit score can also affect your insurance rates. A lower score can result in significantly higher premiums for auto, homeowner's, and renter's insurance.

- Potential employment issues: Some employers conduct credit checks as part of the hiring process. A poor credit history, often stemming from past-due student loans, could negatively impact your employment prospects.

Strategies for Recovering from Past-Due Student Loans

Recovering from past-due student loans requires a proactive and strategic approach. Here are key strategies to help you regain control of your credit:

Contacting Your Loan Servicer

Proactive communication with your loan servicer is the first crucial step. Don't avoid contact; it's far better to address the issue head-on.

- Negotiating a repayment plan: Explore options like income-driven repayment (IDR) plans, deferment, or forbearance. IDR plans base your monthly payments on your income, making them more manageable. Deferment and forbearance temporarily postpone your payments, offering breathing room. Understand the implications of each—deferment and forbearance often don't lower your total loan amount, and might negatively impact your credit score initially.

- Exploring loan rehabilitation options: If you've defaulted on your student loans, loan rehabilitation might be an option. This involves making timely payments for a set period, which can then remove the default from your credit report.

- Understanding the implications of each option on your credit report: Each option has its own impact, some initially negative, so carefully weigh the pros and cons with your loan servicer.

Consolidating Your Student Loans

Consolidating your student loans into a single loan can simplify repayment and potentially lower your monthly payments.

- Simplified repayment process: Managing one loan is easier than juggling multiple ones.

- Potentially lower interest rates: Consolidation may offer a lower interest rate, reducing the overall cost of your loans. However, this isn't guaranteed.

- The impact on your credit report: While consolidation may initially result in a negative mark on your credit report, consistent payments on the new loan can lead to positive changes over time.

Paying Off Your Student Loans

Consistent payments are vital for improving your credit score.

- Budgeting and financial planning: Create a realistic budget to prioritize your student loan payments.

- Prioritizing student loan payments: Make your student loan payments a top financial priority.

- Seeking financial advice if needed: Don't hesitate to seek guidance from a financial advisor to create a personalized debt repayment plan.

Monitoring Your Credit Report

Regularly monitoring your credit reports is essential for identifying and addressing any errors.

- Dispute any inaccuracies: If you find any mistakes on your report, dispute them immediately with the credit bureaus (Equifax, Experian, and TransUnion).

- Understanding what information lenders see: Familiarize yourself with what's on your credit report to understand how lenders view your credit history.

- Using free credit reports (AnnualCreditReport.com): You're entitled to a free credit report from each bureau annually. Utilize this resource.

Preventing Future Damage to Your Credit Score

Proactive measures can prevent future delinquencies and safeguard your credit score.

- Automating payments: Set up automatic payments to avoid missed payments due to oversight.

- Setting up payment reminders: Use calendar reminders or apps to stay on top of your due dates.

- Maintaining a healthy financial budget: Create and maintain a budget that accounts for all expenses, including your student loan payments.

- Understanding your loan terms: Thoroughly review your loan documents to understand repayment schedules, interest rates, and other crucial details.

Conclusion: Taking Control of Your Credit Score After Student Loan Delinquency

Addressing past-due student loans and improving your credit score requires proactive steps, including open communication with your loan servicer, exploring repayment options, and consistent, timely payments. Regularly monitoring your credit reports and implementing proactive measures to prevent future delinquencies are equally important aspects of effective credit score damage control. Don't let past-due student loans continue to damage your credit score. Take control today by contacting your loan servicer and exploring the options outlined in this guide for effective credit score damage control and start building a brighter financial future.

Featured Posts

-

Cinema Con 2025 What To Expect From The Warner Bros Pictures Presentation

May 17, 2025

Cinema Con 2025 What To Expect From The Warner Bros Pictures Presentation

May 17, 2025 -

Mariners Vs Athletics Injury Report March 27 30

May 17, 2025

Mariners Vs Athletics Injury Report March 27 30

May 17, 2025 -

Sbry Abwshealt Tkrym Jzayry Yuthry Alsynma Alerbyt

May 17, 2025

Sbry Abwshealt Tkrym Jzayry Yuthry Alsynma Alerbyt

May 17, 2025 -

Koriun Inversiones Desentranando El Esquema Ponzi

May 17, 2025

Koriun Inversiones Desentranando El Esquema Ponzi

May 17, 2025 -

Tom Thibodeaus Post Game 2 Outburst Criticism Of The Refs Following Knicks Loss

May 17, 2025

Tom Thibodeaus Post Game 2 Outburst Criticism Of The Refs Following Knicks Loss

May 17, 2025

Latest Posts

-

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025 -

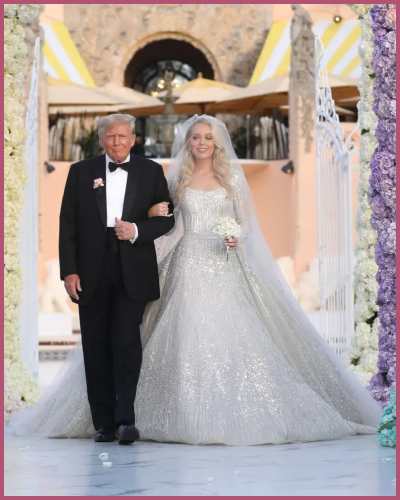

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025