CoreWeave (CRWV) Stock Market Performance: Tuesday's Downturn

Table of Contents

Understanding CoreWeave's Business and Recent Performance

CoreWeave's business model centers around providing high-performance cloud computing infrastructure, specifically tailored for the demanding needs of artificial intelligence and machine learning workloads. Its focus on this rapidly growing market segment positions it for substantial growth potential. While recent financial performance data may vary, understanding CoreWeave's revenue streams and growth trajectory is crucial for assessing its stock market performance.

- Core Offerings: CoreWeave offers scalable cloud computing resources, optimized for AI/ML tasks, including GPU-powered instances and specialized software solutions.

- Key Clients & Partnerships: Identifying CoreWeave's major clients and strategic partnerships helps gauge market acceptance and future revenue streams. These relationships often indicate the stability and potential of the company.

- Recent Financial Performance: Analyzing CoreWeave's recent revenue figures, earnings reports, and other key financial metrics provides insight into its financial health and overall performance.

- Competitor Analysis: Comparing CoreWeave's performance to other players in the cloud computing and AI infrastructure markets, like AWS, Google Cloud, and Microsoft Azure, helps assess its competitive positioning and market share.

Analyzing Tuesday's Decline: Potential Factors

The drop in CRWV stock price on Tuesday can be attributed to a confluence of factors. Understanding these contributing elements is vital for interpreting the market's reaction and anticipating future trends. Market volatility, particularly in the tech sector, often plays a significant role.

- Broader Market Conditions: Factors like interest rate hikes, inflation concerns, and overall economic uncertainty can significantly influence investor sentiment and lead to sell-offs across various sectors, including cloud computing stocks.

- Sector-Specific News: Negative news specific to the cloud computing or AI industries, such as regulatory changes, competitor announcements, or shifts in market demand, can disproportionately impact companies like CoreWeave.

- Technical Analysis: Analyzing trading volume, price charts, and other technical indicators can provide insights into the dynamics behind Tuesday's CRWV stock drop. A price correction, for example, might be a natural part of the market's adjustment.

- Analyst Reports & Opinions: Tracking analyst ratings and reports concerning CoreWeave can help gauge expert opinion and overall market sentiment toward the company and its future prospects.

Long-Term Outlook for CoreWeave (CRWV) Stock

Despite Tuesday's downturn, the long-term outlook for CoreWeave (CRWV) stock remains tied to the growth trajectory of the cloud computing and AI industries. While inherent risks exist, the potential for substantial returns warrants careful consideration.

- Cloud & AI Market Growth: The continued expansion of the cloud computing and AI markets presents a significant opportunity for CoreWeave. The demand for high-performance computing resources is expected to increase dramatically in the coming years.

- Competitive Advantages & Disadvantages: CoreWeave needs to maintain a competitive edge through innovation and strategic partnerships to solidify its position in the market. Assessing its strengths and weaknesses is crucial.

- Financial Health & Sustainability: Analyzing CoreWeave's financial statements, including its debt levels, cash flow, and profitability, is key to understanding its long-term viability and sustainability.

- Risk Assessment: Investing in any stock involves risk. For CoreWeave, potential risks could include increased competition, economic downturns impacting customer spending, or technological disruptions.

Conclusion

Tuesday's decline in CoreWeave (CRWV) stock market performance highlights the inherent volatility of the stock market, particularly in rapidly growing sectors. While various factors contributed to the downturn, the long-term prospects for CoreWeave remain linked to the continued expansion of the cloud computing and AI industries. Understanding the interplay of short-term market fluctuations and the company's long-term growth potential is crucial for informed investment decisions. Remember to conduct thorough research and consult with a financial advisor before investing. Keep a close eye on the CoreWeave (CRWV) stock market performance in the coming days and weeks to gauge its recovery trajectory and make informed decisions about your investment strategy.

Featured Posts

-

American Couple Arrested In Uk After Appearing On Bbc Antiques Roadshow

May 22, 2025

American Couple Arrested In Uk After Appearing On Bbc Antiques Roadshow

May 22, 2025 -

Trans Australia Run Is The Current World Record In Jeopardy

May 22, 2025

Trans Australia Run Is The Current World Record In Jeopardy

May 22, 2025 -

Nederlandse Bankieren Vereenvoudigd Een Praktische Gids Voor Tikkie

May 22, 2025

Nederlandse Bankieren Vereenvoudigd Een Praktische Gids Voor Tikkie

May 22, 2025 -

Testez Vos Connaissances Sur La Loire Atlantique Quiz Histoire Gastronomie And Culture

May 22, 2025

Testez Vos Connaissances Sur La Loire Atlantique Quiz Histoire Gastronomie And Culture

May 22, 2025 -

Dexter Resurrection Analyzing The Popularity Of The New Villain

May 22, 2025

Dexter Resurrection Analyzing The Popularity Of The New Villain

May 22, 2025

Latest Posts

-

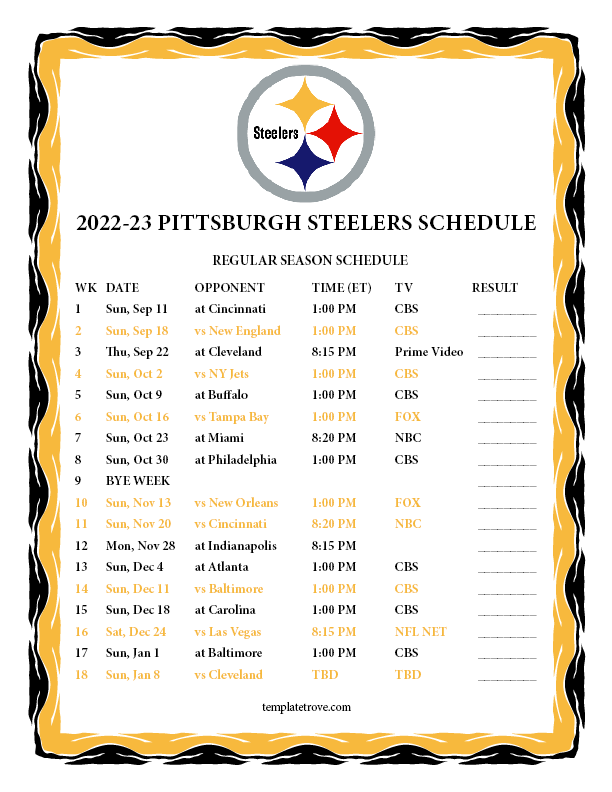

Early Look At The Pittsburgh Steelers 2025 Football Schedule

May 22, 2025

Early Look At The Pittsburgh Steelers 2025 Football Schedule

May 22, 2025 -

Steelers Draft Strategy Kiper Weighs In On Aaron Rodgers Potential Impact

May 22, 2025

Steelers Draft Strategy Kiper Weighs In On Aaron Rodgers Potential Impact

May 22, 2025 -

Potential Pittsburgh Steelers 2025 Schedule And Key Matchups

May 22, 2025

Potential Pittsburgh Steelers 2025 Schedule And Key Matchups

May 22, 2025 -

2025 Nfl Draft Kipers Honest Assessment Of Aaron Rodgers And Its Impact On The Steelers

May 22, 2025

2025 Nfl Draft Kipers Honest Assessment Of Aaron Rodgers And Its Impact On The Steelers

May 22, 2025 -

The 2025 Pittsburgh Steelers Schedule What To Expect

May 22, 2025

The 2025 Pittsburgh Steelers Schedule What To Expect

May 22, 2025