CoreWeave (CRWV) Stock: Jim Cramer's Insights And Predictions

Table of Contents

Jim Cramer's Past Statements on CoreWeave (CRWV) Stock

Identifying any direct mentions of CRWV by Jim Cramer requires thorough research. Unfortunately, publicly available transcripts and recordings of his shows (like "Mad Money") don't always contain detailed analyses of every publicly traded company. Therefore, pinpointing specific past statements on CRWV from Cramer requires extensive searching across various media platforms. At the time of writing, concrete, readily accessible quotes directly referencing CoreWeave from Jim Cramer are limited. However, we can analyze his broader commentary on the cloud computing sector and similar companies to infer potential perspectives on CRWV.

Identifying Key Mentions:

-

Absence of Direct Mentions: It's crucial to acknowledge the lack of readily available direct quotes from Cramer about CRWV. This absence itself can be informative, potentially suggesting that the stock was not yet considered significant enough for detailed analysis at the time.

-

Inference from Sector Analysis: We can infer potential opinions from Cramer's general views on the cloud computing sector's performance and the competitive landscape. If his overall outlook on this sector is bullish, it is likely he would view a company such as CRWV positively (and vice-versa).

-

Future Monitoring: Continued monitoring of Cramer's broadcasts and social media is necessary to identify any future statements regarding CRWV.

Analyzing CoreWeave's (CRWV) Fundamentals and Growth Potential

CoreWeave provides cloud computing infrastructure, specifically focusing on high-performance computing (HPC) solutions for artificial intelligence (AI) and other demanding applications. This niche positions them within a rapidly expanding market.

Business Model and Competitive Landscape:

- Strengths: CoreWeave leverages the power of GPUs to deliver significant compute power, a critical aspect for AI training and other computationally intensive tasks. Their focus on sustainability also adds to their appeal.

- Weaknesses: Competition from established giants like AWS, Google Cloud, and Microsoft Azure is intense. Scaling operations and maintaining profitability in a competitive environment are key challenges.

- Market Share: While precise market share figures are difficult to obtain publicly, CoreWeave has made significant inroads into the HPC market and is known for innovative technologies.

Interpreting Market Trends and Their Impact on CRWV Stock

Understanding the broader market context is vital to predicting CRWV's performance.

Macroeconomic Factors:

- Interest Rates: Rising interest rates can negatively impact growth stocks like CRWV, as investors may shift towards more conservative investments.

- Inflation: High inflation can increase operating costs, potentially squeezing margins.

- Recessionary Fears: A potential recession could reduce corporate spending on cloud computing services.

Sector-Specific Trends:

- Increased Energy Costs: The rising cost of energy directly impacts data center operations, affecting profitability and potentially slowing growth.

- Government Regulations: Regulations around data privacy and security can influence operating costs and strategies.

- Technological Advancements: Rapid technological advancements demand continuous adaptation and investment, posing both challenges and opportunities.

Predicting Future CoreWeave (CRWV) Stock Performance Based on Cramer's Insights

Predicting stock performance is inherently risky. While we lack direct commentary from Cramer on CRWV, we can extrapolate potential scenarios based on our analysis.

Potential Scenarios:

- Bullish Scenario: Strong market growth in the HPC sector, successful execution of CoreWeave's strategy, and positive industry trends could lead to significant stock appreciation.

- Bearish Scenario: Increased competition, macroeconomic headwinds, and unanticipated technological disruptions could lead to decreased performance.

- Neutral Scenario: Moderate growth aligns with broader market trends, resulting in stable but less spectacular returns.

Risk Assessment:

- Upside Potential: Successful penetration into new markets and innovation in HPC technology offer significant upside.

- Downside Risks: Competition, macroeconomic volatility, and execution risks represent key downside concerns.

- Realistic Price Targets: Setting price targets requires comprehensive financial modeling and consideration of numerous factors, and is beyond the scope of this article.

Conclusion

While direct insights from Jim Cramer regarding CoreWeave (CRWV) stock remain elusive, analyzing his broader views on the cloud computing sector and understanding CoreWeave’s fundamentals and the market context provides a valuable framework for informed speculation. The company's position in the rapidly expanding HPC market presents both substantial opportunities and considerable challenges. Macroeconomic factors and sector-specific trends will significantly impact CRWV's future performance. Therefore, remember to conduct your own due diligence before investing in CoreWeave (CRWV) stock. This analysis should be considered a starting point for your own research, and not financial advice. Learn more about CoreWeave (CRWV) stock and make informed investment decisions based on your comprehensive research.

Featured Posts

-

Berns Strong Response To Chinese Military Actions Near Taiwan

May 22, 2025

Berns Strong Response To Chinese Military Actions Near Taiwan

May 22, 2025 -

Core Weave Crwv Stock Plunge On Thursday Reasons Behind The Fall

May 22, 2025

Core Weave Crwv Stock Plunge On Thursday Reasons Behind The Fall

May 22, 2025 -

Adios A Las Enfermedades Cronicas El Superalimento Superior Al Arandano Para Un Envejecimiento Saludable

May 22, 2025

Adios A Las Enfermedades Cronicas El Superalimento Superior Al Arandano Para Un Envejecimiento Saludable

May 22, 2025 -

Watercolor Play Script Review A Critical Assessment

May 22, 2025

Watercolor Play Script Review A Critical Assessment

May 22, 2025 -

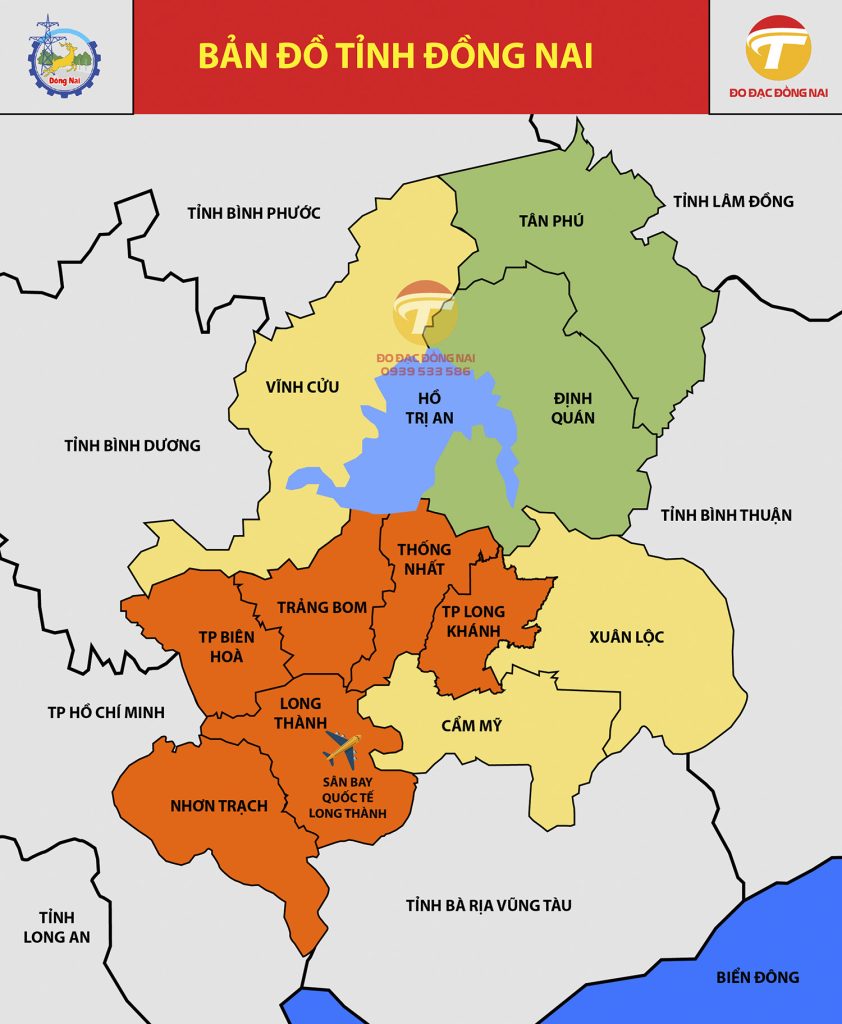

Thang 6 Nay Cau Ma Da Noi Dong Nai Va Binh Phuoc Chinh Thuc Khoi Cong

May 22, 2025

Thang 6 Nay Cau Ma Da Noi Dong Nai Va Binh Phuoc Chinh Thuc Khoi Cong

May 22, 2025

Latest Posts

-

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025 -

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025 -

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025