Crédit Mutuel AM : Géopolitique Et Risques Environnementaux Maritimes

Table of Contents

Géopolitique Maritime et son Impact sur les Investissements

Global maritime geopolitical tensions significantly influence investment decisions. The maritime domain is a critical artery for global trade, making it highly susceptible to geopolitical instability. Understanding these risks is paramount for responsible investment.

-

The impact of conflicts in key shipping lanes: Conflicts in strategically important areas, such as the Strait of Malacca or the Suez Canal, can lead to disruptions in global supply chains, impacting the profitability of shipping companies and related businesses. Increased insurance premiums and potential cargo losses add to the financial risks.

-

The effect of trade wars and sanctions on maritime trade: Trade wars and sanctions often target specific countries or goods, directly affecting maritime trade routes and the companies operating within them. This can create uncertainty and volatility in the market, necessitating careful risk assessment.

-

The rising importance of energy security and its relation to maritime routes: The global energy transition and the increasing demand for various resources are placing a greater emphasis on secure maritime routes for energy transportation. Geopolitical tensions surrounding energy-producing regions directly influence the security and stability of these routes, creating both opportunities and risks for investors.

-

Analysis of political risks affecting specific ports and regions: Crédit Mutuel AM conducts thorough due diligence, analyzing political risks associated with specific ports and regions. This includes assessing factors such as political stability, regulatory environments, and the potential for corruption, which can all significantly impact investment decisions.

Bullet Points:

- The 2021 Suez Canal blockage highlighted the vulnerability of global trade to unforeseen geopolitical events.

- Crédit Mutuel AM utilizes proprietary geopolitical risk models to assess potential disruptions.

- Geopolitical analysis is integrated into portfolio construction to mitigate potential losses and identify opportunities.

Risques Environnementaux Maritimes et la Durabilité

The maritime industry faces significant environmental challenges, including pollution, climate change, and biodiversity loss. These risks are not only environmental but also present significant financial implications for companies operating in the sector. Crédit Mutuel AM recognizes the importance of incorporating Environmental, Social, and Governance (ESG) factors into its investment approach.

-

Discussion of key environmental risks, including oil spills, plastic pollution, and climate change impacts: Oil spills, plastic pollution, and the impacts of climate change (rising sea levels, extreme weather events) pose substantial threats to marine ecosystems and the businesses that rely on them.

-

Analysis of the regulatory landscape and its effect on maritime industries: The increasing stringency of environmental regulations worldwide significantly affects maritime industries. Compliance costs and the potential for penalties necessitate careful consideration of regulatory risk.

-

How Crédit Mutuel AM assesses the environmental performance of companies in its portfolios: Crédit Mutuel AM employs rigorous ESG assessments to evaluate the environmental performance of companies in its portfolios, considering their carbon footprint, waste management practices, and compliance with environmental regulations.

-

Examples of Crédit Mutuel AM's investments in sustainable maritime solutions: Crédit Mutuel AM actively invests in companies developing and implementing sustainable maritime solutions, such as renewable energy technologies, waste management systems, and efficient shipping technologies.

Bullet Points:

- Crédit Mutuel AM actively engages with portfolio companies to promote improved environmental performance.

- Investment decisions are informed by comprehensive ESG ratings and data analysis.

- Support for innovative solutions in areas like decarbonization of shipping is a key focus.

Stratégies d'Investissement Responsable de Crédit Mutuel AM

Crédit Mutuel AM employs a multi-faceted approach to responsible investing, integrating ESG factors throughout its investment process. This proactive strategy aims to mitigate risks and generate long-term sustainable returns.

-

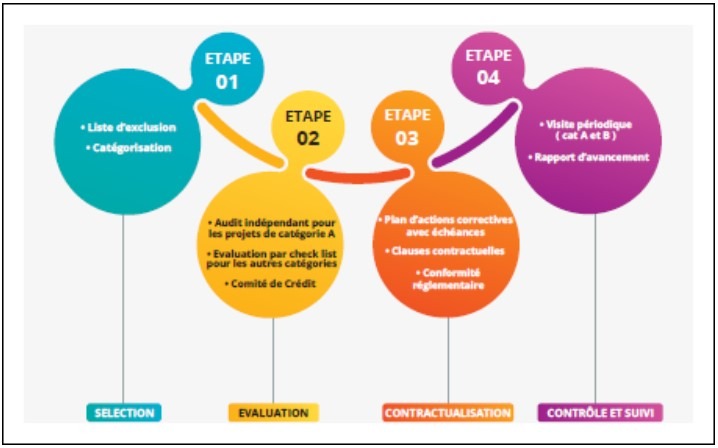

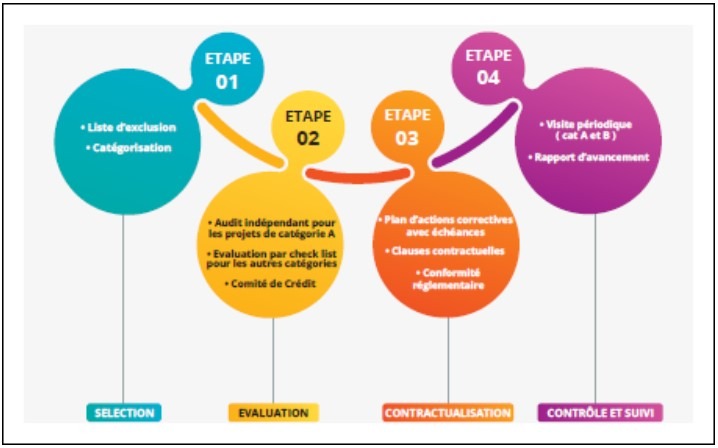

Description of Crédit Mutuel AM's ESG integration process: Crédit Mutuel AM's ESG integration is a systematic process, starting from investment strategy definition and extending through to portfolio construction, monitoring, and reporting.

-

Explanation of their due diligence procedures for assessing environmental and social impacts: Rigorous due diligence procedures are implemented to assess the environmental and social impacts of potential investments. This involves evaluating companies' ESG performance, engaging with management, and conducting site visits when necessary.

-

Examples of successful responsible investment strategies implemented by Crédit Mutuel AM: Crédit Mutuel AM showcases examples of its successful responsible investment strategies, highlighting the positive impacts on both financial performance and environmental sustainability.

-

Discussion of the performance of their responsible investment portfolios: The performance of Crédit Mutuel AM's responsible investment portfolios demonstrates that sustainable investing can be both financially rewarding and environmentally beneficial.

Bullet Points:

- Active ownership and shareholder engagement are crucial elements of Crédit Mutuel AM’s approach.

- Transparency and robust reporting are key to ensuring accountability.

- Long-term value creation is prioritized over short-term gains.

Conclusion

Crédit Mutuel AM demonstrates a proactive approach to managing both geopolitical and maritime environmental risks. Through sophisticated risk assessment, ESG integration, and a commitment to responsible investing, Crédit Mutuel AM strives to deliver strong financial returns while contributing to a more sustainable future. Their expertise in navigating these complex challenges provides investors with a unique opportunity to participate in the growth of the maritime industry while contributing to a positive environmental and social impact.

Call to Action: Learn more about Crédit Mutuel AM's commitment to responsible investment and how their expertise in navigating geopolitical and maritime environmental risks can benefit your portfolio. Explore their investment solutions focused on sustainable and responsible maritime industries today! Contact Crédit Mutuel AM to discuss your investment needs and discover how you can contribute to a more sustainable future through responsible investing.

Featured Posts

-

Ufc 313 Your Guide To The Fights Tickets And Viewing Options

May 19, 2025

Ufc 313 Your Guide To The Fights Tickets And Viewing Options

May 19, 2025 -

Chat Gpt 5 Rumors Debunked Release Date Features Price And More

May 19, 2025

Chat Gpt 5 Rumors Debunked Release Date Features Price And More

May 19, 2025 -

Is Eurovision Lumo The Worst Mascot Ever A Mick Hucknall Crazy Frog Hybrid

May 19, 2025

Is Eurovision Lumo The Worst Mascot Ever A Mick Hucknall Crazy Frog Hybrid

May 19, 2025 -

Lumo Eurovisions Most Controversial Mascot A Public Opinion Poll

May 19, 2025

Lumo Eurovisions Most Controversial Mascot A Public Opinion Poll

May 19, 2025 -

United Kingdoms Eurovision 2025 Performance A 19th Place Finish

May 19, 2025

United Kingdoms Eurovision 2025 Performance A 19th Place Finish

May 19, 2025