CoreWeave's IPO: $40 Listing Price Falls Short Of Initial Projections

Table of Contents

Initial Expectations vs. Reality: The Disappointing IPO Performance

Initial projections for CoreWeave's IPO placed the price range considerably higher than the eventual $40 listing price. Analysts had predicted a more optimistic opening, fueled by the company's strong growth in the rapidly expanding cloud computing market and its focus on high-performance computing solutions. The significant gap between the projected price and the actual listing price highlights the unpredictable nature of the stock market and the influence of broader economic factors.

- Initial price range projections: While the exact figures varied across different analysts, the projected range was significantly above $40 per share.

- Factors contributing to the lower-than-expected price: Several factors likely contributed to this shortfall. These include a general downturn in the tech sector, increased investor caution due to rising interest rates, and perhaps concerns about market saturation in the cloud computing space. Competition from established players also played a role.

- Comparison with similar IPOs in the tech sector: A comparison with other recent tech IPOs reveals a trend of subdued performance, suggesting a broader market correction impacting investor enthusiasm.

Market Conditions and Investor Sentiment: Factors Influencing CoreWeave's Stock Debut

The underwhelming performance of CoreWeave's IPO cannot be viewed in isolation. The broader market context significantly impacted the tech sector and IPO performance in general. Prevailing investor sentiment towards cloud computing companies, while still largely positive, has become more cautious recently.

- Overall market volatility: The stock market experienced considerable volatility in the period leading up to CoreWeave's IPO, creating uncertainty among investors.

- Interest rate hikes and their effect on tech valuations: Rising interest rates have increased borrowing costs and reduced the attractiveness of high-growth tech stocks, impacting valuations across the board.

- Investor concerns regarding the cloud computing market saturation: Concerns about market saturation and increased competition in the cloud computing sector might have contributed to a more conservative approach by investors.

- Analysis of investor response to the CoreWeave offering: The lukewarm response to the CoreWeave offering underscores the need for companies to demonstrate sustainable growth and profitability in a challenging market.

CoreWeave's Business Model and Future Prospects: Analyzing the Long-Term Potential

Despite the disappointing IPO debut, CoreWeave's underlying business model remains strong. The company leverages its expertise in GPU-accelerated computing to offer high-performance cloud services catering to a range of industries. This focus on a specialized niche within the broader cloud market presents long-term growth potential.

- Key strengths of CoreWeave's services: CoreWeave's specialization in GPU computing gives it a competitive edge, particularly in fields like AI and machine learning.

- Market opportunities and potential for expansion: The continued growth of AI and related technologies creates significant opportunities for CoreWeave's expansion.

- Risks and challenges facing the company's future growth: Competition, technological advancements, and economic fluctuations remain significant risks.

- Long-term investment outlook for CoreWeave stock: While the initial IPO price was disappointing, the long-term outlook depends on the company's ability to execute its business plan and adapt to the evolving market landscape.

Impact on Investors and the Future of CoreWeave's Stock Price

The lower-than-expected IPO price directly impacted early investors, who saw their initial returns reduced. The future price trajectory of CoreWeave's stock remains uncertain and will depend on a variety of factors.

- Impact on early investors' returns: Early investors experienced immediate losses compared to initial projections.

- Potential short-term and long-term price fluctuations: The stock price is likely to experience volatility in the short term, influenced by market conditions and investor sentiment.

- Factors that could drive future price increases or decreases: Positive news regarding company performance, technological advancements, and broader market trends could drive price increases. Conversely, negative news or increased competition could lead to price declines.

- Analyst predictions and recommendations: Analysts' recommendations will be crucial in shaping investor sentiment and influencing the stock's price.

Conclusion: Understanding the CoreWeave IPO Outcome and its Implications

CoreWeave's IPO, initially projected at a significantly higher price, opened at $40 per share, underscoring the unpredictable nature of the stock market and the influence of broader economic and market conditions. The lower-than-expected listing price reflects a combination of factors including market volatility, investor sentiment, and competition within the cloud computing sector. While the immediate impact on investors was negative, the long-term potential of CoreWeave's business model remains a key factor in determining its future stock price.

Stay tuned for updates on CoreWeave's IPO and its performance in the coming months. Continue your research on CoreWeave's stock and the broader cloud computing market. The CoreWeave IPO serves as a reminder of the inherent risks and uncertainties in the volatile world of initial public offerings.

Featured Posts

-

Blake Lively And Taylor Swift Friendship Fracture Over Subpoena

May 22, 2025

Blake Lively And Taylor Swift Friendship Fracture Over Subpoena

May 22, 2025 -

Appeal Hearing For Tory Councillors Wife After Migrant Rant Conviction

May 22, 2025

Appeal Hearing For Tory Councillors Wife After Migrant Rant Conviction

May 22, 2025 -

Australian Transcontinental Foot Race New Speed Record Set

May 22, 2025

Australian Transcontinental Foot Race New Speed Record Set

May 22, 2025 -

Jim Cramers Lone Stand Core Weave Crwv As The Ai Infrastructure Star

May 22, 2025

Jim Cramers Lone Stand Core Weave Crwv As The Ai Infrastructure Star

May 22, 2025 -

The Value Proposition Of Middle Managers A Critical Analysis

May 22, 2025

The Value Proposition Of Middle Managers A Critical Analysis

May 22, 2025

Latest Posts

-

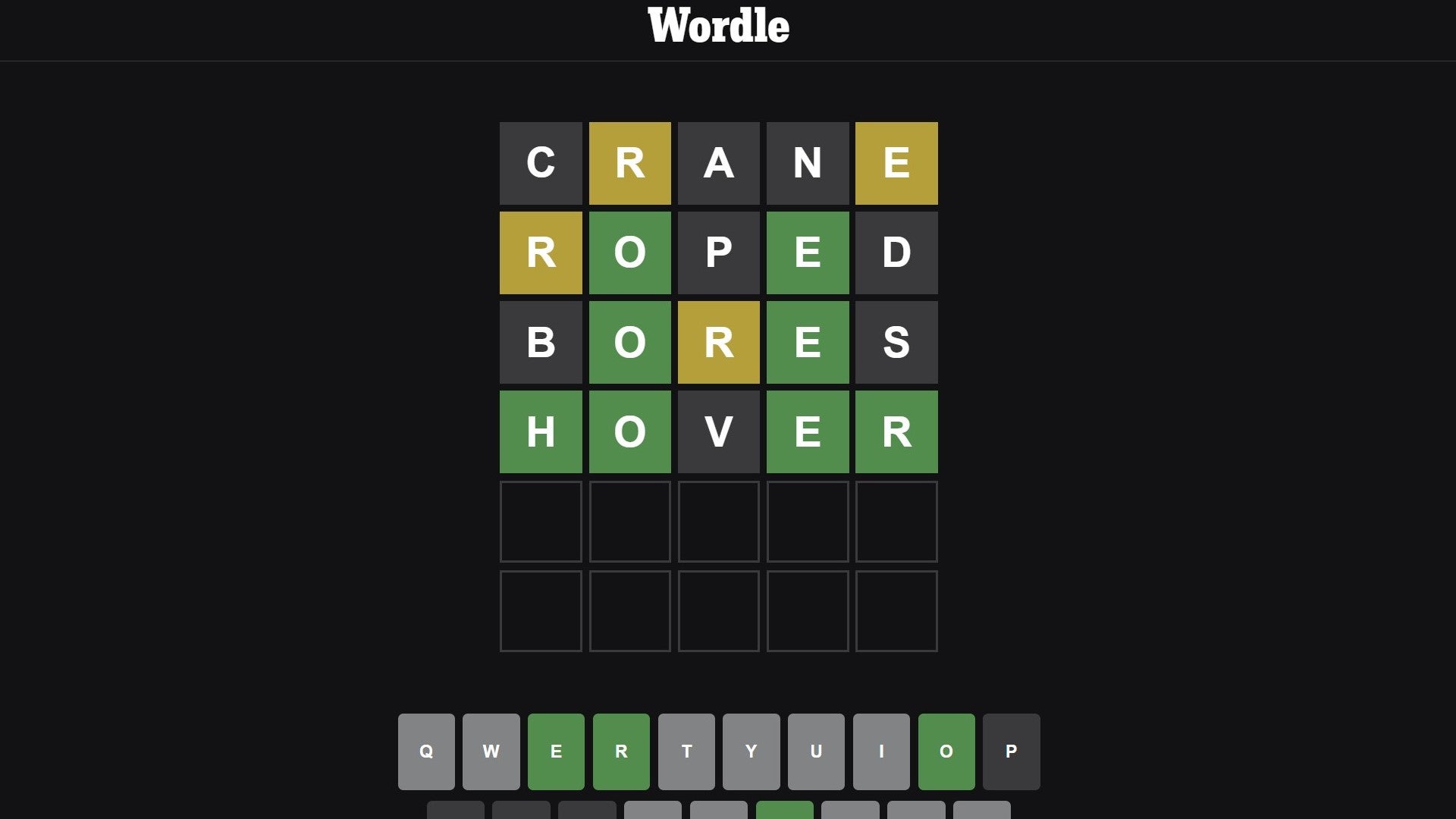

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025 -

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025 -

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025