Conservative Revolt Delays GOP Tax Plan: Medicaid And Clean Energy At Issue

Table of Contents

Conservative Concerns Regarding Medicaid Expansion

Conservatives are raising significant concerns about the proposed Medicaid expansion within the GOP tax plan, leading to the current GOP Tax Plan Delay. These concerns stem from two primary areas: budgetary constraints and the balance of power between federal and state governments.

Budgetary Constraints

Conservatives express serious concerns about the long-term financial implications of expanding Medicaid. They argue that it would lead to unsustainable budget deficits and exacerbate the national debt. This argument forms a crucial part of the resistance contributing to the GOP Tax Plan Delay.

- Demand for Fiscal Responsibility: Conservatives are demanding greater fiscal responsibility and significant spending cuts elsewhere to offset the costs of Medicaid expansion.

- State Budgetary Impact: They are also deeply concerned about the strain an expanded Medicaid program would place on individual state budgets, further complicating the fiscal picture and impacting the timeline of the GOP Tax Plan.

- Alternative Healthcare Solutions: Many conservatives are calling for alternative solutions to address healthcare access, proposing market-based reforms and focusing on greater efficiency within the existing system to alleviate pressure that is causing the GOP Tax Plan Delay.

State Control vs. Federal Overreach

The debate also focuses on the balance of power between state and federal governments in managing Medicaid. Conservatives strongly advocate for greater state autonomy in administering these programs, a key factor in the ongoing GOP Tax Plan Delay.

- Resistance to Federal Overreach: They view the federal government's role in Medicaid as an example of excessive federal overreach, infringing on states' rights and individual liberty.

- Emphasis on States' Rights: The core of their argument rests on a belief in states' rights and the principle of limited federal intervention. This sentiment is a significant contributor to the GOP Tax Plan Delay.

- Block Grants Proposed: Instead of direct federal funding, conservatives are proposing block grants to states, allowing them greater flexibility and control over how Medicaid funds are allocated. This proposal is a major point of contention in the current GOP Tax Plan Delay.

Clean Energy Provisions and the GOP's Conservative Wing

Another significant source of the GOP Tax Plan Delay is the disagreement over clean energy provisions included in the original proposal. This conflict highlights a deep divide within the Republican party.

Opposition to Government Subsidies

A substantial portion of the conservative base vehemently opposes government subsidies for renewable energy sources such as solar and wind power. This opposition is a critical component of the GOP Tax Plan Delay.

- Free Market Principles: They advocate for free market principles and limited government intervention in the energy sector, viewing subsidies as distorting market forces.

- Economic Viability Concerns: Conservatives also express concerns about the economic viability and long-term sustainability of certain renewable energy projects, particularly without government support. This concern fuels the opposition to the original plan and its subsequent GOP Tax Plan Delay.

- Government Intervention: The core of their argument is against government intervention in the energy market, preferring a system driven by competition and consumer choice.

Focus on Fossil Fuels

The internal struggle within the Republican party between traditional support for the fossil fuel industry and the growing need to address climate change is further highlighted by the disagreements causing the GOP Tax Plan Delay.

- Fossil Fuel Industry Protection: Many conservatives are resistant to policies that could negatively impact the fossil fuel industry, a major contributor to the American economy.

- Carbon Emissions and Regulations: The debate surrounding carbon emissions and environmental regulations is central to this conflict, with differing views on the urgency and necessity of addressing climate change contributing to the GOP Tax Plan Delay.

- Differing Views on Climate Change: A range of opinions exists within the Republican party on the urgency and extent of climate change, further complicating the issue and contributing to the GOP Tax Plan Delay.

Political Fallout and Potential Legislative Outcomes

The GOP Tax Plan Delay has significant consequences, impacting not only the tax plan itself but also the broader Republican legislative agenda.

Impact on the GOP's Legislative Agenda

The delay significantly impacts the party's legislative agenda, potentially delaying or even derailing other key initiatives. This ripple effect is a major consequence of the GOP Tax Plan Delay.

- Reduced Legislative Productivity: The internal conflict has led to reduced legislative productivity and efficiency, as time and energy are consumed by internal disagreements.

- Increased Political Gridlock: The situation has further increased political gridlock and partisan divisions, making it more challenging to pass any legislation.

- Erosion of Public Trust: The protracted delay and internal fighting could lead to a loss of public trust and support for the Republican Party.

Negotiations and Compromises

The current situation underscores the need for internal negotiations and compromises within the Republican Party to move forward. The GOP Tax Plan Delay necessitates a resolution.

- Potential Concessions: Compromises might involve concessions on Medicaid expansion and clean energy provisions to garner broader support.

- Party Unity Crucial: Finding common ground is crucial for maintaining party unity and avoiding further fracturing.

- Revised GOP Tax Plan: A revised GOP tax plan reflecting these compromises is the most likely outcome of the current situation.

Conclusion

The conservative revolt delaying the GOP tax plan highlights significant internal divisions within the Republican party, mainly concerning Medicaid expansion and clean energy initiatives. Disagreements over budgetary constraints, states' rights, government subsidies, and the future of the energy sector illustrate the challenges the party faces in addressing complex policy issues. Finding a workable compromise will be crucial for the GOP to move forward with its legislative agenda and maintain its credibility. Understanding the intricacies of this GOP Tax Plan Delay is vital for anyone following American politics. Stay informed and engaged in the ongoing debate surrounding this pivotal moment in the political landscape. Follow the developments closely to stay updated on any further GOP tax plan delays or resolutions.

Featured Posts

-

Section 230 And Banned Chemicals A Recent E Bay Case Ruling

May 18, 2025

Section 230 And Banned Chemicals A Recent E Bay Case Ruling

May 18, 2025 -

Large Rave Festivals A Significant Economic Driver

May 18, 2025

Large Rave Festivals A Significant Economic Driver

May 18, 2025 -

Dodgers Bet On Conforto A Hernandez Like Impact

May 18, 2025

Dodgers Bet On Conforto A Hernandez Like Impact

May 18, 2025 -

Kanye Wests Super Bowl Absence Taylor Swifts Alleged Role

May 18, 2025

Kanye Wests Super Bowl Absence Taylor Swifts Alleged Role

May 18, 2025 -

Can Conforto Replicate Hernandezs Success With The Dodgers

May 18, 2025

Can Conforto Replicate Hernandezs Success With The Dodgers

May 18, 2025

Latest Posts

-

Christophe Mali A Onet Le Chateau Le Concert De La Saison

May 18, 2025

Christophe Mali A Onet Le Chateau Le Concert De La Saison

May 18, 2025 -

Concert De Cloture Saison Onet Le Chateau Christophe Mali

May 18, 2025

Concert De Cloture Saison Onet Le Chateau Christophe Mali

May 18, 2025 -

Onet Le Chateau Christophe Mali En Concert Pour La Saison

May 18, 2025

Onet Le Chateau Christophe Mali En Concert Pour La Saison

May 18, 2025 -

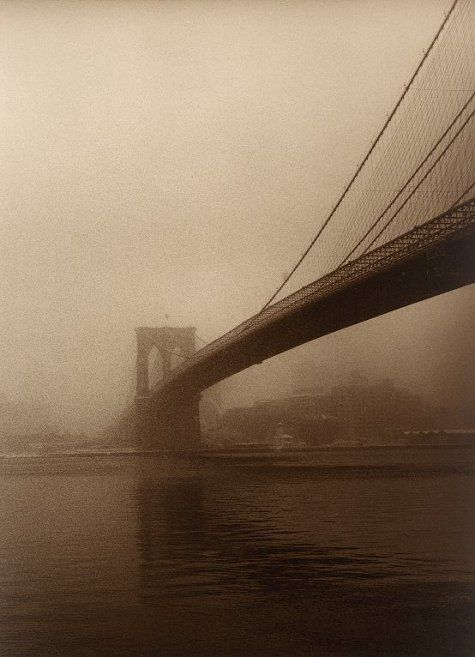

The Brooklyn Bridge Story As Told By Barbara Mensch

May 18, 2025

The Brooklyn Bridge Story As Told By Barbara Mensch

May 18, 2025 -

Posluchaj Podcastu Stan Wyjatkowy Onetu I Newsweeka Aktualnosci Dwa Raz W Tygodniu

May 18, 2025

Posluchaj Podcastu Stan Wyjatkowy Onetu I Newsweeka Aktualnosci Dwa Raz W Tygodniu

May 18, 2025