Could Bitcoin Reach New Heights? A 1,500% Price Surge Prediction

Table of Contents

Factors Fueling the Potential Bitcoin Price Surge

Several converging factors suggest a potential for a significant Bitcoin price surge, although predicting a precise percentage increase like 1500% remains highly speculative. Analyzing these factors offers a clearer picture of Bitcoin's future price trajectory and its potential as a lucrative Bitcoin investment.

Increased Institutional Adoption

Institutional investors are increasingly embracing Bitcoin. This shift signifies a move beyond individual investors and into the realm of large-scale, sophisticated players, bringing increased stability and liquidity to the market.

- MicroStrategy: This business intelligence company holds a substantial Bitcoin reserve, demonstrating confidence in the cryptocurrency's long-term value as a Bitcoin investment.

- Tesla: Elon Musk's company's initial Bitcoin purchase and subsequent sale illustrate the significant impact even one large corporate entity can have on the Bitcoin price.

- BlackRock's Bitcoin ETF application: This shows a growing interest from major financial institutions to offer Bitcoin exposure to a wider range of investors through regulated products.

Institutional Bitcoin investment is a key driver for price stability and significantly improves market liquidity, encouraging further adoption and price appreciation in the cryptocurrency market. The potential approval of a Bitcoin ETF could dramatically accelerate this trend.

Growing Global Adoption and Usage

The expanding global adoption of Bitcoin is another crucial factor. More users and merchants accepting Bitcoin as payment fuel demand, thus impacting the Bitcoin price prediction.

- Increased usage in developing economies: Countries with high inflation or unstable fiat currencies are increasingly adopting Bitcoin as a store of value and a medium of exchange.

- Growing merchant acceptance: An increasing number of businesses worldwide now accept Bitcoin as payment, facilitating mainstream usage.

- Bitcoin adoption rate in El Salvador: El Salvador's adoption of Bitcoin as legal tender provides a real-world example of how government support can spur mass adoption and positively influence the Bitcoin price.

This increasing Bitcoin global usage is directly correlated with the growth of the overall cryptocurrency market, making Bitcoin a key player in the future of finance.

Technological Advancements and Network Upgrades

Bitcoin's underlying technology constantly evolves, enhancing its functionality and efficiency.

- Bitcoin Lightning Network: This layer-2 scaling solution dramatically increases transaction speeds and reduces fees, making Bitcoin more practical for everyday use.

- Taproot upgrade: This upgrade enhanced Bitcoin's privacy and smart contract capabilities, paving the way for more sophisticated applications on the network.

- Ongoing development and research: The ongoing efforts by developers to improve Bitcoin's scalability, security, and overall usability directly contribute to its long-term value proposition and therefore its price.

These Bitcoin upgrades contribute to a more robust and scalable network, attracting more users and improving the overall user experience, ultimately boosting its price.

Regulatory Clarity and Favorable Government Policies

Positive regulatory developments can significantly influence investor confidence and market stability.

- Gradual acceptance in some jurisdictions: Countries like Switzerland and Singapore have established relatively clear frameworks for cryptocurrency businesses, encouraging growth.

- Easing of restrictions in some regions: Certain jurisdictions have begun to relax restrictions on Bitcoin trading and usage, improving its accessibility and attractiveness to investors.

- Focus on regulation rather than prohibition: A growing global trend is towards regulating cryptocurrencies rather than banning them, creating a more predictable and favorable environment for growth.

Clear Bitcoin regulation fosters a more transparent and trustworthy environment, attracting mainstream investors who otherwise might be hesitant due to regulatory uncertainty.

Potential Risks and Challenges to a Bitcoin Price Surge

While a Bitcoin price surge is possible, it's crucial to acknowledge potential obstacles.

Market Volatility and Price Corrections

Bitcoin's price is notoriously volatile, subject to significant swings in both directions.

- Historical price fluctuations: Bitcoin's history is marked by periods of extreme volatility, with significant price increases often followed by sharp corrections.

- Risk mitigation strategies: Investors should be prepared for price corrections and employ risk management strategies, such as diversification and dollar-cost averaging.

- Understanding market cycles: Recognizing the cyclical nature of the cryptocurrency market is crucial for managing expectations and navigating periods of uncertainty.

Bitcoin volatility is inherent and necessitates a cautious approach to Bitcoin investment.

Regulatory Uncertainty and Potential Bans

Regulatory uncertainty remains a significant risk. Governments worldwide are still grappling with how best to regulate cryptocurrencies.

- Varying regulatory landscapes: Different countries have adopted vastly different approaches to cryptocurrency regulation, creating a fragmented global landscape.

- Potential for stricter regulations: Some governments may introduce stricter regulations or even outright bans on cryptocurrencies, impacting Bitcoin's price.

- Geopolitical risks: Global political events can significantly influence the regulatory environment for cryptocurrencies and thus impact Bitcoin's price.

Understanding the evolving regulatory environment is crucial for navigating the risks associated with Bitcoin investment.

Competition from Other Cryptocurrencies

Bitcoin faces competition from a growing number of altcoins.

- Emergence of altcoins with specific functionalities: Altcoins often offer unique features or functionalities that attract investors.

- Competition for market share: The competition for market share among cryptocurrencies could impact Bitcoin's dominance and thus its price.

- Innovation in the cryptocurrency space: The rapid pace of innovation in the cryptocurrency sector constantly introduces new technologies and projects which can challenge Bitcoin's position.

The competitive cryptocurrency landscape necessitates ongoing monitoring of new developments and potential threats to Bitcoin's market position.

Conclusion: Bitcoin's Future: A 1,500% Price Surge – Realistic or Overly Optimistic?

While a 1,500% Bitcoin price surge is certainly ambitious, the factors discussed highlight the potential for significant growth in the cryptocurrency market. Institutional adoption, growing global usage, technological advancements, and increasing regulatory clarity all contribute to a more positive outlook for Bitcoin's future. However, the inherent volatility of the cryptocurrency market, regulatory uncertainty, and competition from altcoins remain significant challenges. Conducting thorough research and understanding the risks involved are crucial for any Bitcoin investment strategy. Before making any Bitcoin investment decisions, conduct your own research and consider the potential for significant growth alongside the inherent risks. Remember to diversify your portfolio and consider Bitcoin as only one element of a well-rounded investment strategy.

Featured Posts

-

185 Potential Van Ecks Top Cryptocurrency Recommendation

May 08, 2025

185 Potential Van Ecks Top Cryptocurrency Recommendation

May 08, 2025 -

Diego Luna On Andor Season 2 A Star Wars Story That Will Redefine The Franchise

May 08, 2025

Diego Luna On Andor Season 2 A Star Wars Story That Will Redefine The Franchise

May 08, 2025 -

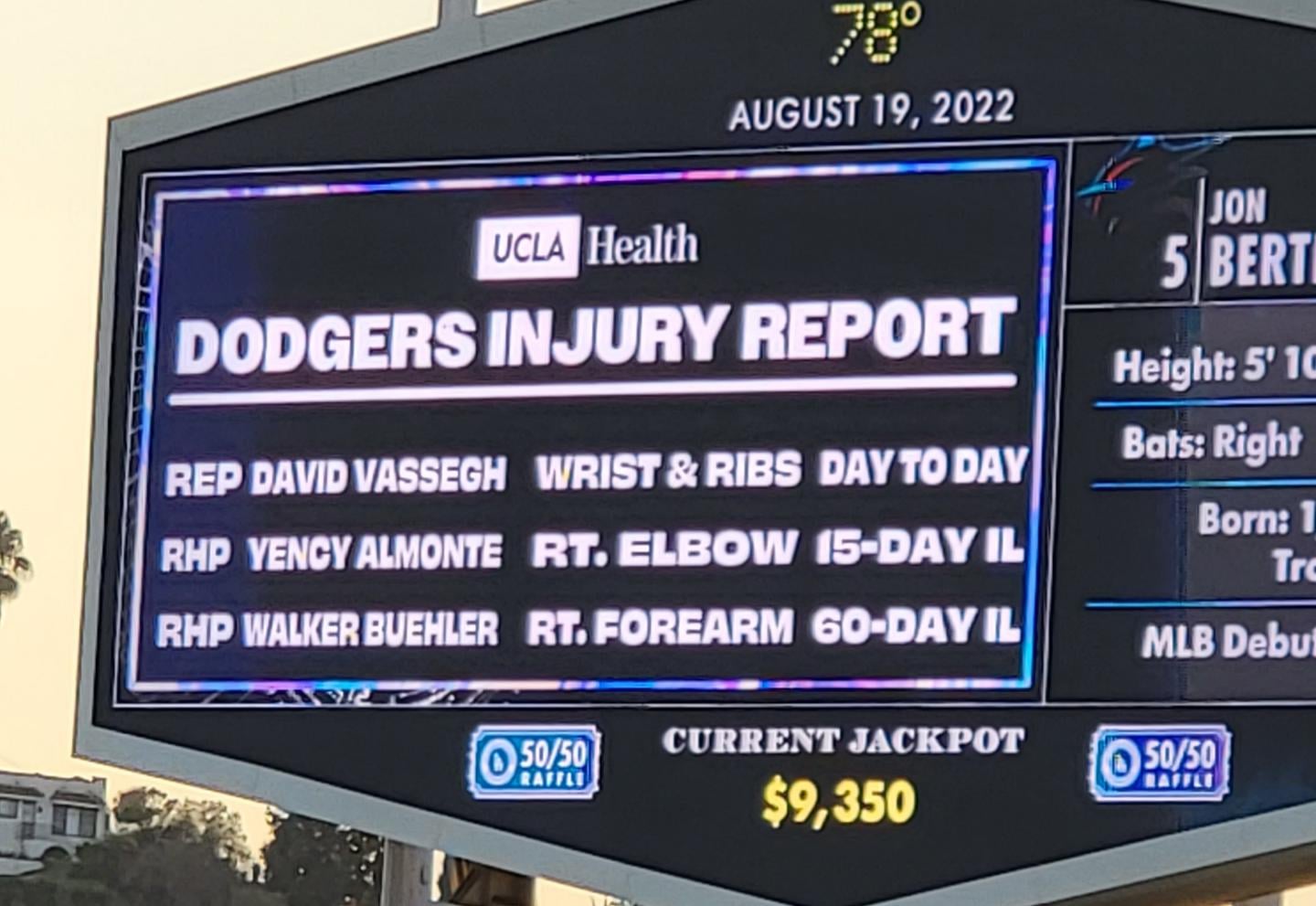

Dodgers Betts Sidelined By Illness Status Uncertain For Series

May 08, 2025

Dodgers Betts Sidelined By Illness Status Uncertain For Series

May 08, 2025 -

Will Xrp See A Surge Analyzing The Impact Of Etf Applications And Sec Developments

May 08, 2025

Will Xrp See A Surge Analyzing The Impact Of Etf Applications And Sec Developments

May 08, 2025 -

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 08, 2025

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 08, 2025