Copper Prices Surge Amidst China-US Trade Talks

Table of Contents

Global Demand for Copper and its Impact on Prices

The fundamental driver behind the surging copper prices is a robust increase in global demand. Several key sectors are fueling this growth, leading to a significant supply-demand imbalance.

Increased Infrastructure Spending in Developing Nations

- China's Belt and Road Initiative: This massive infrastructure project continues to drive significant demand for copper, with projects spanning numerous countries and requiring vast amounts of copper wiring and components.

- India's Railway Modernization: India's ambitious plans to modernize its railway network necessitate substantial copper usage for electrification and signaling systems.

- Other Developing Nations: Similar infrastructure projects across Africa, Southeast Asia, and Latin America contribute to the overall increase in copper demand.

This surge in infrastructure development translates directly into higher copper prices. The sheer scale of these projects means that the demand for copper significantly outpaces current supply capabilities, leading to price inflation. Statistics show a strong correlation between infrastructure spending growth and increased copper consumption. For instance, a 10% increase in infrastructure spending often correlates with a 5-7% increase in copper demand, depending on the types of projects undertaken.

The Growing Renewable Energy Sector and its Copper Requirements

The global shift towards renewable energy is another crucial factor impacting copper prices. Copper is a critical component in:

- Solar Panels: Copper wiring is essential for efficient energy transfer within solar panels.

- Wind Turbines: Significant amounts of copper are used in the generators and electrical systems of wind turbines.

- Electric Vehicle Charging Stations: The expanding electric vehicle market necessitates a massive increase in charging infrastructure, heavily reliant on copper wiring and components.

Government initiatives promoting renewable energy, such as tax credits and subsidies, further amplify this demand, contributing to the upward pressure on copper prices. The ongoing global transition to cleaner energy sources is projected to maintain strong demand for copper for years to come.

Supply Chain Disruptions Affecting Copper Availability

Several factors are disrupting the copper supply chain, further exacerbating the price surge:

- Mine Closures: Operational challenges, environmental concerns, and permitting issues have resulted in the temporary or permanent closure of several copper mines globally, reducing overall supply.

- Logistical Challenges: Global supply chain disruptions, including port congestion and transportation bottlenecks, hinder the efficient movement of copper from mines to processing facilities and end-users.

- Geopolitical Instability: Political instability in key copper-producing regions can disrupt mining operations and impact the flow of copper to the global market.

These supply-side constraints contribute significantly to the current high copper prices, limiting the ability of the market to meet the increasing global demand.

The Influence of China-US Trade Relations on Copper Markets

The ongoing trade tensions between China and the US have a significant, albeit indirect, influence on copper markets.

Impact of Tariffs and Trade Wars on Copper Imports/Exports

- Trade Restrictions: While direct tariffs on copper itself may be minimal, the broader impact of trade tensions creates uncertainty and volatility in the market, influencing investment decisions and overall pricing.

- Trade Flow Disruptions: Trade wars can disrupt established trade flows, impacting the timely delivery of copper and creating pricing fluctuations.

The uncertainty surrounding trade policy creates volatility in the copper market, making it challenging for businesses to accurately forecast demand and pricing.

China's Role as a Major Copper Consumer and Producer

China plays a dominant role in both the consumption and production of copper:

- Massive Consumption: China is the world's largest consumer of copper, driven by its robust infrastructure development and manufacturing sectors.

- Significant Production: While not the largest producer globally, China is a significant copper producer, influencing global supply dynamics.

China's economic growth trajectory and government policies directly impact global copper prices. Any shifts in Chinese economic policy or infrastructure spending can have ripple effects across the global copper market.

Speculation and Investor Sentiment in the Copper Market

Investor sentiment and speculation also play a significant role in shaping copper prices:

- Futures Contracts: Trading in copper futures contracts allows investors to speculate on future price movements, influencing the current market price.

- Investment Trends: Increased investment in commodities, including copper, can drive up demand and prices.

Positive investor sentiment, fueled by expectations of continued strong demand and limited supply, can lead to further price increases.

Conclusion: Understanding and Navigating the Surge in Copper Prices

The surge in copper prices is a complex phenomenon driven by a confluence of factors: robust global demand fueled by infrastructure spending and renewable energy growth, supply chain disruptions, and the ever-present influence of China-US trade relations and investor sentiment. Understanding the interplay of these elements is crucial for navigating the current market conditions. It's essential to continuously monitor China-US trade talks and their potential impact on copper market stability. The future trajectory of copper prices will depend on the resolution of trade disputes, the pace of global economic growth, and the successful mitigation of supply chain challenges. Stay informed about the fluctuating copper prices and consult with financial advisors to make informed investment choices.

Featured Posts

-

Resistance Mounts Car Dealerships Oppose Ev Mandate Push

May 06, 2025

Resistance Mounts Car Dealerships Oppose Ev Mandate Push

May 06, 2025 -

Chris Pratt On Patrick Schwarzeneggers Nudity In Movie Title

May 06, 2025

Chris Pratt On Patrick Schwarzeneggers Nudity In Movie Title

May 06, 2025 -

Internal Conflict Rocks House Democrats Debate Over Senior Representatives

May 06, 2025

Internal Conflict Rocks House Democrats Debate Over Senior Representatives

May 06, 2025 -

Mindy Kalings Dating History A Look At Her Past Relationships

May 06, 2025

Mindy Kalings Dating History A Look At Her Past Relationships

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 06, 2025

Latest Posts

-

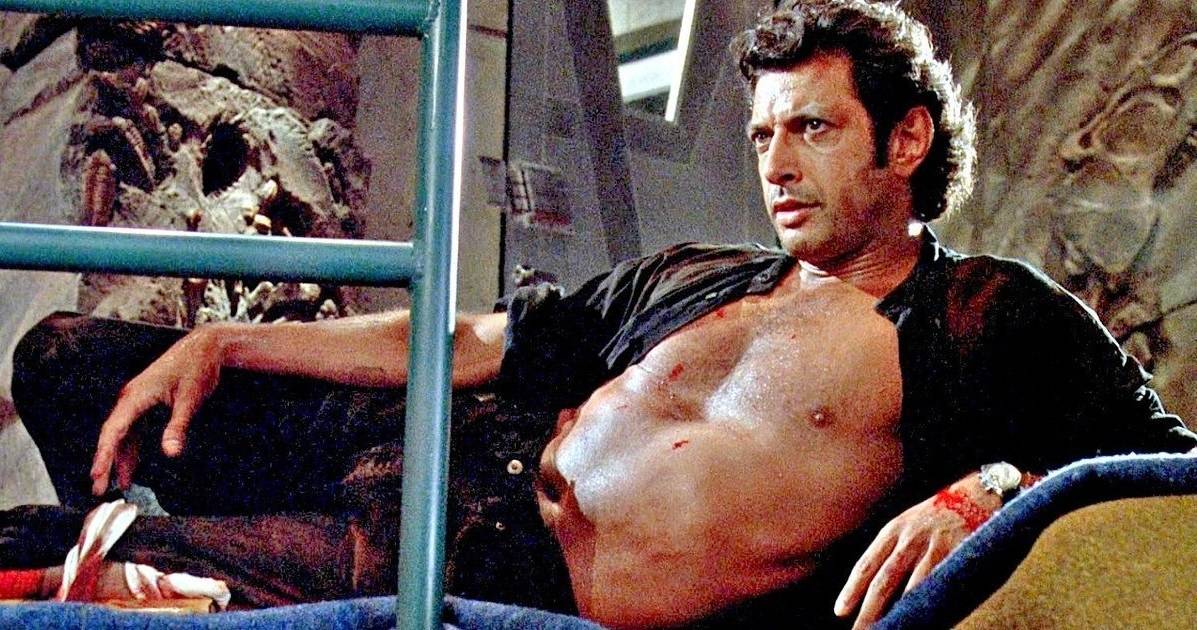

London Welcomes Jeff Goldblum Jurassic Park Fans Turn Out In Force

May 06, 2025

London Welcomes Jeff Goldblum Jurassic Park Fans Turn Out In Force

May 06, 2025 -

Jeff Goldblums Iconic Characters An Analysis Of His Best Performances

May 06, 2025

Jeff Goldblums Iconic Characters An Analysis Of His Best Performances

May 06, 2025 -

Jurassic Parks Jeff Goldblum A London Fan Encounter

May 06, 2025

Jurassic Parks Jeff Goldblum A London Fan Encounter

May 06, 2025 -

Exploring The Career Of Jeff Goldblum His Most Memorable Roles

May 06, 2025

Exploring The Career Of Jeff Goldblum His Most Memorable Roles

May 06, 2025 -

Jeff Goldblum In London Jurassic Park Fans Create A Frenzy

May 06, 2025

Jeff Goldblum In London Jurassic Park Fans Create A Frenzy

May 06, 2025