Considerable Slowdown Predicted For US Economic Growth: Deloitte Report

Table of Contents

Key Factors Contributing to the Predicted Slowdown

Several interconnected factors are contributing to the anticipated slowdown in US economic growth. Understanding these factors is critical to navigating the changing economic landscape.

Inflationary Pressures

Persistent inflation remains a major headwind. High prices are eroding consumer purchasing power and impacting business investment decisions.

- High interest rates: The Federal Reserve's efforts to combat inflation through interest rate hikes are increasing borrowing costs for businesses and consumers, making investments and large purchases less attractive. This directly impacts GDP growth projections.

- Supply chain disruptions: While easing, lingering supply chain disruptions continue to contribute to elevated prices for many goods and services, fueling inflation and dampening economic growth.

- Wage growth lagging inflation: Although wages are rising in some sectors, they are not keeping pace with inflation in many cases, leaving consumers with less disposable income and reducing consumer spending, a vital component of US economic growth.

Weakening Consumer Demand

Rising interest rates and persistent inflation are significantly cooling consumer spending, a key driver of US economic activity.

- Decreased consumer confidence: Surveys reveal declining consumer confidence, indicating reduced willingness to spend on non-essential goods and services. This decrease in discretionary spending directly impacts economic growth rates.

- Increased savings rates: Consumers are increasingly opting to save rather than spend, reflecting a cautious approach in the face of economic uncertainty. This shift in consumer behavior contributes to the slowdown in US economic growth.

- Impact on retail sales: The decline in consumer confidence and spending is already evident in weakening retail sales figures, a clear indicator of the cooling economy and reduced economic expansion.

Global Economic Uncertainty

Geopolitical instability and a global economic slowdown are further impacting US exports and business investment, adding to the pressure on US economic growth.

- The war in Ukraine: The ongoing conflict continues to disrupt global supply chains, particularly energy markets, contributing to inflationary pressures and hindering economic development worldwide, including the US.

- Slowing growth in other major economies: Slower growth in major global economies reduces demand for US exports, impacting US businesses and overall economic performance.

- Uncertainty surrounding global trade policies: Uncertainty and shifting global trade policies create hesitancy among businesses, leading to reduced investment and hindering economic progress.

Deloitte Report's Projections and Methodology

Deloitte's report employs a robust macroeconomic model to project the slowdown in US economic growth.

- Comprehensive macroeconomic model: The report utilizes a sophisticated model incorporating numerous economic indicators to arrive at its projections for economic output.

- Projected GDP growth decrease: The report projects a [Insert Specific Percentage from Report Here]% decrease in US GDP growth for the coming year. This projection highlights the severity of the anticipated slowdown in economic activity.

- Data sources: The methodology involves analyzing a wide range of data, including government statistics, consumer surveys, and business forecasts, to ensure a comprehensive and accurate assessment of the economic outlook.

- Range of possible outcomes: The report acknowledges the inherent uncertainties in economic forecasting and presents a range of possible outcomes, providing a nuanced picture of the future of US economic performance.

Potential Implications for Businesses and Investors

The predicted slowdown in US economic growth has significant implications for businesses and investors.

- Business adjustments: Businesses should prepare for potentially reduced demand and adjust their investment strategies accordingly. This might involve cost-cutting measures and a more cautious approach to expansion.

- Investor portfolio reassessment: Investors may need to reassess their portfolios and consider more conservative investment approaches, potentially shifting towards less volatile assets.

- Job market adjustments: The slowdown could lead to job market adjustments in certain sectors, particularly those most sensitive to economic fluctuations.

- Government policy response: Government policy responses will play a crucial role in mitigating the impact of the slowdown and supporting economic recovery.

Conclusion

The Deloitte report presents a concerning outlook, forecasting a considerable slowdown in US economic growth. Persistent inflation, weakening consumer demand, and global economic uncertainty are key contributing factors. Understanding these elements and the report's projections is vital for businesses and investors to navigate this period of economic transition effectively. Staying informed about future developments concerning US economic growth and related economic indicators is paramount. Monitor the latest reports and analysis to make well-informed decisions about your investments and business strategies in this evolving economic climate. Understanding the dynamics of US economic growth is key to successful navigation of the current market conditions.

Featured Posts

-

Pegula Triumphs Charleston Open Update

Apr 27, 2025

Pegula Triumphs Charleston Open Update

Apr 27, 2025 -

Pfc Halts Gensols Eo W Transfer After Detecting Fraudulent Documentation

Apr 27, 2025

Pfc Halts Gensols Eo W Transfer After Detecting Fraudulent Documentation

Apr 27, 2025 -

Charleston Open Kalinskayas Stunning Victory Over Keys

Apr 27, 2025

Charleston Open Kalinskayas Stunning Victory Over Keys

Apr 27, 2025 -

Professional Help For Hair And Tattoo Transformations Ariana Grandes Inspiration

Apr 27, 2025

Professional Help For Hair And Tattoo Transformations Ariana Grandes Inspiration

Apr 27, 2025 -

The Los Angeles Wildfires A Disturbing Trend In Disaster Betting

Apr 27, 2025

The Los Angeles Wildfires A Disturbing Trend In Disaster Betting

Apr 27, 2025

Latest Posts

-

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

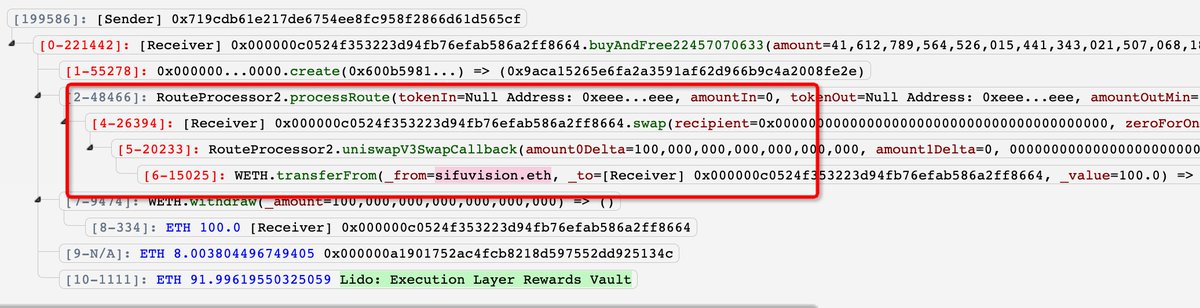

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025 -

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025 -

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025