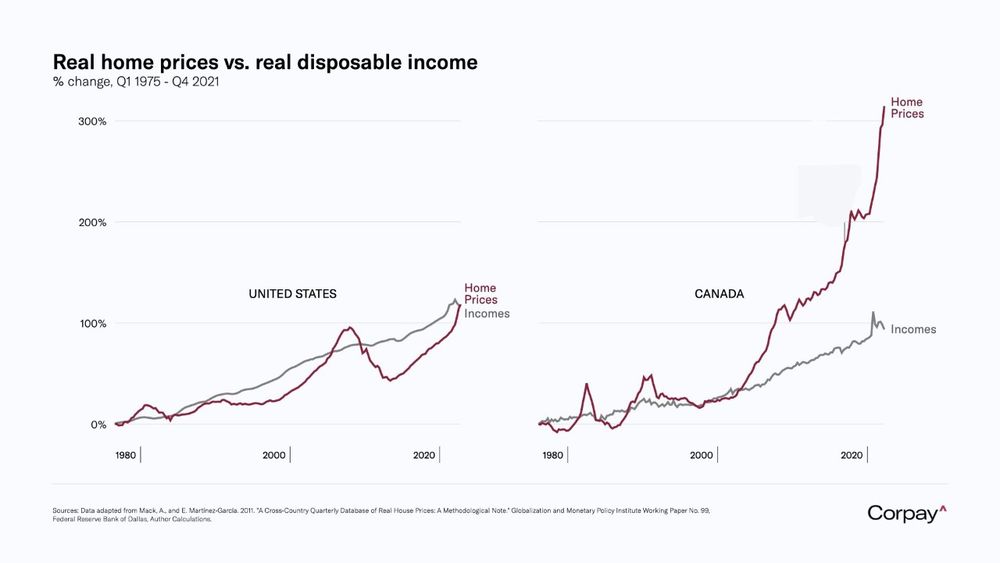

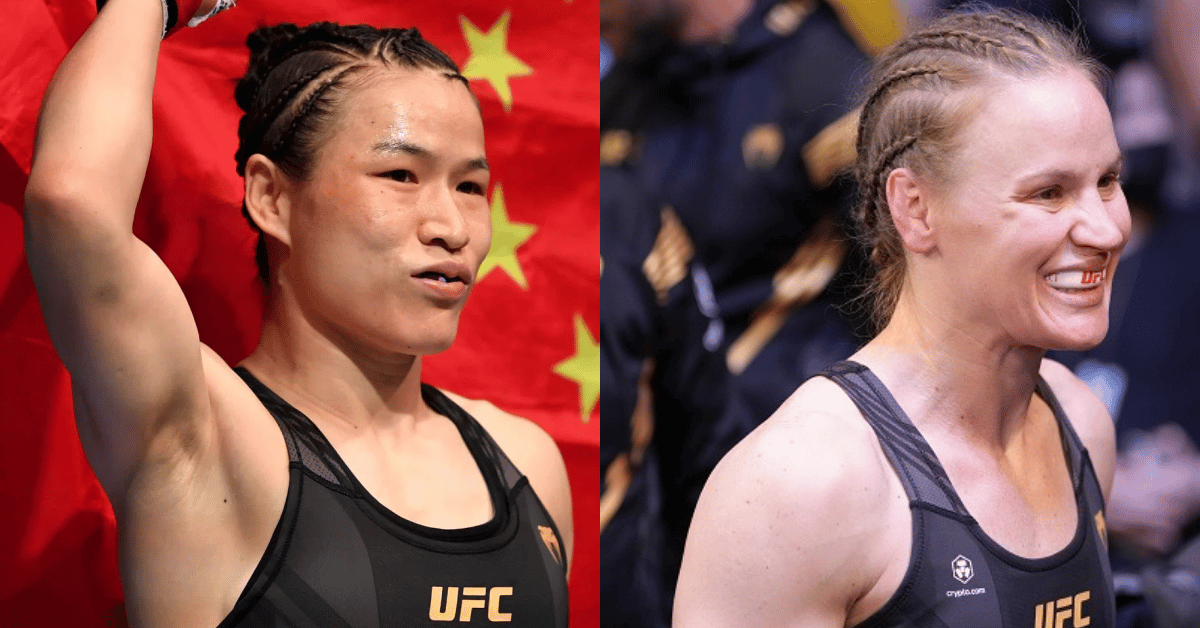

Could 3% Mortgage Rates Revitalize Canada's Real Estate?

Table of Contents

The Impact of Lower Mortgage Rates on Buyer Affordability

Lower mortgage rates directly translate to more affordable monthly payments, significantly impacting buyer affordability and potentially revitalizing the market.

Increased Purchasing Power

A reduction in mortgage rates to 3% would dramatically increase the purchasing power of potential homebuyers.

-

Example: A buyer pre-approved for a $500,000 mortgage at a 6% interest rate might only qualify for a $400,000 mortgage at a 3% interest rate, this difference represents a significant increase in buying power. Lower rates mean buyers can afford more expensive homes or larger down payments, thus boosting market activity.

-

First-time homebuyers: This demographic would experience a particularly noticeable boost in affordability, potentially leading to a surge in first-time home purchases. The increased accessibility could help address Canada's housing shortage, particularly in areas with high demand.

-

Affordability indices: Data from leading Canadian affordability indices would need to be analyzed in relation to the lower rate scenario. While the indices show a decrease in affordability during periods of high interest rates, the return to 3% would immediately show an improvement.

Re-entry of Sidelined Buyers

Many potential buyers who paused their home searches due to high interest rates may re-enter the market if rates drop to 3%.

-

Pent-up demand: The accumulated pent-up demand could lead to a rapid surge in transactions. This potential increase in buyer activity could significantly boost sales numbers and possibly lead to a more competitive marketplace.

-

Return of bidding wars: While not guaranteed, lower rates could increase competition and potentially bring back bidding wars in desirable areas, driving up prices in certain segments of the market. This would need to be considered alongside the impact of other market factors.

The Effect on Market Activity and Prices

A return to 3% mortgage rates would likely have a substantial effect on market activity and property prices across Canada.

Increased Transaction Volume

Lower rates would create a more favorable borrowing environment, resulting in a noticeable increase in the number of homes bought and sold.

-

Rebound in sales activity: Market data from past periods of lower interest rates can be used to model the potential increase in sales volume. Experts' predictions and regional economic forecasts should also be taken into account, as different regions may be more or less impacted.

-

Regional variations: The impact of lower rates will not be uniform across Canada. Areas with already high demand and limited supply may experience a more pronounced increase in price and transaction volume compared to those with lower demand and increased supply.

Potential Price Stabilization or Increase

Increased buyer demand, driven by lower mortgage rates, could create upward pressure on prices. However, this increase may be moderated by several other factors.

-

Supply constraints: The current supply shortage would continue to play a major role, limiting the extent of price increases. Areas with a higher supply of housing may see less dramatic price rises.

-

Economic conditions: The broader economic climate and employment levels will impact the extent of any price growth. A strong economy will likely support higher prices, while a recession could dampen the effects of lower rates.

-

Moderate price increases: Instead of a dramatic boom, a more moderate price increase is a likely scenario, particularly considering supply constraints and the possibility of government interventions. The location of the property will also be a key determinant of any price shifts.

Impact on the Construction and Development Sector

The construction and development sectors stand to benefit significantly from a reduction in mortgage rates to 3%.

Revival of New Construction

Lower rates would stimulate demand for newly constructed homes, resulting in a revival of the construction industry.

-

Increased housing starts: Builders would likely see an increase in demand leading to more new housing starts and increased employment opportunities in the construction sector.

-

Job creation: This translates to job creation not only in construction but also in related industries such as material supply and transportation.

-

Material costs: However, this increased demand could also lead to rising material costs, impacting the overall affordability of new builds.

Increased Investment in Real Estate Development

Lower borrowing costs could encourage a significant surge in investment in new real estate projects.

-

Increased competition: This increased investment could lead to increased competition amongst developers, potentially impacting profitability.

-

Risk and reward: Investors will need to carefully assess the risks and rewards of investing in this environment, factoring in the potential for fluctuating market conditions and the long-term impact of interest rate changes.

Economic Implications of a 3% Mortgage Rate Scenario

A return to 3% mortgage rates would have widespread economic implications across Canada.

Stimulus to the Economy

Increased real estate activity acts as a significant economic stimulus, benefiting many sectors.

-

Job creation: As discussed previously, increased construction and related activities will lead to job creation.

-

Consumer spending: Increased homeownership can also stimulate consumer spending in areas like furniture, appliances, and home renovations, leading to a positive ripple effect throughout the economy.

-

Government revenue: Higher property values and increased transactions result in increased government revenue through property taxes and related levies.

Potential Risks and Challenges

While lower rates offer many benefits, they also pose certain risks and challenges.

-

Increased inflation: A surge in demand fueled by lower rates could contribute to inflationary pressures. The Bank of Canada would need to carefully monitor the situation to prevent runaway inflation.

-

Potential for unsustainable price growth: Uncontrolled price increases could create market instability and the potential for a future correction.

-

Government regulation and intervention: Governments may need to intervene to regulate the market and prevent the creation of an unsustainable housing bubble. This may involve implementing stricter lending regulations or introducing measures to cool down overheated markets.

Conclusion

The potential return to 3% mortgage rates in Canada carries significant implications for the real estate market and the broader economy. While such a rate reduction could lead to increased buyer affordability, higher transaction volumes, and a revitalization of the construction industry, the potential risks associated with rapid price increases and market instability must be carefully considered. Further analysis and continuous monitoring of economic indicators are essential to fully understand the long-term effects of such a shift. Understanding the potential impact of fluctuating mortgage rates is crucial for both buyers and sellers navigating the Canadian real estate market. Stay informed about mortgage rate changes and their potential impact on your real estate decisions.

Featured Posts

-

Ufc 315 Valentina Shevchenkos Next Challenge Against Manon Fiorot

May 12, 2025

Ufc 315 Valentina Shevchenkos Next Challenge Against Manon Fiorot

May 12, 2025 -

Jessica Simpson And Eric Johnson Spotted Together Amidst Split Rumors

May 12, 2025

Jessica Simpson And Eric Johnson Spotted Together Amidst Split Rumors

May 12, 2025 -

Conociendo A Los Posibles Sucesores Del Papa Francisco

May 12, 2025

Conociendo A Los Posibles Sucesores Del Papa Francisco

May 12, 2025 -

Ufc 315 Shevchenko Open To Zhang Weili Superfight

May 12, 2025

Ufc 315 Shevchenko Open To Zhang Weili Superfight

May 12, 2025 -

Flight Attendant To Pilot A Womans Journey Against The Odds

May 12, 2025

Flight Attendant To Pilot A Womans Journey Against The Odds

May 12, 2025

Latest Posts

-

Hostages In Gaza The Families Continuing Nightmare

May 13, 2025

Hostages In Gaza The Families Continuing Nightmare

May 13, 2025 -

Gaza Hostage Situation A Protracted Nightmare For Families

May 13, 2025

Gaza Hostage Situation A Protracted Nightmare For Families

May 13, 2025 -

The Unending Ordeal Gaza Hostages And Their Families Plight

May 13, 2025

The Unending Ordeal Gaza Hostages And Their Families Plight

May 13, 2025 -

The Unending Nightmare The Plight Of Hostage Families In Gaza

May 13, 2025

The Unending Nightmare The Plight Of Hostage Families In Gaza

May 13, 2025 -

Gaza Hostages The Nightmare Continues For Families

May 13, 2025

Gaza Hostages The Nightmare Continues For Families

May 13, 2025