Copper Outlook Gloomy: Tongling Cites US Tariffs

Table of Contents

Tongling's Warning Signals a Bleak Copper Market Forecast

Tongling's pronouncements serve as a stark warning, reflecting a broader trend of weakening copper demand and increased market uncertainty. Several factors contribute to this bleak copper market forecast.

Declining Copper Demand

Global copper demand is experiencing a significant decrease, impacting copper price projections and market stability. This downturn can be attributed to several key factors:

- Reduced construction projects in major economies: Slowdowns in the construction sectors of major economies like the US and China have significantly decreased the demand for copper, a key component in building infrastructure.

- Lower demand from the automotive and electronics industries: The automotive industry, a significant consumer of copper, is facing its own challenges, leading to a reduction in copper consumption. Similarly, the electronics industry, another major user, is experiencing slower growth, impacting copper demand.

- Impact of global economic slowdown on copper consumption: The broader global economic slowdown is impacting various sectors, resulting in lower overall demand for raw materials, including copper. This creates a negative feedback loop, affecting copper prices further.

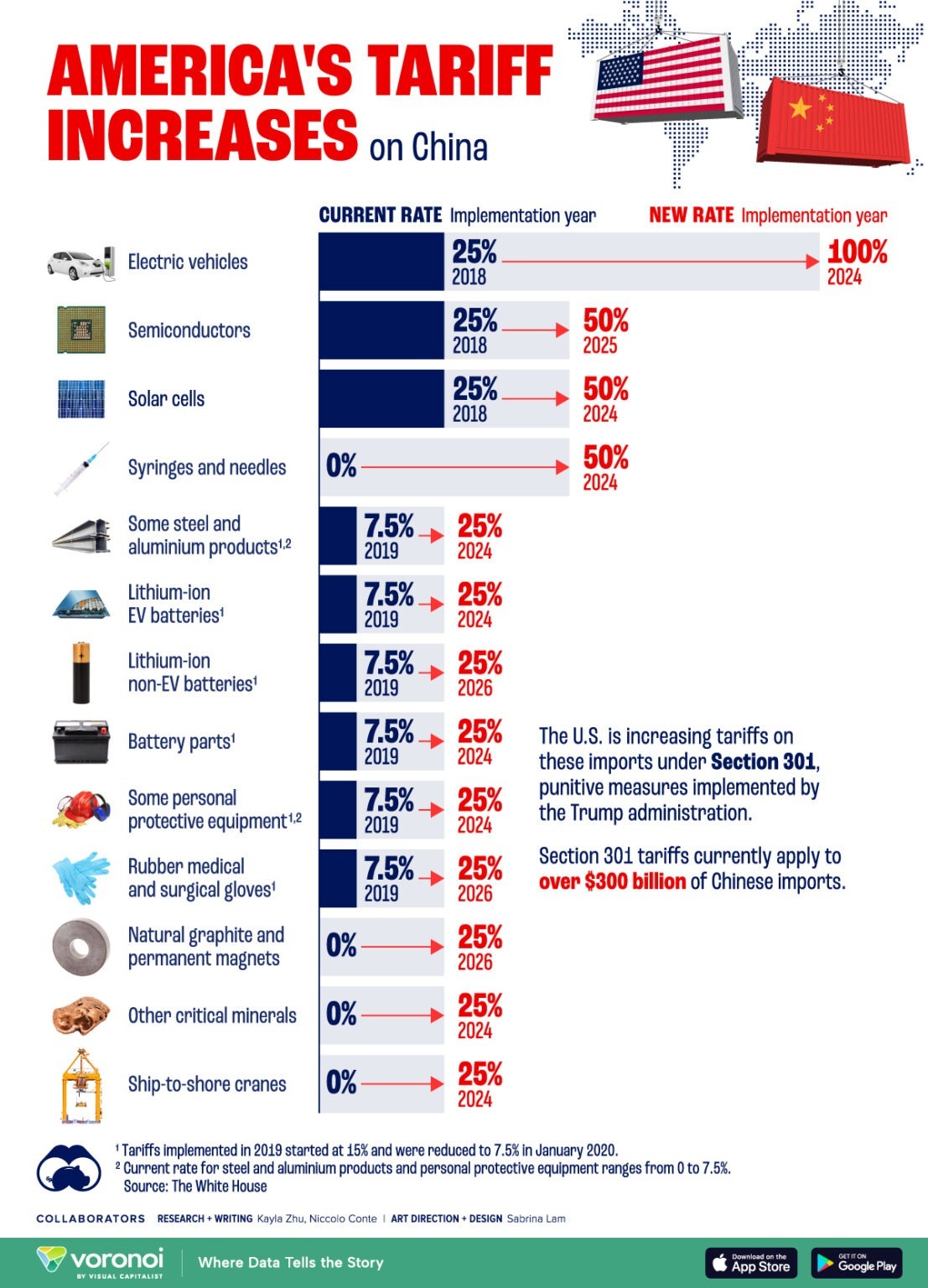

The Role of US-China Trade Tensions

The ongoing trade disputes between the US and China have profoundly impacted copper prices and global trade, creating uncertainty and instability within the copper market outlook.

- Uncertainty caused by trade wars affecting investment decisions: The unpredictable nature of trade wars discourages long-term investments in copper-related projects, further dampening demand.

- Disruption of supply chains impacting copper availability and pricing: Tariffs and trade restrictions disrupt global supply chains, making copper more expensive and less readily available.

- Increased costs due to tariffs impacting copper product competitiveness: Tariffs increase the cost of copper products, making them less competitive in the global market.

Tongling's Financial Performance as a Barometer

Tongling's recent financial reports paint a concerning picture, acting as a microcosm of the broader copper market challenges.

- Specific data points from Tongling's reports (e.g., decreased profits, reduced production): A detailed analysis of Tongling's financial statements reveals a significant decline in profits and production, directly reflecting the weakened copper market.

- Analysis of the company’s outlook and predictions: Tongling's own predictions for the future suggest continued challenges, indicating the severity of the current situation.

- How Tongling’s situation reflects the overall copper market trend: Tongling's struggles are not isolated; they mirror the broader trend of declining profitability and reduced production within the copper industry.

US Tariffs Exacerbate the Copper Market Challenges

US tariffs have significantly worsened the already challenging copper market landscape. Their impact is felt both directly and indirectly throughout the global copper supply chain.

Direct Impact on Copper Imports

Tariffs directly affect the import and export of copper and copper products, creating significant hurdles for businesses.

- Increased costs for importers, leading to higher prices for consumers: Tariffs increase the cost of imported copper, resulting in higher prices for consumers and reduced affordability.

- Reduced competitiveness of copper products in the US market: Higher prices due to tariffs make US-imported copper less competitive compared to domestically produced copper or copper from other countries.

- Potential for trade retaliation from other countries: Tariffs can trigger retaliatory measures from other countries, further disrupting global trade and increasing uncertainty.

Indirect Impact on Global Copper Supply Chains

Beyond direct import costs, tariffs indirectly disrupt the intricate global supply chains of copper.

- Delays in copper shipments affecting production schedules: Trade restrictions and increased customs checks cause delays in shipments, disrupting production schedules and causing further economic losses.

- Increased transportation costs due to trade restrictions: Tariffs and trade restrictions often lead to the use of more expensive and less efficient transportation routes, increasing costs.

- Uncertainty surrounding future trade policies hindering long-term planning: The unpredictable nature of trade policies makes it difficult for businesses to plan for the future, hindering long-term investments and growth.

Potential Mitigation Strategies and Future Outlook for Copper

While the current copper outlook is gloomy, there are potential mitigation strategies and factors that could influence the future of the copper market.

Government Intervention and Policy Changes

Government intervention and policy changes could play a crucial role in alleviating the current copper market challenges.

- Potential for government support to stimulate copper demand: Governments could provide subsidies or incentives to boost domestic copper consumption and stimulate demand.

- Negotiations to reduce or eliminate trade tariffs: Negotiations to reduce or eliminate tariffs would significantly improve the copper market outlook and alleviate supply chain disruptions.

- Investment in infrastructure projects to boost copper consumption: Increased investment in infrastructure projects, which heavily rely on copper, would boost copper demand.

Industry Innovation and Sustainability Initiatives

Technological advancements and sustainable practices are key to shaping the future of the copper market.

- Development of new copper alloys and applications: Innovation in copper alloys and the development of new applications can lead to increased demand and improved market competitiveness.

- Increased recycling of copper to reduce reliance on mining: Improving copper recycling rates reduces the reliance on environmentally damaging mining practices and provides a more sustainable source of copper.

- Focus on sustainable mining practices to improve environmental impact: Adopting more environmentally friendly mining techniques improves the overall sustainability of copper production.

Conclusion: Navigating the Gloomy Copper Outlook: A Call to Action

The current gloomy copper outlook is a complex issue stemming from declining demand, US tariffs, and broader economic uncertainties, as evidenced by Tongling's warning. The challenges facing the copper market require proactive solutions and informed decision-making. To navigate this challenging landscape, staying informed about copper market trends and policy developments is crucial. Regularly consult reliable sources for updates on copper price, copper market outlook, and global commodity prices. Share this article and join the conversation in the comments below to contribute to a better understanding of the current situation and potential solutions for the future of the copper market.

Featured Posts

-

Radno Vrijeme Supermarketa Za Uskrs I Uskrsni Ponedjeljak

Apr 23, 2025

Radno Vrijeme Supermarketa Za Uskrs I Uskrsni Ponedjeljak

Apr 23, 2025 -

Guemueshane Kar Tatili Okullar Tatil Mi Degil Mi 24 Subat 2024

Apr 23, 2025

Guemueshane Kar Tatili Okullar Tatil Mi Degil Mi 24 Subat 2024

Apr 23, 2025 -

Ai Powered Podcast Creation Turning Repetitive Scatological Texts Into Engaging Audio

Apr 23, 2025

Ai Powered Podcast Creation Turning Repetitive Scatological Texts Into Engaging Audio

Apr 23, 2025 -

Aaron Judges 3 Hrs Lead Yankees To 9 Homer Night A New Team Record

Apr 23, 2025

Aaron Judges 3 Hrs Lead Yankees To 9 Homer Night A New Team Record

Apr 23, 2025 -

Reds Three Game Losing Streak Continues With 1 0 Loss

Apr 23, 2025

Reds Three Game Losing Streak Continues With 1 0 Loss

Apr 23, 2025