CoreWeave Stock Performance: A Current Analysis

Table of Contents

Recent CoreWeave Stock Price Trends and Volatility

While CoreWeave is currently a privately held company, its valuation is closely watched by investors given its significant funding rounds and strategic partnerships. Analyzing its valuation trends offers valuable insights into market sentiment and future potential. Tracking CoreWeave's valuation provides a snapshot of investor confidence in its business model and growth prospects. Understanding the factors influencing its valuation is crucial for assessing CoreWeave investment opportunities.

- Valuation Fluctuations: Tracking CoreWeave's valuation through funding rounds reveals significant growth, indicating strong investor interest in its innovative cloud computing and AI infrastructure solutions. [Insert hypothetical valuation data here, e.g., "Valuation increased by X% following its Series Y funding round in [Date]." If possible, use a graph to visually represent this data].

- Impactful Events: Key partnerships and technological advancements directly impact CoreWeave's valuation. For example, a major partnership with a leading AI company could significantly boost its valuation.

- Market Sentiment: Overall market sentiment towards the technology sector, specifically cloud computing and AI, directly influences CoreWeave's perceived value. Positive market trends often translate to higher valuations.

- Competitive Landscape: The competitive intensity within the cloud computing market impacts CoreWeave’s perceived relative strength. Aggressive competitor actions might affect its valuation.

CoreWeave's Financial Health and Future Projections

Analyzing CoreWeave's financial health, though limited by its private status, is crucial for gauging its long-term viability. While complete financial statements aren't publicly available, information from funding rounds and press releases can offer insights into its revenue streams, expenses, and growth trajectory.

- Revenue Streams: CoreWeave's revenue is likely driven by its cloud computing services, particularly those catering to the burgeoning AI market. The growth of the AI market is directly correlated to CoreWeave's potential for future revenue growth.

- Growth Projections: Based on its funding rounds and market position, analysts could provide (hypothetical) projections for future revenue growth. [Insert hypothetical growth projections with relevant context and caveats].

- Investment and Acquisitions: Any significant investments or acquisitions by CoreWeave significantly influence its financial health and potential. Such activities demonstrate a commitment to growth and expansion.

- Financial Risks: The primary financial risk for CoreWeave is likely competition from established players in the cloud computing market. Market saturation and fluctuations in demand are also important considerations.

Impact of Market Factors on CoreWeave Stock Performance

CoreWeave's performance is intricately linked to broader market trends and specific industry developments. Understanding these factors is essential for predicting its future performance.

- Macroeconomic Factors: Interest rates, inflation, and recessionary fears heavily influence investor sentiment and risk appetite, directly impacting CoreWeave's valuation. A strong economy generally favors higher valuations for tech companies.

- Technology Sector Performance: The overall performance of the technology sector significantly influences investor confidence in companies like CoreWeave. Positive sector performance usually leads to higher valuations for tech stocks.

- AI Market Dynamics: As a company heavily involved in AI infrastructure, CoreWeave's performance is directly linked to the overall growth and development of the AI market. Positive developments in AI usually benefit CoreWeave.

- Competitive Landscape: The actions and strategies of CoreWeave's competitors influence its market share and, consequently, its valuation. Increased competition might put downward pressure on valuation.

Analyst Ratings and Future Outlook for CoreWeave Stock

While publicly available analyst ratings are currently unavailable for CoreWeave due to its private status, we can extrapolate potential analyst sentiment based on market trends and the company's progress. Hypothetically, analysts might focus on factors such as its technological innovation, market share growth, and financial stability.

- Hypothetical Analyst Ratings: If CoreWeave were publicly traded, analysts might issue a range of ratings from "Buy" to "Hold," depending on their assessment of its risks and potential rewards. The basis for these ratings would depend on factors such as market share growth, technological leadership, and financial stability.

- Price Target Range: Analysts might provide a range of price targets, reflecting differing opinions on the company’s future growth trajectory and market valuation.

- Reasons for Varying Opinions: Differing opinions on the company's competitive advantages, the long-term growth prospects of the AI market, and the execution of its business strategy would lead to varying analyst ratings and price targets.

CoreWeave Stock Performance: A Final Assessment and Call to Action

Analyzing CoreWeave's performance requires a multifaceted approach, considering both its internal strengths and external market forces. While currently privately held, the company shows significant promise in the burgeoning cloud computing and AI infrastructure markets. Its valuation reflects investor confidence in its technology and growth potential. However, investors should also be mindful of the competitive landscape and broader macroeconomic factors which could influence future performance.

To make informed investment decisions regarding CoreWeave, it's crucial to conduct thorough due diligence. Learn more about CoreWeave stock by researching its funding rounds, partnerships, and technological advancements. Consult with a qualified financial advisor to assess CoreWeave’s investment potential within the context of your overall investment strategy and risk tolerance. Understand the risks and rewards of investing in CoreWeave before making any decisions. Remember that understanding CoreWeave stock performance is critical for successful investment in this promising company.

Featured Posts

-

The Sse Spending Cut A Detailed Look At The 3 Billion Reduction

May 22, 2025

The Sse Spending Cut A Detailed Look At The 3 Billion Reduction

May 22, 2025 -

Vidmova Ukrayini Vid Nato Realni Zagrozi Ta Politichni Naslidki

May 22, 2025

Vidmova Ukrayini Vid Nato Realni Zagrozi Ta Politichni Naslidki

May 22, 2025 -

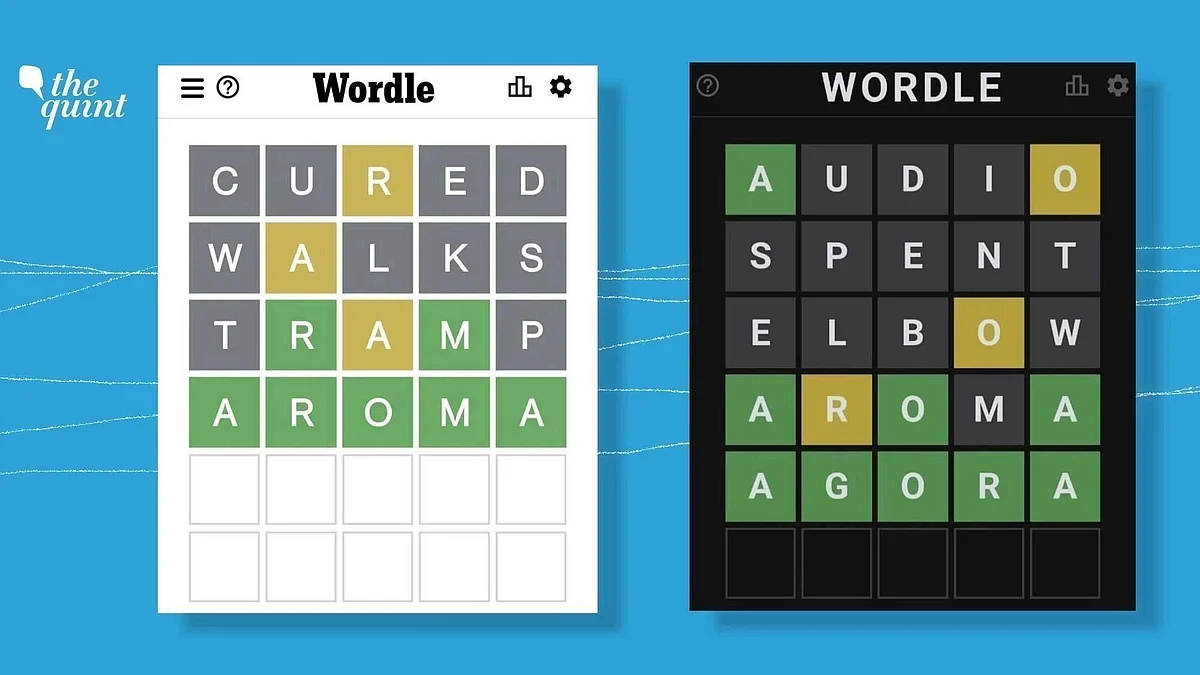

Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025

Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025 -

Mysterious Red Lights Flash Over France What Was It

May 22, 2025

Mysterious Red Lights Flash Over France What Was It

May 22, 2025 -

Blake Lively And Taylor Swift Friendship Fracture Over Subpoena

May 22, 2025

Blake Lively And Taylor Swift Friendship Fracture Over Subpoena

May 22, 2025

Latest Posts

-

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025 -

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025 -

How To Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025

How To Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025 -

Wordle Hints And Answer For March 18th 2024 1368

May 22, 2025

Wordle Hints And Answer For March 18th 2024 1368

May 22, 2025 -

Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025

Solve Wordle 1366 Hints And Answer For March 16th

May 22, 2025