CoreWeave IPO: Listing Price Set At $40, Below Expectations

Table of Contents

Pricing Below Expectations: A Detailed Look at the $40 Listing Price

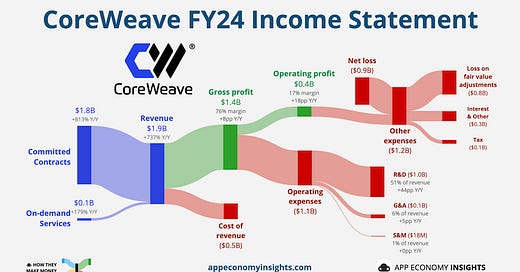

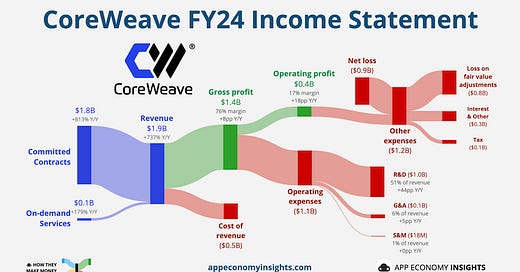

The $40 listing price represents a considerable drop from CoreWeave's initially anticipated range. While the exact range wasn't publicly disclosed, market whispers suggested a significantly higher figure, potentially exceeding $50 or even reaching into the $60s. This discrepancy sparks immediate concerns regarding CoreWeave's valuation and the overall investor confidence in the company's future.

Several factors could contribute to this lower-than-expected IPO price:

- Market Volatility: The current economic climate and ongoing market uncertainty have undoubtedly impacted investor sentiment towards tech IPOs. Fear of recession and rising interest rates make investors more cautious.

- Investor Sentiment: Negative sentiment surrounding the broader technology sector, coupled with concerns about specific aspects of CoreWeave's business model or financial projections, might have contributed to the lower valuation.

- Company Valuation Concerns: Perhaps the initial projections were overly optimistic, and a more conservative valuation was deemed necessary closer to the IPO date. A more thorough scrutiny by potential investors may have led to a reassessment of the company's true worth.

Comparing CoreWeave's IPO pricing to similar companies in the cloud computing sector is crucial. Analyzing the CoreWeave valuation against competitors reveals whether the $40 price is truly reflective of its market position and growth potential or if it represents a significant undervaluation in the cloud computing stocks market. Understanding the IPO price range of comparable companies will provide a clearer picture.

Impact on Investors and Market Reaction to the CoreWeave IPO

The immediate market reaction to the lowered IPO price was, as expected, negative. CoreWeave’s stock price likely experienced a significant drop on its first day of trading. Early investors and venture capitalists who had invested at higher valuations might experience substantial investor losses. This outcome will undoubtedly impact their confidence in future investments and potentially influence their strategy going forward.

- Impact on Early Investors: The lower IPO price could dilute the returns of early-stage investors and venture capitalists, affecting their overall portfolio performance and future investment decisions.

- Future Funding Rounds: The less-than-stellar IPO performance could make securing future funding rounds more challenging, potentially hindering CoreWeave’s growth trajectory.

- Post-IPO Performance: The immediate market reaction will significantly influence the post-IPO performance of the CoreWeave stock. This will be an important metric to observe to determine the long-term success of the company.

Analyzing CoreWeave's Business Model and Future Prospects

CoreWeave's business model centers around providing cloud computing infrastructure tailored specifically to the demands of AI and high-performance computing. Its target market includes businesses and researchers requiring significant computational power for AI model training and other data-intensive tasks.

CoreWeave boasts several competitive advantages, including:

- Specialized Infrastructure: Its focus on AI and high-performance computing gives it a niche advantage over general-purpose cloud providers.

- Technological Innovation: Continuous innovation and investment in cutting-edge technology are crucial for maintaining its competitive edge.

- Scalability: The ability to scale its infrastructure to meet the ever-growing demands of the AI market is vital for long-term success.

However, CoreWeave also faces challenges:

- Competition: The cloud computing market is highly competitive, with established giants like AWS, Google Cloud, and Microsoft Azure.

- Market Saturation: The increased competition could lead to market saturation and pressure on pricing, impacting profitability.

- Technological Advancements: The rapid pace of technological advancement requires continuous adaptation and investment.

Assessing the long-term growth prospects and future profitability of CoreWeave requires a careful evaluation of these factors. The investment risks are undeniable, but the potential rewards in the burgeoning AI market are equally significant.

CoreWeave IPO: A Case Study in Market Uncertainty

The CoreWeave IPO serves as a compelling case study illustrating the current uncertainties in the tech IPO market and the broader economic landscape. The lower-than-expected pricing highlights the prevalent investor risk and the impact of market uncertainty on even promising companies. This outcome could signal a broader trend, affecting upcoming tech IPOs.

The economic outlook and market trends impacting the technology sector played a crucial role in shaping investor sentiment. A thorough analysis of these macro factors is essential for understanding the wider implications of the CoreWeave IPO.

Conclusion: Understanding the CoreWeave IPO and its Implications

The CoreWeave IPO’s lower-than-expected listing price of $40 resulted from a confluence of factors, including market volatility, investor sentiment, and potential concerns about company valuation. This outcome had a significant impact on early investors and reflects the broader uncertainty in the tech IPO market. While CoreWeave’s business model in the AI and high-performance computing space holds promise, navigating the competitive landscape and adapting to technological advancements will be critical for long-term success. The CoreWeave IPO underscores the need for careful due diligence and a realistic assessment of risk before investing in any tech company. To stay informed about CoreWeave’s post-IPO performance and its impact on the broader cloud computing and AI sectors, stay updated on CoreWeave stock and continue to monitor developments in this rapidly evolving market. Learn more about investing in cloud computing companies and the AI market to make informed investment decisions.

Featured Posts

-

Heartwarming Meaning Behind Peppa Pigs New Baby Sisters Name Revealed

May 22, 2025

Heartwarming Meaning Behind Peppa Pigs New Baby Sisters Name Revealed

May 22, 2025 -

Peppa Pigs Big Screen Baby Adventure 10 Episodes This May

May 22, 2025

Peppa Pigs Big Screen Baby Adventure 10 Episodes This May

May 22, 2025 -

Second Reintroduced Colorado Gray Wolf Found Dead In Wyoming

May 22, 2025

Second Reintroduced Colorado Gray Wolf Found Dead In Wyoming

May 22, 2025 -

Funko Releases First Ever Dexter Pop Figures Details And Images

May 22, 2025

Funko Releases First Ever Dexter Pop Figures Details And Images

May 22, 2025 -

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Espanol

May 22, 2025

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Espanol

May 22, 2025

Latest Posts

-

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025 -

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025 -

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025