CoreWeave IPO Pricing: $40 – A Lower-Than-Expected Debut

Table of Contents

Pricing Below Expectations: A Detailed Look at the CoreWeave IPO

The CoreWeave IPO pricing at $40 represents a considerable divergence from initial expectations. While the precise initial price range wasn't publicly released with complete transparency, market analysts and industry insiders had speculated a higher opening price, potentially exceeding $50 per share. This suggests a significant gap between the anticipated valuation and the final pricing.

The underwriters, the financial institutions responsible for managing the IPO process, play a critical role in determining the final offering price. They assess market demand, investor interest, and overall market conditions to arrive at a price that they believe is fair and will attract sufficient investment. In the case of the CoreWeave IPO, the underwriters clearly factored in several concerning elements, leading to a lower-than-expected price.

Several macroeconomic factors influenced investor sentiment and contributed to the lower-than-expected CoreWeave IPO price. Persistent inflation, rising interest rates, and ongoing economic uncertainty have created a risk-averse environment, particularly impacting the tech sector. This overall market volatility significantly dampened investor enthusiasm for new tech IPOs, including CoreWeave's.

- Initial IPO price range speculation: Estimates ranged from $45 to $55 per share, based on various financial models and market analyses.

- Final pricing and the percentage difference from expectations: The $40 price represents a substantial discount, potentially exceeding 20% below the lowest end of the speculated range.

- Market volatility impacting investor confidence: The current economic climate and uncertainty in the tech sector directly contributed to the lower pricing.

- Potential impact on company valuation: The lower IPO price resulted in a lower initial market capitalization for CoreWeave than initially projected.

Analyzing the Factors Contributing to the Lower-Than-Expected CoreWeave IPO Price

The lower-than-expected CoreWeave IPO price wasn't solely due to macroeconomic factors. Several company-specific elements also played a significant role. The tech sector is experiencing a general downturn, impacting investor confidence in even rapidly growing companies. CoreWeave faces stiff competition from established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These competitors possess significant market share, brand recognition, and extensive resources.

CoreWeave's financials, while showing impressive revenue growth, may not have fully met the expectations of some investors. While specific financial details are available in the IPO prospectus, a thorough analysis reveals that while the revenue trajectory is positive, profitability and debt levels might have caused some concern among investors. This, combined with the general market apprehension toward tech stocks, contributed to a more conservative pricing strategy.

- Overall market downturn for tech companies: A broader trend of decreased investor confidence in the tech sector.

- Competition from established cloud providers (AWS, Azure, GCP): The intensely competitive landscape presents significant challenges for CoreWeave.

- CoreWeave's financial performance compared to competitors: Investors scrutinized CoreWeave's performance against larger, more established players.

- Risk factors disclosed in the IPO prospectus: Potential risks outlined in the prospectus also likely influenced investor decisions.

Investor Reactions and Market Response to the CoreWeave IPO

The initial market reaction to the $40 CoreWeave IPO price was subdued. Trading volume was somewhat muted on the first day, reflecting a cautious approach by investors. Price fluctuations were relatively mild, further indicating a lack of significant immediate buying pressure. The long-term implications for CoreWeave's stock price are uncertain and will depend largely on the company’s ability to execute its business plan and navigate the competitive landscape. Future funding rounds will also likely be influenced by the initial IPO performance and investor confidence.

- Opening day trading performance of CoreWeave stock: The initial trading activity provided limited insight into long-term investor sentiment.

- Investor sentiment reflected in analyst ratings and commentary: Post-IPO analysis and ratings from financial analysts offered diverse perspectives on the stock’s prospects.

- Potential impact on future investment opportunities for CoreWeave: The IPO outcome may affect CoreWeave's ability to secure further funding in the future.

- Comparison with similar tech IPOs in the recent past: Analyzing the performance of comparable tech IPOs provides context for CoreWeave’s debut.

Long-Term Outlook and Potential for CoreWeave's Growth

Despite the disappointing initial IPO pricing, CoreWeave retains significant long-term growth potential in the rapidly expanding AI-focused cloud computing market. The company's strategic focus on providing specialized AI infrastructure presents a competitive advantage. However, challenges remain, including competition from established players and the need for sustained innovation. Future partnerships and acquisitions could significantly shape CoreWeave's trajectory and market position.

- CoreWeave's competitive advantages in the AI infrastructure space: Its specialization in AI cloud computing offers a niche market position.

- Potential for expansion into new markets and services: CoreWeave can leverage its technology to expand into related areas.

- Risks associated with future growth and scalability: Maintaining growth while managing costs and competition presents a significant challenge.

- Opportunities for strategic alliances and acquisitions: Strategic partnerships could accelerate CoreWeave's growth and expansion.

Conclusion: Navigating the CoreWeave IPO Landscape

The CoreWeave IPO, priced at $40, fell below initial expectations due to a complex interplay of macroeconomic conditions, competitive pressures, and investor sentiment. While the initial market response was muted, CoreWeave's long-term potential in the rapidly growing AI cloud computing sector remains a key factor for investors. Careful consideration of the risks and rewards is crucial before investing in CoreWeave stock. Continuous monitoring of the CoreWeave IPO and its performance is essential for informed investment decisions in the dynamic world of AI-powered cloud computing. Stay informed on all future developments surrounding the CoreWeave IPO and its impact on the market.

Featured Posts

-

Abn Amro Toename Autobezit Leidt Tot Meer Occasionverkopen

May 22, 2025

Abn Amro Toename Autobezit Leidt Tot Meer Occasionverkopen

May 22, 2025 -

Nato Nun Yeni Stratejisi Tuerkiye Ve Italya Nin Oenemli Goerevi

May 22, 2025

Nato Nun Yeni Stratejisi Tuerkiye Ve Italya Nin Oenemli Goerevi

May 22, 2025 -

Le Hellfest S Invite Au Noumatrouff De Mulhouse

May 22, 2025

Le Hellfest S Invite Au Noumatrouff De Mulhouse

May 22, 2025 -

Blake Lively Allegedly A Look At Recent Reports And Speculation

May 22, 2025

Blake Lively Allegedly A Look At Recent Reports And Speculation

May 22, 2025 -

Elektrik Kesintileri Rutte Sanchez Goeruesmesi Ve Nato Nun Tepkisi

May 22, 2025

Elektrik Kesintileri Rutte Sanchez Goeruesmesi Ve Nato Nun Tepkisi

May 22, 2025

Latest Posts

-

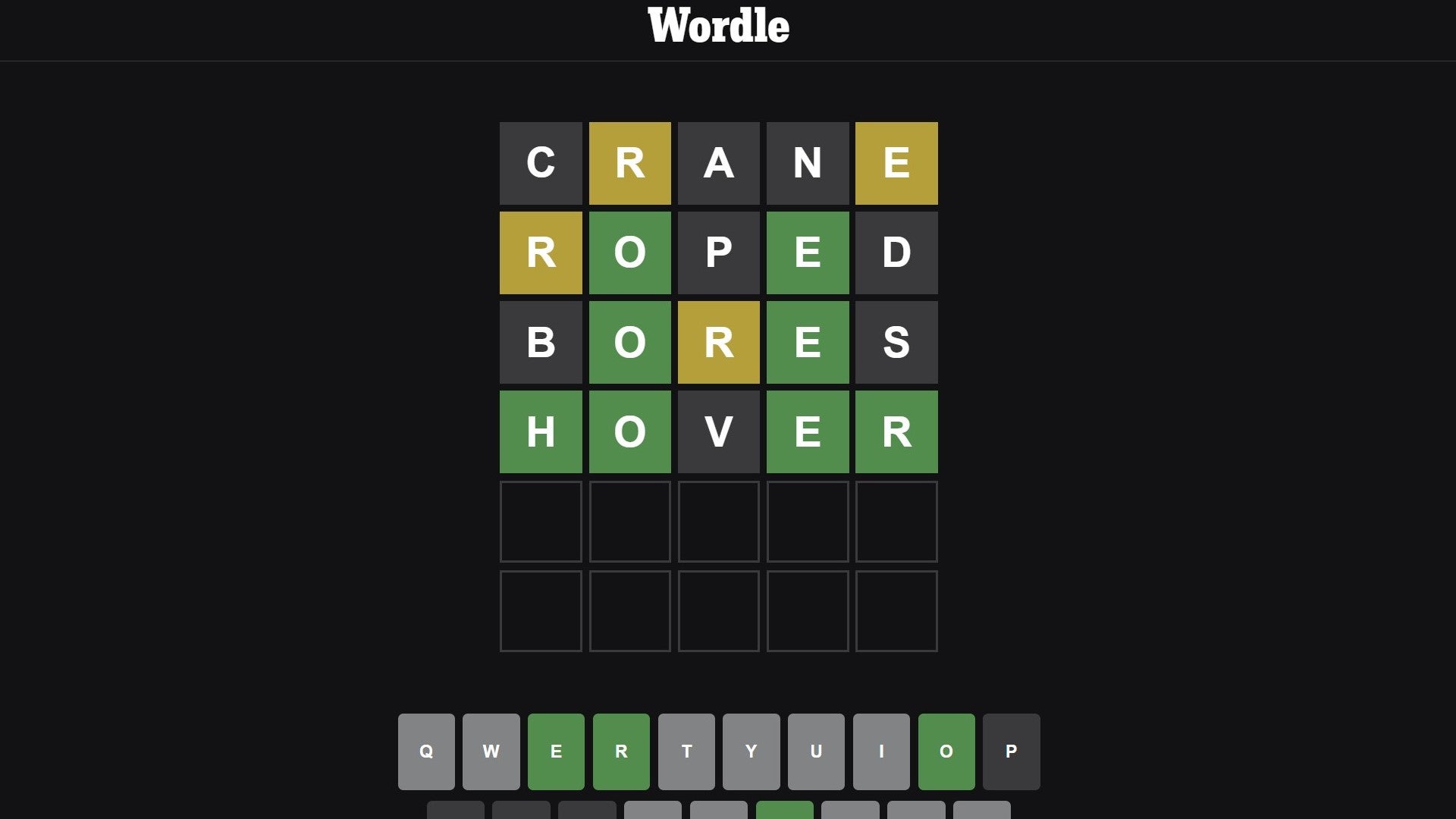

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025 -

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025