CoreWeave (CRWV) Stock Surge: Understanding Today's Price Jump

Table of Contents

Potential Factors Contributing to the CoreWeave (CRWV) Stock Price Increase

Several factors could be contributing to the remarkable increase in CoreWeave stock price. Let's examine some key areas:

Positive Earnings Reports and Financial Performance

Recent financial performance from CoreWeave has likely played a significant role in boosting investor confidence. Strong earnings reports often translate directly into increased stock prices. For example:

- Q[Insert Quarter] Revenue Exceeds Expectations: CoreWeave may have announced revenue figures that significantly surpassed analyst predictions, indicating strong market demand for their services. The exact percentage increase needs to be inserted here based on the actual report.

- Increased Profitability: Improvements in net income, operating margins, and overall profitability are all positive indicators that signal to investors a healthy and growing company. Specific figures from the earnings report are needed here for accurate analysis.

- Positive Analyst Upgrades: Favorable ratings and price target increases from respected financial analysts can significantly influence investor sentiment and drive up the stock price. Mentioning specific analysts and their upgrades would add credibility.

- Debt Reduction: A decrease in debt levels reflects improved financial stability and strengthens the company's overall financial health, attracting more investors. Include specifics on debt reduction here if available.

Increased Market Demand for AI and Cloud Computing Services

CoreWeave operates within the booming AI and cloud computing markets. The company's specialized infrastructure is perfectly positioned to capitalize on the explosive growth in these sectors.

- AI Infrastructure Provider: CoreWeave provides crucial infrastructure for AI development and deployment, making them a key player in the rapidly expanding AI market. This strategic position is a major driver of their success.

- High-Performance Computing (HPC): The company's focus on HPC solutions caters to the demanding computational needs of AI and other data-intensive applications. Mention specific examples of their HPC offerings.

- Strategic Partnerships: New partnerships and contracts with major players in the AI and cloud computing industries would greatly influence market perception and boost investor confidence. If available, cite specific partnerships.

- Market Growth Projections: The continued high growth projections for the AI and cloud computing markets suggest a strong future for CoreWeave, making it an attractive investment opportunity for growth-focused investors. Include data on projected market growth for context.

Technological Advancements and Innovation

CoreWeave's commitment to technological innovation is a key differentiator in a competitive market.

- Proprietary Technology: Mention any unique technologies or platforms developed by CoreWeave that provide a competitive edge. Examples include specialized hardware or software solutions for AI processing.

- New Product Launches: The introduction of new products or service enhancements demonstrates the company's ongoing commitment to innovation and its ability to adapt to evolving market demands. Detail any recent product launches.

- Patents and Intellectual Property: A strong IP portfolio protects CoreWeave's technological advantage and adds value to the company. Mention any key patents or intellectual property if available.

- Competitive Advantage: Highlight how CoreWeave's technological advancements translate into a tangible competitive advantage, allowing them to capture a larger market share.

Market Speculation and Investor Sentiment

Market sentiment and speculation can significantly impact stock prices, even in the absence of fundamental changes.

- News Coverage: Positive news coverage and social media sentiment surrounding CoreWeave can create a positive feedback loop, driving up the stock price. Reference any specific positive news articles or social media trends.

- Short Squeeze: The possibility of a short squeeze, where investors who bet against the stock are forced to buy to cover their positions, can rapidly increase the stock price. Discuss this possibility if relevant.

- Overall Market Conditions: The general state of the stock market also plays a role. A bullish market environment often benefits technology stocks, including CoreWeave.

Conclusion: Understanding the CoreWeave (CRWV) Stock Surge and Future Outlook

The CoreWeave (CRWV) stock surge is likely a result of a combination of factors, including strong financial performance, increased demand for AI and cloud computing services, technological advancements, and positive market sentiment. While the current price jump is significant, investors should approach CRWV stock with a balanced perspective, considering both the potential for continued growth and the inherent risks involved in any investment. The future outlook for CoreWeave depends on continued innovation, successful execution of its business strategy, and the overall health of the AI and cloud computing markets. While this article provides insights into today's CoreWeave (CRWV) stock surge, remember to always conduct thorough due diligence before making any investment decisions related to CRWV stock or other similar cloud computing stocks. Consult with a financial advisor before making any investment choices.

Featured Posts

-

Ukrayina Ta Nato Poperedzhennya Yevrokomisara Pro Potentsiyni Nebezpeki

May 22, 2025

Ukrayina Ta Nato Poperedzhennya Yevrokomisara Pro Potentsiyni Nebezpeki

May 22, 2025 -

Federal Charges Hacker Made Millions Targeting Executive Office365 Inboxes

May 22, 2025

Federal Charges Hacker Made Millions Targeting Executive Office365 Inboxes

May 22, 2025 -

Ohio Gas Price Hike Akron And Clevelands Recent Fuel Cost Increases Explained

May 22, 2025

Ohio Gas Price Hike Akron And Clevelands Recent Fuel Cost Increases Explained

May 22, 2025 -

Columbus Gas Station Price Range A 48 Cent Difference

May 22, 2025

Columbus Gas Station Price Range A 48 Cent Difference

May 22, 2025 -

Trinidad And Tobago Newsday Police Cite Safety Concerns For Kartels Restrictions

May 22, 2025

Trinidad And Tobago Newsday Police Cite Safety Concerns For Kartels Restrictions

May 22, 2025

Latest Posts

-

Adam Ramey Dropout Kings Lead Singer Dead At 32

May 22, 2025

Adam Ramey Dropout Kings Lead Singer Dead At 32

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Vocalist Passes Away At 31

May 22, 2025

Remembering Adam Ramey Dropout Kings Vocalist Passes Away At 31

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At 31 Suicide Confirmed Go Fund Me Established

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At 31 Suicide Confirmed Go Fund Me Established

May 22, 2025 -

Dropout Kings Lose Vocalist Adam Ramey A Tragic Loss At 31

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey A Tragic Loss At 31

May 22, 2025 -

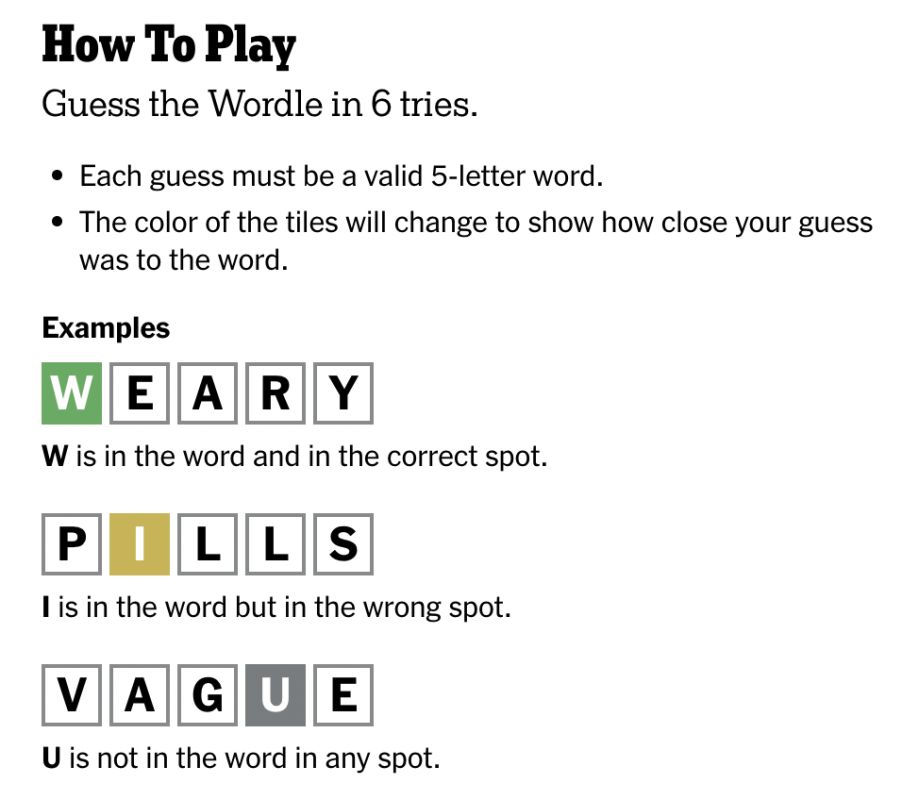

Solve Wordle 1408 Clues And Answer For Sundays Puzzle April 27th

May 22, 2025

Solve Wordle 1408 Clues And Answer For Sundays Puzzle April 27th

May 22, 2025