CoreWeave Inc. (CRWV) Stock Price Drop: Causes And Implications

Table of Contents

Macroeconomic Factors Affecting CRWV Stock Performance

The current macroeconomic climate has significantly impacted the performance of technology stocks, including CoreWeave. Several factors contribute to this downward pressure. The rapid increase in interest rates by central banks globally aims to combat inflation, but it simultaneously increases borrowing costs for companies like CoreWeave, impacting their profitability and valuation. High-growth tech companies, often valued based on future earnings potential, are particularly susceptible to rising interest rates as these rates discount future cash flows.

-

Impact of rising interest rates on valuations: Higher interest rates lead to higher discount rates, reducing the present value of future earnings, thus impacting stock valuations of growth companies like CRWV.

-

Correlation between inflation and decreased investor confidence: Persistent inflation erodes purchasing power and increases uncertainty, leading to decreased investor confidence and risk aversion, negatively impacting tech stocks, including CRWV.

-

How recessionary concerns influence spending on cloud computing services: Fears of a recession often lead companies to cut discretionary spending, including cloud computing services, potentially affecting CoreWeave's revenue growth.

Company-Specific Factors Contributing to the CRWV Stock Price Drop

Beyond macroeconomic headwinds, company-specific factors may have contributed to the CRWV stock price decline. A thorough analysis of CoreWeave's recent financial performance, including earnings reports and any negative news impacting investor sentiment, is crucial. The competitive landscape in the AI cloud computing market is fiercely competitive, with established players posing a significant challenge to newer entrants like CoreWeave.

-

Analysis of CRWV's recent earnings reports: A detailed review of CoreWeave’s financial statements, including revenue growth, profitability, and future projections, is necessary to understand the company's performance and assess its impact on investor confidence. Any shortfalls in meeting expectations can directly impact the stock price.

-

Discussion of CoreWeave's competitive landscape: The presence of major players in the AI cloud computing market presents a significant challenge. Analyzing CoreWeave's competitive advantages, market share, and strategies for differentiation is crucial in understanding its long-term prospects.

-

Examination of any negative news or controversies: Negative press, regulatory hurdles, or any controversies surrounding the company can significantly affect investor sentiment and lead to a drop in the stock price.

The Role of Investor Sentiment and Market Speculation in the CRWV Stock Price Decline

Investor sentiment and market speculation play a powerful role in shaping stock prices. Media coverage, analyst ratings, social media discussions, and short-selling activity all contribute to the overall perception of a company and its stock. Negative sentiment, amplified by social media and online forums, can lead to a rapid decline in stock prices.

-

Influence of analyst ratings and price targets: Changes in analyst ratings and price targets can significantly impact investor behavior, potentially triggering sell-offs or buy-ins depending on the direction of the change.

-

Role of social media and online forums: Social media platforms and online investment forums often influence public perception, sometimes creating herd behavior that can drive stock prices up or down irrespective of fundamental factors.

-

Impact of short-selling activity: Short-selling, where investors bet against a stock's price, can contribute to downward pressure, especially if a significant number of investors engage in this practice.

Future Implications and Potential Recovery Scenarios for CRWV

While the current situation presents challenges, assessing CoreWeave's long-term prospects is vital. The company's growth strategy, technological innovations, and potential partnerships will play a crucial role in its future performance. Identifying potential catalysts for a price rebound is key for investors.

-

Discussion of CoreWeave's long-term growth strategy: Understanding CoreWeave's plans for expansion, technological advancements, and market penetration is essential in determining its future success and potential for recovery.

-

Potential catalysts for a price rebound: Factors such as exceeding earnings expectations, securing major partnerships, successful product launches, or positive industry trends can act as catalysts for a price rebound.

-

Analysis of the risks and rewards associated with investing in CRWV: Investors need to carefully weigh the potential risks associated with investing in CRWV against the potential rewards, considering factors such as market volatility and the company's financial performance.

Conclusion: Navigating the CoreWeave Inc. (CRWV) Stock Price Volatility

The recent decline in CoreWeave Inc. (CRWV) stock price is attributable to a confluence of macroeconomic factors, company-specific challenges, and investor sentiment. Understanding these interconnected elements is crucial for investors. While risks exist, CoreWeave's position in the rapidly growing AI and cloud computing sector presents potential opportunities. Conduct thorough research, carefully analyze financial statements, and monitor CRWV stock price and related news closely before making any investment decisions. Remember to diversify your portfolio and consult with a financial advisor to make informed choices regarding CoreWeave Inc. (CRWV) stock.

Featured Posts

-

Understanding The Factors Behind Core Weave Crwv S Stock Surge

May 22, 2025

Understanding The Factors Behind Core Weave Crwv S Stock Surge

May 22, 2025 -

Abn Amro En Transferz Partnerschap Voor Innovatieve Digitale Oplossingen

May 22, 2025

Abn Amro En Transferz Partnerschap Voor Innovatieve Digitale Oplossingen

May 22, 2025 -

Diversification Economique A Moncoutant Sur Sevre Le Cas De Clisson

May 22, 2025

Diversification Economique A Moncoutant Sur Sevre Le Cas De Clisson

May 22, 2025 -

Abn Amro Analyse Van De Stijgende Occasionmarkt En Groeiend Autobezit

May 22, 2025

Abn Amro Analyse Van De Stijgende Occasionmarkt En Groeiend Autobezit

May 22, 2025 -

Het Kamerbrief Verkoopprogramma Abn Amro Voordelen Strategieen En Resultaten

May 22, 2025

Het Kamerbrief Verkoopprogramma Abn Amro Voordelen Strategieen En Resultaten

May 22, 2025

Latest Posts

-

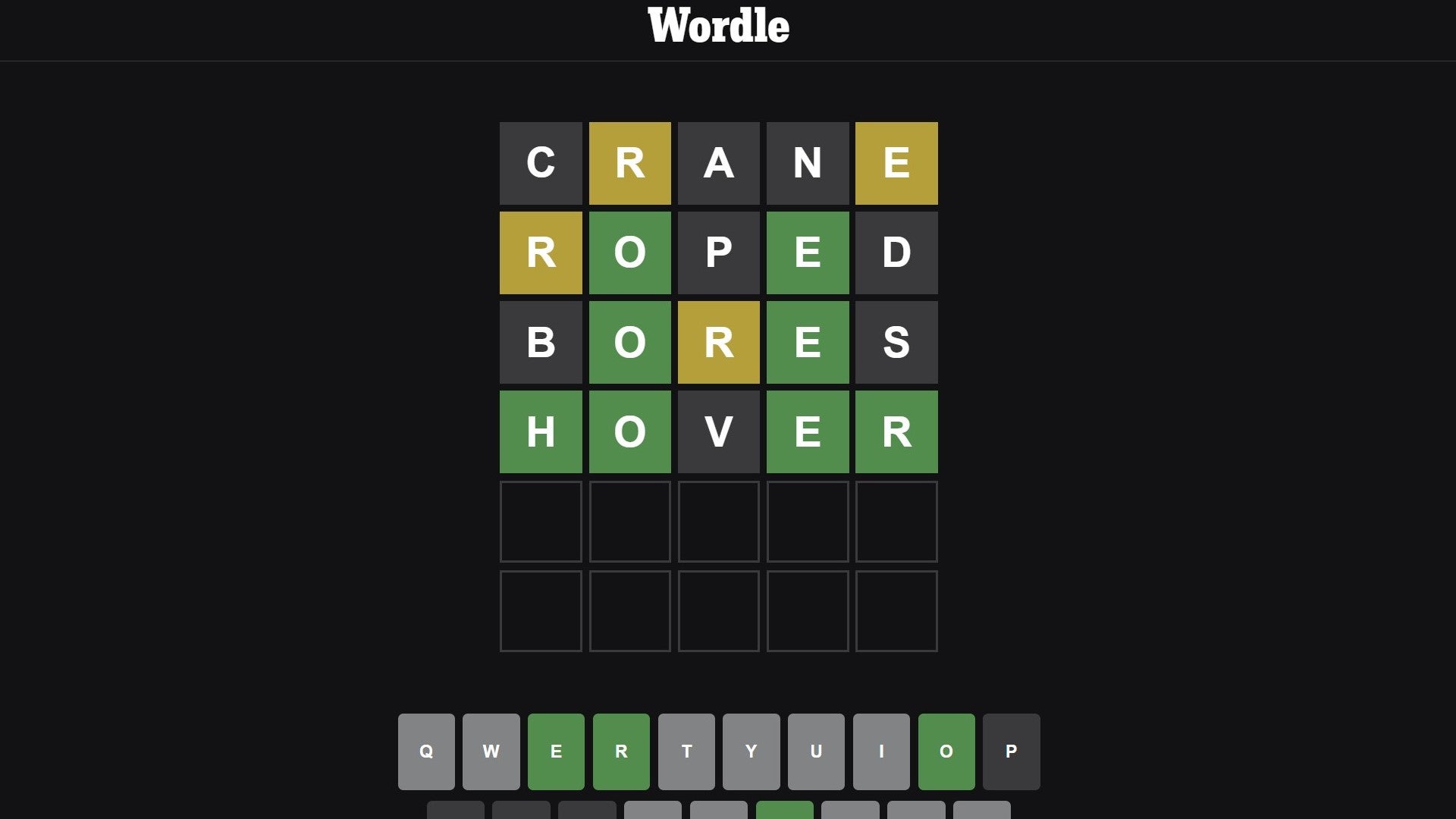

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025 -

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025 -

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025