Comprehensive Ethereum Price Prediction: Analyzing Future Trends And Market Dynamics

Table of Contents

Ethereum's Technological Advancements and Their Impact on Price

Ethereum's price is intrinsically linked to its technological advancements. Significant upgrades and the burgeoning DeFi ecosystem are major factors in any Ethereum price prediction.

Ethereum 2.0 and its role in scalability and efficiency

Ethereum 2.0, a multi-phased upgrade, aims to drastically improve the network's scalability and efficiency. Sharding, a key component, will divide the network into smaller, more manageable parts, significantly increasing transaction throughput. This means faster transaction speeds and drastically reduced gas fees.

- Reduced transaction fees leading to increased adoption: Lower costs make Ethereum more accessible to a wider range of users and applications.

- Improved scalability attracting institutional investors: The enhanced capacity and efficiency will attract larger institutional investments, further boosting demand.

- Enhanced security through proof-of-stake: The shift to a proof-of-stake consensus mechanism enhances network security and reduces energy consumption, attracting environmentally conscious investors.

These improvements are crucial for an accurate Ethereum price prediction, as they directly impact usability and attract wider adoption.

The growth of the DeFi ecosystem

The decentralized finance (DeFi) ecosystem, largely built on Ethereum, is experiencing explosive growth. DeFi applications, ranging from lending and borrowing platforms to decentralized exchanges (DEXs), are driving significant demand for ETH.

- Growing total value locked (TVL) in DeFi protocols: The increasing amount of cryptocurrency locked in DeFi protocols indicates strong user engagement and confidence in the Ethereum network.

- Expansion of DeFi applications beyond lending and borrowing: The DeFi space is constantly evolving, with new applications and innovations emerging, further solidifying Ethereum's position as the leading platform for DeFi.

- Yield farming and staking rewards: These incentives attract users to participate in the DeFi ecosystem, increasing demand for ETH.

Macroeconomic Factors Influencing Ethereum Price Prediction

Macroeconomic factors play a significant role in any cryptocurrency price prediction, and Ethereum is no exception.

The impact of Bitcoin's price movement

Bitcoin's price often acts as a leading indicator for the broader cryptocurrency market, including Ethereum. Positive Bitcoin price movements often lead to increased investor confidence and spillover effects on altcoins like Ethereum.

- Bitcoin's price as a leading indicator for altcoins: Historical data shows a strong correlation between Bitcoin and Ethereum price movements.

- Market sentiment and its influence on both Bitcoin and Ethereum: Overall market sentiment significantly impacts both cryptocurrencies.

Regulatory landscape and its effects

The regulatory landscape surrounding cryptocurrencies is constantly evolving and presents both opportunities and risks. Clearer regulatory frameworks could attract institutional investment, while overly restrictive regulations could stifle growth.

- Potential for increased institutional investment with clearer regulations: Greater regulatory clarity reduces uncertainty and encourages larger institutional players to enter the market.

- Risks associated with stricter regulatory environments: Overly stringent regulations could hinder innovation and limit the growth of the crypto industry.

Global economic conditions

Global economic conditions, such as inflation, interest rates, and economic recessions, can significantly influence investor behavior and affect cryptocurrency prices.

- Impact of rising inflation on cryptocurrency investments: Cryptocurrencies are often viewed as a hedge against inflation, leading to increased demand during inflationary periods.

- Ethereum's potential as a store of value: The growing perception of Ethereum as a store of value could lead to increased investment, especially during times of economic uncertainty.

Analyzing Historical Price Data and Predicting Future Trends

Understanding past price movements can offer insights into potential future trends, although it's crucial to remember that past performance is not indicative of future results.

Technical analysis of Ethereum's price charts

Technical analysis uses various indicators and chart patterns to identify potential price movements. Tools such as moving averages, RSI (Relative Strength Index), and support/resistance levels can be used to predict short-term and long-term trends.

- Support and resistance levels: These price points often act as barriers to price movements.

- Trend lines and their implications: Identifying trends through trend lines can help anticipate future price direction.

Fundamental analysis of Ethereum's market capitalization and adoption

Fundamental analysis focuses on the underlying value of Ethereum, considering factors like market capitalization and adoption rate.

- Market capitalization as a valuation metric: Market capitalization provides an indication of the overall value of Ethereum.

- Factors influencing adoption rate: Increased adoption, driven by technological advancements and DeFi growth, could significantly impact price.

Conclusion

Predicting the Ethereum price with certainty is impossible. However, by considering the technological advancements, macroeconomic environment, and historical price data, we can form a more informed opinion. Our Ethereum price prediction analysis suggests a range of potential scenarios, from bullish to bearish, depending on the interplay of these factors. This analysis doesn’t offer specific price targets; rather, it emphasizes understanding the diverse forces shaping Ethereum’s future. Remember, this information is for educational purposes only and should not be considered financial advice. Conduct your own thorough research and stay updated on the latest developments in the Ethereum ecosystem to inform your own Ethereum price prediction and investment strategy. Continue your research on Ethereum price prediction and stay updated on the latest market trends.

Featured Posts

-

Shkelje Te Rregullave Te Uefa S Arsenali Nen Hetim Pas Ndeshjes Me Psg

May 08, 2025

Shkelje Te Rregullave Te Uefa S Arsenali Nen Hetim Pas Ndeshjes Me Psg

May 08, 2025 -

Analyzing The Overvalued Canadian Dollar Economic Perspectives And Recommendations

May 08, 2025

Analyzing The Overvalued Canadian Dollar Economic Perspectives And Recommendations

May 08, 2025 -

Bitcoins Critical Juncture Price Levels And Predictions

May 08, 2025

Bitcoins Critical Juncture Price Levels And Predictions

May 08, 2025 -

Racha Imparable Dodgers Mejor Inicio De Temporada En La Historia

May 08, 2025

Racha Imparable Dodgers Mejor Inicio De Temporada En La Historia

May 08, 2025 -

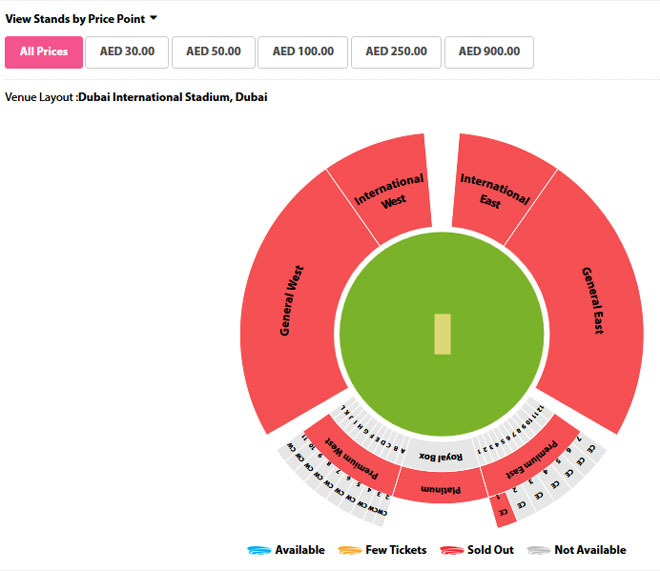

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025