Copper Market Volatility: China's Stance On US Trade

Table of Contents

China's Role as a Dominant Copper Consumer

China's massive construction boom and robust manufacturing sector are primary drivers of global copper demand. Its influence on copper consumption is undeniable; any shift in China's economic growth trajectory directly translates to changes in copper consumption levels. This makes understanding China's economic policies crucial for predicting copper price movements.

- China accounts for approximately half of global copper consumption. This dominance makes it a kingmaker in the copper market.

- Infrastructure projects (high-speed rail, renewable energy) significantly influence demand. Massive government investment in these projects fuels substantial copper demand.

- Manufacturing output, particularly in electronics and construction, dictates copper needs. These sectors are huge consumers of copper, creating a direct link between industrial production and copper prices.

- Government policies concerning infrastructure spending directly impact copper prices. Changes in government investment strategies can lead to sudden shifts in copper demand and prices.

The Impact of US-China Trade Relations on Copper Prices

Trade tensions and tariffs imposed by both the US and China significantly disrupt global supply chains, creating ripples that directly affect copper prices. The uncertainty generated by these trade disputes contributes substantially to copper market volatility. Navigating this volatile landscape requires close monitoring of trade relations between these two economic powerhouses.

- Tariffs on copper or related goods increase production costs and potentially reduce demand. Increased costs can make copper less competitive, impacting both supply and demand.

- Trade disputes create uncertainty, leading investors to hesitate and impacting copper futures. Uncertainty discourages investment, increasing volatility in the copper futures market.

- Disruptions to supply chains lead to delays and shortages, further increasing prices. Trade wars can severely restrict the flow of copper, causing artificial shortages and price spikes.

- De-globalization trends and attempts to diversify supply chains away from China influence copper markets. Geopolitical shifts and efforts to reduce reliance on China have significant effects on copper trade routes and pricing.

Analyzing China's Current Economic Policies and Their Influence on Copper

China's economic policies, including stimulus packages and infrastructure investments, exert a powerful influence on copper demand. Analyzing these policies is crucial for forecasting future price movements and adapting investment strategies accordingly. Careful observation of these policies is essential for those participating in the copper market.

- Government spending on infrastructure projects directly correlates with copper demand. Increased infrastructure spending usually translates to higher copper demand.

- Economic growth targets set by the Chinese government shape investment in copper-intensive industries. Ambitious growth targets often result in increased investment in copper-consuming sectors.

- Environmental regulations impacting mining and processing influence copper supply. Stringent environmental policies can affect copper production, influencing both supply and price.

- The “Belt and Road Initiative” and other foreign investments impact global copper demand. China's global initiatives create further demand for copper in participating countries.

Predicting Future Copper Market Trends based on China's Actions

Based on current trends and predicted Chinese economic policies, we can attempt to forecast future movements in the copper market. Understanding these predictions is critical for investors and businesses operating within the copper industry. While prediction is never certain, careful analysis can minimize risk.

- Consider China's economic growth projections. Forecasts for Chinese economic growth directly impact copper demand predictions.

- Analyze government investment plans in key industries. Government investment plans provide valuable insights into future copper demand.

- Assess the impact of global geopolitical events on trade relations. Geopolitical stability significantly impacts trade and, thus, copper prices.

- Evaluate the sustainability of current infrastructure projects and their copper requirements. The longevity of these projects determines long-term copper demand.

Conclusion

The volatility of the copper market is inextricably linked to China's economic policies and its relationship with the US. Understanding China’s stance on US trade, and its impact on copper demand and supply chains, is crucial for navigating this complex commodity market. By meticulously analyzing Chinese economic policies and global trade relations, investors and businesses can better anticipate and manage the risks associated with copper market volatility. Stay informed on the latest developments in China US trade and its influence on copper prices to make well-informed decisions in this dynamic market. Keep monitoring the interplay between China US trade and copper market volatility for optimal investment strategies.

Featured Posts

-

After 127 Years Anchor Brewing Company To Shut Its Doors

May 06, 2025

After 127 Years Anchor Brewing Company To Shut Its Doors

May 06, 2025 -

Hos Kokmuyor Ama Itibari Zedelemedi Basari Oeykuesue

May 06, 2025

Hos Kokmuyor Ama Itibari Zedelemedi Basari Oeykuesue

May 06, 2025 -

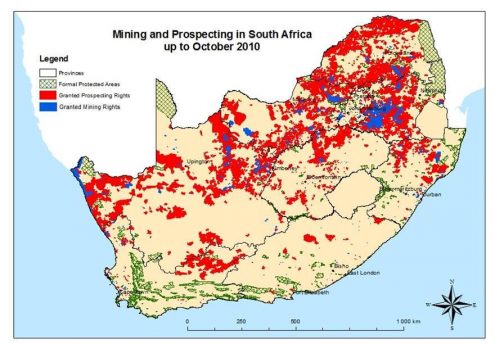

A Toxic Time Bomb The Environmental Impact Of Abandoned Gold Mines

May 06, 2025

A Toxic Time Bomb The Environmental Impact Of Abandoned Gold Mines

May 06, 2025 -

Halle Bailey Turns 25 Birthday Photos And Wishes

May 06, 2025

Halle Bailey Turns 25 Birthday Photos And Wishes

May 06, 2025 -

Shotgun Cop Man Platforming Action Meets Devilish Challenges

May 06, 2025

Shotgun Cop Man Platforming Action Meets Devilish Challenges

May 06, 2025

Latest Posts

-

Ddg And Halle Bailey Feud Escalates With New Diss Track Dont Take My Son

May 06, 2025

Ddg And Halle Bailey Feud Escalates With New Diss Track Dont Take My Son

May 06, 2025 -

Ddg Fires Shots At Halle Bailey In New Song Dont Take My Son

May 06, 2025

Ddg Fires Shots At Halle Bailey In New Song Dont Take My Son

May 06, 2025 -

Ddg Diss Track Targets Halle Bailey Dont Take My Son Explodes Online

May 06, 2025

Ddg Diss Track Targets Halle Bailey Dont Take My Son Explodes Online

May 06, 2025 -

Halle Bailey The Target Of Ddgs Dont Take My Son

May 06, 2025

Halle Bailey The Target Of Ddgs Dont Take My Son

May 06, 2025 -

Ddg Fires Shots At Halle Bailey In Dont Take My Son Diss Track

May 06, 2025

Ddg Fires Shots At Halle Bailey In Dont Take My Son Diss Track

May 06, 2025