CoreWeave (CRWV) Stock Performance On Thursday: Causes And Implications

Table of Contents

Market Conditions and Their Impact on CRWV Stock

Overall Market Sentiment

Thursday's market performance played a crucial role in CRWV's stock movement. The overall stock market experienced [describe the market's performance – e.g., a slight downturn/robust rally]. This broader market trend, coupled with specific economic indicators, significantly impacted investor sentiment. For instance, [mention specific economic data, e.g., a higher-than-expected inflation report/positive jobs report] may have influenced investor risk appetite. The tech sector, where CRWV operates, also saw [describe tech sector performance – e.g., a general decline/surge in activity], impacting investor confidence in cloud computing stocks like CoreWeave. Key terms like market volatility, investor confidence, and tech stock performance directly influence CRWV’s daily fluctuations.

- Inflation data directly affects interest rates, influencing investor decisions.

- Positive economic news generally boosts investor confidence.

- Negative tech sector performance can drag down individual tech stocks.

Competitor Analysis and Industry Trends

Analyzing the performance of CoreWeave's competitors is vital to understanding its stock movement. On Thursday, key players in the cloud computing space, such as [mention specific competitors, e.g., AWS, Google Cloud, Microsoft Azure], experienced [describe their performance]. Any significant news or announcements from these competitors, such as new product launches or strategic partnerships, could have influenced investor perception of CRWV. Furthermore, industry-wide trends, particularly the surging demand for AI processing power, heavily influence companies like CoreWeave. The growing need for AI infrastructure provides significant tailwinds for CRWV, but also increases competition. Keywords like cloud computing stocks, AI infrastructure, and competition analysis are essential to understanding CRWV's position in the market.

- Increased demand for AI processing power benefits cloud computing companies.

- Competitive pricing strategies can impact market share.

- New product launches by competitors can shift investor sentiment.

CoreWeave (CRWV) Specific News and Announcements

Company News and Press Releases

Any company-specific news or press releases issued by CoreWeave on or before Thursday are crucial to understanding the stock's performance. Did CoreWeave announce [mention potential news, e.g., a new strategic partnership, a successful product launch, updated financial guidance]? The impact of such announcements on investor confidence can be significant. A positive press release can boost stock prices, while negative news can lead to a decline. Tracking CoreWeave press releases, understanding any CRWV partnerships, and monitoring any product launches are crucial for investors.

- Positive news, like a major partnership, often results in a positive stock price reaction.

- Negative news, such as missed earnings expectations, can lead to a price drop.

- Financial updates and guidance significantly influence investor sentiment.

Analyst Ratings and Price Target Changes

Changes in analyst ratings and price targets can also significantly impact a stock's performance. Did any prominent financial analysts revise their ratings or price targets for CRWV on Thursday or in the preceding days? These revisions, often based on detailed financial modeling and analysis, can sway investor decisions. Positive upgrades generally lead to buying pressure, while downgrades often cause selling. Consulting reputable financial sources for information on analyst ratings, price targets, and stock recommendations is a critical part of informed investment.

- Positive analyst upgrades generally lead to increased demand.

- Negative analyst downgrades often trigger selling pressure.

- Changes in price targets reflect analysts’ revised expectations for future performance.

Implications for Investors: Analyzing CRWV’s Future

Short-Term Outlook

Based on Thursday's events, the short-term outlook for CRWV stock appears [describe short-term outlook – e.g., uncertain/positive/negative]. Further short-term price fluctuations are likely, depending on market conditions and any further news releases. Investors should carefully monitor news and market trends before making any quick decisions.

Long-Term Potential

CoreWeave's long-term growth prospects appear [describe long-term outlook – e.g., strong/promising/challenging] given its focus on [mention core business strengths – e.g., high-performance computing, AI infrastructure, cloud services]. Its market position and business model suggest [explain reasons – e.g., potential for significant market share growth/challenges from increased competition]. Analyzing the company's financial statements, strategic initiatives, and competitive landscape is crucial for assessing its long-term potential.

Investment Strategies

Based on your risk tolerance and investment goals, several investment strategies might be considered. Conservative investors might choose a “hold” strategy, while more aggressive investors could consider a “buy” approach. Conversely, risk-averse investors might opt for a "sell" decision. It’s crucial to conduct thorough due diligence and consult with a financial advisor before making any investment decisions. Keywords like CRWV investment, long-term growth, risk assessment, and investment strategy are critical considerations.

Conclusion: Understanding CoreWeave (CRWV) Stock Performance on Thursday

CoreWeave (CRWV) stock performance on Thursday was influenced by a confluence of factors, including overall market sentiment, competitive dynamics, company-specific news, and analyst ratings. Understanding these factors is crucial for investors to assess both short-term and long-term implications. Investors should continue monitoring CoreWeave's (CRWV) stock performance and remain updated on relevant news to make informed investment decisions. Regularly reviewing CoreWeave stock analysis and staying abreast of the CRWV stock outlook is crucial for navigating the complexities of the market. Conduct thorough research and seek professional financial advice before making any investment decisions related to CRWV or any other stock.

Featured Posts

-

Sesame Streets Netflix Debut What You Need To Know

May 22, 2025

Sesame Streets Netflix Debut What You Need To Know

May 22, 2025 -

Massive Fire At Franklin County Pa Chicken Farm 600 Foot Barn In Flames

May 22, 2025

Massive Fire At Franklin County Pa Chicken Farm 600 Foot Barn In Flames

May 22, 2025 -

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025 -

Streamers Are Finally Making Money A More Complex Landscape For Viewers

May 22, 2025

Streamers Are Finally Making Money A More Complex Landscape For Viewers

May 22, 2025 -

Palisades Fire A List Of Celebrities Who Lost Their Properties

May 22, 2025

Palisades Fire A List Of Celebrities Who Lost Their Properties

May 22, 2025

Latest Posts

-

Siren Trailer Milly Alcock And Meghann Fahy Fight Toxic Work Environment

May 22, 2025

Siren Trailer Milly Alcock And Meghann Fahy Fight Toxic Work Environment

May 22, 2025 -

2025 Emmy Awards Who Will Win Lead Actress In A Limited Series

May 22, 2025

2025 Emmy Awards Who Will Win Lead Actress In A Limited Series

May 22, 2025 -

2025 Emmys Predicting The Lead Actress In A Limited Series Nominees

May 22, 2025

2025 Emmys Predicting The Lead Actress In A Limited Series Nominees

May 22, 2025 -

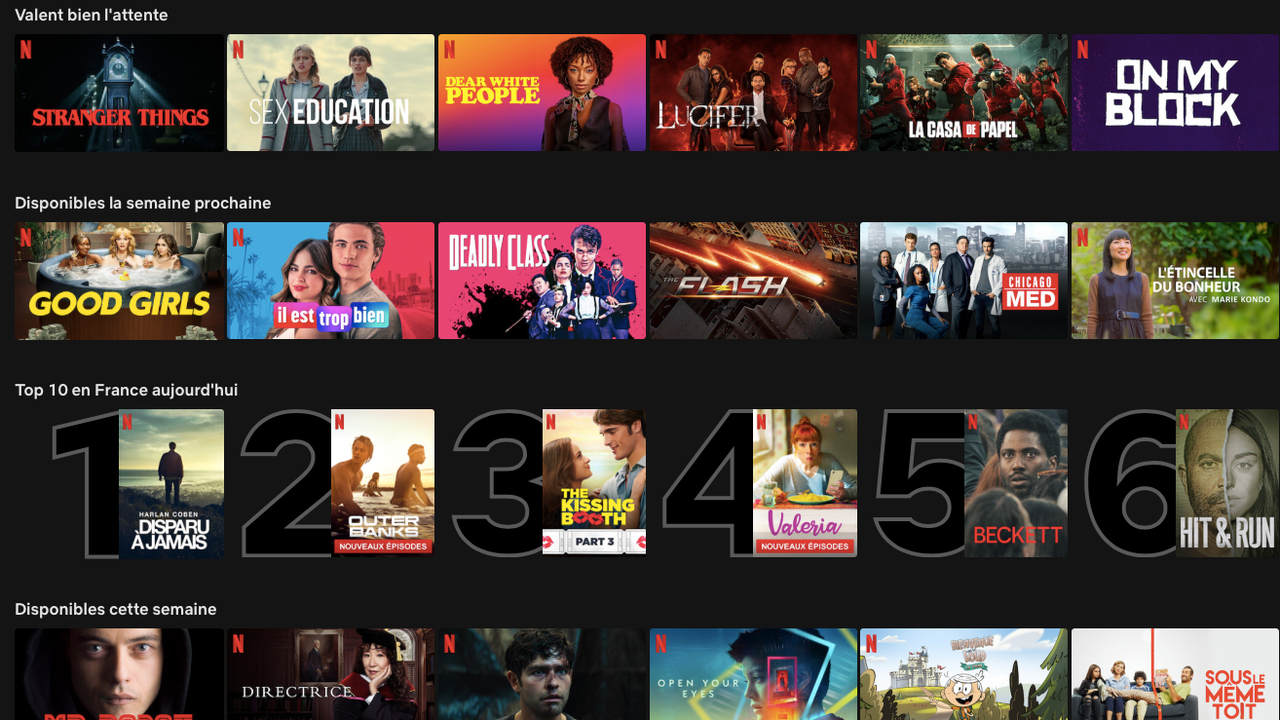

7 Shows To Watch On Netflix This Week May 18 24

May 22, 2025

7 Shows To Watch On Netflix This Week May 18 24

May 22, 2025 -

Your Netflix Guide 7 Shows To Watch May 18 24

May 22, 2025

Your Netflix Guide 7 Shows To Watch May 18 24

May 22, 2025