CoreWeave Inc. (CRWV): Explaining The Stock Price Increase On Tuesday

Table of Contents

Strong Financial Performance and Earnings Reports

One of the most likely explanations for the CRWV stock price surge is strong recent financial performance. While specific numbers may require further investigation depending on the exact date of the surge, a strong earnings report or a positive financial announcement preceding Tuesday could easily explain the jump. Let's consider several key performance indicators (KPIs) that would indicate positive growth:

- Revenue Growth: A significant percentage increase in revenue, perhaps driven by increased demand for CoreWeave's AI-focused cloud services, would be a major catalyst. Examples: "Revenue increased by 50% year-over-year," or "Q[Quarter] revenue exceeded expectations by 15%."

- Profitability Improvements: Increased profitability, even small margins, demonstrating efficient scaling and operational improvements, would significantly enhance investor confidence.

- User Base Expansion: An increase in the number of customers, particularly large enterprise clients adopting CoreWeave's infrastructure for significant AI projects, would signal substantial market penetration. Examples: "Added X number of new enterprise clients" or "Expanded partnerships with Y companies".

- Positive Analyst Predictions: Upward revisions to earnings estimates or price targets from respected financial analysts, following the release of financial data, could influence a positive market reaction.

- Strategic Partnerships: Securing major contracts or partnerships with influential technology companies or research institutions could also explain a significant stock price increase.

Positive Market Sentiment and Industry Trends

Beyond CoreWeave's internal performance, the overall market sentiment towards cloud computing and AI stocks also plays a significant role. The current trend favors companies positioned at the forefront of AI infrastructure development.

- Growing Demand for AI Infrastructure: The global demand for powerful cloud computing resources to support the rapid advancements in AI and machine learning is exponentially growing. CoreWeave's specialization in this area directly benefits from this trend.

- Competitive Advantage: Any positive news regarding CoreWeave's competitive landscape, such as outpacing competitors in innovation or market share gains, could have fueled the price increase.

- Positive AI/Cloud News: General positive news in the broader AI and cloud computing sectors, regardless of CoreWeave-specific announcements, can boost investor confidence and positively affect related stocks.

Speculation and Investor Activity

Sometimes, market movements are driven by factors beyond fundamental performance. Speculative trading and investor activity can significantly impact stock prices.

- Unusual Trading Volume: A dramatic increase in trading volume on Tuesday, significantly higher than the average daily volume, suggests substantial investor activity driving the price upwards.

- Institutional Investments: Large investments from institutional investors like mutual funds or hedge funds can create a significant buying pressure, pushing the stock price higher.

- Insider Trading: While unlikely to be the sole cause, any significant insider buying could signal strong internal confidence in the company's future prospects, influencing other investors.

- Rumors and Speculation: Positive news, rumors, or speculation about future product launches, partnerships, or acquisitions can fuel excitement and lead to speculative buying.

Technical Analysis of CRWV Stock Chart

While fundamental analysis focuses on the company's financials, a brief look at the technical aspects of the CRWV stock chart might offer additional context. (Note: Technical analysis is not a foolproof method and shouldn't be the sole basis for investment decisions.)

- Chart Patterns: Observing patterns like a breakout from a period of consolidation or a significant upward trendline can support the price increase.

- Volume and Momentum: Analyzing the relationship between price changes and trading volume on Tuesday can provide insight into the strength of the upward movement.

- Support and Resistance Levels: Identifying whether the price increase broke through key resistance levels would offer technical confirmation of the upward trend.

Conclusion: Understanding the CoreWeave (CRWV) Stock Price Increase and Future Outlook

The CoreWeave (CRWV) stock price increase on Tuesday likely resulted from a combination of factors: strong financial performance possibly indicated by positive earnings reports, positive market sentiment toward AI and cloud computing, and possibly some speculative investor activity. It's crucial to remember that stock movements are complex and influenced by multiple factors. While the reasons for Tuesday's surge are compelling, predicting future price movements remains challenging. While the positive momentum is encouraging, investors should exercise caution and conduct thorough due diligence before making any investment decisions related to CRWV stock. Stay informed about CoreWeave stock prices, monitor CoreWeave's future performance, and further research on CRWV is recommended before investing. Consult financial professionals for personalized advice. Consider exploring additional resources for deeper analysis of the cloud computing and AI sectors for informed decision-making.

Featured Posts

-

Un Siecle De Diversification A Moncoutant Sur Sevre L Exemple De Clisson

May 22, 2025

Un Siecle De Diversification A Moncoutant Sur Sevre L Exemple De Clisson

May 22, 2025 -

Why Did Core Weave Crwv Stock Price Increase Significantly On Thursday

May 22, 2025

Why Did Core Weave Crwv Stock Price Increase Significantly On Thursday

May 22, 2025 -

Analyzing Aimscaps Participation In The World Trading Tournament Wtt

May 22, 2025

Analyzing Aimscaps Participation In The World Trading Tournament Wtt

May 22, 2025 -

The Trans Australia Run On The Verge Of A New Record

May 22, 2025

The Trans Australia Run On The Verge Of A New Record

May 22, 2025 -

The Allure Of Cassis Blackcurrant Liqueur

May 22, 2025

The Allure Of Cassis Blackcurrant Liqueur

May 22, 2025

Latest Posts

-

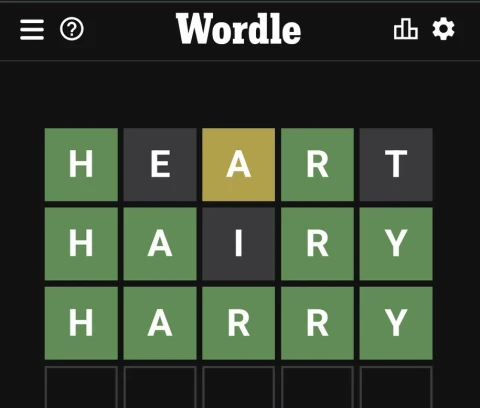

Solve Wordle 1356 Hints And Answer For Thursday March 6

May 22, 2025

Solve Wordle 1356 Hints And Answer For Thursday March 6

May 22, 2025 -

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025

Wordle Solution And Clues For April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle Today 1 356 Hints Clues And Answer For Thursday March 6th Game

May 22, 2025

Wordle Today 1 356 Hints Clues And Answer For Thursday March 6th Game

May 22, 2025 -

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025