CoreWeave (CRWV) Soars: Analyzing The Factors Contributing To Last Week's Gains

Table of Contents

The Booming AI Market Fuels CoreWeave's Growth

The explosive growth of artificial intelligence (AI) is undeniably a major catalyst for CoreWeave's recent success. The demand for powerful computing resources to fuel AI advancements is skyrocketing, and CoreWeave is perfectly positioned to capitalize on this trend.

Increased Demand for GPU Computing Power

- The surge in AI, particularly large language models (LLMs) and machine learning, requires massive GPU computing power. Training these complex models demands immense processing capabilities, far exceeding what traditional CPUs can provide.

- CoreWeave provides the crucial infrastructure to support this demand. Its specialized data centers are optimized for GPU-intensive workloads, offering clients the scalability and performance needed for AI development and deployment.

- Market research firm IDC projects the AI infrastructure market to reach hundreds of billions of dollars in the coming years. This exponential growth directly translates into increased demand for services like those offered by CoreWeave.

The company's infrastructure, built on a foundation of high-performance GPUs, allows it to handle the computationally intensive tasks required for training and running sophisticated AI models. This specialized approach differentiates CoreWeave from general-purpose cloud providers and positions it as a critical partner for businesses across various industries looking to leverage the power of AI.

CoreWeave's Strategic Position in the Cloud Computing Landscape

CoreWeave's success isn't solely dependent on the AI boom; its strategic position within the broader cloud computing landscape also plays a significant role.

- Scalable infrastructure: CoreWeave offers clients unparalleled scalability, allowing them to adjust their computing resources as needed, ensuring optimal cost-efficiency.

- Energy efficiency: The company focuses on sustainable and energy-efficient data centers, a crucial factor for environmentally conscious businesses and investors.

- Focus on specialized workloads: Unlike generalist cloud providers, CoreWeave caters specifically to demanding workloads, such as AI and machine learning, giving it a competitive edge.

CoreWeave's business model, centered on providing high-performance GPU computing resources, sets it apart from traditional cloud providers. This focused approach allows the company to cater to the specific needs of businesses heavily reliant on AI and data-intensive applications, fueling its growth in this rapidly expanding market.

Positive Financial Performance and Investor Sentiment

Beyond the market trends, CoreWeave's own financial performance and the positive sentiment surrounding the company have contributed significantly to its recent stock price gains.

Strong Financial Results (if applicable)

(This section should be updated with actual financial data if available at the time of publishing. For example: "CoreWeave's recent quarterly earnings report showcased impressive revenue growth of X%, exceeding analyst expectations. This strong performance, coupled with an increase in user acquisition, demonstrates the company's robust financial health and growth potential.")

Analyst Upgrades and Positive Media Coverage

- Several financial analysts have recently upgraded their ratings on CRWV stock, citing the company's strong growth prospects and market position. Increased price targets further bolster investor confidence.

- Positive media coverage highlighting CoreWeave's technological advancements and market leadership has also contributed to the positive investor sentiment. Favorable press coverage reinforces the company's image and attracts attention from potential investors.

The combination of strong financial results (where applicable) and positive analyst sentiment has created a virtuous cycle, driving up investor confidence and pushing the CRWV stock price higher.

Technological Advancements and Innovation at CoreWeave

CoreWeave's commitment to technological innovation further solidifies its position as a leader in the AI and cloud computing sectors.

Investment in Cutting-Edge GPU Technology

- CoreWeave consistently invests in the latest GPU technology, ensuring its clients have access to the most advanced computing resources. This commitment to cutting-edge technology maintains CoreWeave's competitive advantage.

- Recent partnerships with leading GPU manufacturers further enhance CoreWeave's capabilities and expand its access to the latest hardware. Strategic alliances with technology leaders solidify CoreWeave's position in the market.

This forward-looking approach ensures that CoreWeave remains at the forefront of technological innovation, attracting clients and investors who seek exposure to cutting-edge technologies.

Focus on Sustainability and Energy Efficiency

- CoreWeave's commitment to sustainable and energy-efficient data centers is a significant differentiator. This focus appeals to environmentally conscious investors and clients.

- By prioritizing energy efficiency, CoreWeave reduces its operational costs and minimizes its environmental impact. This strategy aligns with broader societal trends towards sustainability and responsible business practices.

This commitment to environmental responsibility not only appeals to a growing segment of environmentally conscious investors but also contributes to the long-term sustainability and profitability of the company.

Conclusion

CoreWeave's recent stock price surge is a result of a confluence of factors: the explosive growth of the AI market, strong financial performance (where applicable), positive investor sentiment fueled by analyst upgrades and media coverage, and CoreWeave's own commitment to technological innovation and sustainability. The company's strategic position within the cloud computing landscape, its focus on high-performance GPU computing, and its dedication to cutting-edge technology all contribute to its compelling growth story.

Call to Action: CoreWeave (CRWV) presents a compelling investment opportunity within the rapidly expanding AI and cloud computing sectors. Further research into CoreWeave's business model and future prospects is highly recommended for investors interested in this dynamic and rapidly growing company. Stay tuned for further updates on CoreWeave and the evolving landscape of AI-powered cloud computing.

Featured Posts

-

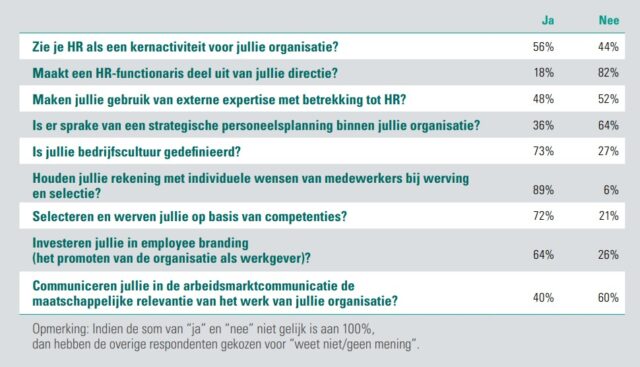

Succesvol Verkopen Met Het Abn Amro Kamerbrief Certificaten Programma

May 22, 2025

Succesvol Verkopen Met Het Abn Amro Kamerbrief Certificaten Programma

May 22, 2025 -

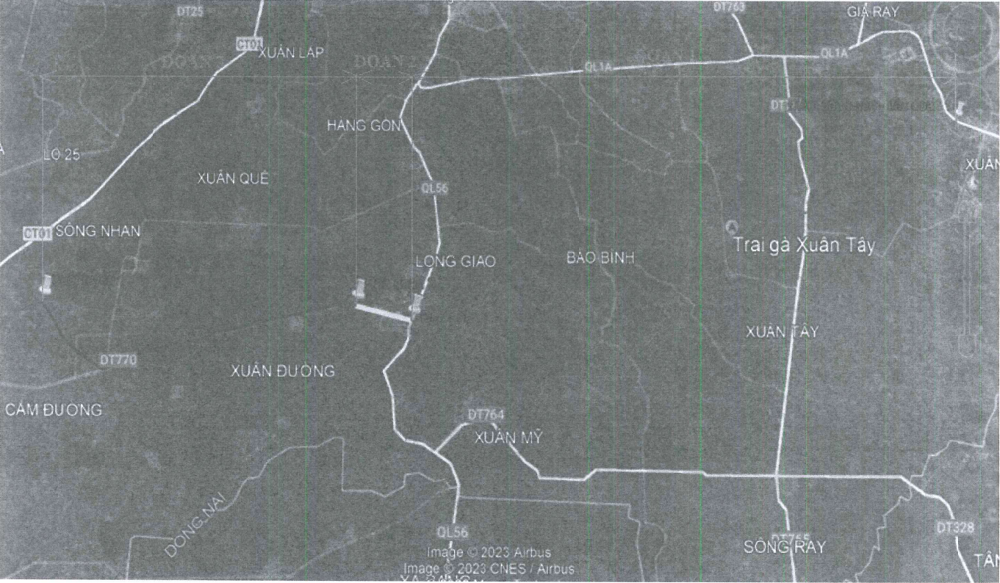

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc

May 22, 2025 -

The Goldbergs Behind The Scenes Insights And Fun Facts

May 22, 2025

The Goldbergs Behind The Scenes Insights And Fun Facts

May 22, 2025 -

Viral Video Cubs Fans Lady And The Tramp Hot Dog Recreation

May 22, 2025

Viral Video Cubs Fans Lady And The Tramp Hot Dog Recreation

May 22, 2025 -

Massive Zebra Mussel Infestation Discovered In Casper

May 22, 2025

Massive Zebra Mussel Infestation Discovered In Casper

May 22, 2025

Latest Posts

-

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025