CoreWeave Inc. (CRWV) Stock Drop On Tuesday: Reasons And Analysis

Table of Contents

Market-Wide Downturn and Tech Sector Weakness

Tuesday's market saw a considerable downturn, with the tech sector particularly hard hit. This broader market correction played a significant role in CRWV's stock price drop. Several factors contributed to this negative market sentiment:

- Interest Rate Hikes: Continued interest rate hikes by central banks to combat inflation created uncertainty in the market, impacting investor confidence across various sectors, including technology.

- Inflation Concerns: Persistent inflation concerns led investors to seek safer, more stable investments, causing a sell-off in riskier assets like tech stocks.

- Tech Stock Underperformance: Many other cloud computing and AI companies also experienced declines on Tuesday, suggesting a sector-wide trend rather than a CoreWeave-specific issue. For example, [mention specific examples of similar drops in competitor stocks]. This widespread weakness underscores the impact of macroeconomic factors on the tech sector's performance. Keywords used here include: Market correction, tech stock downturn, macroeconomic factors, interest rates, inflation.

Specific News or Announcements Impacting CRWV

While the broader market downturn contributed significantly, it's crucial to investigate whether any specific news or announcements directly impacted CoreWeave's stock price. This includes:

- Earnings Reports: Were there any recent earnings reports released by CoreWeave that fell short of analyst expectations? A disappointing earnings report could easily trigger a sell-off.

- Press Releases: Did CoreWeave release any negative press releases on or shortly before Tuesday? News regarding operational challenges, contract losses, or regulatory issues could all contribute to a stock price decline.

- Analyst Ratings and Price Target Changes: A downgrade from a major investment bank or a significant reduction in price targets could also significantly influence investor sentiment and lead to a stock price drop. Any such changes should be carefully examined for their impact on CRWV's valuation. Keywords used here include: Earnings report, press release, regulatory announcement, analyst ratings, price target.

Competition and Industry Dynamics

The competitive landscape within the cloud computing and AI infrastructure markets is incredibly dynamic. Analyzing the competitive pressures impacting CoreWeave is essential to understanding its stock performance.

- Increased Competition: The cloud computing and AI infrastructure sectors are highly competitive, with established giants like AWS, Azure, and GCP constantly vying for market share. New entrants also pose challenges.

- Market Share Erosion: Any evidence suggesting CoreWeave is losing market share to competitors could contribute to investor concern. Analysis of market share reports and industry trends is vital here.

- Competitive Pricing Strategies: Aggressive pricing strategies employed by competitors could squeeze CoreWeave's margins and potentially impact its profitability, impacting investor confidence. Keywords used here include: Cloud computing competition, AI infrastructure competition, market share, competitive landscape.

Technical Analysis of CRWV Stock Chart

A technical analysis of the CRWV stock chart can provide further insights, although it should not be the sole basis for investment decisions.

- Support and Resistance Levels: Examining the chart for significant support and resistance levels can help determine if the drop was a breach of a key support level, indicating further potential downside.

- Trading Volume: High trading volume during the drop could suggest significant selling pressure.

- Moving Averages: The relationship between the stock price and moving averages (e.g., 50-day, 200-day) can provide signals about potential trend reversals or continuations. [Include a chart if possible, clearly labelled and cited]. Note that technical analysis is just one piece of the puzzle and shouldn't be interpreted in isolation. Keywords used here include: Technical analysis, support levels, resistance levels, trading volume, moving averages, chart patterns.

Conclusion: Investing in CoreWeave Inc. (CRWV) After the Drop

The CoreWeave Inc. (CRWV) stock drop on Tuesday resulted from a confluence of factors, including a broader market correction affecting the tech sector, potentially negative company-specific news (which requires further investigation), and competitive pressures within the cloud computing and AI infrastructure market. A thorough technical analysis can offer additional perspective.

It’s crucial to reiterate the importance of conducting extensive research before making any investment decisions. While the drop presents potential opportunities for long-term investors, it also highlights the inherent risks in the tech sector. Analyze the CoreWeave (CRWV) situation further, assessing the long-term potential of CRWV stock and carefully monitoring CRWV stock price movements before making any investment decisions. Keywords used here include: CoreWeave investment, CRWV stock analysis, long-term prospects, investment decision, risk assessment.

Featured Posts

-

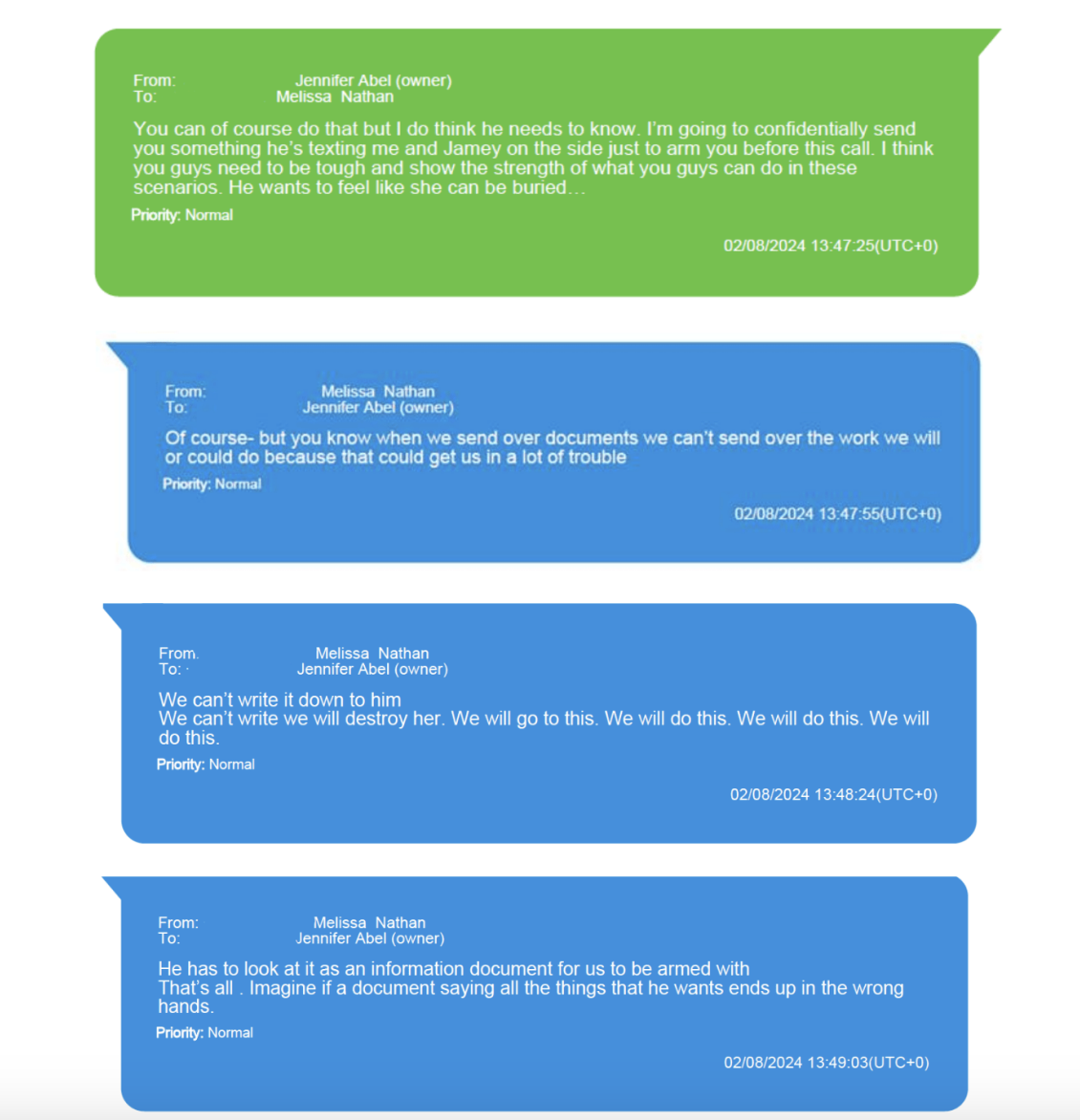

Blake Lively And Taylor Swift Alleged Blackmail Over Leaked Texts And The Baldoni Feud

May 22, 2025

Blake Lively And Taylor Swift Alleged Blackmail Over Leaked Texts And The Baldoni Feud

May 22, 2025 -

Ex Ukrainian Official Shot Dead Outside Madrids American School

May 22, 2025

Ex Ukrainian Official Shot Dead Outside Madrids American School

May 22, 2025 -

Vybz Kartel Self Esteem Issues And Skin Bleaching

May 22, 2025

Vybz Kartel Self Esteem Issues And Skin Bleaching

May 22, 2025 -

Streamers Are Finally Making Money A More Complex Landscape For Viewers

May 22, 2025

Streamers Are Finally Making Money A More Complex Landscape For Viewers

May 22, 2025 -

Theatre Tivoli Clisson Decouverte En Images D Un Site Patrimonial 2025

May 22, 2025

Theatre Tivoli Clisson Decouverte En Images D Un Site Patrimonial 2025

May 22, 2025

Latest Posts

-

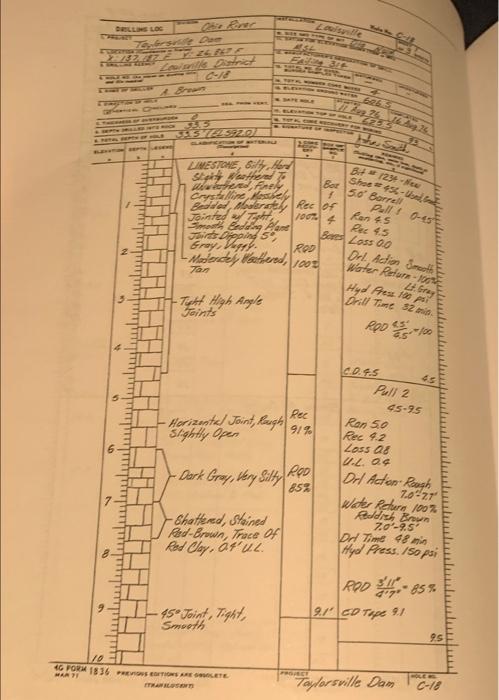

Deciphering Big Rig Rock Report 3 12 Laser 101 7 Data

May 23, 2025

Deciphering Big Rig Rock Report 3 12 Laser 101 7 Data

May 23, 2025 -

Analyzing Briefs Deconstructing Effective Communication

May 23, 2025

Analyzing Briefs Deconstructing Effective Communication

May 23, 2025 -

Big Rig Rock Report 3 12 In Depth Look At X101 5s Report

May 23, 2025

Big Rig Rock Report 3 12 In Depth Look At X101 5s Report

May 23, 2025 -

Decoding The Big Rig Rock Report 3 12 For Rock 101 Students

May 23, 2025

Decoding The Big Rig Rock Report 3 12 For Rock 101 Students

May 23, 2025 -

Analyzing The Big Rig Rock Report 3 12 97 1 Double Q Metrics

May 23, 2025

Analyzing The Big Rig Rock Report 3 12 97 1 Double Q Metrics

May 23, 2025